(ii) Evaluate the relative advantages and disadvantages of Chen’s risk management committee beingnon-executive rather than executive in nature. (7 marks)

题目

(ii) Evaluate the relative advantages and disadvantages of Chen’s risk management committee being

non-executive rather than executive in nature. (7 marks)

相似考题

更多“(ii) Evaluate the relative advantages and disadvantages of Chen’s risk management committee beingnon-executive rather than executive in nature. (7 marks)”相关问题

-

第1题:

Roy Crawford has argued for a reduction in both the product range and customer base to improve company

performance.

(b) Assess the operational advantages and disadvantages to Bonar Paint of choosing such a strategy.

(15 marks)

正确答案:

(b) Divestment of products or parts of the business is one of the most difficult strategic decisions. As apparent in Bonar Paint a

reduction in the products and customers served by the firm is likely to cause significant changes to the firm’s value chain and

system. Currently Bonar Paint supplies its customers, regardless of size, directly and this inevitably means that their

distribution costs are increased. The reduction in products and customers may allow a choice to be made about the costs of

supplying customers directly as against using distributors to handle the smaller customers.

In using the value chain one is looking to identify the significant cost activities and how those costs behave. Some costs may

be affected by the overall size of the firm e.g. advertising while others affected by the batch size being processed. The changeto fewer products will lead to a bigger batch size and a number of positive consequences for costs. The value chain’s major

benefit is in identifying and quantifying the links that exist between various activities within the firm and between the firm

and its customers and suppliers. In Bonar Paint’s case does a reduction in product range lead to less product failures and

consequent warranty claims? Does simplifying the product range lead to shorter lead times and better delivery time

performance for its customers? Above all, a good understanding of its value chain will let it know if it changes an activity what

are the consequences for other parts of the system.

In terms of reducing the product range, before such a decision is taken Bonar Paint must carry out a thorough analysis of the

pattern of customer demand for each paint type. In all probability it will find that 80% of its sales come from 20% of its

product range. Having given this qualification, reducing the product range can have a number of beneficial results on other

parts of the value chain. The immediate effect is likely to be that Bonar Paint produces fewer batches over a given time period

but produces them in larger quantities. This will bring cost savings but the impact on other parts of the value chain is equally

important. The beneficial effects are:

– With a smaller product range the control of raw materials and finished inventory will be simplified affecting inbound and

outbound logistics. This will improve the inventory turn and make for better product availability.

– With an improved inventory turn this will reduce the firm’s working capital needs and release significant amounts of

cash.

– A simpler operations process should facilitate staff savings and support more automation.

– Warranty claims and support costs could be reduced.

– Bonar Paint will be purchasing fewer raw materials but in greater volume and on a more regular basis. This will lead to

improved price and delivery terms from its suppliers.

– Bonar Paint can offer improved product reliability and better delivery to its customers and should improve its market

share.

In terms of operational disadvantages, these therefore are largely in terms of the impact on customer service levels seen in

terms of product range availability. Once again it is important to have accurate information on the sales and profitability of

each product so informed divestment decisions could be taken. Care must be taken to identify any paints, which though

ordered infrequently, and in small quantities are a pre-cursor for customers ordering other paints. Some important customers

may require that the full range of their paint needs are met in order to continue buying from Bonar Paint.

Reduction of the product range and customer base is an important strategic decision. Eliminating non-contributors or ‘dog’

products both in terms of paints and customers is a key part of managing the product portfolio. However, inertia both in terms

of products and customers is a real strategic weakness. In terms of the three tests of suitability, acceptability and feasibility

the analysis suggests that only acceptability is likely to be an issue. Tony Edmunds needs to be convinced that it is an

appropriate strategy to adopt. It is the lack of accurate sales analysis that lies at the heart of the problem and that is his areaof responsibility! -

第2题:

(c) Identify and evaluate other strategic options ONA could consider to address the airline’s current financial and

operational weaknesses.

Note: requirement (c) includes 2 professional marks (10 marks)

正确答案:(c) Within the strategy clock, ONA might consider both differentiation and focus. A differentiation strategy seeks to provide

products or services that offer different benefits from those offered by competitors. These benefits are valued by customers

and so can lead to increased market share and, in the context of ONA, higher seat utilisation. Differentiation is particularly

attractive when it provides the opportunity of providing a price premium. In other words, margins are enhanced through

differentiation. Air travellers may be willing to pay more to travel with an airline that offers seat allocation and free in-flight

food and drinks.

However, such a broad-based differentiation strategy may be inappropriate for ONA because of the need to service both

business and leisure travellers. Consequently, the potential strategy also has to be considered in the context of the two sectors

that the company perceives that it services. In the regional sector a focused differentiation strategy looks particularly attractive.

Here, the strategy focuses on a selected niche or market segment. The most obvious focus is on business travel and building

the company’s strengths in this sector. This focus on the business traveller might be achieved through:

– Ensuring that flight times are appropriate for the business working day. This is already a perceived strength of the

company. This needs to be built on.

– Providing more space in the aircraft by changing the seating configuration – and the balance between business and

standard class. ONA currently has a low seat occupancy rate and a reduction in seat capacity could be borne.

– Fewer passengers in the aircraft may also lead to improved throughput times. Loading and unloading aircraft is quicker,

minimising the delays encountered by the traveller.

– Providing supporting business services – lounges with fax and internet facilities.

– Speeding the process of booking and embarkation (through electronic check-in), so making the process of booking and

embarkation easier and faster.

– Providing loyalty schemes that are aimed at the business traveller.

Although this focused differentiation is aimed at the business customer it is also likely that particular aspects of it will be

valued by certain leisure travellers. Given the strong regional brand (people from Oceania are likely to travel ONA) and the

nature of the leisure travel in this sector (families visiting relatives) it seems unlikely that there will be a significant fall off in

leisure travel in the regional sector.

