(ii) Explain how the existing product range and the actions per Note (3) would feature in Ansoff’sproduct-market matrix. (7 marks)

题目

(ii) Explain how the existing product range and the actions per Note (3) would feature in Ansoff’s

product-market matrix. (7 marks)

相似考题

更多“(ii) Explain how the existing product range and the actions per Note (3) would feature in Ansoff’sproduct-market matrix. (7 marks)”相关问题

-

第1题:

(b) Compare and contrast Gray, Owen and Adams’s ‘pristine capitalist’ position with the ‘social contractarian’

position. Explain how these positions would affect responses to stakeholder concerns in the new stadium

project. (8 marks)

正确答案:

-

第2题:

(ii) Explain the ethical tensions between these roles that Anne is now experiencing. (4 marks)

正确答案:

(ii) Tensions in roles

On one hand, Anne needs to cultivate and manage her relationship with her manager (Zachary) who seems convinced

that Van Buren, and Frank in particular, are incapable of bad practice. He shows evidence of poor judgment and

compromised independence. Anne must decide how to deal with Zachary’s poor judgment.

On the other hand, Anne has a duty to both the public interest and the shareholders of Van Buren to ensure that the

accounts do contain a ‘true and fair view’. Under a materiality test, she may ultimately decide that the payment in

question need not hold up the audit signoff but the poor client explanation (from Frank) is also a matter of concern to

Anne as a professional accountant. -

第3题:

(ii) Using the previous overhead allocation basis (as per note 4), calculate the budgeted profit/(loss)

attributable to each type of service for the year ending 31 December 2006 and comment on the results

obtained using the previous and revised methods of overhead allocation. (5 marks)

正确答案:

-

第4题:

(b) Explain how the use of SWOT analysis may be of assistance to the management of Diverse Holdings Plc.

(3 marks)

正确答案:

(b) The use of SWOT analysis will focus management attention on current strengths and weaknesses of each subsidiary company

which will be of assistance in the formulating of the business strategy of Diverse Holdings Plc. It will also enable management

to monitor trends and developments in the constantly changing environments of their subsidiaries. Each trend or development

may be classified as an opportunity or a threat that will provide a stimulus for an appropriate management response.

Management can make an assessment of the feasibility of required actions in order that the company may capitalise upon

opportunities whilst considering how best to negate or minimise the effect of any threats.

A SWOT analysis should assist the management of Diverse Holdings Plc as they must identify their strengths, weaknesses,

opportunities and threats. These may be classified as follows:

Strengths which appear to include both OFL and HTL.

Weaknesses which must include PSL and its limited outlets, which generate little growth and could collapse overnight. KAL

is also a weakness due to its declining profitability.

Opportunities where OFT, HTL and OPL are operating in growth markets.

Threats from which KAL is suffering.

If these four categories are identified and analysed then the group should be strengthened. -

第5题:

(c) Explain how the introduction of an ERPS could impact on the role of management accountants. (5 marks)

正确答案:

(c) The introduction of ERPS has the potential to have a significant impact on the work of management accountants. The use of

ERPS causes a substantial reduction in the gathering and processing of routine information by management accountants.

Instead of relying on management accountants to provide them with information, managers are able to access the system to

obtain the information they require directly via a suitable electronic access medium.

ERPS integrate separate business functions in one system for the entire organisation and therefore co-ordination is usually

undertaken centrally by information management specialists who have a dual responsibility for the implementation and

operation of the system.

ERPS perform. routine tasks that not so long ago were seen as an essential part of the daily routines of management

accountants, for example perpetual inventory valuation. Therefore if the value of the role of management accountants is not

to be diminished then it is of necessity that management accountants should seek to expand their roles within their

organisations.

The management accountant will also control and audit the ERPS data input and analysis. Hence the implementation of ERPS

provides the management accountant with an opportunity to change the emphasis of their role from information gathering

and processing to that of the role of advisers and internal consultants to their organisations. This new role will require

management accountants to be involved in interpreting the information generated from the ERPS and to provide business

support for all levels of management within an organisation. -

第6题:

(iii) State how your answer in (ii) would differ if the sale were to be delayed until August 2006. (3 marks)

正确答案:

-

第7题:

(ii) Explain how the inclusion of rental income in Coral’s UK income tax computation could affect the

income tax due on her dividend income. (2 marks)

You are not required to prepare calculations for part (b) of this question.

