(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in theconsolidated balance sheet. At 30

题目

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

相似考题

更多“(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in theconsolidated balance sheet. At 30”相关问题

-

第1题:

(b) Prepare the balance sheet of York at 31 October 2006, using International Financial Reporting Standards,

discussing the nature of the accounting treatments selected, the adjustments made and the values placed

on the items in the balance sheet. (20 marks)

正确答案:

Gow’s net assets

IAS36 ‘Impairment of Assets’, sets out the events that might indicate that an asset is impaired. These circumstances include

external events such as the decline in the market value of an asset and internal events such as a reduction in the cash flows

to be generated from an asset or cash generating unit. The loss of the only customer of a cash generating unit (power station)

would be an indication of the possible impairment of the cash generating unit. Therefore, the power station will have to be

impairment tested.

The recoverable amount will have to be determined and compared to the value given to the asset on the setting up of the

joint venture. The recoverable amount is the higher of the cash generating unit’s fair value less costs to sell, and its value-inuse.

The fair value less costs to sell will be $15 million which is the offer for the purchase of the power station ($16 million)

less the costs to sell ($1 million). The value-in-use is the discounted value of the future cash flows expected to arise from the

cash generating unit. The future dismantling costs should be provided for as it has been agreed with the government that it

will be dismantled. The cost should be included in the future cash flows for the purpose of calculating value-in-use and

provided for in the financial statements and the cost added to the property, plant and equipment ($4 million ($5m/1·064)).

The value-in-use based on a discount rate of 6 per cent is $21 million (working). Therefore, the recoverable amount is

$21 million which is higher than the carrying value of the cash generating unit ($20 million) and, therefore, the value of the

cash generating unit is not impaired when compared to the present carrying value of $20 million (value before impairment

test).

Additionally IAS39, ‘Financial Instruments: recognition and measurement’, says that an entity must assess at each balance

sheet date whether a financial asset is impaired. In this case the receivable of $7 million is likely to be impaired as Race is

going into administration. The present value of the estimated future cash flows will be calculated. Normally cash receipts from

trade receivables will not be discounted but because the amounts are not likely to be received for a year then the anticipated

cash payment is 80% of ($5 million × 1/1·06), i.e. $3·8 million. Thus a provision for the impairment of the trade receivables

of $3·2 million should be made. The intangible asset of $3 million would be valueless as the contract has been terminated.

Glass’s Net Assets

The leased property continues to be accounted for as property, plant and equipment and the carrying amount will not be

adjusted. However, the remaining useful life of the property will be revised to reflect the shorter term. Thus the property will

be depreciated at $2 million per annum over the next two years. The change to the depreciation period is applied prospectively

not retrospectively. The lease liability must be assessed under IAS39 in order to determine whether it constitutes a

de-recognition of a financial liability. As the change is a modification of the lease and not an extinguishment, the lease liability

would not be derecognised. The lease liability will be adjusted for the one off payment of $1 million and re-measured to the

present value of the revised future cash flows. That is $0·6 million/1·07 + $0·6 million/(1·07 × 1·07) i.e. $1·1 million. The

adjustment to the lease liability would normally be recognised in profit or loss but in this case it will affect the net capital

contributed by Glass.

The termination cost of the contract cannot be treated as an intangible asset. It is similar to redundancy costs paid to terminate

a contract of employment. It represents compensation for the loss of future income for the agency. Therefore it must be

removed from the balance sheet of York. The recognition criteria for an intangible asset require that there should be probable

future economic benefits flowing to York and the cost can be measured reliably. The latter criterion is met but the first criterion

is not. The cost of gaining future customers is not linked to this compensation.

IAS18 ‘Revenue’ contains a concept of a ‘multiple element’ arrangement. This is a contract which contains two or more

elements which are in substance separate and are separately identifiable. In other words, the two elements can operate

independently from each other. In this case, the contract with the overseas company has two distinct elements. There is a

contract not to supply gas to any other customer in the country and there is a contract to sell gas at fair value to the overseas

company. The contract has not been fulfilled as yet and therefore the payment of $1·5 million should not be taken to profit

or loss in its entirety at the first opportunity. The non supply of gas to customers in that country occurs over the four year

period of the contract and therefore the payment should be recognised over that period. Therefore the amount should be

shown as deferred income and not as a deduction from intangible assets. The revenue on the sale of gas will be recognised

as normal according to IAS18.

There may be an issue over the value of the net assets being contributed. The net assets contributed by Glass amount to

$21·9 million whereas those contributed by Gow only total $13·8 million after taking into account any adjustments required

by IFRS. The joint venturers have equal shareholding in York but no formal written agreements, thus problems may arise ifGlass feels that the contributions to the joint venture are unequal.

-

第2题:

19 Which of the following statements about intangible assets in company financial statements are correct according

to international accounting standards?

1 Internally generated goodwill should not be capitalised.

2 Purchased goodwill should normally be amortised through the income statement.

3 Development expenditure must be capitalised if certain conditions are met.

A 1 and 3 only

B 1 and 2 only

C 2 and 3 only

D All three statements are correct

正确答案:A

-

第3题:

3 You are the manager responsible for the audit of Albreda Co, a limited liability company, and its subsidiaries. The

group mainly operates a chain of national restaurants and provides vending and other catering services to corporate

clients. All restaurants offer ‘eat-in’, ‘take-away’ and ‘home delivery’ services. The draft consolidated financial

statements for the year ended 30 September 2005 show revenue of $42·2 million (2004 – $41·8 million), profit

before taxation of $1·8 million (2004 – $2·2 million) and total assets of $30·7 million (2004 – $23·4 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In September 2005 the management board announced plans to cease offering ‘home delivery’ services from the

end of the month. These sales amounted to $0·6 million for the year to 30 September 2005 (2004 – $0·8

million). A provision of $0·2 million has been made as at 30 September 2005 for the compensation of redundant

employees (mainly drivers). Delivery vehicles have been classified as non-current assets held for sale as at 30

September 2005 and measured at fair value less costs to sell, $0·8 million (carrying amount,

$0·5 million). (8 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:3 ALBREDA CO

(a) Cessation of ‘home delivery’ service

(i) Matters

■ $0·6 million represents 1·4% of reported revenue (prior year 1·9%) and is therefore material.

Tutorial note: However, it is clearly not of such significance that it should raise any doubts whatsoever regarding

the going concern assumption. (On the contrary, as revenue from this service has declined since last year.)

