(ii) The shares held in Date Inc and the dividend income received from that company. (7 marks)

题目

(ii) The shares held in Date Inc and the dividend income received from that company. (7 marks)

相似考题

更多“(ii) The shares held in Date Inc and the dividend income received from that company. (7 marks)”相关问题

-

第1题:

4 Ryder, a public limited company, is reviewing certain events which have occurred since its year end of 31 October

2005. The financial statements were authorised on 12 December 2005. The following events are relevant to the

financial statements for the year ended 31 October 2005:

(i) Ryder has a good record of ordinary dividend payments and has adopted a recent strategy of increasing its

dividend per share annually. For the last three years the dividend per share has increased by 5% per annum.

On 20 November 2005, the board of directors proposed a dividend of 10c per share for the year ended

31 October 2005. The shareholders are expected to approve it at a meeting on 10 January 2006, and a

dividend amount of $20 million will be paid on 20 February 2006 having been provided for in the financial

statements at 31 October 2005. The directors feel that a provision should be made because a ‘valid expectation’

has been created through the company’s dividend record. (3 marks)

(ii) Ryder disposed of a wholly owned subsidiary, Krup, a public limited company, on 10 December 2005 and made

a loss of $9 million on the transaction in the group financial statements. As at 31 October 2005, Ryder had no

intention of selling the subsidiary which was material to the group. The directors of Ryder have stated that there

were no significant events which have occurred since 31 October 2005 which could have resulted in a reduction

in the value of Krup. The carrying value of the net assets and purchased goodwill of Krup at 31 October 2005

were $20 million and $12 million respectively. Krup had made a loss of $2 million in the period 1 November

2005 to 10 December 2005. (5 marks)

(iii) Ryder acquired a wholly owned subsidiary, Metalic, a public limited company, on 21 January 2004. The

consideration payable in respect of the acquisition of Metalic was 2 million ordinary shares of $1 of Ryder plus

a further 300,000 ordinary shares if the profit of Metalic exceeded $6 million for the year ended 31 October

2005. The profit for the year of Metalic was $7 million and the ordinary shares were issued on 12 November

2005. The annual profits of Metalic had averaged $7 million over the last few years and, therefore, Ryder had

included an estimate of the contingent consideration in the cost of the acquisition at 21 January 2004. The fair

value used for the ordinary shares of Ryder at this date including the contingent consideration was $10 per share.

The fair value of the ordinary shares on 12 November 2005 was $11 per share. Ryder also made a one for four

bonus issue on 13 November 2005 which was applicable to the contingent shares issued. The directors are

unsure of the impact of the above on earnings per share and the accounting for the acquisition. (7 marks)

(iv) The company acquired a property on 1 November 2004 which it intended to sell. The property was obtained

as a result of a default on a loan agreement by a third party and was valued at $20 million on that date for

accounting purposes which exactly offset the defaulted loan. The property is in a state of disrepair and Ryder

intends to complete the repairs before it sells the property. The repairs were completed on 30 November 2005.

The property was sold after costs for $27 million on 9 December 2005. The property was classified as ‘held for

sale’ at the year end under IFRS5 ‘Non-current Assets Held for Sale and Discontinued Operations’ but shown at

the net sale proceeds of $27 million. Property is depreciated at 5% per annum on the straight-line basis and no

depreciation has been charged in the year. (5 marks)

(v) The company granted share appreciation rights (SARs) to its employees on 1 November 2003 based on ten

million shares. The SARs provide employees at the date the rights are exercised with the right to receive cash

equal to the appreciation in the company’s share price since the grant date. The rights vested on 31 October

2005 and payment was made on schedule on 1 December 2005. The fair value of the SARs per share at

31 October 2004 was $6, at 31 October 2005 was $8 and at 1 December 2005 was $9. The company has

recognised a liability for the SARs as at 31 October 2004 based upon IFRS2 ‘Share-based Payment’ but the

liability was stated at the same amount at 31 October 2005. (5 marks)

Required:

Discuss the accounting treatment of the above events in the financial statements of the Ryder Group for the year

ended 31 October 2005, taking into account the implications of events occurring after the balance sheet date.

(The mark allocations are set out after each paragraph above.)

(25 marks)

正确答案:

4 (i) Proposed dividend

The dividend was proposed after the balance sheet date and the company, therefore, did not have a liability at the balance

sheet date. No provision for the dividend should be recognised. The approval by the directors and the shareholders are

enough to create a valid expectation that the payment will be made and give rise to an obligation. However, this occurred

after the current year end and, therefore, will be charged against the profits for the year ending 31 October 2006.

