(b) Using the information contained in Appendix 1.1, discuss the financial performance of HLP and MAS,incorporating details of the following in your discussion:(i) Overall client fees (total and per consultation)(ii) Advisory protection scheme consultatio

题目

(b) Using the information contained in Appendix 1.1, discuss the financial performance of HLP and MAS,

incorporating details of the following in your discussion:

(i) Overall client fees (total and per consultation)

(ii) Advisory protection scheme consultation ‘utilisation levels’ for both property and commercial clients

(iii) Cost/expense levels. (10 marks)

相似考题

更多“(b) Using the information contained in Appendix 1.1, discuss the financial performance of HLP and MAS,incorporating details of the following in your discussion:(i) Overall client fees (total and per consultation)(ii) Advisory protection scheme consultatio”相关问题

-

第1题:

(b) Discuss the relative costs to the preparer and benefits to the users of financial statements of increased

disclosure of information in financial statements. (14 marks)

Quality of discussion and reasoning. (2 marks)

正确答案:

(b) Increased information disclosure benefits users by reducing the likelihood that they will misallocate their capital. This is

obviously a direct benefit to individual users of corporate reports. The disclosure reduces the risk of misallocation of capital

by enabling users to improve their assessments of a company’s prospects. This creates three important results.

(i) Users use information disclosed to increase their investment returns and by definition support the most profitable

companies which are likely to be those that contribute most to economic growth. Thus, an important benefit of

information disclosure is that it improves the effectiveness of the investment process.

(ii) The second result lies in the effect on the liquidity of the capital markets. A more liquid market assists the effective

allocation of capital by allowing users to reallocate their capital quickly. The degree of information asymmetry between

the buyer and seller and the degree of uncertainty of the buyer and the seller will affect the liquidity of the market as

lower asymmetry and less uncertainty will increase the number of transactions and make the market more liquid.

Disclosure will affect uncertainty and information asymmetry.

(iii) Information disclosure helps users understand the risk of a prospective investment. Without any information, the user

has no way of assessing a company’s prospects. Information disclosure helps investors predict a company’s prospects.

Getting a better understanding of the true risk could lower the price of capital for the company. It is difficult to prove

however that the average cost of capital is lowered by information disclosure, even though it is logically and practically

impossible to assess a company’s risk without relevant information. Lower capital costs promote investment, which can

stimulate productivity and economic growth.

However although increased information can benefit users, there are problems of understandability and information overload.

Information disclosure provides a degree of protection to users. The benefit is fairness to users and is part of corporate

accountability to society as a whole.

The main costs to the preparer of financial statements are as follows:

(i) the cost of developing and disseminating information,

(ii) the cost of possible litigation attributable to information disclosure,

(iii) the cost of competitive disadvantage attributable to disclosure.

The costs of developing and disseminating the information include those of gathering, creating and auditing the information.

Additional costs to the preparers include training costs, changes to systems (for example on moving to IFRS), and the more

complex and the greater the information provided, the more it will cost the company.

Although litigation costs are known to arise from information disclosure, it does not follow that all information disclosure leads

to litigation costs. Cases can arise from insufficient disclosure and misleading disclosure. Only the latter is normally prompted

by the presentation of information disclosure. Fuller disclosure could lead to lower costs of litigation as the stock market would

have more realistic expectations of the company’s prospects and the discrepancy between the valuation implicit in the market

price and the valuation based on a company’s financial statements would be lower. However, litigation costs do not

necessarily increase with the extent of the disclosure. Increased disclosure could reduce litigation costs.