■ The home delivery service is not a component of Albreda and its cessation does not classify as a discontinued

operation (IFRS 5 ‘Non-current Assets Held for Sale and Discontinued Operations’).

? It is not a cash-generating unit because home delivery revenues are not independent of other revenues

generated by the restaurant kitchens.

? 1·4% of revenue is not a ‘major line of business’.

? Home delivery does not cover a separate geographical area (but many areas around the numerous

restaurants).

■ The redundancy provision of $0·2 million represents 11·1% of profit before tax (10% before allowing for the

provision) and is therefore material. However, it represents only 0·6% of total assets and is therefore immaterial

to the balance sheet.

■ As the provision is a liability it should have been tested primarily for understatement (completeness).

■ The delivery vehicles should be classified as held for sale if their carrying amount will be recovered principally

through a sale transaction rather than through continuing use. For this to be the case the following IFRS 5 criteria

must be met:

? the vehicles must be available for immediate sale in their present condition; and

? their sale must be highly probable.

Tutorial note: Highly probable = management commitment to a plan + initiation of plan to locate buyer(s) +

active marketing + completion expected in a year.

■ However, even if the classification as held for sale is appropriate the measurement basis is incorrect.

■ Non-current assets classified as held for sale should be carried at the lower of carrying amount and fair value less

costs to sell.

■ It is incorrect that the vehicles are being measured at fair value less costs to sell which is $0·3 million in excess

of the carrying amount. This amounts to a revaluation. Wherever the credit entry is (equity or income statement)

it should be reversed. $0·3 million represents just less than 1% of assets (16·7% of profit if the credit is to the

income statement).

■ Comparison of fair value less costs to sell against carrying amount should have been made on an item by item

basis (and not on their totals).

(ii) Audit evidence

■ Copy of board minute documenting management’s decision to cease home deliveries (and any press

releases/internal memoranda to staff).

■ An analysis of revenue (e.g. extracted from management accounts) showing the amount attributed to home delivery

sales.

■ Redundancy terms for drivers as set out in their contracts of employment.

■ A ‘proof in total’ for the reasonableness/completeness of the redundancy provision (e.g. number of drivers × sum

of years employed × payment per year of service).

■ A schedule of depreciated cost of delivery vehicles extracted from the non-current asset register.

■ Checking of fair values on a sample basis to second hand market prices (as published/advertised in used vehicle

guides).

■ After-date net sale proceeds from sale of vehicles and comparison of proceeds against estimated fair values.

■ Physical inspection of condition of unsold vehicles.

■ Separate disclosure of the held for sale assets on the face of the balance sheet or in the notes.

■ Assets classified as held for sale (and other disposals) shown in the reconciliation of carrying amount at the

beginning and end of the period.

■ Additional descriptions in the notes of:

? the non-current assets; and

? the facts and circumstances leading to the sale/disposal (i.e. cessation of home delivery service). -

第4题:

(ii) Audit work on after-date bank transactions identified a transfer of cash from Batik Co. The audit senior has

documented that the finance director explained that Batik commenced trading on 7 October 2005, after

being set up as a wholly-owned foreign subsidiary of Jinack. No other evidence has been obtained.

(4 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

正确答案:

(ii) Wholly-owned foreign subsidiary

■ The cash transfer is a non-adjusting post balance sheet event. It indicates that Batik was trading after the balance

sheet date. However, that does not preclude Batik having commenced trading before the year end.

■ The finance director’s oral representation is wholly insufficient evidence with regard to the existence (or otherwise)

of Batik at 30 September 2005. If it existed at the balance sheet date its financial statements should have been

consolidated (unless immaterial).

■ The lack of evidence that might reasonably be expected to be available (e.g. legal papers, registration payments,

etc) suggests a limitation on the scope of the audit.

■ If such evidence has been sought but not obtained then the limitation is imposed by the entity (rather than by

circumstances).

■ Whilst the transaction itself may not be material, the information concerning the existence of Batik may be material

to users and should therefore be disclosed (as a non-adjusting event). The absence of such disclosure, if the

auditor considered necessary, would result in a qualified ‘except for’, opinion.

Tutorial note: Any matter that is considered sufficiently material to be worthy of disclosure as a non-adjusting

event must result in such a qualified opinion if the disclosure is not made.

■ If Batik existed at the balance sheet date and had material assets and liabilities then its non-consolidation would

have a pervasive effect. This would warrant an adverse opinion.

■ Also, the nature of the limitation (being imposed by the entity) could have a pervasive effect if the auditor is

suspicious that other audit evidence has been withheld. In this case the auditor should disclaim an opinion. -

第5题:

(c) In November 2006 Seymour announced the recall and discontinuation of a range of petcare products. The

product recall was prompted by the high level of customer returns due to claims of poor quality. For the year to

30 September 2006, the product range represented $8·9 million of consolidated revenue (2005 – $9·6 million)

and $1·3 million loss before tax (2005 – $0·4 million profit before tax). The results of the ‘petcare’ operations

are disclosed separately on the face of the income statement. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

■ The discontinuation of the product line after the balance sheet date provides additional evidence that, as at the

balance sheet date, it was of poor quality. Therefore, as at the balance sheet date:

– an allowance (‘provision’) may be required for credit notes for returns of products after the year end that were

sold before the year end;

– goods returned to inventory should be written down to net realisable value (may be nil);

– any plant and equipment used exclusively in the production of the petcare range of products should be tested

for impairment;

– any material contingent liabilities arising from legal claims should be disclosed.

(ii) Audit evidence

■ A copy of Seymour’s announcement (external ‘press release’ and any internal memorandum).

■ Credit notes raised/refunds paid after the year end for faulty products returned.

■ Condition of products returned as inspected during physical attendance of inventory count.

■ Correspondence from customers claiming reimbursement/compensation for poor quality.

■ Direct confirmation from legal adviser (solicitor) regarding any claims for customers including estimates of possible

payouts. -

第6题:

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

正确答案:

(b) (i) Enquiries in respect of the external valuer

Enquiries would need to be made for two main reasons, firstly to determine the competence, and secondly the objectivity

of the valuer. ISA 620 Using the Work of an Expert contains guidance in this area.

Competence

Enquiries could include:

– Is the valuer a member of a recognised professional body, for example a nationally or internationally recognised

institute of registered surveyors?

– Does the valuer possess any necessary licence to carry out valuations for companies?