In the international sector, the strategic customer is less clear. This sector is serving both the leisure and business market and

is also competing with strong ‘no frills’ competitors. The nature of customer and competition is different. A strategy of

differentiation could still be pursued, although perhaps general differentiation (without a price premium) may be more effective

with the aim of increasing seat occupancy rate. This sector would also benefit from most of the suggested improvements of

the regional sector – providing more space in aircraft, faster passenger throughput, electronic check-in etc. However, these

small changes will not address the relatively low flight frequency in this sector. This could be addressed through seeking

alliances with established airlines in the continental countries that it services. Simple code share agreements could double

ONA’s frequencies overnight. Obviously, ONA would be seeking a good cultural fit – the ‘no frills’ low-cost budget airlineswould not be candidates for code shares.ONA’s perception of market segmentation, reflected in splitting regional from international travel and distinguishing leisure

from business appears to be a sensible understanding of the marketplace. However, it might also be useful for them to

consider on-line customers and commission customers (travel agents) as different segments. Perceiving travel agents as the

strategic customer would lead to a different strategic focus, one in which the amount and structure of commission played an

important part.

Finally, whichever strategy ONA adopts, it must continue to review its operational efficiency. An important strategic capability

in any organisation is to ensure that attention is paid to cost-efficiency. It can be argued that a continual reduction in costs

is necessary for any organisation in a competitive market. Management of costs is a threshold competence for survival. ONA

needs to address some of the weaknesses identified earlier in the question. Specific points, not covered elsewhere, include:

– Improved employee productivity to address the downward decline in efficiency ratios.

– Progressive standardisation of the fleet to produce economies of scale in maintenance and training. This should reduce

the cost base.

– Careful monitoring of expenditure, particularly on wages and salaries, to ensure that these do not exceed revenue

increases.

Candidates may address this question in a number of ways. In the model answer given above, the strategy clock is used –

as it uses the term ‘no frills’ in its definition and so it seems appropriate to look at other options within this structure. However,

answers that use other frameworks (such as Ansoff’s product/market matrix) are perfectly acceptable. Furthermore, answerswhich focus on the suitability, acceptability and feasibility of certain options are also acceptable. -

第3题:

There is considerable evidence that small firms are reluctant to carry out strategic planning in their businesses.

(b) What are the advantages and disadvantages for Gould and King Associates in creating and implementing a

strategic plan? (8 marks)

正确答案:

(b) Clearly, there is a link between the ability to write a business plan and the willingness, or otherwise, of small firms to carry

out strategic planning. Whilst writing a business plan may be a necessity in order to acquire financial support, there is much

more question over the benefits to the existing small business, such as Gould and King, of carrying out strategic planning.

One of the areas of greatest debate is whether carrying out strategic planning leads to improved performance. Equally

contentious is whether the formal rational planning model is worthwhile or whether strategy is much more of an emergent

process, with the firm responding to changes in its competitive environment.

One source argues that small firms may be reluctant to create a strategic plan because of the time involved; small firms may

find day-to-day survival and crisis management prevents them having the luxury of planning where they mean to be over the

next few years. Secondly, strategic plans may also be viewed as too restricting, stopping the firm responding flexibly and

quickly to opportunities and threats. Thirdly, many small firms may feel that they lack the necessary skills to carry out strategic

planning. Strategic planning is seen as a ‘big’ firm process and inappropriate for small firms. Again, there is evidence to

suggest that owner-managers are much less aware of strategic management tools such as SWOT, PESTEL and mission

statements than their managers. Finally, owner-managers may be reluctant to involve others in the planning process, which

would necessitate giving them access to key information about the business. Here there is an issue of the lack of trust and

openness preventing the owner-manager developing and sharing a strategic plan. Many owner-managers may be quite happy

to limit the size of the business to one which they can personally control.

On the positive side there is evidence to show that a commitment to strategic planning results in speedier decision making,

a better ability to introduce change and innovation and being good at managing change. This in turn results in better

performance including higher rates of growth and profits, clear indicators of competitive advantage. If Gould and King arelooking to grow the business as suggested, this means some strategic planning will necessarily be involved -

第4题:

(c) Assess the advantages and disadvantages to Datum Paper Products taking the greenfield option as opposed

to the acquisition of Papier Presse. (15 marks)

正确答案:

(c) From the information given in the scenario, DPP will face significant problems if it chooses to develop a greenfield site. The

bureaucratic planning procedures adopted by the host government can add considerable time to get an efficient plant up and

running. In some ways, such governments are in a dilemma, anxious to secure foreign direct investment, but at the same

time protect inefficient domestic manufacturers. Certainly, DPP in its own risk assessment would need to take political risk

into account. In assessing the risks of a greenfield site, Ken could use Porter’s ‘diamond’ to good effect. Factor conditions

might be seen as quite favourable, with an educated, trained, albeit low productivity, labour force. However, the lack of

demanding tough global customers, a weak and inefficient domestic industry to supply the new venture and competitors who

have been highly protected mean that DPP will have to battle to create a supportive and sustaining environment. Financial

exposure may be increased through currency risk.

Clearly, the fresh start will allow integrated information systems to be developed and the latest technology to be used.

However, the new capacity will have a significant impact on DPP’s existing plants. The extent to which expatriate

management is used is clearly an issue. The host government is likely to require some commitment to the training of local

management and the degree of autonomy given to the new plant may well be an issue. Cultural issues and sensitivities will

be significant – often shop floor workers and managers will be used to high levels of absenteeism being tolerated in

government owned and controlled firms. Also the issue of involvement and participation could be an issue – there may be a

marked reluctance on the shop floor to contribute ideas towards raising productivity and quality. DPP is part of a group that

has experience of operating abroad and there is a real need to access information on key problems in greenfield operations.

In many ways the move to a greenfield site links the macro environmental analysis generated by a SLEPT or PEST to five

forces industry analysis with its focus on customers, competitors and suppliers. Certainly, creating an integrated value chain

with DPP’s existing business will be a real challenge to the management. It also adds capacity to a European industry where

there is already a problem. Choosing between the two options to achieve the strategic goal of a lower cost base can be doneusing the tests of suitability, acceptability and feasibility. The decision will not be an easy one. -

第5题:

(c) Critically evaluate Vincent Viola’s view that corporate governance provisions should vary by country.

(8 marks)

正确答案:

(c) Corporate governance provisions varying by country

There is a debate about the extent to which corporate governance provisions (in the form. of either written codes, laws or

general acceptances) should be global or whether they should vary to account for local differences. In this answer, Vincent

Viola’s view is critically evaluated.

In general terms, corporate governance provisions vary depending on such factors as local business culture, businesses’

capital structures, the extent of development of capital funding of businesses and the openness of stock markets. In Germany,

for example, companies have traditionally drawn much of their funding from banks thereby reducing their dependence on

shareholders’ equity. Stock markets in the Soviet Union are less open and less liquid than those in the West. In many

developing countries, business activity is concentrated among family-owned enterprises.