Disclosure could weaken a company’s ability to generate future cash flows by aiding its competitors. The effect of disclosure

on competitiveness involves benefits as well as costs. Competitive disadvantage could be created if disclosure is made relating

to strategies, plans, (for example, planned product development, new market targeting) or information about operations (for

example, production-cost figures). There is a significant difference between the purpose of disclosure to users and

competitors. The purpose of disclosure to users is to help them to estimate the amount, timing, and certainty of future cash

flows. Competitors are not trying to predict a company’s future cash flows, and information of use in that context is not

necessarily of use in obtaining competitive advantage. Overlap between information designed to meet users’ needs and

information designed to further the purposes of a competitor is often coincidental. Every company that could suffer competitive

disadvantage from disclosure could gain competitive advantage from comparable disclosure by competitors. Published figures

are often aggregated with little use to competitors.

Companies bargain with suppliers and with customers, and information disclosure could give those parties an advantage in

negotiations. In such cases, the advantage would be a cost for the disclosing entity. However, the cost would be offset

whenever information disclosure was presented by both parties, each would receive an advantage and a disadvantage.

There are other criteria to consider such as whether the information to be disclosed is about the company. This is both a

benefit and a cost criterion. Users of corporate reports need company-specific data, and it is typically more costly to obtain

and present information about matters external to the company. Additionally, consideration must be given as to whether the

company is the best source for the information. It could be inefficient for a company to obtain or develop data that other, more

expert parties could develop and present or do develop at present.

There are many benefits to information disclosure and users have unmet information needs. It cannot be known with any

certainty what the optimal disclosure level is for companies. Some companies through voluntary disclosure may have

achieved their optimal level. There are no quantitative measures of how levels of disclosure stand with respect to optimal

levels. Standard setters have to make such estimates as best they can, guided by prudence, and by what evidence of benefits

and costs they can obtain. -

第2题:

(b) Comment (with relevant calculations) on the performance of the business of Quicklink Ltd and Celer

Transport during the year ended 31 May 2005 and, insofar as the information permits, its projected

performance for the year ending 31 May 2006. Your answer should specifically consider:

(i) Revenue generation per vehicle

(ii) Vehicle utilisation and delivery mix

(iii) Service quality. (14 marks)

正确答案:

difference will reduce in the year ending 31 May 2006 due to the projected growth in sales volumes of the Celer Transport

business. The average mail/parcels delivery of mail/parcels per vehicle of the Quicklink Ltd part of the business is budgeted

at 12,764 which is still 30·91% higher than that of the Celer Transport business.

As far as specialist activities are concerned, Quicklink Ltd is budgeted to generate average revenues per vehicle amounting to

£374,850 whilst Celer Transport is budgeted to earn an average of £122,727 from each of the vehicles engaged in delivery

of processed food. It is noticeable that all contracts with major food producers were renewed on 1 June 2005 and it would

appear that there were no increases in the annual value of the contracts with major food producers. This might have been

the result of a strategic decision by the management of the combined entity in order to secure the future of this part of the

business which had been built up previously by the management of Celer Transport.

Each vehicle owned by Quicklink Ltd and Celer Transport is in use for 340 days during each year, which based on a

365 day year would give an in use % of 93%. This appears acceptable given the need for routine maintenance and repairs

due to wear and tear.

During the year ended 31 May 2005 the number of on-time deliveries of mail and parcel and industrial machinery deliveries

were 99·5% and 100% respectively. This compares with ratios of 82% and 97% in respect of mail and parcel and processed

food deliveries made by Celer Transport. In this critical area it is worth noting that Quicklink Ltd achieved their higher on-time

delivery target of 99% in respect of each activity whereas Celer Transport were unable to do so. Moreover, it is worth noting

that Celer Transport missed their target time for delivery of food products on 975 occasions throughout the year 31 May 2005

and this might well cause a high level of customer dissatisfaction and even result in lost business.

It is interesting to note that whilst the businesses operate in the same industry they have a rather different delivery mix in

terms of same day/next day demands by clients. Same day deliveries only comprise 20% of the business of Quicklink Ltd

whereas they comprise 75% of the business of Celer Transport. This may explain why the delivery performance of Celer

Transport with regard to mail and parcel deliveries was not as good as that of Quicklink Ltd.