– How long has the valuer been a member of the recognised body, or how long has the valuer been licensed under

that body?

– How much experience does the valuer have in providing valuations of the particular type of investment properties

held by Poppy Co?

– Does the valuer have specific experience of evaluating properties for the purpose of including their fair value within

the financial statements?

– Is there any evidence of the reputation of the valuer, e.g. professional references, recommendations from other

companies for which a valuation service has been provided?

– How much experience, if any, does the valuer have with Poppy Co?

Using the above enquiries, the auditor is trying to form. an opinion as to the relevance and reliability of the valuation

provided. ISA 500 Audit Evidence requires that the auditor gathers evidence that is both sufficient and appropriate. The

auditor needs to ensure that the fair values provided by the valuer for inclusion in the financial statements have been

arrived at using appropriate knowledge and skill which should be evidenced by the valuer being a member of a

professional body, and, if necessary, holding a licence under that body.

It is important that the fair values have been arrived at using methods allowed under IAS 40 Investment Property. If any

other valuation method has been used then the value recognised in the statement of financial position may not be in

accordance with financial reporting standards. Thus it is important to understand whether the valuer has experience

specifically in providing valuations that comply with IAS 40, and how many times the valuer has appraised properties

similar to those owned by Poppy Co.

In gauging the reliability of the fair value, the auditor may wish to consider how Poppy Co decided to appoint this

particular valuer, e.g. on the basis of a recommendation or after receiving references from companies for which

valuations had previously been provided.

It will also be important to consider how familiar the valuer is with Poppy Co’s business and environment, as a way to

assess the reliability and appropriateness of any assumptions used in the valuation technique.

Objectivity

Enquiries could include:

– Does the valuer have any financial interest in Poppy Co, e.g. shares held directly or indirectly in the company?

– Does the valuer have any personal relationship with any director or employee of Poppy Co?

– Is the fee paid for the valuation service reasonable and a fair, market based price?

With these enquiries, the auditor is gaining assurance that the valuer will perform. the valuation from an independent

point of view. If the valuer had a financial interest in Poppy Co, there would be incentive to manipulate the valuation in

a way best suited to the financial statements of the company. Equally if the valuer had a personal relationship with a

senior member of staff at Poppy Co, the valuer may feel pressured to give a favourable opinion on the valuation of the

properties.

The level of fee paid is important. It should be commensurate with the market rate paid for this type of valuation. If the

valuer was paid in excess of what might be considered a normal fee, it could indicate that the valuer was encouraged,

or even bribed, to provide a favourable valuation. -

第7题:

The balance of the allowance for doubtful accounts is added to accounts receivable on the balance sheet.()

正确答案:错

-

第8题:

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

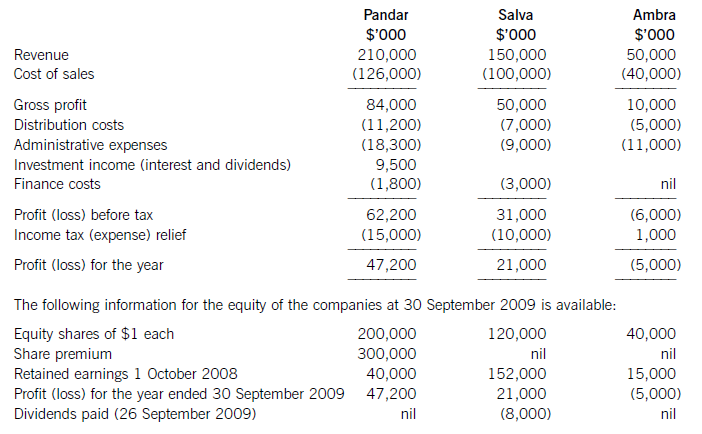

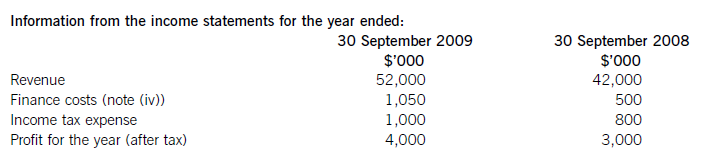

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

正确答案:

-

第9题:

(a) The following information relates to Crosswire a publicly listed company.

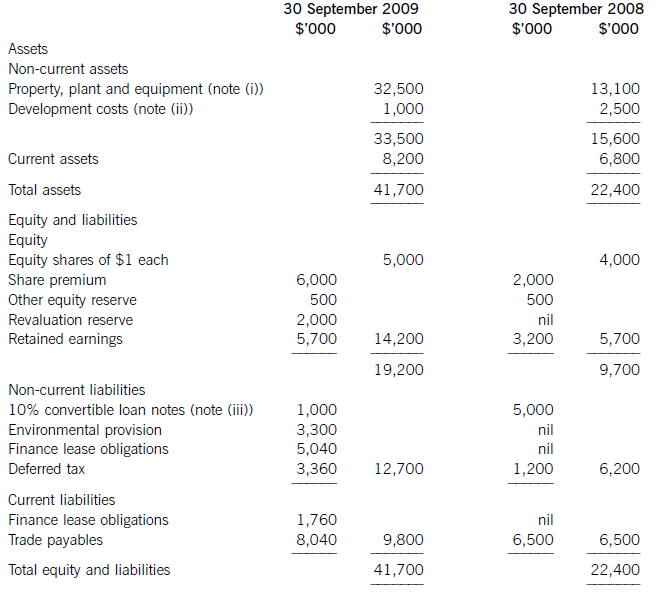

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

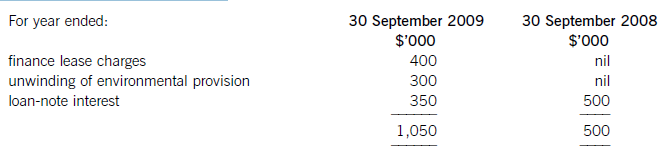

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

正确答案:

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced. -

第10题:

( ) is a process that consumers go through it to purchase products or services over the Internet。

A.E-leraning

B.E-government

C.Online analysis

D.Online shopping

正确答案:D

-

第11题:

Cisco.com offers account managers which three of these resources? ()

- A、 customer issue narratives

- B、 training and events

- C、 ordering information

- D、 products and services information

正确答案:B,C,D -

第12题:

单选题Le Manifeste du surréalisme a été rédigé par _____ en 1925.AAndré Breton

BApollinaire

CPaul Éluard

DLouis Aragon

正确答案: D解析:

《超现实主义宣言》作者是安德烈·布勒东。 -

第13题:

2 Tyre, a public limited company, operates in the vehicle retailing sector. The company is currently preparing its financial

statements for the year ended 31 May 2006 and has asked for advice on how to deal with the following items:

(i) Tyre requires customers to pay a deposit of 20% of the purchase price when placing an order for a vehicle. If the

customer cancels the order, the deposit is not refundable and Tyre retains it. If the order cannot be fulfilled by

Tyre, the company repays the full amount of the deposit to the customer. The balance of the purchase price

becomes payable on the delivery of the vehicle when the title to the goods passes. Tyre proposes to recognise

the revenue from the deposits immediately and the balance of the purchase price when the goods are delivered

to the customer. The cost of sales for the vehicle is recognised when the balance of the purchase price is paid.