Against Vincent’s view

Although business cultures vary around the world, all business financed by private capital have private shareholders. Any

dilution of the robustness of provisions may ignore the needs of local investors to have their interests adequately represented.

This dilution, in turn, may allow bad practice, when present, to exist and proliferate.

Some countries suffer from a poor reputation in terms of endemic corruption and fraud and any reduction in the rigour with

which corporate governance provisions are implemented fail to address these shortcomings, notwithstanding the fact that they

might be culturally unexpected or difficult to implement.

In terms of the effects of macroeconomic systems, Vincent’s views ignore the need for sound governance systems to underpin

confidence in economic systems. This is especially important when inward investment needs are considered as the economic

wealth of affected countries are partly underpinned by the robustness, or not, of their corporate governance systems.

Supporting Vincent’s view

In favour of Vincent’s view are a number of arguments. Where local economies are driven more by small family businesses

and less by public companies, accountability relationships are quite different (perhaps the ‘family reasons’ referred to in the

case) and require a different type of accounting and governance.

There is a high compliance and monitoring cost to highly structured governance regimes that some developing countries may

deem unnecessary to incur.

There is, to some extent, a link between the stage of economic development and the adoption of formal governance codes.

It is generally accepted that developing countries need not necessarily observe the same levels of formality in governance as

more mature, developed economies.

Some countries’ governments may feel that they can use the laxity of their corporate governance regimes as a source of

international comparative advantage. In a ‘race to the bottom’, some international companies seeking to minimise the effects

of structured governance regimes on some parts of their operations may seek countries with less tight structures for some

operations.

-

第6题:

(c) Risk committee members can be either executive or non-executive.

Required:

(i) Distinguish between executive and non-executive directors. (2 marks)

正确答案:

(c) Risk committee members can be either executive on non-executive.

(i) Distinguish between executive and non-executive directors

Executive directors are full time members of staff, have management positions in the organisation, are part of the

executive structure and typically have industry or activity-relevant knowledge or expertise, which is the basis of their

value to the organisation.

Non-executive directors are engaged part time by the organisation, bring relevant independent, external input and

scrutiny to the board, and typically occupy positions in the committee structure. -

第7题:

(ii) Calculate the probability of the net profit being less than £75 million. (2 marks)

正确答案:

-

第8题:

(ii) Briefly discuss THREE disadvantages of using EVA? in the measurement of financial performance.

(3 marks)

正确答案:

(ii) Disadvantages of an EVA approach to the measurement of financial performance include:

(i) The calculation of EVA may be complicated due to the number of adjustments required.

(ii) It is difficult to use EVA for inter-firm and inter-divisional comparisons because it is not a ratio measure.

(iii) Economic depreciation is difficult to estimate and conflicts with generally accepted accounting principles.

Note: Other relevant discussion would be acceptable. -

第9题:

Note: requirement (a) includes 4 professional marks.

A central feature of the performance measurement system at TSC is the widespread use of league tables that display

each depot’s performance relative to one another.

Required:

(b) Evaluate the potential benefits and problems associated with the use of ‘league tables’ as a means of

measuring performance. (6 marks)

正确答案:

(b) A central feature of many performance measurement systems is the widespread use of league tables that display each

business unit’s performance relative to one another. In the case of service organisations such as TSC the use of league tables

emphasises the company’s critical success factors of profitability and quality of service by reporting results on a weekly basis

at the depot level. The fact that such league tables are used by management will actively encourage competition, in terms of

performance, among depots. The individual position of a business unit in the league table is keenly observed both by the

manager of that unit and his/her peers.

In theory, performance is transparent. In practice although each depot performs essentially the same function and is subject

to the same modes of measurement, circumstances pertaining to different business units may vary significantly. Some depots

may be situated near to the hub (main distribution centre), some may be located far away and some may be in urban zones

with well developed road networks whilst others may be in remote rural areas. Measuring performance via a league table

makes no allowance whatsoever for these relative differences, hence, inequality is built into the performance measurement

system.

Moreover, depot managers might be held responsible for areas over which they have no formal control. The network nature

of the business suggests that there will be a high degree of interdependence of depots; the depot responsible for collection

will very often not be the depot responsible for delivery. Therefore, it is frequently the case that business may be gained for

which the collecting depot receives the revenue, but for which the delivering depot bears the cost. Obviously this impacts

upon the profit statements of both depots. The formal system might not recognise such difficulties, the corporate view being

that ‘the business needs to be managed’; the depots should therefore see any such anomalies as mild constraints to work

around rather than barriers to break down. In such circumstances delivering depots and collecting depots should discuss such

problems on an informal basis. Such informal discussions are aided by close communications between depots recognising

the interdependencies of the business. -

第10题:

TQ Company, a listed company, recently went into administration (it had become insolvent and was being managed by a firm of insolvency practitioners). A group of shareholders expressed the belief that it was the chairman, Miss Heike Hoiku, who was primarily to blame. Although the company’s management had made a number of strategic errors that brought about the company failure, the shareholders blamed the chairman for failing to hold senior management to account. In particular, they were angry that Miss Hoiku had not challenged chief executive Rupert Smith who was regarded by some as arrogant and domineering. Some said that Miss Hoiku was scared of Mr Smith.

Some shareholders wrote a letter to Miss Hoiku last year demanding that she hold Mr Smith to account for a number of previous strategic errors. They also asked her to explain why she had not warned of the strategic problems in her chairman’s statement in the annual report earlier in the year. In particular, they asked if she could remove Mr Smith from office for incompetence. Miss Hoiku replied saying that whilst she understood their concerns, it was difficult to remove a serving chief executive from office.

Some of the shareholders believed that Mr Smith may have performed better in his role had his reward package been better designed in the first place. There was previously a remuneration committee at TQ but when two of its four non-executive members left the company, they were not replaced and so the committee effectively collapsed.

Mr Smith was then able to propose his own remuneration package and Miss Hoiku did not feel able to refuse him.

He massively increased the proportion of the package that was basic salary and also awarded himself a new and much more expensive company car. Some shareholders regarded the car as ‘excessively’ expensive. In addition, suspecting that the company’s performance might deteriorate this year, he exercised all of his share options last year and immediately sold all of his shares in TQ Company.