The existence of a good record of dividend payments and an established dividend policy does not create a valid expectation

or an obligation. However, the proposed dividend will be disclosed in the notes to the financial statements as the directors

approved it prior to the authorisation of the financial statements.

(ii) Disposal of subsidiary

It would appear that the loss on the sale of the subsidiary provides evidence that the value of the consolidated net assets of

the subsidiary was impaired at the year end as there has been no significant event since 31 October 2005 which would have

caused the reduction in the value of the subsidiary. The disposal loss provides evidence of the impairment and, therefore,

the value of the net assets and goodwill should be reduced by the loss of $9 million plus the loss ($2 million) to the date of

the disposal, i.e. $11 million. The sale provides evidence of a condition that must have existed at the balance sheet date

(IAS10). This amount will be charged to the income statement and written off goodwill of $12 million, leaving a balance of

$1 million on that account. The subsidiary’s assets are impaired because the carrying values are not recoverable. The net

assets and goodwill of Krup would form. a separate income generating unit as the subsidiary is being disposed of before the

financial statements are authorised. The recoverable amount will be the sale proceeds at the date of sale and represents the

value-in-use to the group. The impairment loss is effectively taking account of the ultimate loss on sale at an earlier point in

time. IFRS5, ‘Non-current assets held for sale and discontinued operations’, will not apply as the company had no intention

of selling the subsidiary at the year end. IAS10 would require disclosure of the disposal of the subsidiary as a non-adjusting

event after the balance sheet date.

(iii) Issue of ordinary shares

IAS33 ‘Earnings per share’ states that if there is a bonus issue after the year end but before the date of the approval of the

financial statements, then the earnings per share figure should be based on the new number of shares issued. Additionally

a company should disclose details of all material ordinary share transactions or potential transactions entered into after the

balance sheet date other than the bonus issue or similar events (IAS10/IAS33). The principle is that if there has been a

change in the number of shares in issue without a change in the resources of the company, then the earnings per share

calculation should be based on the new number of shares even though the number of shares used in the earnings per share

calculation will be inconsistent with the number shown in the balance sheet. The conditions relating to the share issue

(contingent) have been met by the end of the period. Although the shares were issued after the balance sheet date, the issue

of the shares was no longer contingent at 31 October 2005, and therefore the relevant shares will be included in the

computation of both basic and diluted EPS. Thus, in this case both the bonus issue and the contingent consideration issue

should be taken into account in the earnings per share calculation and disclosure made to that effect. Any subsequent change

in the estimate of the contingent consideration will be adjusted in the period when the revision is made in accordance with

IAS8.

Additionally IFRS3 ‘Business Combinations’ requires the fair value of all types of consideration to be reflected in the cost of

the acquisition. The contingent consideration should be included in the cost of the business combination at the acquisition

date if the adjustment is probable and can be measured reliably. In the case of Metalic, the contingent consideration has

been paid in the post-balance sheet period and the value of such consideration can be determined ($11 per share). Thus

an accurate calculation of the goodwill arising on the acquisition of Metalic can be made in the period to 31 October 2005.

Prior to the issue of the shares on 12 November 2005, a value of $10 per share would have been used to value the

contingent consideration. The payment of the contingent consideration was probable because the average profits of Metalic

averaged over $7 million for several years. At 31 October 2005 the value of the contingent shares would be included in a

separate category of equity until they were issued on 12 November 2005 when they would be transferred to the share capital

and share premium account. Goodwill will increase by 300,000 x ($11 – $10) i.e. $300,000.

(iv) Property

IFRS5 (paragraph 7) states that for a non-current asset to be classified as held for sale, the asset must be available for

immediate sale in its present condition subject to the usual selling terms, and its sale must be highly probable. The delay in

this case in the selling of the property would indicate that at 31 October 2005 the property was not available for sale. The

property was not to be made available for sale until the repairs were completed and thus could not have been available for

sale at the year end. If the criteria are met after the year end (in this case on 30 November 2005), then the non-current

asset should not be classified as held for sale in the previous financial statements. However, disclosure of the event should

be made if it meets the criteria before the financial statements are authorised (IFRS5 paragraph 12). Thus in this case,

disclosure should be made.