The fact that 120 items of mail and 25 parcels were lost by the Celer Transport business is most disturbing and could prove

damaging as the safe delivery of such items is the very substance of the business and would almost certainly have resulted

in a loss of customer goodwill. This is an issue which must be addressed as a matter of urgency.

The introduction of the call management system by Quicklink Ltd on 1 June 2004 is now proving its worth with 99% of calls

answered within the target time of 20 seconds. This compares favourably with the Celer Transport business in which only

90% of a much smaller volume of calls were answered within a longer target time of 30 seconds. Future performance in this

area will improve if the call management system is applied to the Celer Transport business. In particular, it is likely that the

number of abandoned calls will be reduced and enhance the ‘image’ of the Celer Transport business.

-

第3题:

(c) Using the information contained in Appendix 1.2, compare the performance of HLP and MAS incorporating

relevant percentage and ratio statistics under the following headings:

(i) Competitiveness; (5 marks)

正确答案:

-

第4题:

(b) Using the unit cost information available and your calculations in (a), prepare a financial analysis of the

decision strategy which TOC may implement with regard to the manufacture of each product. (6 marks)

正确答案:

-

第5题:

Overall objective of financial reporting is to provide financial information useful to internal users in making economic decisions.()

正确答案:错

-

第6题:

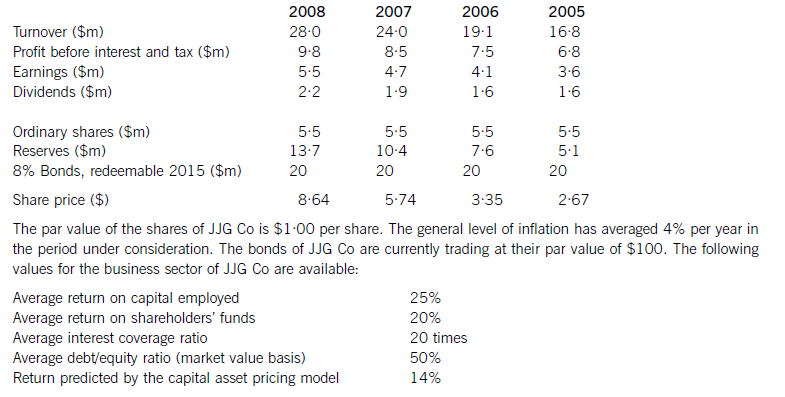

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第7题:

资料: The following passage is the introduction about one of the Monsell international financial products.According to the passage,there will be 5 questions.You should read carefully,then select the right answer.

Passage:

As a teenager between the age of 13 and 18,maybe you would like to manage your own money and have your own bank account.The good news is that Bank of Monsell has just launched several great solutions for you.

The first one is the Teen Discounted Bank Plans(TDBPS).TDBPS feature a discount of $9.95 per month on your monthly bank fee—that’s a savings of up to $120 per year.It’s the primary and most common account chosen by nearly 45% of our teen customers.If it is not to your liking,maybe the following alternatives which offer more discount and benefits on your bank accounts are able to meet your demands.

In a Plus Plan,you can have up to 30 transactions per month free of charge on as many as accounts as you need on the condition that your Primary Chequing Account must be your lead account,the one you designate to pay any fees required by your Bank Plan(i.e.monthly plan fees,transaction fees).It includes Primary Chequing and up to 19 more eligible accounts.You can make 30 transactions either in branch,by phone,online,by mobile or at an ATM of Bank of Monsell.From the 31st transaction,a fee of $0.7 per transaction will be charged.A Plus Plan is able to help save you up to $288.60 a year on fees.Besides,it enables you to send money globally to over 200 countries and territories via Interact e–Transfer through its Online Banking. A Plus Plan offers preferred exchange rate only when buying U.S. cash (up to $5,000 U.S. per transaction).