Note: you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year to

31 March 2007 will continue to apply for the foreseeable future.

正确答案:

(ii) The effect of taxable rental income on the tax due on Coral’s dividend income

Remitting rental income to the UK may cause some of Coral’s dividend income currently falling within the basic rate

band to fall within the higher rate band. The effect of this would be to increase the tax on the gross dividend income

from 0% (10% less the 10% tax credit) to 221/2% (321/2% less 10%).

Tutorial note

It would be equally acceptable to state that the effective rate of tax on the dividend income would increase from 0%

to 25%. -

第8题:

(ii) If a partner, who is an actuary, provides valuation services to an audit client, can we continue with the audit?

(3 marks)

Required:

For each of the three questions, explain the threats to objectivity that may arise and the safeguards that

should be available to manage them to an acceptable level.

NOTE: The mark allocation is shown against each of the three questions above.

正确答案:

(ii) Actuarial services to an audit client

IFAC’s ‘Code of Ethics for Professional Accountants’ does not deal specifically with actuarial valuation services but with

valuation services in general.

A valuation comprises:

■ making assumptions about the future;

■ applying certain methodologies and techniques;

■ computing a value (or range of values) for an asset, a liability or for a business as a whole.

A self-review threat may be created when a firm or network firm2 performs a valuation for a financial statement audit

client that is to be incorporated into the client’s financial statements.

As an actuarial valuation service is likely to involve the valuation of matters material to the financial statements (e.g. the

present value of obligations) and the valuation involves a significant degree of subjectivity (e.g. length of service), the

self-review threat created cannot be reduced to an acceptable level of the application of any safeguard. Accordingly:

■ such valuation services should not be provided; or

■ the firm should withdraw from the financial statement audit engagement.

If the net liability was not material to the financial statements the self-review threat may be reduced to an acceptable

level by the application of safeguards such as:

■ involving an additional professional accountant who was not a member of the audit team to review the work done

by the actuary;

■ confirming with the audit client their understanding of the underlying assumptions of the valuation and the

methodology to be used and obtaining approval for their use;

■ obtaining the audit client‘s acknowledgement of responsibility for the results of the work performed by the firm; and

■ making arrangements so that the partner providing the actuarial services does not participate in the audit

engagement. -

第9题:

(ii) the directors agree to disclose the note. (4 marks)

正确答案:

(ii) If the directors agree to disclose the note, it should be reviewed by the auditors to ensure that it is sufficiently detailed.

In evaluating the adequacy of the disclosure in the note, the auditor should consider whether the disclosure explicitly

draws the reader’s attention to the possibility that the entity may not be able to continue as a going concern in the

foreseeable future. The note should include a description of conditions giving rise to significant doubt, and the directors’

plans to deal with the conditions. If the note provided contains adequate information then there is no breach of financial

reporting standards, and so no disagreement with the directors.

If the disclosure is considered adequate, then the opinion should not be qualified. The auditors should consider a

modification by adding an emphasis of matter paragraph to highlight the existence of the material uncertainties, and to

draw attention to the note to the financial statements. The emphasis of matter paragraph should firstly contain a brief

description of the uncertainties, and also refer explicitly to the note to the financial statements where the situation has

been fully described. The emphasis of matter paragraph should re-iterate that the audit opinion is not qualified.

However, it could be the case that a note has been given in the financial statements, but that the details are inadequate

and do not fully explain the significant uncertainties affecting the going concern status of the company. In this situation

the auditors should express a qualified opinion, disagreeing with the preparation of the financial statements, as the

disclosure requirements of IAS 1 have not been followed. -

第10题:

PV Co is evaluating an investment proposal to manufacture Product W33, which has performed well in test marketing trials conducted recently by the company’s research and development division. The following information relating to this investment proposal has now been prepared.

Initial investment $2 million

Selling price (current price terms) $20 per unit

Expected selling price inflation 3% per year

Variable operating costs (current price terms) $8 per unit

Fixed operating costs (current price terms) $170,000 per year

Expected operating cost inflation 4% per year

The research and development division has prepared the following demand forecast as a result of its test marketing trials. The forecast reflects expected technological change and its effect on the anticipated life-cycle of Product W33.