The property on the application of IFRS5 should have been carried at the lower of its carrying amount and fair value less

costs to sell. However, the company has simply used fair value less costs to sell as the basis of valuation and shown the

property at $27 million in the financial statements.

The carrying amount of the property would have been $20 million less depreciation $1 million, i.e. $19 million. Because

the property is not held for sale under IFRS5, then its classification in the balance sheet will change and the property will be

valued at $19 million. Thus the gain of $7 million on the wrong application of IFRS5 will be deducted from reserves, and

the property included in property, plant and equipment. Total equity will therefore be reduced by $8 million.

(v) Share appreciation rights

IFRS2 ‘Share-based payment’ (paragraph 30) requires a company to re-measure the fair value of a liability to pay cash-settled

share based payment transactions at each reporting date and the settlement date, until the liability is settled. An example of

such a transaction is share appreciation rights. Thus the company should recognise a liability of ($8 x 10 million shares),

i.e. $80 million at 31 October 2005, the vesting date. The liability recognised at 31 October 2005 was in fact based on the

share price at the previous year end and would have been shown at ($6 x 1/2) x 10 million shares, i.e. $30 million. This

liability at 31 October 2005 had not been changed since the previous year end by the company. The SARs vest over a twoyear

period and thus at 31 October 2004 there would be a weighting of the eventual cost by 1 year/2 years. Therefore, an

additional liability and expense of $50 million should be accounted for in the financial statements at 31 October 2005. The

SARs would be settled on 1 December 2005 at $9 x 10 million shares, i.e. $90 million. The increase in the value of the

SARs since the year end would not be accrued in the financial statements but charged to profit or loss in the year ended31 October 2006. -

第2题:

(ii) Explain the income tax (IT), national insurance (NIC) and capital gains tax (CGT) implications arising on

the grant to and exercise by an employee of an option to buy shares in an unapproved share option

scheme and on the subsequent sale of these shares. State clearly how these would apply in Henry’s

case. (8 marks)

正确答案:

(ii) Exercising of share options

The share option is not part of an approved scheme, and will not therefore enjoy the benefits of such a scheme. There

are three events with tax consequences – grant, exercise and sale.

Grant. If shares or options over shares are sold or granted at less than market value, an income tax charge can arise on

the difference between the price paid and the market value. [Weight v Salmon]. In addition, if options can be exercised

more than 10 years after the date of the grant, an employment income charge can arise. This is based on the market

value at the date of grant less the grant and exercise priced.

In Henry’s case, the options were issued with an exercise price equal to the then market value, and cannot be exercised

more than 10 years from the grant. No income tax charge therefore arises on grant.

Exercise. On exercise, the individual pays the agreed amount in return for a number of shares in the company. The price

paid is compared with the open market value at that time, and if less, the difference is charged to income tax. National

insurance also applies, and the company has to pay Class 1 NIC. If the company and shareholder agree, the national

insurance can be passed onto the individual, and the liability becomes a deductible expense in calculating the income

tax charge.

In Henry’s case on exercise, the difference between market value (£14) and the price paid (£1) per share will be taxed

as income. Therefore, £130,000 (10,000 x (£14 – £1)) will be taxed as income. In addition, national insurance will

be chargeable on the company at 12·8% (£16,640) and on Henry at the rate of 1% (£1,300).

Sale. The base cost of the shares is taken to be the market value at the time of exercise. On the sale of the shares, any

gain or loss arising falls under the capital gains tax rules, and CGT will be payable on any gain. Business asset taper

relief will be available as the company is an unquoted trading company, but the relief will only run from the time that

the share options are exercised – i.e. from the time when the shares were acquired.

In Henry’s case, the sale of the shares will immediately follow the exercise of the option (6 days later). The sale proceeds

and the market value at the time of exercise are likely to be similar; thus little to no gain is likely to arise. -

第3题:

(ii) List the additional information required in order to calculate the employment income benefit in respect

of the provision of the furnished flat for 2007/08 and advise Benny of the potential income tax

implications of requesting a more centrally located flat in accordance with the company’s offer.

(4 marks)

正确答案:

(ii) The flat

The following additional information is required in order to calculate the employment income benefit in respect of the

flat.

– The flat’s annual value.

– The cost of any improvements made to the flat prior to 6 April 2007.

– The cost of power, water, repairs and maintenance etc borne by Summer Glow plc.

– The cost of the furniture provided by Summer Glow plc.