In a Performance Plan,the number of transactions is unlimited on as many as accounts as you need,meaning that you can make as many everyday banking transactions as you want free of chargein branch,on line or at an ATM of Bank of Monsell.It does not include phone banking services.However,a fee of $4.00 a month is charged for this service.It also includes Primary Chequing and up to 16 more eligible accounts.It helps you save up to $456.60 a year on fees.It also enables you to send money globally to over 200 countries and territories via Interac e–Transfer through its Online Banking.What’s more,one non-bank of Monsell ATM withdrawal on the Interac network per month is offered.A Performance Plan offers preferred exchange rate when buying or selling U.S.cash(up to $5,000 U.S.per transaction).

In a Premium Plan you can also make unlimited transactions on as many accounts as you need at a monthly fee of $15.05.It includes Primary Chequing and up to 15 more eligible accounts.The everyday banking transactions of this plan should be controlled fewer than 40,or you have to pay a fee of $0.8 for every transaction beyond 40.It helps save up to $791.95 per year on fees.What’s more,5 non-bank of Monsell ATM debit transactions on the Interac network and 5 international debit transactions using non-bank of Monsell ATMs per month is included.However,it does not have the ability to send money globally to any country or territory via Interac e–Transfer through its Online Banking.A Premium Plan offers preferred exchange rate only when selling U.S.cash(up to $5,000 U.S.per transaction).

You can apply for any of these accounts by phone,online or in person.Please feel free to call us at 1-870-226-5266 or write emails to Bank of Monsell Mike@yahoo.com or get on our website for any further details of these services and products.

The purpose of the writer in writing this passage is to_______.A.introduce the Bank of Monsell

B.analyze the products of Bank of Monsell

C.introduce certain products and services for teens

D.show the success of the Bank of Monsell答案:C解析:本题考查的是主旨大意。

【关键词】purpose of the writer in writing this passage

【主题句】第1自然段As a teenager between the age of 13 and 18,maybe you would like to manage your own money and have your own bank account.The good news is that Bank of Monsell has just launched several great solutions for you.作为年龄在13-18岁之间的青年,也许你打算管理自己的金钱,开立自己的银行账户。好消息是,Bank of Monsell刚好为你准备了一些合适的方案。

【解析】本题的问题是“作者写这篇文章的目的是?”A选项“介绍the Bank of Monsell”,B选项“分析the Bank of Monsell的产品”,C选项“介绍针对青少年的特定服务和产品”,D选项“展示the Bank of Monsell的成就”。文章开头就直接表达写作目的,根据主题句,就是介绍the Bank of Monsell为青少年准备的账户管理方案,涉及到产品和服务,吸引轻松前去开立账户。选项C正确。 -

第8题:

资料: The following passage is the introduction about one of the Monsell international financial products.According to the passage,there will be 5 questions.You should read carefully,then select the right answer.

Passage:

As a teenager between the age of 13 and 18,maybe you would like to manage your own money and have your own bank account.The good news is that Bank of Monsell has just launched several great solutions for you.

The first one is the Teen Discounted Bank Plans(TDBPS).TDBPS feature a discount of $9.95 per month on your monthly bank fee—that’s a savings of up to $120 per year.It’s the primary and most common account chosen by nearly 45% of our teen customers.If it is not to your liking,maybe the following alternatives which offer more discount and benefits on your bank accounts are able to meet your demands.

In a Plus Plan,you can have up to 30 transactions per month free of charge on as many as accounts as you need on the condition that your Primary Chequing Account must be your lead account,the one you designate to pay any fees required by your Bank Plan(i.e.monthly plan fees,transaction fees).It includes Primary Chequing and up to 19 more eligible accounts.You can make 30 transactions either in branch,by phone,online,by mobile or at an ATM of Bank of Monsell.From the 31st transaction,a fee of $0.7 per transaction will be charged.A Plus Plan is able to help save you up to $288.60 a year on fees.Besides,it enables you to send money globally to over 200 countries and territories via Interact e–Transfer through its Online Banking. A Plus Plan offers preferred exchange rate only when buying U.S. cash (up to $5,000 U.S. per transaction).