It was noted that Mr Smith spent long periods of time travelling away on company business whilst less experienced directors struggled with implementing strategy at the company headquarters. This meant that operational procedures were often uncoordinated and this was one of the causes of the eventual strategic failure.

(a) Miss Hoiku stated that it was difficult to remove a serving chief executive from office.

Required:

(i) Explain the ways in which a company director can leave the service of a board. (4 marks)

(ii) Discuss Miss Hoiku’s statement that it is difficult to remove a serving chief executive from a board.

(4 marks)

(b) Assess, in the context of the case, the importance of the chairman’s statement to shareholders in TQ

Company’s annual report. (5 marks)

(c) Criticise the structure of the reward package that Mr Smith awarded himself. (4 marks)

(d) Criticise Miss Hoiku’s performance as chairman of TQ Company. (8 marks)

正确答案:(a) (i) Leaving the service of a board

Resignation with or without notice. Any director is free to withdraw his or her labour at any time but there is normally

a notice period required to facilitate an orderly transition from the outgoing chief executive to the incoming one.

Not offering himself/herself for re-election. Terms of office, which are typically three years, are renewable if the director

offers him or herself for re-election and the shareholders support the renewal. Retirement usually takes place at the end

of a three-year term when the director decides not to seek re-election.

Death in service when, obviously, the director is unable to either provide notice or seek retirement.

Failure of the company. When a company fails, all directors’ contracts are cancelled although this need not signal the

end of the directors’ involvement with company affairs as there may be ongoing legal issues to be resolved.

Being removed e.g. by being dismissed for disciplinary offences. It is relatively easy to ‘prove’ a disciplinary offence but

much more difficult to ‘prove’ incompetence. The nature of disciplinary offences are usually made clear in the terms and

conditions of employment and company policy.

Prolonged absence. Directors unable to perform. their duties owing to protracted absence, for any reason, may be

removed. The length of qualifying absence period varies by jurisdiction.

Being disqualified from being a company director by a court. Directors can be banned from holding directorships by a

court for a number of reasons including personal bankruptcy and other legal issues.

Failing to be re-elected if, having offered him or herself for re-election, shareholders elect not to re-appoint.

An ‘agreed departure’ such as by providing compensation to a director to leave.(ii) Discuss Miss Hoiku’s statement

The way that directors’ contracts and company law are written (in most countries) makes it difficult to remove a director

such as Mr Smith from office during an elected term of office so in that respect, Miss Hoiku is correct. Unless his contract

has highly specific performance targets built in to it, it is difficult to remove Mr Smith for incompetence in the

short-term as it is sometimes difficult to assess the success of strategies until some time has passed. If the alleged

incompetence is within Mr Smith’s term of office (typically three years) then it will usually be necessary to wait until the

director offers himself for re-election. The shareholders can then simply not re-elect the incompetent director (in this

case, Mr Smith). The most likely way to achieve the departure of Mr Smith within his term of office will be to ‘encourage’

him to resign by other directors failing to support him or by shareholders issuing a vote of no confidence at an AGM or

EGM. This would probably involve offering him a suitable financial package to depart at a time chosen by the other

members of the board or company shareholders.

(b) Importance of the chairman’s statement

The chairman’s statement (or president’s letter in some countries) is an important and usually voluntary item, typically carried

at the very beginning of an annual report. In general terms, it is intended to convey important messages to shareholders in

general, strategic terms. As a separate section from other narrative reporting sections of an annual report, it offers the

chairman the opportunity to inform. shareholders about issues that he or she feels it would be beneficial for them to be aware

of. This independent communication is an important part of the separation of the roles of CEO and chairman.

In the case of TQ Company, the role of the chairman is of particular importance because of the dominance of Mr Smith.

Miss Hoiku had a particular responsibility to use her most recent statement to inform. shareholders about going concern issues

notwithstanding the difficulties that might cause in her relationship with Mr Smith. Miss Hoiku has an ethical as well as an

agency responsibility to express her independence in the chairman’s statement and convey issues relevant to company value

to the company’s shareholders. She can use her chairman’s statement for this purpose.(c) Criticise the structure of the reward package that Mr Smith awarded himself

The balance between basic to performance related pay was very poor. Mr Smith, perhaps being aware that the prospect of

gaining much performance related income was low, took the opportunity to increase the fixed element of his income to

compensate. This was not only unprofessional and unethical on Mr Smith’s part, but it also represented very bad value for

shareholders. Having exercised his share options and sold the resulting shares, there was now no element of alignment of

his package with shareholder interests at all. His award to himself of an ‘excessively’ expensive company car was also not

in the shareholders’ interests. The fact that he exercised and sold all of his share options means that he will now have no

personal financial motivation to take strategic decisions intended to increase TQ Company’s share value. This represents a

poor degree of alignment between Mr Smith’s package and the interests of TQ’s shareholders.

(d) Criticise Miss Hoiku’s performance as chairman of TQ Company

The case describes a particularly poor performance by a company chairman. It is a key function of the chairman to represent

the shareholders’ interests in the company and Miss Hoiku has clearly failed in this duty.

A key reason for her poor performance was her reported inability or unwillingness to face up to Mr Smith who was clearly a

domineering personality. A key quality of a company chairman is his or her ability and willingness to personally challenge the

chief executive if necessary.

She failed to ensure that a committee structure was in place, allowing as she did, the remunerations committee to atrophy

when two members left the company.

Linked to this, it appears from the case that the two non-executive directors that left were not replaced and again, it is a part

of the chairman’s responsibility to ensure that an adequate number of non-executives are in place on the board.

She inexplicably allowed Mr Smith to design his own rewards package and presided over him reducing the performance

related element of his package which was clearly misaligned with the shareholders’ interests.

When Mr Smith failed to co-ordinate the other directors because of his unspecified business travel, she failed to hold him to

account thereby allowing the company’s strategy to fail.

There seems to have been some under-reporting of potential strategic problems in the most recent annual report. A ‘future

prospects’ or ‘continuing business’ statement is often a required disclosure in an annual report (in many countries) and there is evidence that this statement may have been missing or misleading in the most recent annual report. -

第11题:

one of the disadvantages of traditional pedagogy is ___.A、language is used to perform. certain communicative functions

B、learners are not able to make sentences

C、it focuses on form. rather than on functions

D、learners are not able to do translation

参考答案:C

-

第12题:

问答题◆Topic 5: Buildings: Good to Use or Good to Look? Questions for Reference: 1. Is there any building impressed you? Describe it. 2. What are the advantages/disadvantages of buildings designed as works of art? 3. Recently, more and more people believe that a building should serve its purpose rather than looking beautiful. What’s your view?正确答案: 【参考答案】

Recently, more and more people believe that a building should serve its purpose rather than looking beautiful, whether the architects should worry about buildings as works of art has become an issue of controversy. Before presenting my opinion, I would like to probe into both sides of the debate.