Additionally, Tyre had sold a fleet of cars to Hub and gave Hub a discount of 30% of the retail price on the

transaction. The discount given is normal for this type of transaction. Tyre has given Hub a buyback option which

entitles Hub to require Tyre to repurchase the vehicles after three years for 40% of the purchase price. The normal

economic life of the vehicles is five years and the buyback option is expected to be exercised. (8 marks)

Required:

Advise the directors of Tyre on how to treat the above items in the financial statements for the year ended

31 May 2006.

(The mark allocation is shown against each of the above items)

正确答案:

2 Advice on sundry accounting issues: year ended 31 May 2006

The following details the nature of the advice relevant to the accounting issues.

Revenue recognition

(i) Sale to customers

IAS18 ‘Revenue’ requires that revenue relating to the sale of goods is recognised when the significant risks and rewards are

transferred to the buyer. Also the company should not retain any continuing managerial involvement associated with

ownership or control of the goods. Additionally the revenue and costs must be capable of reliable measurement and it should

be probable that the economic benefits of the transaction will go to the company.

Although the deposit is non refundable on cancellation of the order by the customer, there is a valid expectation that the

deposit will be repaid where the company does not fulfil its contractual obligation in supplying the vehicle. The deposit should,

therefore, only be recognised in revenue when the vehicle has been delivered and accepted by the customer. It should be

treated as a liability up to this point. At this point also, the balance of the sale proceeds will be recognised. If the customer

does cancel the order, then the deposit would be recognised in revenue at the date of the cancellation of the order.

The appendix to IAS18, although not part of the standard, agrees that revenue is recognised when goods of this nature are

delivered to the buyer.

Sale of Fleet cars

The company has not transferred the significant risks and rewards of ownership as required by IAS18 as the buyback option

is expected to occur. The reason for this conclusion is that the company has retained the risk associated with the residual

value of the vehicles. Therefore, the transaction should not be treated as a sale. The vehicles should be treated as an operating

lease as essentially only 60% of the purchase price will be received by Tyre. Ownership of the assets are not expected to be

transferred to Hub, the lease term is arguably not for the major part of the assets’ life, and the present value of the minimum

lease payments will not be substantially equivalent to the fair value of the asset. Therefore it is an operating lease (IAS17).

No ‘outright sale profit’ will be recognised as the risks and rewards of ownership have been retained and no sale has occurred.

The vehicles will be shown in property, plant and equipment at their carrying amount. The lease income should be recognised

on a straight line basis over the lease term of three years unless some other basis is more representative. The vehicles will

be depreciated in accordance with IAS16, ‘Property, Plant and Equipment’. If there is any indication of impairment then the

company will apply IAS36 ‘Impairment of Assets’. As the discount given is normal for this type of transaction, it will not be

taken into account in estimating the fair value of the assets.

The buyback option will probably meet the definition of a financial liability and will be accounted for under IAS39 ‘Financial

Instruments: recognition and measurement’. The liability should be measured at ‘fair value’ and subsequently at amortisedcost unless designated at the outset as being at fair value through profit or loss. -

第14题:

2 The draft financial statements of Choctaw, a limited liability company, for the year ended 31 December 2004 showed

a profit of $86,400. The trial balance did not balance, and a suspense account with a credit balance of $3,310 was

included in the balance sheet.

In subsequent checking the following errors were found:

(a) Depreciation of motor vehicles at 25 per cent was calculated for the year ended 31 December 2004 on the

reducing balance basis, and should have been calculated on the straight-line basis at 25 per cent.

Relevant figures:

Cost of motor vehicles $120,000, net book value at 1 January 2004, $88,000

(b) Rent received from subletting part of the office accommodation $1,200 had been put into the petty cash box.

No receivable balance had been recognised when the rent fell due and no entries had been made in the petty

cash book or elsewhere for it. The petty cash float in the trial balance is the amount according to the records,

which is $1,200 less than the actual balance in the box.

(c) Bad debts totalling $8,400 are to be written off.

(d) The opening accrual on the motor repairs account of $3,400, representing repair bills due but not paid at

31 December 2003, had not been brought down at 1 January 2004.

(e) The cash discount totals for December 2004 had not been posted to the discount accounts in the nominal ledger.

The figures were:

$

Discount allowed 380

Discount received 290

After the necessary entries, the suspense account balanced.

Required:

Prepare journal entries, with narratives, to correct the errors found, and prepare a statement showing the

necessary adjustments to the profit.

(10 marks)

正确答案:

-

第15题:

(c) During the year Albreda paid $0·1 million (2004 – $0·3 million) in fines and penalties relating to breaches of

health and safety regulations. These amounts have not been separately disclosed but included in cost of sales.

(5 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(c) Fines and penalties

(i) Matters

■ $0·1 million represents 5·6% of profit before tax and is therefore material. However, profit has fallen, and

compared with prior year profit it is less than 5%. So ‘borderline’ material in quantitative terms.

■ Prior year amount was three times as much and represented 13·6% of profit before tax.

■ Even though the payments may be regarded as material ‘by nature’ separate disclosure may not be necessary if,

for example, there are no external shareholders.

■ Treatment (inclusion in cost of sales) should be consistent with prior year (‘The Framework’/IAS 1 ‘Presentation of

Financial Statements’).

■ The reason for the fall in expense. For example, whether due to an improvement in meeting health and safety

regulations and/or incomplete recording of liabilities (understatement).

■ The reason(s) for the breaches. For example, Albreda may have had difficulty implementing new guidelines in

response to stricter regulations.