It is expected that all units of Product W33 produced will be sold, in line with the company’s policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product W33 is planned to end. For investment appraisal purposes, PV Co uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 30% per year. Ignore taxation.

Required:

(a) Identify and explain the key stages in the capital investment decision-making process, and the role of

investment appraisal in this process. (7 marks)

(b) Calculate the following values for the investment proposal:

(i) net present value;

(ii) internal rate of return;

(iii) return on capital employed (accounting rate of return) based on average investment; and

(iv) discounted payback period. (13 marks)

(c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. (5 marks)

正确答案:

(a)Thekeystagesinthecapitalinvestmentdecision-makingprocessareidentifyinginvestmentopportunities,screeninginvestmentproposals,analysingandevaluatinginvestmentproposals,approvinginvestmentproposals,andimplementing,monitoringandreviewinginvestments.IdentifyinginvestmentopportunitiesInvestmentopportunitiesorproposalscouldarisefromanalysisofstrategicchoices,analysisofthebusinessenvironment,researchanddevelopment,orlegalrequirements.Thekeyrequirementisthatinvestmentproposalsshouldsupporttheachievementoforganisationalobjectives.ScreeninginvestmentproposalsIntherealworld,capitalmarketsareimperfect,soitisusualforcompaniestoberestrictedintheamountoffinanceavailableforcapitalinvestment.Companiesthereforeneedtochoosebetweencompetinginvestmentproposalsandselectthosewiththebeststrategicfitandthemostappropriateuseofeconomicresources.AnalysingandevaluatinginvestmentproposalsCandidateinvestmentproposalsneedtobeanalysedindepthandevaluatedtodeterminewhichofferthemostattractiveopportunitiestoachieveorganisationalobjectives,forexampletoincreaseshareholderwealth.Thisisthestagewhereinvestmentappraisalplaysakeyrole,indicatingforexamplewhichinvestmentproposalshavethehighestnetpresentvalue.ApprovinginvestmentproposalsThemostsuitableinvestmentproposalsarepassedtotherelevantlevelofauthorityforconsiderationandapproval.Verylargeproposalsmayrequireapprovalbytheboardofdirectors,whilesmallerproposalsmaybeapprovedatdivisionallevel,andsoon.Onceapprovalhasbeengiven,implementationcanbegin.Implementing,monitoringandreviewinginvestmentsThetimerequiredtoimplementtheinvestmentproposalorprojectwilldependonitssizeandcomplexity,andislikelytobeseveralmonths.Followingimplementation,theinvestmentprojectmustbemonitoredtoensurethattheexpectedresultsarebeingachievedandtheperformanceisasexpected.Thewholeoftheinvestmentdecision-makingprocessshouldalsobereviewedinordertofacilitateorganisationallearningandtoimprovefutureinvestmentdecisions. -

第11题:

That is the existing product range. "product range" means product portfolio.

A对

B错

对

略 -

第12题:

判断题That is the existing product range. "product range" means product portfolio.A对

B错

正确答案: 对解析: 暂无解析 -

第13题:

(b) Using the TARA framework, construct four possible strategies for managing the risk presented by Product 2.

Your answer should describe each strategy and explain how each might be applied in the case.

(10 marks)

正确答案:

(b) Risk management strategies and Chen Products

Risk transference strategy

This would involve the company accepting a portion of the risk and seeking to transfer a part to a third party. Although an

unlikely possibility given the state of existing claims, insurance against future claims would serve to limit Chen’s potential

losses and place a limit on its losses. Outsourcing manufacture may be a way of transferring risk if the ourtsourcee can be

persuaded to accept some of the product liability.

Risk avoidance strategy

An avoidance strategy involves discontinuing the activity that is exposing the company to risk. In the case of Chen this would

involve ceasing production of Product 2. This would be pursued if the impact (hazard) and probability of incurring an

acceptable level of liability were both considered to be unacceptably high and there were no options for transference or

reduction.