Critics argue about the shortcomings of buildings designed as works of art. First of all, it needs a great sum of money to design beautiful buildings with extra decorations. Most people would like to have better infrastructures and recreational facilities rather than a better look. Secondly, the side effects brought by artistic designs also arouse people’s wide concern. They worry about the safety of buildings and they believe the steadiness is more essential. Last but not least, the appearance which is loved by the designers may not be accepted by everyone. Different people have discrepant views. It is easier said than done to settle a proposal satisfying everybody.

Supporters also claim that there are a large number of benefits following the special architectures. For one thing, we can hand down our cultural heritages by constructions. If we fail to build up symbols of our tradition, our descendants may forget it someday. For another thing, it’s also a good way to enhance the embellishment. There is no doubt that a good image of the city could successfully attract the world’s attention and powder .the dwellers with more opportunities. Also worth mentioning is that it can give us good feelings. Under such circumstance, people could work more efficiently and rest more comfortably.

Generally speaking, both of their views are rational. But personally, I side with the latter one.

Anyway, we don’t want to live in a world with the same buildings, the same colours and the same styles.解析: 暂无解析 -

第13题:

Bonar Paint to date has had no formal strategic planning process.

(d) What are the advantages and disadvantages of developing a formal mission statement to guide Bonar Paint’s

future direction after the buyout? (10 marks)

正确答案:

(d) The change in ownership represents a major change in the life of any organisation and the opportunity to convince the various

stakeholders of the strategic direction the firm is going in should not be missed. Mission statements are not something that

can be created at five minutes notice and once created need to be revisited to ensure they are still relevant and engaging.

Some experts argue that the mission can only be developed once the firm’s competitive strategy has been developed. Others

argue that it is the starting point for the whole strategic planning process.

A mission statement expresses the purpose of the business and great care will need to be taken to clarify the new role and

status of the buyout directors. Two other critical stakeholders are the workforce and the customers – alienation of either group

will have serious consequences for the firm. Customers need to be convinced that they should stay with the firm and staff

that there is a future for them in the new set up. Bonar Paint needs to ensure that its reputation for customer care is part of

the statement.

The strategy of the firm in terms of where and how it is going to compete again should create confidence in the key

stakeholders. Developing this clear sense of where Bonar Paint is going and how it is going to get there will be of particular

interest to its financial backers. Expressing the mission of the business will be a key part of any business plan. Bonar Paint

may also choose to emphasise the standards of behaviour that will underpin the way it does business. This may include an

explicit commitment to innovative products and customer service. Once again the impact and relevance to both internal and

external stakeholders is important.

Finally, the buyout managers have to convince stakeholders that the culture and values associated with that culture will be

retained after the change in ownership. Bonar Paint, under the Bonar brothers’ ownership and direction, did not feel that

strategic planning was a necessary activity. A succinct and meaningful mission statement may be an excellent way to

communicate the new ownership and sense of purpose in Bonar Paint.

Creating mission statements that convey a sense of purpose may not be easy for the buyout team. The time spent creating

the statement has to have positive outcomes or it will be time wasted. Creating such a statement with no previous experience

increases the difficulties. Seeing it as an integral part of a strategic planning process is important. Care must be taken to

involve other stakeholders in the process or statements may be made with little meaning for them. The degree of involvement

is also significant; most stakeholders are more likely to be useful as ‘sounding boards’ for testing and refining the statement.

The danger is that a statement is produced that few stakeholders buy into and does not affect attitudes or behaviours towardBonar Paint. -

第14题:

(b) Both divisions have recognised the need for a strategic alliance to help them achieve a successful entry into

European markets.

Critically evaluate the advantages and disadvantages of the divisions using strategic alliances to develop their

respective businesses in Europe. (15 marks)

正确答案:

(b) Johnson, Scholes and Whittington define a strategic alliance as ‘where two or more organisations share resources and

activities to pursue a strategy’. There are a number of types of alliance ranging from a formal joint venture through to networks

where there is collaboration but no formal agreement. The type of strategic alliance will be affected by how quickly market

conditions are changing – swift rates of change may require flexible less formal types of alliance and determine whether

specific dedicated resources are required or whether the partners can use existing resources. Johnson, Scholes and

Whittington argue that for an alliance to be successful there needs to be a clear strategic purpose and senior management

support; compatibility between the partners at all levels – this may be complicated if it is a cross-border alliance; time spent

defining and meeting performance expectations including clear goals, governance and organisational arrangements; and

finally trust both in terms of respective competences and trustworthiness.

6D–ENGAA

Paper 3.5

6D–ENGAA

Paper 3.5

The advantages that may be gained by a successful strategic alliance include creating a joint operation that has a ‘critical

mass’ that may lead to lower costs or an improved offer to the customer. It may also allow each partner to specialise in areas

where they have a particular advantage or competence. Interestingly, alliances are often entered into where a company is

seeking to enter new geographical markets, as is the case with both divisions. The partner brings local knowledge and

expertise in distribution, marketing and customer support. A good strategic alliance will also enable the partners to learn from

one another and develop competences that may be used in other markets. Often firms looking to develop an e-business will

use an alliance with a partner with experience in website development. Once its e-business is up and running a firm may

eventually decide to bring the website design skills in-house and acquire the partner.

Disadvantages of alliances range from over-dependence on the partner, not developing own core competences and a tendency

for them not to have a defined end date. Clearly there is a real danger of the partner eventually becoming a competitor.

In assessing the suitability for each division in using a strategic alliance to enter European markets one clearly has to analyse

the very different positions of the divisions in terms of what they can offer a potential partner. The earlier analysis suggests

that the Shirtmaster division may have the greater difficulty in attracting a partner. One may seriously question the feasibility

of using the Shirtmaster brand in Europe and the competences the division has in terms of manufacturing and selling to large

numbers of small independent UK clothing retailers would seem inappropriate to potential European partners. Ironically, if

the management consultant recommends that the Shirtmaster division sources some or all of its shirts from low cost

manufacturers in Europe this may provide a reason for setting up an alliance with such a manufacturer.