■ Whether expenditure has been adjusted for in the income tax computation (as disallowed for tax purposes).

■ Management’s attitude to health and safety issues (e.g. if it regards breaches as an acceptable operational practice

or cheaper than compliance).

■ Any references to health and safety issues in other information in documents containing audited financial

statements that might conflict with Albreda incurring these costs.

■ Any cost savings resulting from breaches of health and safety regulations would result in Albreda possessing

proceeds of its own crime which may be a money laundering offence.

(ii) Audit evidence

■ A schedule of amounts paid totalling $0·1 million with larger amounts being agreed to the cash book/bank

statements.

■ Review/comparison of current year schedule against prior year for any apparent omissions.

■ Review of after-date cash book payments and correspondence with relevant health and safety regulators (e.g. local

authorities) for liabilities incurred before 30 September 2005.

■ Notes in the prior year financial statements confirming consistency, or otherwise, of the lack of separate disclosure.

■ A ‘signed off’ review of ‘other information’ (i.e. directors’ report, chairman’s statement, etc).

■ Written management representation that there are no fines/penalties other than those which have been reflected in

the financial statements. -

第16题:

3 You are the manager responsible for the audit of Seymour Co. The company offers information, proprietary foods and

medical innovations designed to improve the quality of life. (Proprietary foods are marketed under and protected by

registered names.) The draft consolidated financial statements for the year ended 30 September 2006 show revenue

of $74·4 million (2005 – $69·2 million), profit before taxation of $13·2 million (2005 – $15·8 million) and total

assets of $53·3 million (2005 – $40·5 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In 2001, Seymour had been awarded a 20-year patent on a new drug, Tournose, that was also approved for

food use. The drug had been developed at a cost of $4 million which is being amortised over the life of the

patent. The patent cost $11,600. In September 2006 a competitor announced the successful completion of

preliminary trials on an alternative drug with the same beneficial properties as Tournose. The alternative drug is

expected to be readily available in two years time. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

■ A change in the estimated useful life should be accounted for as a change in accounting estimate in accordance

with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. For example, if the development

costs have little, if any, useful life after the introduction of the alternative drug (‘worst case’ scenario), the carrying

value ($3 million) should be written off over the current and remaining years, i.e. $1 million p.a. The increase in

amortisation/decrease in carrying value ($800,000) is material to PBT (6%) and total assets (1·5%).

■ Similarly a change in the expected pattern of consumption of the future economic benefits should be accounted for

as a change in accounting estimate (IAS 8). For example, it may be that the useful life is still to 2020 but that

the economic benefits may reduce significantly in two years time.

■ After adjusting the carrying amount to take account of the change in accounting estimate(s) management should

have tested it for impairment and any impairment loss recognised in profit or loss.

(ii) Audit evidence

■ $3 million carrying amount of development costs brought forward agreed to prior year working papers and financial

statements.

■ A copy of the press release announcing the competitor’s alternative drug.

■ Management’s projections of future cashflows from Tournose-related sales as evidence of the useful life of the

development costs and pattern of consumption.

■ Reperformance of management’s impairment test on the development costs: Recalculation of management’s

calculation of the carrying amount after revising estimates of useful life and/or consumption of benefits compared

with management’s calculation of value in use.

■ Sensitivity analysis on management’s key assumptions (e.g. estimates of useful life, discount rate).

■ Written management representation on the key assumptions concerning the future that have a significant risk of

causing material adjustment to the carrying amount of the development costs. (These assumptions should be

disclosed in accordance with IAS 1 Presentation of Financial Statements.) -

第17题:

1 Your client, Island Co, is a manufacturer of machinery used in the coal extraction industry. You are currently planning

the audit of the financial statements for the year ended 30 November 2007. The draft financial statements show

revenue of $125 million (2006 – $103 million), profit before tax of $5·6 million (2006 – $5·1 million) and total

assets of $95 million (2006 – $90 million). Your firm was appointed as auditor to Island Co for the first time in June

2007.

Island Co designs, constructs and installs machinery for five key customers. Payment is due in three instalments: 50%

is due when the order is confirmed (stage one), 25% on delivery of the machinery (stage two), and 25% on successful

installation in the customer’s coal mine (stage three). Generally it takes six months from the order being finalised until

the final installation.

At 30 November, there is an amount outstanding of $2·85 million from Jacks Mine Co. The amount is a disputed

stage three payment. Jacks Mine Co is refusing to pay until the machinery, which was installed in August 2007, is

running at 100% efficiency.

One customer, Sawyer Co, communicated in November 2007, via its lawyers with Island Co, claiming damages for

injuries suffered by a drilling machine operator whose arm was severely injured when a machine malfunctioned. Kate

Shannon, the chief executive officer of Island Co, has told you that the claim is being ignored as it is generally known

that Sawyer Co has a poor health and safety record, and thus the accident was their fault. Two orders which were

placed by Sawyer Co in October 2007 have been cancelled.

Work in progress is valued at $8·5 million at 30 November 2007. A physical inventory count was held on

17 November 2007. The chief engineer estimated the stage of completion of each machine at that date. One of the

major components included in the coal extracting machinery is now being sourced from overseas. The new supplier,

Locke Co, is located in Spain and invoices Island Co in euros. There is a trade payable of $1·5 million owing to Locke

Co recorded within current liabilities.

All machines are supplied carrying a one year warranty. A warranty provision is recognised on the balance sheet at

$2·5 million (2006 – $2·4 million). Kate Shannon estimates the cost of repairing defective machinery reported by

customers, and this estimate forms the basis of the provision.

Kate Shannon owns 60% of the shares in Island Co. She also owns 55% of Pacific Co, which leases a head office to

Island Co. Kate is considering selling some of her shares in Island Co in late January 2008, and would like the audit

to be finished by that time.

Required:

(a) Using the information provided, identify and explain the principal audit risks, and any other matters to be

considered when planning the final audit for Island Co for the year ended 30 November 2007.

Note: your answer should be presented in the format of briefing notes to be used at a planning meeting.