In a Performance Plan,the number of transactions is unlimited on as many as accounts as you need,meaning that you can make as many everyday banking transactions as you want free of chargein branch,on line or at an ATM of Bank of Monsell.It does not include phone banking services.However,a fee of $4.00 a month is charged for this service.It also includes Primary Chequing and up to 16 more eligible accounts.It helps you save up to $456.60 a year on fees.It also enables you to send money globally to over 200 countries and territories via Interac e–Transfer through its Online Banking.What’s more,one non-bank of Monsell ATM withdrawal on the Interac network per month is offered.A Performance Plan offers preferred exchange rate when buying or selling U.S.cash(up to $5,000 U.S.per transaction).

In a Premium Plan you can also make unlimited transactions on as many accounts as you need at a monthly fee of $15.05.It includes Primary Chequing and up to 15 more eligible accounts.The everyday banking transactions of this plan should be controlled fewer than 40,or you have to pay a fee of $0.8 for every transaction beyond 40.It helps save up to $791.95 per year on fees.What’s more,5 non-bank of Monsell ATM debit transactions on the Interac network and 5 international debit transactions using non-bank of Monsell ATMs per month is included.However,it does not have the ability to send money globally to any country or territory via Interac e–Transfer through its Online Banking.A Premium Plan offers preferred exchange rate only when selling U.S.cash(up to $5,000 U.S.per transaction).

You can apply for any of these accounts by phone,online or in person.Please feel free to call us at 1-870-226-5266 or write emails to Bank of Monsell Mike@yahoo.com or get on our website for any further details of these services and products.

If you choose the Plus Plan,which of the following will NOT be true?A.Together with Primary Chequing,you can own 20 accounts.

B.If you make 32 transaction,a fee of $1.4 will be charged.

C.You will be able to save up to $240.5 a month on fees.

D.You can sell U.S.cash(up to $5,000 U.S.per transaction)at preferred exchange rate.答案:C解析:本题考查的是细节理解。

【关键词】Plus Plan;NOT be true

【主题句】第3自然段1.It includes Primary Chequing and up to 19 more eligible accounts.它包括初始支票账户和另外多达19个符合条件的账户。

2.You can make 30 transactions either in branch,by phone,online,by mobile or at an ATM of Bank of Monsell.From the 31st transaction,a fee of $0.7 per transaction will be charged.你可以进行30笔免手续费交易,方式可以是在分行柜台,手机银行,网上银行,移动支付或者Bank of Monsell的ATM机。从第31笔交易起,每笔将收取0.7美元的手续费。

3.A Plus Plan is able to help save you up to $288.60 a year on fees.附加方案每年可以节省288.6美元费用。

4.4.A Plus Plan offers preferred exchange rate only when buying U.S. cash (up to $5,000 U.S. per transaction).附加方案仅提供以优先汇率购入美元(每笔交易上限是5000美元)。

【解析】本题的问题是“如果你选择了附加方案,下列哪一项不正确?”A选项“加上初始支票账户,你可以拥有20个账户。”,根据主题句1,正确。B选项“如果你进行了32笔交易,将收取1.4美元的手续费。”,根据主题句2,从第31笔开始收费,两笔收取1.4美元,正确。C选项“每个月你可以节约240.5美元的费用。”根据主题句3,文中说的是省288.6一年,而不是240.5一个月,错误。D选项“你可以以优先汇率售出美元(每笔交易上限是5000美元)。”。根据主题句4,以优先汇率是购入美元,而不是售出,错误。 -

第9题:

Which type of scheme describes the default operation of Gateway Load Balancing Protocol (GLBP)?()

- A、 per host using a round robin scheme

- B、 per host using a strict priority scheme

- C、 per session using a round robin scheme

- D、 per session using a strict priority scheme

- E、 per GLBP group using a round robin scheme

- F、 per GLBP group using a strict priority scheme

正确答案:A -

第10题:

Which of the following is MOST likely causing a client’s computer to have an IP address of169.254.0.10?()

- A、The office is using a public IP scheme.