The prospects of developing a strategic alliance in the Corporate Clothing division are much more favourable. The division

has developed a value added service for its corporate customers, indeed its relationship with its customers can be seen as a

relatively informal network or alliance and there seems every chance this could be replicated with large corporate customers

in Europe. Equally, there may be European workwear companies looking to grow and develop who would welcome sharingthe Corporate Clothing division’s expertise. -

第15题:

(b) What advantages and disadvantages might result from outsourcing Global Imaging’s HR function?

(8 marks)

正确答案:

(b) It is important to note that there is nothing in the nature of the activities carried out by HR staff and departments that prevents

outsourcing being looked at as a serious option. Indeed, amongst larger companies the outsourcing of some parts of the HR

function is already well under way, with one source estimating that HR outsourcing is growing by 27% each year. Paul,

therefore, needs to look at the HR activities identified above and assess the advantages and disadvantages of outsourcing a

particular HR activity. Outsourcing certain parts of the recruitment process has long been accepted, with professional

recruitment agencies and ‘head-hunters’ being heavily involved in the advertising and short listing of candidates for senior

management positions. Some HR specialists argue that outsourcing much of the routine personnel work, including

maintaining employees’ records, frees the HR specialist to make a real contribution to the strategic planning process. One

study argues that ‘HR should become a partner with senior and line managers in strategy execution’.

If Paul is able to outsource the routine HR activities this will free him to contribute to the development of the growth strategy

and the critical people needs that strategy will require. In many ways the HR specialist is in a unique position to assess current

skills and capabilities of existing staff and the extent to which these can be ‘leveraged’ to achieve the desired strategy. In

Hamel and Prahalad’s terms this strategy is likely to ‘stretch’ the people resources of the company and require the recruitment

of additional staff with the relevant capabilities. Paul needs to show how long it will take to develop the necessary staff

resources as this will significantly influence the time needed to achieve the growth strategy.

Outsourcing passes on to the provider the heavy investment needed if the company sets up its own internal HR services with

much of this investment now going into web-based systems. The benefits are reduced costs and improved service quality.

The downside is a perceived loss of control and a reduced ability to differentiate the HR function from that of competitors.

Issues of employee confidentiality are also relevant in the decision to outsource.

-

第16题:

(b) What are the advantages and disadvantages of using franchising to develop La Familia Amable budget hotel

chain? (8 marks)

正确答案:

(b) Franchising is typically seen as a quick and cost effective way of growing the business but Ramon should be aware of both

the advantages and disadvantages of using it as the preferred method of growth. Franchised chains are argued to benefit from

the sort of brand recognition and economies of scale not enjoyed by independent owner/managers. When combined with the

high levels of motivation normally associated with owner/managed businesses, franchises can be argued to get the best of

both worlds.

Franchising is defined as ‘a contractual agreement between two legally independent companies whereby the franchisor grants

the right to the franchisee to sell the franchisor’s product or do business under its trademarks in a given location for a specified

period of time. In return, the franchisee agrees to pay the franchisor a combination of fees, usually including an up-front

franchise fee, royalties calculated as a percentage of unit revenues, and an advertising conbribution that is also usually a

percentage of unit sales.’

Ramon is considering a type of franchising called ‘business-format franchising’, where the franchisor sells a way of doing

business to its franchisees. Business-format franchising is a model frequently found in the fast food and restaurant industry,

hotels and motels, construction and maintenance, and non-food retailing. Often these franchises are labour intensive and

relatively small-scale operations.

Franchising is seen as a safer alternative to growing the business organically, so while this may be true of well established

global franchises, failure rates among franchised small businesses were greater than those of independent businesses (in one

US study a 34·7% failure rate for franchises as opposed to 28·0% for independents over a six or seven year period). Often

it is the failure of the franchisor that brings down its franchisees. Failure stems from the franchisee not only having to rely on

their own skills and enthusiasm but also the capacity of the franchisor and other franchisees to make the overall operation

work.

The advantages to the franchisee are through gaining access to a well-regarded brand name that will generate a higher level

of demand and use of a tried and tested business model that should reduce the franchisee’s operating costs. Both of these

benefits stem from being a member of a well-established franchised system. Yet La Familia Amable along with many other

franchises will be new and small. These smaller franchises tend to be regional in scope, and fairly unknown outside their

regional market. This has a significant effect on what the franchisees can expect to gain from their franchisors and their

prospects of success. Both parties need to carefully assess the strengths and weaknesses of the system. Companies growing

via franchises need to take the time to understand their business model thoroughly and determine how franchising fits with

their long-term strategy. Care must be taken with the franchise agreement that creates a genuine partnership with the rightbalance between freedom and control over the franchisees. -

第17题:

2 Chen Products produces four manufactured products: Products 1, 2, 3 and 4. The company’s risk committee recently

met to discuss how the company might respond to a number of problems that have arisen with Product 2. After a

number of incidents in which Product 2 had failed whilst being used by customers, Chen Products had been presented

with compensation claims from customers injured and inconvenienced by the product failure. It was decided that the

risk committee should meet to discuss the options.

When the discussion of Product 2 began, committee chairman Anne Ricardo reminded her colleagues that, apart from

the compensation claims, Product 2 was a highly profitable product.

Chen’s risk management committee comprised four non-executive directors who each had different backgrounds and

areas of expertise. None of them had direct experience of Chen’s industry or products. It was noted that it was

common for them to disagree among themselves as to how risks should be managed and that in some situations,

each member proposed a quite different strategy to manage a given risk. This was the case when they discussed

which risk management strategy to adopt with regard to Product 2.

Required:

(a) Describe the typical roles of a risk management committee. (6 marks)

正确答案:

(a) Typical roles of a risk management committee

The typical roles of a risk management committee are as follows:

To agree and approve the risk management strategy and policies. The design of risk policy will take into account the

environment, the strategic posture towards risk, the product type and a range of other relevant factors.

Receiving and reviewing risk reports from affected departments. Some departments will file regular reports on key risks (such

as liquidity assessments from the accounting department, legal risks from the company secretariat or product risks from the

sales manager).