Requirement (a) includes 2 professional marks. (13 marks)

正确答案:

1 ISLAND CO

(a) Briefing Notes

Subject: Principal Audit Risks – Island Co

Revenue Recognition – timing

Island Co raises sales invoices in three stages. There is potential for breach of IAS 18 Revenue, which states that revenue

should only be recognised once the seller has the right to receive it, in other words the seller has performed its contractual

obligations. This right does not necessarily correspond to amounts falling due for payment in accordance with an invoice

schedule agreed with a customer as part of a contract. Island Co appears to receive payment from its customers in advance

of performing any obligation, as the stage one invoice is raised when an order is confirmed i.e. before any work has actually

taken place. This creates the potential for revenue to be recognised too early, in advance of any performance of contractual

obligation. When a payment is received in advance of performance, a liability should be recognised equal to the amount

received, representing the obligation under the contract. Therefore a significant risk is that revenue is overstated and liabilities

understated.

Tutorial note: Equivalent guidance is also provided in IAS 11 Construction Contracts and credit will be awarded where

candidates discuss revenue recognition under IAS 11 as Island Co is providing a single substantial asset for a customer

under the terms of a contract.

Disputed receivable

The amount owed from Jacks Mine Co is highly material as it represents 50·9% of profit before tax, 2·3% of revenue, and

3% of total assets. The risk is that the receivable is overstated if no impairment of the disputed receivable is recognised.

Legal claim

The claim should be investigated seriously by Island Co. The chief executive officer’s (CEO) opinion that the claim will not

result in any financial consequence for Island Co is na?ve and flippant. Damages could be awarded against Island Co if it is

found that the machinery is faulty. The recurring high level of warranty provision implies that machinery faults are fairly

common and therefore the accident could be the result of a defective machine being supplied to Sawyer Co. The risk is that

no provision is created for the potential damages under IAS 37 Provisions, Contingent Liabilities and Contingent Assets, if the

likelihood of paying damages is considered probable. Alternatively, if the likelihood of damages being paid to Sawyer Co is

considered a possibility then a disclosure note should be made in the financial statements describing the nature and possible

financial effect of the contingent liability. As discussed below, the CEO, Kate Shannon, has an incentive not to make a

provision or disclose a contingent liability due to the planned share sale post year end.

A further risk is that any legal fees associated with the claim have not been accrued within the financial statements. As the

claim has arisen during the year, the expense must be included in this year’s income statement, even if the claim is still ongoing

at the year end.

The fact that the legal claim is effectively being ignored may cast doubts on the overall integrity of senior management, and

on the integrity of the financial statements. Management representations should be approached with a degree of professional

scepticism during the audit.

Sawyer Co has cancelled two orders. If the amounts are still outstanding at the year end then it is highly likely that Sawyer

Co will not pay the invoiced amounts, and thus receivables are overstated. If the stage one payments have already been made,

then Sawyer Co may claim a refund, in which case a provision should be made to repay the amount, or a contingent liability

disclosed in a note to the financial statements.

Sawyer Co is one of only five major customers, and losing this customer could have future going concern implications for

Island Co if a new source of revenue cannot be found to replace the lost income stream from Sawyer Co. If the legal claim

becomes public knowledge, and if Island Co is found to have supplied faulty machinery, then it will be difficult to attract new

customers.

A case of this nature could bring bad publicity to Island Co, a potential going concern issue if it results in any of the five key

customers terminating orders with Island Co. The auditors should plan to extend the going concern work programme to

incorporate the issues noted above.

Inventories

Work in progress is material to the financial statements, representing 8·9% of total assets. The inventory count was held two

weeks prior to the year end. There is an inherent risk that the valuation has not been correctly rolled forward to a year end

position.

The key risk is the estimation of the stage of completion of work in progress. This is subjective, and knowledge appears to

be confined to the chief engineer. Inventory could be overvalued if the machines are assessed to be more complete than they

actually are at the year end. Absorption of labour costs and overheads into each machine is a complex calculation and must

be done consistently with previous years.

It will also be important that consumable inventories not yet utilised on a machine, e.g. screws, nuts and bolts, are correctly

valued and included as inventories of raw materials within current assets.

Overseas supplier

As the supplier is new, controls may not yet have been established over the recording of foreign currency transactions.

Inherent risk is high as the trade payable should be retranslated using the year end exchange rate per IAS 21 The Effects of

Changes in Foreign Exchange Rates. If the retranslation is not performed at the year end, the trade payable could be

significantly over or under valued, depending on the movement of the dollar to euro exchange rate between the purchase date

and the year end. The components should remain at historic cost within inventory valuation and should not be retranslated

at the year end.

Warranty provision

The warranty provision is material at 2·6% of total assets (2006 – 2·7%). The provision has increased by only $100,000,

an increase of 4·2%, compared to a revenue increase of 21·4%. This could indicate an underprovision as the percentage

change in revenue would be expected to be in line with the percentage change in the warranty provision, unless significant

improvements had been made to the quality of machines installed for customers during the year. This appears unlikely given

the legal claim by Sawyer Co, and the machines installed at Jacks Mine Co operating inefficiently. The basis of the estimate

could be understated to avoid charging the increase in the provision as an expense through the income statement. This is of

special concern given that it is the CEO and majority shareholder who estimates the warranty provision.

Majority shareholder

Kate Shannon exerts control over Island Co via a majority shareholding, and by holding the position of CEO. This greatly

increases the inherent risk that the financial statements could be deliberately misstated, i.e. overvaluation of assets,

undervaluation of liabilities, and thus overstatement of profits. The risk is severe at this year end as Kate Shannon is hoping

to sell some Island Co shares post year end. As the price that she receives for these shares will be to a large extent influenced

by the balance sheet position of the company at 30 November 2007, she has a definite interest in manipulating the financial

statements for her own personal benefit. For example:

– Not recognising a provision or contingent liability for the legal claim from Sawyer Co

– Not providing for the potentially irrecoverable receivable from Jacks Mines Co

– Not increasing the warranty provision

– Recognising revenue earlier than permitted by IAS 18 Revenue.

Related party transactions

Kate Shannon controls Island Co and also controls Pacific Co. Transactions between the two companies should be disclosed

per IAS 24 Related Party Disclosures. There is risk that not all transactions have been disclosed, or that a transaction has

been disclosed at an inappropriate value. Details of the lease contract between the two companies should be disclosed within

a note to the financial statements, in particular, any amounts owed from Island Co to Pacific Co at 30 November 2007 should

be disclosed.

Other issues

– Kate Shannon wants the audit to be completed as soon as possible, which brings forward the deadline for completion

of the audit. The audit team may not have time to complete all necessary procedures, or there may not be time for

adequate reviews to be carried out on the work performed. Detection risk, and thus audit risk is increased, and the

overall quality of the audit could be jeopardised.