Risk reduction strategy

A risk reduction strategy involves seeking to retain a component of the risk (in order to enjoy the return assumed to be

associated with that risk) but to reduce it and thereby limit its ability to create liability. Chen produces four products and it

could reconfigure its production capacity to produce proportionately more of Products 1, 3 and 4 and proportionately less of

Product 2. This would reduce Product 2 in the overall portfolio and therefore Chen’s exposure to its risks. This would need

to be associated with instructions to other departments (e.g. sales and marketing) to similarly reconfigure activities to sell

more of the other products and less of Product 2.

Risk acceptance strategy

A risk acceptance strategy involves taking limited or no action to reduce the exposure to risk and would be taken if the returns

expected from bearing the risk were expected to be greater than the potential liabilities. The case mentions that Product 2 is

highly profitable and it may be that the returns attainable by maintaining and even increasing Product 2’s sales are worth the

liabilities incurred by compensation claims. This is a risk acceptance strategy. -

第14题:

(c) Explain how absolutist (dogmatic) and relativist (pragmatic) ethical assumptions would affect the outcome

of Anne’s decision. (6 marks)

正确答案:

(c) Absolutism and relativism

Absolutism and relativism represent two extreme positions of ethical assumptions.

Definitions

An absolutist assumption is one that believes that there are ‘eternal’ rules that should guide all ethical and moral decision

making in all situations. Accordingly, in any given situation, there is likely to be one right course of action regardless of the

outcome. An absolutist believes that this should be chosen regardless of the consequences or the cost. A dogmatic approach

to morality is an example of an absolutist approach to ethics. A dogmatic assumption is one that is accepted without

discussion or debate.

Relativist assumptions are ‘situational’ in nature. Rather than arguing that there is a single right choice, a relativist will tend

to adopt a pragmatic approach and decide, in the light of the situation being considered, which is the best outcome. This will

involve a decision on what outcome is the most favourable and that is a matter of personal judgment.

Outcomes

If Anne were to adopt absolutist/dogmatic assumptions, she would be likely to decide that she would need to pursue what

she perceives is the right course of action regardless of cost to herself or the relationship with the client or her manager. Given

that she unearthed a suspect and unaccounted-for payment, and that she received an inadequate explanation from the client,

she would probably recommend extension to the audit beyond the weekend.

If Ann were to adopt relativist or pragmatic assumptions, she would have a potentially much more complicated decision to

make. She would have to decide whether it was more important, ethically, to yield to the pressure from Zachary in the

interests of her short-term career interests or ‘hold out’ to protect the interests of the shareholders. Anne could recommend

sign off and trust the FD’s explanation but she is more likely to seek further evidence or assurance from the company before

she does so. -

第15题:

(c) Identify TWO QUALITATIVE benefits that might arise as a consequence of the investment in a new IT system

and explain how you would attempt to assess them. (4 marks)

正确答案:

(c) One of the main qualitative benefits that may arise from an investment in a new IT system by Moffat Ltd is the improved level

of service to its customers in the form. of reduced waiting times which may arise as a consequence of better scheduling of

appointments, inventory management etc. This could be assessed via the introduction of a questionnaire requiring customers

to rate the service that they have received from their recent visit to a location within Moffat Ltd according to specific criteria

such as adherence to appointment times, time taken to service the vehicle, cleanliness of the vehicle, attitude of staff etc.

Alternatively a follow-up telephone call from a centralised customer services department may be made by Moffat Ltd

personnel in order to gather such information.

Another qualitative benefit of the proposed investment may arise in the form. of competitive advantage. Improvements in

customer specific information and service levels may give Moffat Ltd a competitive advantage. Likewise, improved inventory

management may enable costs to be reduced thereby enabling a ‘win-win’ relationship to be enjoyed with its customers. -

第16题:

(b) (i) Explain how the use of Ansoff’s product-market matrix might assist the management of Vision plc to

reduce the profit-gap that is forecast to exist at 30 November 2009. (3 marks)

正确答案:

-

第17题:

(ii) Explain the income tax (IT), national insurance (NIC) and capital gains tax (CGT) implications arising on

the grant to and exercise by an employee of an option to buy shares in an unapproved share option

scheme and on the subsequent sale of these shares. State clearly how these would apply in Henry’s

case. (8 marks)

正确答案:

(ii) Exercising of share options

The share option is not part of an approved scheme, and will not therefore enjoy the benefits of such a scheme. There

are three events with tax consequences – grant, exercise and sale.