– Any use of the flat by Benny wholly, exclusively and necessarily for the purposes of his employment.

Tutorial note

The market value of the flat is not required as Summer Glow plc has owned it for less than six years.

One element of the employment income benefit in respect of the flat is calculated by reference to its original cost plus

the cost of any capital improvements prior to 6 April 2007. If Benny requests a flat in a different location, this element

of the benefit will be computed instead by reference to the cost of the new flat, which in turn equals the proceeds of

sale of the old flat.

Accordingly, if, as is likely, the value of the flat has increased since it was purchased, Benny’s employment income

benefit will also increase. The increase in the employment income benefit will be the flat’s sales proceeds less its original

cost less the cost of any capital improvements prior to 6 April 2007 multiplied by 5%. -

第4题:

(ii) Explain, with reasons, the relief available in respect of the fall in value of the shares in All Over plc,

identify the years in which it can be claimed and state the time limit for submitting the claim.

(3 marks)

正确答案:

-

第5题:

(ii) Advise Andrew of the tax implications arising from the disposal of the 7% Government Stock, clearly

identifying the tax year in which any liability will arise and how it will be paid. (3 marks)

正确答案:

(ii) Government stock is an exempt asset for the purposes of capital gains tax, however, as Andrew’s holding has a nominal

value in excess of £5,000, a charge to income tax will arise under the accrued income scheme. This charge to income

tax will arise in 2005/06, being the tax year in which the next interest payment following disposal falls due (20 April

2005) and it will relate to the income accrued for the period 21 October 2004 to 14 March 2005 of £279 (145/182

x £350). As interest on Government Stock is paid gross (unless the holder applies to receive it net), the tax due of £112

(£279 x 40%) will be collected via the self-assessment system and as the interest was an ongoing source of income

will be included within Andrew’s half yearly payments on account payable on 31 January and 31 July 2006. -

第6题:

(ii) The UK value added tax (VAT) implications for Razor Ltd of selling tools to and purchasing tools from

Cutlass Inc; (2 marks)

正确答案:

(ii) Value added tax (VAT)

Goods exported are zero-rated. Razor Ltd must retain appropriate documentary evidence that the export has taken place.

Razor Ltd must account for VAT on the value of the goods purchased from Cutlass Inc at the time the goods are brought

into the UK. The VAT payable should be included as deductible input tax on the company’s VAT return. -

第7题:

(ii) Advise Mr Fencer of the income tax implications of the proposed financing arrangements. (2 marks)

正确答案:

(ii) The income tax implications of the proposed financing arrangements

Mr Fencer has borrowed money from a UK bank in order to make a loan to Rapier Ltd, a close company. The interest

paid by Mr Fencer to the bank will be an allowable charge on income as long as he continues to hold more than 5% of

Rapier Ltd. Charges on income are deductible in arriving at an individual’s statutory total income.

Mr Fencer will receive interest from Rapier Ltd net of 20% income tax. The gross amount of interest will be subject to

income tax at either 10%, 20% or 40% depending on whether the income falls into Mr Fencer’s starting rate, basic rate

or higher rate tax band. Mr Fencer will obtain a tax credit for the 20% income tax suffered at source. -

第8题:

(ii) Explain how the inclusion of rental income in Coral’s UK income tax computation could affect the

income tax due on her dividend income. (2 marks)

You are not required to prepare calculations for part (b) of this question.

Note: you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year to

31 March 2007 will continue to apply for the foreseeable future.

正确答案:

(ii) The effect of taxable rental income on the tax due on Coral’s dividend income

Remitting rental income to the UK may cause some of Coral’s dividend income currently falling within the basic rate

band to fall within the higher rate band. The effect of this would be to increase the tax on the gross dividend income

from 0% (10% less the 10% tax credit) to 221/2% (321/2% less 10%).

Tutorial note

It would be equally acceptable to state that the effective rate of tax on the dividend income would increase from 0%

to 25%. -

第9题:

2 Assume that today’s date is 1 July 2005.

Jan is aged 45 and single. He is of Danish domicile but has been working in the United Kingdom since 1 May 2004

and intends to remain in the UK for the medium to long term. Although Jan worked briefly in the UK in 1986, he

has forgotten how UK taxation works and needs some assistance before preparing his UK income tax return.