– This is especially important given that this is the first year audit and therefore the audit team will be working with a

steep learning curve. Audit procedures may take longer than originally planned, yet there is little time to extend

procedures where necessary.

– Kate Shannon may also exert considerable influence on the members of the audit team to ensure that the financial

statements show the best possible position of Island Co in view of her share sale. It is crucial that the audit team

members adhere strictly to ethical guidelines and that independence is beyond question.

– Due to the seriousness of the matters noted above, a final matter to be considered at the planning stage is that a second

partner review (Engagement Quality Control Review) should be considered for the audit this year end. A suitable

independent reviewer should be indentified, and time planned and budgeted for at the end of the assignment.

Conclusion

From the range of issues discussed in these briefing notes, it can be seen that the audit of Island Co will be a relatively high

risk engagement. -

第18题:

The writer reveals the "foolishness" of the custom in the paragraph by ______.

A. giving old or humorous examples

B. using convincing arguments

C. giving eyewitness accounts

D. saying that Philip IV of Aragon put a stop to it

正确答案:D最后一段。

-

第19题:

is defined as the buying and selling of products and services over the Internet. It had included the handling of purchase(67)and funds transfers over computer networks from its inception.

A.Electronicmail

B.Searchengine

C.Multimedia

D.Electroniccommerce

正确答案:D

解析:译文:电子商务是指通过因特网购买、销售产品或者服务。 -

第20题:

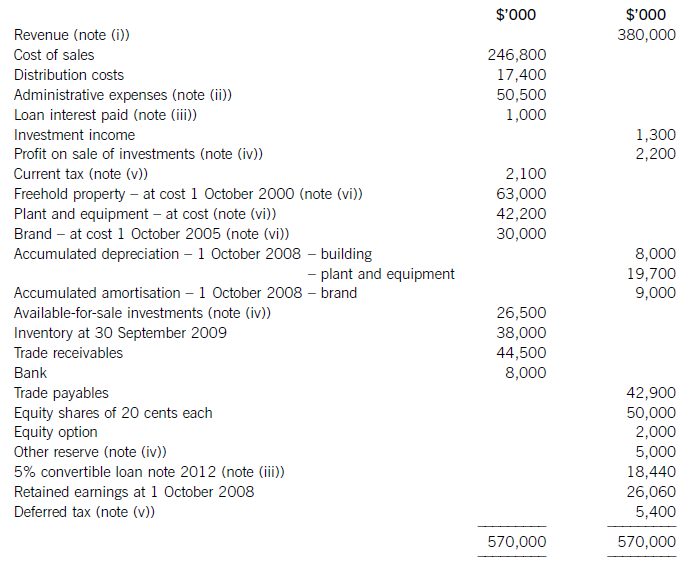

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

正确答案:

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities. -

第21题:

You are an audit manager at Rockwell & Co, a firm of Chartered Certified Accountants. You are responsible for the audit of the Hopper Group, a listed audit client which supplies ingredients to the food and beverage industry worldwide.

The audit work for the year ended 30 June 2015 is nearly complete, and you are reviewing the draft audit report which has been prepared by the audit senior. During the year the Hopper Group purchased a new subsidiary company, Seurat Sweeteners Co, which has expertise in the research and design of sugar alternatives. The draft financial statements of the Hopper Group for the year ended 30 June 2015 recognise profit before tax of $495 million (2014 – $462 million) and total assets of $4,617 million (2014: $4,751 million). An extract from the draft audit report is shown below:

Basis of modified opinion (extract)

In their calculation of goodwill on the acquisition of the new subsidiary, the directors have failed to recognise consideration which is contingent upon meeting certain development targets. The directors believe that it is unlikely that these targets will be met by the subsidiary company and, therefore, have not recorded the contingent consideration in the cost of the acquisition. They have disclosed this contingent liability fully in the notes to the financial statements. We do not feel that the directors’ treatment of the contingent consideration is correct and, therefore, do not believe that the criteria of the relevant standard have been met. If this is the case, it would be appropriate to adjust the goodwill balance in the statement of financial position.

We believe that any required adjustment may materially affect the goodwill balance in the statement of financial position. Therefore, in our opinion, the financial statements do not give a true and fair view of the financial position of the Hopper Group and of the Hopper Group’s financial performance and cash flows for the year then ended in accordance with International Financial Reporting Standards.

Emphasis of Matter Paragraph

We draw attention to the note to the financial statements which describes the uncertainty relating to the contingent consideration described above. The note provides further information necessary to understand the potential implications of the contingency.

Required:

(a) Critically appraise the draft audit report of the Hopper Group for the year ended 30 June 2015, prepared by the audit senior.

Note: You are NOT required to re-draft the extracts from the audit report. (10 marks)

(b) The audit of the new subsidiary, Seurat Sweeteners Co, was performed by a different firm of auditors, Fish Associates. During your review of the communication from Fish Associates, you note that they were unable to obtain sufficient appropriate evidence with regard to the breakdown of research expenses. The total of research costs expensed by Seurat Sweeteners Co during the year was $1·2 million. Fish Associates has issued a qualified audit opinion on the financial statements of Seurat Sweeteners Co due to this inability to obtain sufficient appropriate evidence.

Required:

Comment on the actions which Rockwell & Co should take as the auditor of the Hopper Group, and the implications for the auditor’s report on the Hopper Group financial statements. (6 marks)

(c) Discuss the quality control procedures which should be carried out by Rockwell & Co prior to the audit report on the Hopper Group being issued. (4 marks)

正确答案:(a) Critical appraisal of the draft audit report

Type of opinion

When an auditor issues an opinion expressing that the financial statements ‘do not give a true and fair view’, this represents an adverse opinion. The paragraph explaining the modification should, therefore, be titled ‘Basis of Adverse Opinion’ rather than simply ‘Basis of Modified Opinion’.

An adverse opinion means that the auditor considers the misstatement to be material and pervasive to the financial statements of the Hopper Group. According to ISA 705 Modifications to Opinions in the Independent Auditor’s Report, pervasive matters are those which affect a substantial proportion of the financial statements or fundamentally affect the users’ understanding of the financial statements. It is unlikely that the failure to recognise contingent consideration is pervasive; the main effect would be to understate goodwill and liabilities. This would not be considered a substantial proportion of the financial statements, neither would it be fundamental to understanding the Hopper Group’s performance and position.