Monitoring overall exposure and specific risks. If the risk policy places limits on the total risk exposure for a given risk then

this role ensures that limits are adhered to. In the case of certain strategic risks, monitoring could occur on a very frequent

basis whereas for more operational risks, monitoring will more typically occur to coincide with risk management committee

meetings.

Assessing the effectiveness of risk management systems. This involves getting feedback from departments and the internal

audit function on the workings of current management and risk mitigation systems.

Providing general and explicit guidance to the main board on emerging risks and to report on existing risks. This will involve

preparing reports on apparent risks and assessing their probability of being realised and their potential impact if they do.

To work with the audit committee on designing and monitoring internal controls for the management and mitigation of risks.

If the risk committee is part of the executive structure, it will likely have an advisory role in respect of its input into the audit

committee. If it is non-executive, its input may be more directly influential.

[Tutorial note: other roles may be suggested that, if relevant, will be rewarded] -

第18题:

(c) Define ‘market risk’ for Mr Allejandra and explain why Gluck and Goodman’s market risk exposure is

increased by failing to have an effective audit committee. (5 marks)

正确答案:

(c) Market risk

Definition of market risk

Market risks are those arising from any of the markets that a company operates in. Most common examples are those risks

from resource markets (inputs), product markets (outputs) or capital markets (finance).

[Tutorial note: markers should exercise latitude in allowing definitions of market risk. IFRS 7, for example, offers a technical

definition: ‘Market risk is the risk that the fair value or cash flows of a financial instrument will fluctuate due to changes in

market prices. Market risk reflects interest rate risk, currency risk, and other price risks’.]

Why non-compliance increases market risk

The lack of a fully compliant committee structure (such as having a non-compliant audit committee) erodes investor

confidence in the general governance of a company. This will, over time, affect share price and hence company value. Low

company value will threaten existing management (possibly with good cause in the case of Gluck and Goodman) and make

the company a possible takeover target. It will also adversely affect price-earnings and hence market confidence in Gluck and

Goodman’s shares. This will make it more difficult to raise funds from the stock market. -

第19题:

(b) Briefly discuss how stakeholder groups (other than management and employees) may be rewarded for ‘good’

performance. (4 marks)

正确答案:

(b) Good performance should result in improved profitability and therefore other stakeholder groups may be rewarded for ‘good

performance’ as follows:

– Shareholders may receive increased returns on equity in the form. of increased dividends and /or capital growth.

– Customers may benefit from improved quality of products and services, and possibly lower prices.

– Suppliers may benefit from increased volumes of purchases.

– Government will benefit from increased amounts of taxation. -

第20题:

(ii) evaluates the relative performance of the four depots as indicated by the analysis in the summary table

prepared in (i); (5 marks)

正确答案:

(ii) The summary analysis in (a)(i) shows that using overall points gained, Michaelangelotown has achieved the best

performance with 12 points. Donatellotown and Leonardotown have achieved a reasonable level of performance with

eight points each. Raphaeltown has under performed, however, gaining only four out of the available 12 points.

Michaelangelotown is the only depot to have achieved both an increase in revenue over budget and an increased

profit:revenue percentage.

In the customer care and service delivery statistics, Michaelangelotown has achieved all six of the target standards,

Donatellotown four; Leonardotown three. The Raphaeltown statistic of achieving only one out of six targets indicates the

need for investigation.

With regard to the credit control and administrative efficiency statistics, Leonardotown and Michaelangelotown achieved

all four standards and Donatellotown achieved three of the four standards. Once again, Raphaeltown is the ‘poor

performer’ achieving only two of the four standards. -

第21题:

(ii) State, giving reasons, the tax reliefs in relation to inheritance tax (IHT) and capital gains tax (CGT) which

would be available to Alasdair if he acquires the warehouse and leases it to Gallus & Co, rather than to

an unconnected tenant. (4 marks)

正确答案:

(ii) Apart from the fact that Alasdair can keep an eye on his tenant, the main advantages are twofold:

IHT: If the firm are the tenants, the property will be land and buildings used in a business carried on by a partnership

in which the donor is a partner. Thus, Alasdair will be able to claim business property relief (BPR) at a rate of 50%

so long as he remains a partner in the firm. However, this relief would not be available until Alasdair has owned

the property for at least two years from his firm taking up the tenancy.

CGT: As Alasdair is a partner in the firm using the building, it will also be a qualifying asset for the purposes of rollover

relief on any gains arising from the disposal of the property. Assuming that Alasdair acquires a replacement asset

which will be used in the trade, the gain on sale can be deferred against the tax base cost of the replacement asset.

In the event that rollover relief cannot be used, any gains on disposal will be subject to business asset taper relief. -

第22题:

John Pentanol was appointed as risk manager at H&Z Company a year ago and he decided that his first task was to examine the risks that faced the company. He concluded that the company faced three major risks, which he assessed by examining the impact that would occur if the risk were to materialise. He assessed Risk 1 as being of low potential impact as even if it materialised it would have little effect on the company’s strategy. Risk 2 was assessed as being of medium potential impact whilst a third risk, Risk 3, was assessed as being of very high potential impact.

When John realised the potential impact of Risk 3 materialising, he issued urgent advice to the board to withdraw from the activity that gave rise to Risk 3 being incurred. In the advice he said that the impact of Risk 3 was potentially enormous and it would be irresponsible for H&Z to continue to bear that risk.

The company commercial director, Jane Xylene, said that John Pentanol and his job at H&Z were unnecessary and that risk management was ‘very expensive for the benefits achieved’. She said that all risk managers do is to tell people what can’t be done and that they are pessimists by nature. She said she wanted to see entrepreneurial risk takers in H&Z and not risk managers who, she believed, tended to discourage enterprise.

John replied that it was his job to eliminate all of the highest risks at H&Z Company. He said that all risk was bad and needed to be eliminated if possible. If it couldn’t be eliminated, he said that it should be minimised.

(a) The risk manager has an important role to play in an organisation’s risk management.

Required:

(i) Describe the roles of a risk manager. (4 marks)

(ii) Assess John Pentanol’s understanding of his role. (4 marks)

(b) With reference to a risk assessment framework as appropriate, criticise John’s advice that H&Z should

withdraw from the activity that incurs Risk 3. (6 marks)

(c) Jane Xylene expressed a particular view about the value of risk management in H&Z Company. She also said that she wanted to see ‘entrepreneurial risk takers’.