Jan’s salary from 1 May 2004 was £74,760 per annum. Jan also has a company car – a Jaguar XJ8 with a list price

of £42,550 including extras, and CO2 emissions of 242g/km. The car was available to him from 1 July 2004. Free

petrol is provided by the company. Jan has other taxable benefits amounting to £3,965.

Jan’s other 2004/05 income comprises:

£

Dividend income from UK companies (cash received) 3,240

Interest received on an ISA account 230

Interest received on a UK bank account 740

Interest remitted from an offshore account (net of 15% withholding tax) 5,100

Income remitted from a villa in Portugal (net of 45% withholding tax) 4,598

The total interest arising on the offshore account was £9,000 (gross). In addition, Jan has not remitted other

Portuguese rental income arising in the year, totalling a further £1,500 (gross).

Jan informs you that his employer is thinking of providing him with rented accommodation while he looks for a house

to buy. The accommodation would be a two bedroom flat, valued at £155,000 with an annual value of £6,000. It

would be made available from 6 August 2005. The company will pay the rent of £600 per month for the first six

months. All other bills will be paid by Jan.

Jan also informs you that he has 25,000 ordinary shares in Gilet Ltd (‘Gilet’), an unquoted UK trading company. He

has held these shares since August 1986 when he bought 2,500 shares at £4.07 per share. In January 1994, a

bonus issue gave each shareholder nine shares for each ordinary share held. In the last week all Gilet’s shareholders

have received an offer from Jumper plc (‘Jumper’) who wishes to acquire the shares. Jumper has offered the following:

– 3 shares in Jumper (currently trading at £3.55 per share) for every 5 shares in Gilet, and

– 25p cash per share

Required:

(a) Calculate Jan’s 2004/05 income tax (IT) payable. (11 marks)

正确答案:

-

第10题:

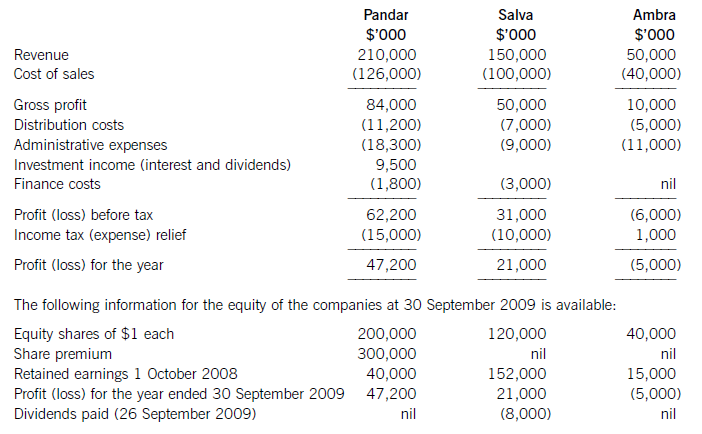

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

正确答案:

-

第11题:

Examine the structure of the STUDENTS table: STUDENT_ID NUMBER NOT NULL, Primary Key STUDENT_NAME VARCHAR2(30) COURSE_ID VARCHAR2(10) NOT NULL MARKS NUMBER START_DATE DATE FINISH_DATE DATE You need to create a report of the 10 students who achieved the highest ranking in the course INT SQL and who completed the course in the year 1999. Which SQL statement accomplishes this task?()

- A、SELECT student_ id, marks, ROWNUM "Rank" FROM students WHERE ROWNUM <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC-99' AND course_id = 'INT_SQL' ORDER BY marks DESC;

- B、SELECT student_id, marks, ROWID "Rank" FROM students WHERE ROWID <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC-99' AND course_id = 'INT_SQL' ORDER BY marks;

- C、SELECT student_id, marks, ROWNUM "Rank" FROM (SELECT student_id, marks FROM students WHERE ROWNUM <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC-99' AND course_id = 'INT_SQL' ORDER BY marks DESC);

- D、SELECT student_id, marks, ROWNUM "Rank" FROM (SELECT student_id, marks FROM students ORDER BY marks DESC) WHERE ROWNUM <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC-99' AND course _ id ='INT _ SQL';

正确答案:D -

第12题:

单选题Examine the structure of the STUDENTS table: STUDENT_ID NUMBER NOT NULL, Primary Key STUDENT_NAME VARCHAR2(30) COURSE_ID VARCHAR2(10) NOT NULL MARKS NUMBER START_DATE DATE FINISH_DATE DATE You need to create a report of the 10 students who achieved the highest ranking in the course INT SQL and who completed the course in the year 1999. Which SQL statement accomplishes this task? ()ASELECT student_ id, marks, ROWNUM Rank FROM students WHERE ROWNUM <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC-99 AND course_id = 'INT_SQL' ORDER BY mark DESC;