- B、The client is set to a static IP address.

- C、The DHCP server is out of addresses.

- D、The firewall on the PC is down.

正确答案:C -

第11题:

单选题pany uses GLBP to provide for router redundancy in the network. Which describes the default load balancing scheme used by the Gateway Load Balancing Protocol (GLBP)?()APer host basis using a strict priority scheme

BPer session using a round-robin scheme

CPer session using a strict priority scheme

DPer GLBP group using a strict priority scheme

EPer host basis using a round-robin scheme

FPer GLBP group using a round-robin scheme

正确答案: A解析: 暂无解析 -

第12题:

单选题Which type of scheme describes the default operation of Gateway Load Balancing Protocol (GLBP)?()Aper host using a round robin scheme

Bper host using a strict priority scheme

Cper session using a round robin scheme

Dper session using a strict priority scheme

Eper GLBP group using a round robin scheme

Fper GLBP group using a strict priority scheme

正确答案: F解析: 暂无解析 -

第13题:

(b) Discuss the relevance of each of the following actions as steps in trying to remedy performance measurement

problems relating to the ‘365 Sports Complex’ and suggest examples of specific problem classifications that

may be reduced or eliminated by each action:

(i) Focusing on and improving the measurement of customer satisfaction

(ii) Involving staff at all levels in the development and implementation of performance measures

(iii) Being flexible in the extent to which formal performance measures are relied on

(iv) Giving consideration to the auditing of the performance measurement system. (8 marks)

正确答案:

(b) Trying to focus on and improve the measurement of customer satisfaction.

This is a vital goal. Without monitoring and improvement of levels of customer satisfaction, an organisation will tend to

underachieve and is likely to have problems with its future effectiveness. Positive signals from performance measures made

earlier in the value chain are only relevant if they contribute to the ultimate requirement of customer satisfaction. Tunnel vision

and sub-optimisation are examples of measurement problems that may be reduced through recognition of the need for a

management focus on customer satisfaction. For example undue focus on the importance of maximising opening hours may

lead to lack of focus on other quality issues seen as important by customers.

Involving staff at all levels in the development and implementation of performance measures.

People are involved in the achievement of performance measures at all levels and in all aspects of an organisation. It is

important that all staff are willing to accept and work towards any performance measures that are developed to monitor their

part in the operation of the organisation and in the achievement of its objectives. This should help, for example, to reduce

gaming. At the sports complex an example of gaming might be, a deliberate attempt to understate the potential benefits of

maintaining the buildings in order to ensure that funds would be used for other purposes such as an increased advertising

budget. The directors of Astrodome Sports Ltd must recognise that leisure facilities that appear dated and in a poor state of

repair will cause customers to look for more aesthetically appealing alternatives.

Being flexible in the extent to which formal performance measures are relied on.

It is best to acknowledge that measures should not be relied on exclusively for control. A performance measure may give a

short-term signal that does not relate directly to actions that are taking place to improve the level of performance in the longer

term. To some extent, improved performance may be achieved through the informal interaction between individuals and

groups. This flexibility should help to reduce measure fixation and misrepresentation. For example the percentage increase in

the quantity of bowling equipment purchased is seen as necessarily implying increased demand for use of the bowling greens.

Giving consideration to the audit of the performance measurement system.

Actions that may be taken may include:

– Seeking expert interpretation of the performance measures in place. It is important that any audit is ‘free from bias’ and

conducted independently on an ‘arm’s length’ basis. Thus it is essential that such audits should be ‘free from the

influence’ of those personnel involved in the operation of the system.

– Maintaining a careful audit of the data used. Any assessment scheme is only as good as the data on which it is founded

and how this data is analysed and interpreted.

The above actions should help, in particular, to reduce the incidence and impact of measure fixation, misinterpretation and

gaming.