Required:

(i) Define ‘entrepreneurial risk’ and explain why it is important to accept entrepreneurial risk in business

organisations; (4 marks)

(ii) Critically evaluate Jane Xylene’s view of risk management. (7 marks)

正确答案:(a) (i) Roles of a risk manager

Providing overall leadership, vision and direction, involving the establishment of risk management (RM) policies,

establishing RM systems etc. Seeking opportunities for improvement or tightening of systems.

Developing and promoting RM competences, systems, culture, procedures, protocols and patterns of behaviour. It is

important to understand that risk management is as much about instituting and embedding risk systems as much as

issuing written procedure. The systems must be capable of accurate risk assessment which seem not to be the case at

H&Z as he didn’t account for variables other than impact/hazard.

Reporting on the above to management and risk committee as appropriate. Reporting information should be in a form

able to be used for the generation of external reporting as necessary. John’s issuing of ‘advice’ will usually be less useful

than full reporting information containing all of the information necessary for management to decide on risk policy.Ensuring compliance with relevant codes, regulations, statutes, etc. This may be at national level (e.g. Sarbanes Oxley)

or it may be industry specific. Banks, oil, mining and some parts of the tourism industry, for example, all have internal

risk rules that risk managers are required to comply with.

[Tutorial note: do not reward bullet lists. Study texts both use lists but question says ‘describe’.]

(ii) John Pentanol’s understanding of his role

John appears to misunderstand the role of a risk manager in four ways.

Whereas the establishment of RM policies is usually the most important first step in risk management, John launched

straight into detailed risk assessments (as he saw it). It is much more important, initially, to gain an understanding of

the business, its strategies, controls and risk exposures. The assessment comes once the policy has been put in place.

It is important for the risk manager to report fully on the risks in the organisation and John’s issuing of ‘advice’ will usually

be less useful than full reporting information. Full reporting would contain all of the information necessary for

management to decide on risk policy.

He told Jane Xylene that his role as risk manager involved eliminating ‘all of the highest risks at H&Z Company’ which

is an incorrect view. Jane Xylene was correct to say that entrepreneurial risk was important, for example.

The risk manager is an operational role in a company such as H&Z Company and it will usually be up to senior

management to decide on important matters such as withdrawal from risky activities. John was being presumptuous

and overstepping his role in issuing advice on withdrawal from Risk 3. It is his job to report on risks to senior

management and for them to make such decisions based on the information he provides.(b) Criticise John’s advice

The advice is based on an incomplete and flawed risk assessment. Most simple risk assessment frameworks comprise at least

two variables of which impact or hazard is only one. The other key variable is probability. Risk impact has to be weighed

against probability and the fact that a risk has a high potential impact does not mean the risk should be avoided as long as

the probability is within acceptable limits. It is the weighted combination of hazard/impact and probability that forms the basis

for meaningful risk assessment.

John appears to be very certain of his impact assessments but the case does not tell us on what information the assessment

is made. It is important to recognise that ‘hard’ data is very difficult to obtain on both impact and probability. Both measures

are often made with a degree of assumption and absolute measures such as John’s ranking of Risks 1, 2 and 3 are not as

straightforward as he suggests.

John also overlooks a key strategic reason for H&Z bearing the risks in the first place, which is the return achievable by the

bearing of risk. Every investment and business strategy carries a degree of risk and this must be weighed against the financial

return that can be expected by the bearing of the risk.

(c) (i) Define ‘entrepreneurial risk’

Entrepreneurial risk is the necessary risk associated with any new business venture or opportunity. It is most clearly seen

in entrepreneurial business activity, hence its name. In ‘Ansoff’ terms, entrepreneurial risk is expressed in terms of the

unknowns of the market/customer reception of a new venture or of product uncertainties, for example product design,

construction, etc. There is also entrepreneurial risk in uncertainties concerning the competences and skills of the

entrepreneurs themselves.

Entrepreneurial risk is necessary, as Jane Xylene suggested, because it is from taking these risks that business

opportunities arise. The fact that the opportunity may not be as hoped does not mean it should not be pursued. Any

new product, new market development or new activity is a potential source of entrepreneurial risk but these are also the

sources of future revenue streams and hence growth in company value.(ii) Critically evaluate Jane Xylene’s view of risk management

There are a number of arguments against risk management in general. These arguments apply against the totality of risk

management and also of the employment of inappropriate risk measures.

There is a cost associated with all elements of risk management which must obviously be borne by the company.

Disruption to normal organisational practices and procedures as risk systems are complied with.

Slowing (introducing friction to) the seizing of new business opportunities or the development of internal systems as they

are scrutinised for risk.

‘STOP’ errors can occur as a result of risk management systems where a practice or opportunity has been stopped on

the grounds of its risk when it should have been allowed to proceed. This may be the case with Risk 3 in the case.

(Contrast with ‘GO’ errors which are the opposite of STOP errors.)

There are also arguments for risk management people and systems in H&Z. The most obvious benefit is that an effective

risk system identifies those risks that could detract from the achievements of the company’s strategic objectives. In this

respect, it can prevent costly mistakes by advising against those actions that may lose the company value. It also has

the effect of reassuring investors and capital markets that the company is aware of and is in the process of managing

its risks. Where relevant, risk management is necessary for compliance with codes, listing rules or statutory instruments. -

第23题:

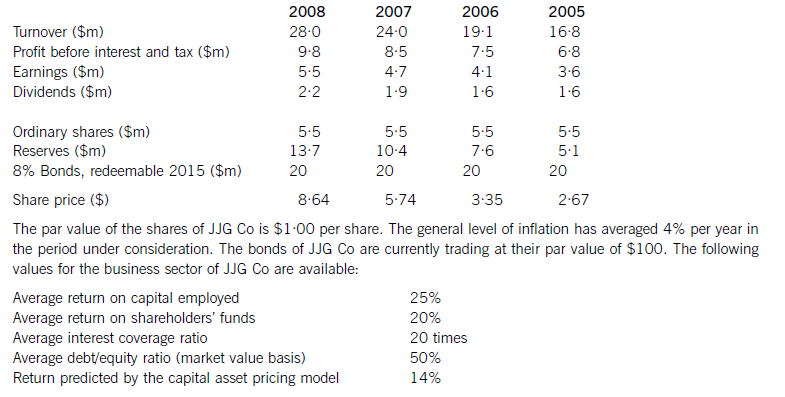

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.