However, there is also some uncertainty as to whether the matter is even material. If the matter is determined to be material but not pervasive, then a qualified opinion would be appropriate on the basis of a material misstatement. If the matter is not material, then no modification would be necessary to the audit opinion.

Wording of opinion/report

The auditor’s reference to ‘the acquisition of the new subsidiary’ is too vague; the Hopper Group may have purchased a number of subsidiaries which this phrase could relate to. It is important that the auditor provides adequate description of the event and in these circumstances it would be appropriate to name the subsidiary referred to.

The auditor has not quantified the amount of the contingent element of the consideration. For the users to understand the potential implications of any necessary adjustments, they need to know how much the contingent consideration will be if it becomes payable. It is a requirement of ISA 705 that the auditor quantifies the financial effects of any misstatements, unless it is impracticable to do so.

In addition to the above point, the auditor should provide more description of the financial effects of the misstatement, including full quantification of the effect of the required adjustment to the assets, liabilities, incomes, revenues and equity of the Hopper Group.

The auditor should identify the note to the financial statements relevant to the contingent liability disclosure rather than just stating ‘in the note’. This will improve the understandability and usefulness of the contents of the audit report.

The use of the term ‘we do not feel that the treatment is correct’ is too vague and not professional. While there may be some interpretation necessary when trying to apply financial reporting standards to unique circumstances, the expression used is ambiguous and may be interpreted as some form. of disclaimer by the auditor with regard to the correct accounting treatment. The auditor should clearly explain how the treatment applied in the financial statements has departed from the requirements of the relevant standard.

Tutorial note: As an illustration to the above point, an appropriate wording would be: ‘Management has not recognised the acquisition-date fair value of contingent consideration as part of the consideration transferred in exchange for the acquiree, which constitutes a departure from International Financial Reporting Standards.’

The ambiguity is compounded by the use of the phrase ‘if this is the case, it would be appropriate to adjust the goodwill’. This once again suggests that the correct treatment is uncertain and perhaps open to interpretation.

If the auditor wishes to refer to a specific accounting standard they should refer to its full title. Therefore instead of referring to ‘the relevant standard’ they should refer to International Financial Reporting Standard 3 Business Combinations.

The opinion paragraph requires an appropriate heading. In this case the auditors have issued an adverse opinion and the paragraph should be headed ‘Adverse Opinion’.

As with the basis paragraph, the opinion paragraph lacks authority; suggesting that the required adjustments ‘may’ materially affect the financial statements implies that there is a degree of uncertainty. This is not the case; the amount of the contingent consideration will be disclosed in the relevant purchase agreement, so the auditor should be able to determine whether the required adjustments are material or not. Regardless, the sentence discussing whether the balance is material or not is not required in the audit report as to warrant inclusion in the report the matter must be considered material. The disclosure of the nature and financial effect of the misstatement in the basis paragraph is sufficient.

Finally, the emphasis of matter paragraph should not be included in the audit report. An emphasis of matter paragraph is only used to draw attention to an uncertainty/matter of fundamental importance which is correctly accounted for and disclosed in the financial statements. An emphasis of matter is not required in this case for the following reasons:

– Emphasis of matter is only required to highlight matters which the auditor believes are fundamental to the users’ understanding of the business. An example may be where a contingent liability exists which is so significant it could lead to the closure of the reporting entity. That is not the case with the Hopper Group; the contingent liability does not appear to be fundamental.

– Emphasis of matter is only used for matters where the auditor has obtained sufficient appropriate evidence that the matter is not materially misstated in the financial statements. If the financial statements are materially misstated, in this regard the matter would be fully disclosed by the auditor in the basis of qualified/adverse opinion paragraph and no emphasis of matter is necessary.

(b) Communication from the component auditor

The qualified opinion due to insufficient evidence may be a significant matter for the Hopper Group audit. While the possible adjustments relating to the current year may not be material to the Hopper Group, the inability to obtain sufficient appropriate evidence with regard to a material matter in Seurat Sweeteners Co’s financial statements may indicate a control deficiency which the auditor was not aware of at the planning stage and it could indicate potential problems with regard to the integrity of management, which could also indicate a potential fraud. It could also indicate an unwillingness of management to provide information, which could create problems for future audits, particularly if research and development costs increase in future years. If the group auditor suspects that any of these possibilities are true, they may need to reconsider their risk assessment and whether the audit procedures performed are still appropriate.

If the detail provided in the communication from the component auditor is insufficient, the group auditor should first discuss the matter with the component auditor to see whether any further information can be provided. The group auditor can request further working papers from the component auditor if this is necessary. However, if Seurat Sweeteners has not been able to provide sufficient appropriate evidence, it is unlikely that this will be effective.

If the discussions with the component auditor do not provide satisfactory responses to evaluate the potential impact on the Hopper Group, the group auditor may need to communicate with either the management of Seurat Sweeteners or the Hopper Group to obtain necessary clarification with regard to the matter.

Following these procedures, the group auditor needs to determine whether they have sufficient appropriate evidence to draw reasonable conclusions on the Hopper Group’s financial statements. If they believe the lack of information presents a risk of material misstatement in the group financial statements, they can request that further audit procedures be performed, either by the component auditor or by themselves.

Ultimately the group engagement partner has to evaluate the effect of the inability to obtain sufficient appropriate evidence on the audit opinion of the Hopper Group. The matter relates to research expenses totalling $1·2 million, which represents 0·2% of the profit for the year and 0·03% of the total assets of the Hopper Group. It is therefore not material to the Hopper Group’s financial statements. For this reason no modification to the audit report of the Hopper Group would be required as this does not represent a lack of sufficient appropriate evidence with regard to a matter which is material to the Group financial statements.

Although this may not have an impact on the Hopper Group audit opinion, this may be something the group auditor wishes to bring to the attention of those charged with governance. This would be particularly likely if the group auditor believed that this could indicate some form. of fraud in Seurat Sweeteners Co, a serious deficiency in financial reporting controls or if this could create problems for accepting future audits due to management’s unwillingness to provide access to accounting records.

(c) Quality control procedures prior to issuing the audit report

ISA 220 Quality Control for an Audit of Financial Statements and ISQC 1 Quality Control for Firms that Perform. Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Agreements require that an engagement quality control reviewer shall be appointed for audits of financial statements of listed entities. The audit engagement partner then discusses significant matters arising during the audit engagement with the engagement quality control reviewer.