For example, an audit may show that the directors of Astrodome Sports Ltd are fixated on equipment availability and

misinterpret this as being the key to customer volume and high profitability. The audit may also provide evidence of gaming

such as a deliberate attempt to underplay the benefits of one course of action in order to release funds for use on some

alternative.

-

第14题:

(ii) Briefly discuss FOUR non-financial factors which might influence the above decision. (4 marks)

正确答案:

(ii) Four factors that could be considered are as follows:

(i) The quality of the service provided by NSC as evidenced by, for example, the comfort of the ferries, on-board

facilities, friendliness and responsiveness of staff.

(ii) The health and safety track record of NSC – passenger safety is a ‘must’ in such operations.

(iii) The reliability, timeliness and dependability of NSC as a service provider.

(iv) The potential loss of image due to redundancies within Wonderland plc. -

第15题:

(ii) Briefly discuss THREE disadvantages of using EVA? in the measurement of financial performance.

(3 marks)

正确答案:

(ii) Disadvantages of an EVA approach to the measurement of financial performance include:

(i) The calculation of EVA may be complicated due to the number of adjustments required.

(ii) It is difficult to use EVA for inter-firm and inter-divisional comparisons because it is not a ratio measure.

(iii) Economic depreciation is difficult to estimate and conflicts with generally accepted accounting principles.

Note: Other relevant discussion would be acceptable. -

第16题:

(c) (i) Provide three examples of personal financial planning protection products that would be of use in

Henry’s situation. Justify your selections by reference to the type of protection provided. (6 marks)

正确答案:

(c) (i) Protection products

Henry is still working and has a mortgage to support. He therefore needs to protect not only his assets but also cover

any debt, or the ability to repay. The following protection policies are relevant to Henry’s situation.

Life assurance

This is a form. of insurance that pays out on a chargeable event, usually death. The main types are:

– Term Assurance which provides cover for a fixed term with the sum assured payable only on death. No investment

benefits or payments arise on survival.

– Whole of Life Assurance where the policy provides life protection. The sum assured is payable on death at any time

and usually some form. of investment benefit will accrue in the form. of a surrender value.

A qualifying policy will give a tax-free lump sum that could, for example, be used to repay the mortgage.

Permanent health insurance

Permanent health insurance policies are designed to provide the policyholder with a benefit if s/he is unable to work

through sickness or if s/he needs medical expenses or long-term care.

This would provide Henry with an income in the event of illness – again useful given his mortgage, and would avoid

the need to liquidate other assets to pay the mortgage or ongoing costs.

Critical illness insurance

These policies provide a capital sum where a critical illness (from a large range listed in the policy) is diagnosed.

For the same reasons above, Henry should consider this in conjunction with permanent health insurance.

Note: Marks will also be given for other relevant protection products, e.g. specific mortgage protection insurance linked

to an event other than death. -

第17题:

KFP Co, a company listed on a major stock market, is looking at its cost of capital as it prepares to make a bid to buy a rival unlisted company, NGN. Both companies are in the same business sector. Financial information on KFP Co and NGN is as follows:

NGN has a cost of equity of 12% per year and has maintained a dividend payout ratio of 45% for several years. The current earnings per share of the company is 80c per share and its earnings have grown at an average rate of 4·5% per year in recent years.

The ex div share price of KFP Co is $4·20 per share and it has an equity beta of 1·2. The 7% bonds of the company are trading on an ex interest basis at $94·74 per $100 bond. The price/earnings ratio of KFP Co is eight times.

The directors of KFP Co believe a cash offer for the shares of NGN would have the best chance of success. It has been suggested that a cash offer could be financed by debt.