BSELECT student_id, marks, ROWID Rank FROM students WHERE ROWID <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC-99' AND course_id = 'INT_SQL' ORDER BY mark;

CSELECT student_id, marks, ROWNUM Rank FROM (SELECT student_id, marks FROM students WHERE ROWNUM <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC- 99' AND course_id = 'INT_SQL' ORDER BY mark DESC;

DSELECT student_id, marks, ROWNUM Rank FROM (SELECT student_id, marks FROM students WHERE (finish_date BETWEEN '01-JAN-99 AND '31-DEC-99' AND course_id = 'INT_SQL' ORDER BY marks DESC) WHERE ROWNUM <= 10;

ESELECT student id, marks, ROWNUM Rank FROM (SELECT student_id, marks FROM students ORDER BY marks) WHERE ROWNUM <= 10 AND finish date BETWEEN '01-JAN-99' AND '31-DEC-99' AND course _ id 'INT_SQL';

正确答案: B解析: 暂无解析 -

第13题:

(ii) Calculate her income tax (IT) and national insurance (NIC) payable for the year of assessment 2006/07.

(4 marks)

正确答案:

-

第14题:

(b) (i) Advise Benny of the income tax implications of the grant and exercise of the share options in Summer

Glow plc on the assumption that the share price on 1 September 2007 and on the day he exercises the

options is £3·35 per share. Explain why the share option scheme is not free from risk by reference to

the rules of the scheme and the circumstances surrounding the company. (4 marks)

正确答案:

(b) (i) The share options

There are no income tax implications on the grant of the share options.

In the tax year in which Benny exercises the options and acquires the shares, the excess of the market value of the

shares over the price paid, i.e. £11,500 ((£3·35 – £2·20) x 10,000) will be subject to income tax.

Benny’s financial exposure is caused by the rule within the share option scheme obliging him to hold the shares for a

year before he can sell them. If the company’s expansion into Eastern Europe fails, such that its share price

subsequently falls to less than £2·20 before Benny has the chance to sell the shares, Benny’s financial position may be

summarised as follows:

– Benny will have paid £22,000 (£2·20 x 10,000) for shares which are now worth less than that.

– He will also have paid income tax of £4,600 (£11,500 x 40%). -

第15题:

(ii) Compute the annual income tax saving from your recommendation in (i) above as compared with the

situation where Cindy retains both the property and the shares. Identify any other tax implications

arising from your recommendation. Your answer should consider all relevant taxes. (3 marks)

正确答案:

-

第16题:

(ii) Following on from your answer to (i), evaluate the two purchase proposals, and advise Bill and Ben

which course of action will result in the highest amount of after tax cash being received by the

shareholders if the disposal takes place on 31 March 2006. (4 marks)

正确答案:

-

第17题:

(ii) State the taxation implications of both equity and loan finance from the point of view of a company.

(3 marks)

正确答案:

(ii) A company needs to be aware of the following issues:

Equity

(1) Costs incurred in issuing share capital are not allowed as a trading deduction.

(2) Distributions to investors are not allowed as a trading deduction.

(3) The cost of making distributions to shareholders are disallowable.

(4) Where profits are taxed at an effective rate of less than 19%, any profits used to make a distribution to noncorporate

shareholders will themselves be taxed at the full 19% rate.

Loan finance/debt

(1) The incidental costs of obtaining/raising loan finance are broadly deductible as a trading expense.

(2) Capital costs of raising loan finance (for example, loans issued at a discount) are not deductible for tax purposes.

(3) Interest incurred on a loan to finance a business is deductible from trading income. -

第18题:

(iii) The extent to which Amy will be subject to income tax in the UK on her earnings in respect of duties

performed for Cutlass Inc and the travel costs paid for by that company. (5 marks)

Appropriateness of format and presentation of the report and the effectiveness with which its advice is

communicated. (2 marks)

Note:

You should assume that the income tax rates and allowances for the tax year 2006/07 and the corporation tax

rates and allowances for the financial year 2006 apply throughout this questio

正确答案:

(iii) Amy’s UK income tax position

Amy will remain UK resident and ordinarily resident as she is not leaving the UK permanently or for a complete tax year

under a full time contract of employment. Accordingly, she will continue to be subject to UK tax on her worldwide income

including her earnings in respect of the duties she performs for Cutlass Inc. The earnings from these duties will also be

taxable in Sharpenia as the income arises in that country.