Grant. If shares or options over shares are sold or granted at less than market value, an income tax charge can arise on

the difference between the price paid and the market value. [Weight v Salmon]. In addition, if options can be exercised

more than 10 years after the date of the grant, an employment income charge can arise. This is based on the market

value at the date of grant less the grant and exercise priced.

In Henry’s case, the options were issued with an exercise price equal to the then market value, and cannot be exercised

more than 10 years from the grant. No income tax charge therefore arises on grant.

Exercise. On exercise, the individual pays the agreed amount in return for a number of shares in the company. The price

paid is compared with the open market value at that time, and if less, the difference is charged to income tax. National

insurance also applies, and the company has to pay Class 1 NIC. If the company and shareholder agree, the national

insurance can be passed onto the individual, and the liability becomes a deductible expense in calculating the income

tax charge.

In Henry’s case on exercise, the difference between market value (£14) and the price paid (£1) per share will be taxed

as income. Therefore, £130,000 (10,000 x (£14 – £1)) will be taxed as income. In addition, national insurance will

be chargeable on the company at 12·8% (£16,640) and on Henry at the rate of 1% (£1,300).

Sale. The base cost of the shares is taken to be the market value at the time of exercise. On the sale of the shares, any

gain or loss arising falls under the capital gains tax rules, and CGT will be payable on any gain. Business asset taper

relief will be available as the company is an unquoted trading company, but the relief will only run from the time that

the share options are exercised – i.e. from the time when the shares were acquired.

In Henry’s case, the sale of the shares will immediately follow the exercise of the option (6 days later). The sale proceeds

and the market value at the time of exercise are likely to be similar; thus little to no gain is likely to arise. -

第18题:

(ii) Advise Andrew of the tax implications arising from the disposal of the 7% Government Stock, clearly

identifying the tax year in which any liability will arise and how it will be paid. (3 marks)

正确答案:

(ii) Government stock is an exempt asset for the purposes of capital gains tax, however, as Andrew’s holding has a nominal

value in excess of £5,000, a charge to income tax will arise under the accrued income scheme. This charge to income

tax will arise in 2005/06, being the tax year in which the next interest payment following disposal falls due (20 April

2005) and it will relate to the income accrued for the period 21 October 2004 to 14 March 2005 of £279 (145/182

x £350). As interest on Government Stock is paid gross (unless the holder applies to receive it net), the tax due of £112

(£279 x 40%) will be collected via the self-assessment system and as the interest was an ongoing source of income

will be included within Andrew’s half yearly payments on account payable on 31 January and 31 July 2006. -

第19题:

(ii) Can we entertain our clients as a gesture of goodwill or is corporate hospitality ruled out? (3 marks)

Required:

For EACH of the three FAQs, explain the threats to objectivity that may arise and the safeguards that should

be available to manage them to an acceptable level.

NOTE: The mark allocation is shown against each of the three questions.

正确答案:

(ii) Corporate hospitality

A partner in an audit firm is obviously in a position to influence the conduct and outcome of an audit. Therefore a

partner being on ‘too friendly’ terms with an audit client creates a familiarity threat. Other members of the audit team

may not exert as much influence on the audit.

A self-interest threat may also be perceived (e.g. if corporate hospitality is provided to keep a prestigious client).

There is no absolute prohibition against corporate hospitality provided:

■ the value attached to such hospitality is ‘insignificant’; and

■ the ‘frequency, nature and cost’ of the hospitality is reasonable.

Thus, flying the directors of an audit client for weekends away could be seen as significant. Similarly, entertaining an

audit client on a regular basis could be seen as unacceptable.

Partners and staff of Boleyn will need to be objective in their assessments of the significance or reasonableness of the

hospitality offered. (Would ‘a reasonable and informed third party’ conclude that the hospitality will or is likely to be

seen to impair your objectivity?)

If they have any doubts they should discuss the matter in the first instance with the audit engagement partner, who

should refer the matter to the ethics partner if in doubt. -

第20题:

(ii) Describe the evidence you would seek to support the assertion that development costs are technically

feasible. (3 marks)

正确答案:

(ii) Evidence supporting the assertion that development costs are technically feasible would include the following:

– Review the results of scientific tests performed on the products, for example, the results of animal or human testing

of the products.

– Discuss any detrimental results of these tests, e.g. harmful side effects, with the scientists working on the project

to determine what corrective action is being taken.

– Enquire whether any licences necessary for continued development and/or commercial production have been

granted by the appropriate regulatory body.

– Compare expected to actual development costs incurred per product being developed. Where actual costs are in

excess of expected costs investigate whether the extra costs have been incurred in order to make good any problems

identified in the development process.

– Review board minutes for relevant discussion of the product development taking place during the year. -

第21题:

(ii) From the information provided above, recommend the matters which should be included as ‘findings

from the audit’ in your report to those charged with governance, and explain the reason for their

inclusion. (7 marks)

正确答案:

(ii) Control weakness

ISA 260 contains guidance on the type of issues that should be communicated. One of the matters identified is a control

weakness in the capital expenditure transaction cycle. The assets for which no authorisation was obtained amount to

0·3% of total assets (225,000/78 million x 100%), which is clearly immaterial. However, regardless of materiality, the

auditor should ensure that the weakness is brought to the attention of the management, with a clear indication of the

implication of the weakness, and recommendations as to how the control weakness should be eliminated.

The auditor is providing information to help those charged with governance improve the internal systems and controls

and ultimately reduce business risk. In this case there is a high risk of fraud, as the lack of authorisation for purchase

of office equipment could allow expenditure on assets not used for bona fide business purposes.

Disagreement with accounting treatment of brand

Audit procedures have revealed a breach of IAS 38 Intangible Assets, in which internally generated brand names are

specifically prohibited from being recognised. Blod Co has recognised an internally generated brand name which is

material to the statement of financial position (balance sheet) as it represents 12·8% of total assets (10/78 x 100%).

The statement of financial position (balance sheet) therefore contains a material misstatement.

The report to those charged with governance should clearly explain the rules on recognition of internally generated brand

names, to ensure that the management has all relevant technical facts available. In the report the auditors should

request that the financial statements be corrected, and clarify that if the brand is not derecognised, then the audit opinion

will be qualified on the grounds of a material disagreement – an ‘except for’ opinion would be provided. Once the breach

of IAS 38 is made clear to the management in the report, they then have the opportunity to discuss the matter and

decide whether to amend the financial statements, thereby avoiding a qualified audit opinion.

Audit inefficiencies

Documentation relating to inventories was not always made readily available to the auditors. This seems to be due to

poor administration by the client rather than a deliberate attempt to conceal information. The report should contain a

brief description of the problems encountered by the audit team. The management should be made aware that

significant delay to the receipt of necessary paperwork can cause inefficiencies in the audit process. This may seem a

relatively trivial issue, but it could lead to an increase in audit fee. Management should react to these comments by

ensuring as far as possible that all requested documentation is made available to the auditors in a timely fashion. -

第22题:

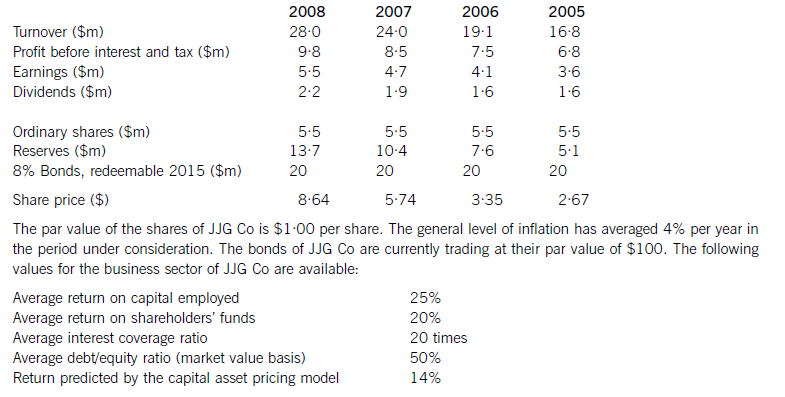

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第23题:

That is the existing product range. "product range" means product portfolio.

正确答案:正确