The double tax treaty between the UK and Sharpenia will either exempt the employment income in one of the two

countries or give double tax relief for the tax paid in Sharpenia. The double tax relief will be the lower of the UK tax and

the Sharpenian tax on the income from Cutlass Inc.

Amy will not be subject to UK income tax on the expenses borne by Cutlass Inc in respect of her flights to and from

Sharpenia provided her journeys are wholly and exclusively for the purposes of performing her duties in Sharpenia.

The amounts paid by Cutlass Inc in respect of Amy’s family travelling to Sharpenia will be subject to UK income tax as

Amy will not be absent from the UK for a continuous period of at least 60 days. -

第19题:

3 Palm plc recently acquired 100% of the ordinary share capital of Nikau Ltd from Facet Ltd. Palm plc intends to use

Nikau Ltd to develop a new product range, under the name ‘Project Sabal’. Nikau Ltd owns shares in a non-UK

resident company, Date Inc.

The following information has been extracted from client files and from a meeting with the Finance Director of Palm

plc.

Palm plc:

– Has more than 40 wholly owned subsidiaries such that all group companies pay corporation tax at 30%.

– All group companies prepare accounts to 31 March.

– Acquired Nikau Ltd on 1 November 2007 from Facet Ltd, an unrelated company.

Nikau Ltd:

– UK resident company that manufactures domestic electronic appliances for sale in the European Union (EU).

– Large enterprise for the purposes of the enhanced relief available for research and development expenditure.

– Trading losses brought forward as at 1 April 2007 of £195,700.

– Budgeted taxable trading profit of £360,000 for the year ending 31 March 2008 before taking account of ‘Project

Sabal’.

– Dividend income of £38,200 will be received in the year ending 31 March 2008 in respect of the shares in Date

Inc.

‘Project Sabal’:

– Development of a range of electronic appliances, for sale in North America.

– Project Sabal will represent a significant advance in the technology of domestic appliances.

– Nikau Ltd will spend £70,000 on staffing costs and consumables researching and developing the necessary

technology between now and 31 March 2008. Further costs will be incurred in the following year.

– Sales to North America will commence in 2009 and are expected to generate significant profits from that year.

Shares in Date Inc:

– Nikau Ltd owns 35% of the ordinary share capital of Date Inc.

– The shares were purchased from Facet Ltd on 1 June 2003 for their market value of £338,000.

– The sale was a no gain, no loss transfer for the purposes of corporation tax.

– Facet Ltd purchased the shares in Date Inc on 1 March 1994 for £137,000.

Date Inc:

– A controlled foreign company resident in the country of Palladia.

– Annual chargeable profits arising out of property investment activities are approximately £120,000, of which

approximately £115,000 is distributed to its shareholders each year.

The tax system in Palladia:

– No taxes on income or capital profits.

– 4% withholding tax on dividends paid to shareholders resident outside Palladia.

Required:

(a) Prepare detailed explanatory notes, including relevant supporting calculations, on the effect of the following

issues on the amount of corporation tax payable by Nikau Ltd for the year ending 31 March 2008.

(i) The costs of developing ‘Project Sabal’ and the significant commercial changes to the company’s

activities arising out of its implementation. (8 marks)

正确答案:

(a) Nikau Ltd – Effect on corporation tax payable for the year ending 31 March 2008

(i) Project Sabal

Research and development expenditure

The expenditure incurred in respect of research and development will give rise to an enhanced deduction for the

purposes of computing the taxable trading profits of Nikau Ltd. The enhanced deduction is 125% of the qualifying

expenditure as Nikau Ltd is a large enterprise for this purpose.

The expenditure will reduce the profits chargeable to corporation tax of Nikau Ltd by £87,500 (£70,000 x 1·25) and

its corporation tax liability by £26,250 (£87,500 x 30%).

The budgeted expenditure will qualify for the enhanced deduction because it appears to satisfy the following conditions.

– It is likely to qualify as research and development expenditure within generally accepted accounting principles as

it will result in new technical knowledge and the production of a substantially improved device for use in the

industry.

– It exceeds £10,000 in Nikau Ltd’s accounting period.

– It relates to staff costs, consumable items or other qualifying expenditure as opposed to capital items.

– It will result in further trading activities for Nikau Ltd.

Use of brought forward trading losses

The development of products for the North American market is likely to represent a major change in the nature and

conduct of the trade of Nikau Ltd. This is because the company is developing new products and intends to sell them in

a new market. It is a major change as sales to North America are expected to generate significant additional profits.

Because this change will occur within three years of the change in the ownership of Nikau Ltd on 1 November 2007,

any trading losses arising prior to that date cannot be carried forward beyond that date.

Accordingly, the trading losses brought forward may only be offset against £158,958 ((£360,000 – £87,500) x 7/12)

of the company’s trading profits for the year. The remainder of the trading losses £36,742 (£195,700 – £158,958) will

be lost resulting in lost tax relief of £11,023 (£36,742 x 30%).

Tutorial note

The profits for the year ending 31 March 2008 will be apportioned to the periods pre and post 1 November 2007 on

either a time basis or some other basis that is just and reasonable. -

第20题:

(ii) State, with reasons, whether Messier Ltd can provide Galileo with accommodation in the UK without

giving rise to a UK income tax liability. (2 marks)

正确答案:

(ii) Tax-free accommodation

It is not possible for Messier Ltd to provide Galileo with tax-free accommodation. The provision of accommodation by an

employer to an employee will give rise to a taxable benefit unless it is:

– necessary for the proper performance of the employee’s duties, e.g. a caretaker; or

– for the better performance of the employee’s duties and customary, e.g. a hotel manager; or

– part of arrangements arising out of threats to the employee’s security, e.g. a government minister.

As a manager of Messier Ltd Galileo is unable to satisfy any of the above conditions. -

第21题:

During the current year, Mars Corporation receives dividend income of $20,000 from an 85%-owned domestic corporation. What is Mars' maximum allowable dividend-received deduction for the current year()A. $0

B. $10,000

C. $13,000

D.$14,000

E. $20,000

参考答案:A

-

第22题:

Examine the above configuration. What does the route map named test accomplish?()

A. permits only the 10.0.0.0/8 prefix to be advertised to the 10.1.1.1 neighbor

B. marks all prefixes received fro m the 10.1.1.1 neighbor with a MED of 200

C. marks the 10.0.0.0/8 prefix advertised to the 10.1.1.1 neighbor with a MED of 200

D. permits only the 10.0.0.0/8 prefix to be received from the 10.1.1.1 neighbor

E. marks all prefixes advertised to the 10.1.1 .1 neighbor with a MED of 200

F. marks the 10.0.0.0/8 prefix received from the 10.1.1.1 neighbor with a MED of 200

参考答案:C

-

第23题:

Examine the structure of the STUDENTS table: STUDENT_ID NUMBER NOT NULL, Primary Key STUDENT_NAME VARCHAR2(30) COURSE_ID VARCHAR2(10) NOT NULL MARKS NUMBER START_DATE DATE FINISH_DATE DATE You need to create a report of the 10 students who achieved the highest ranking in the course INT SQL and who completed the course in the year 1999. Which SQL statement accomplishes this task? ()

- A、SELECT student_ id, marks, ROWNUM "Rank" FROM students WHERE ROWNUM <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC-99 AND course_id = 'INT_SQL' ORDER BY mark DESC;

- B、SELECT student_id, marks, ROWID "Rank" FROM students WHERE ROWID <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC-99' AND course_id = 'INT_SQL' ORDER BY mark;

- C、SELECT student_id, marks, ROWNUM "Rank" FROM (SELECT student_id, marks FROM students WHERE ROWNUM <= 10 AND finish_date BETWEEN '01-JAN-99' AND '31-DEC- 99' AND course_id = 'INT_SQL' ORDER BY mark DESC;

- D、SELECT student_id, marks, ROWNUM "Rank" FROM (SELECT student_id, marks FROM students WHERE (finish_date BETWEEN '01-JAN-99 AND '31-DEC-99' AND course_id = 'INT_SQL' ORDER BY marks DESC) WHERE ROWNUM <= 10;

- E、SELECT student id, marks, ROWNUM "Rank" FROM (SELECT student_id, marks FROM students ORDER BY marks) WHERE ROWNUM <= 10 AND finish date BETWEEN '01-JAN-99' AND '31-DEC-99' AND course _ id 'INT_SQL';

正确答案:D