Required:

(a) Calculate the weighted average cost of capital of KFP Co on a market value weighted basis. (10 marks)

(b) Calculate the total value of the target company, NGN, using the following valuation methods:

(i) Price/earnings ratio method, using the price/earnings ratio of KFP Co; and

(ii) Dividend growth model. (6 marks)

(c) Discuss the relationship between capital structure and weighted average cost of capital, and comment on

the suggestion that debt could be used to finance a cash offer for NGN. (9 marks)

正确答案:

(b)(i)Price/earningsratiomethodEarningspershareofNGN=80cpersharePrice/earningsratioofKFPCo=8SharepriceofNGN=80x8=640cor$6·40NumberofordinarysharesofNGN=5/0·5=10millionsharesValueofNGN=6·40x10m=$64millionHowever,itcanbearguedthatareductionintheappliedprice/earningsratioisneededasNGNisunlistedandthereforeitssharesaremoredifficulttobuyandsellthanthoseofalistedcompanysuchasKFPCo.Ifwereducetheappliedprice/earningsratioby10%(othersimilarpercentagereductionswouldbeacceptable),itbecomes7·2timesandthevalueofNGNwouldbe(80/100)x7·2x10m=$57·6million(ii)DividendgrowthmodelDividendpershareofNGN=80cx0·45=36cpershareSincethepayoutratiohasbeenmaintainedforseveralyears,recentearningsgrowthisthesameasrecentdividendgrowth,i.e.4·5%.Assumingthatthisdividendgrowthcontinuesinthefuture,thefuturedividendgrowthratewillbe4·5%.Sharepricefromdividendgrowthmodel=(36x1·045)/(0·12–0·045)=502cor$5·02ValueofNGN=5·02x10m=$50·2million(c)Adiscussionofcapitalstructurecouldstartfromrecognisingthatequityismoreexpensivethandebtbecauseoftherelativeriskofthetwosourcesoffinance.Equityisriskierthandebtandsoequityismoreexpensivethandebt.Thisdoesnotdependonthetaxefficiencyofdebt,sincewecanassumethatnotaxesexist.Wecanalsoassumethatasacompanygearsup,itreplacesequitywithdebt.Thismeansthatthecompany’scapitalbaseremainsconstantanditsweightedaveragecostofcapital(WACC)isnotaffectedbyincreasinginvestment.Thetraditionalviewofcapitalstructureassumesanon-linearrelationshipbetweenthecostofequityandfinancialrisk.Asacompanygearsup,thereisinitiallyverylittleincreaseinthecostofequityandtheWACCdecreasesbecausethecostofdebtislessthanthecostofequity.Apointisreached,however,wherethecostofequityrisesataratethatexceedsthereductioneffectofcheaperdebtandtheWACCstartstoincrease.Inthetraditionalview,therefore,aminimumWACCexistsand,asaresult,amaximumvalueofthecompanyarises.ModiglianiandMillerassumedaperfectcapitalmarketandalinearrelationshipbetweenthecostofequityandfinancialrisk.Theyarguedthat,asacompanygearedup,thecostofequityincreasedataratethatexactlycancelledoutthereductioneffectofcheaperdebt.WACCwasthereforeconstantatalllevelsofgearingandnooptimalcapitalstructure,wherethevalueofthecompanywasatamaximum,couldbefound.Itwasarguedthattheno-taxassumptionmadebyModiglianiandMillerwasunrealistic,sinceintherealworldinterestpaymentswereanallowableexpenseincalculatingtaxableprofitandsotheeffectivecostofdebtwasreducedbyitstaxefficiency.Theyrevisedtheirmodeltoincludethistaxeffectandshowedthat,asaresult,theWACCdecreasedinalinearfashionasacompanygearedup.Thevalueofthecompanyincreasedbythevalueofthe‘taxshield’andanoptimalcapitalstructurewouldresultbygearingupasmuchaspossible.Itwaspointedoutthatmarketimperfectionsassociatedwithhighlevelsofgearing,suchasbankruptcyriskandagencycosts,wouldlimittheextenttowhichacompanycouldgearup.Inpractice,therefore,itappearsthatcompaniescanreducetheirWACCbyincreasinggearing,whileavoidingthefinancialdistressthatcanariseathighlevelsofgearing.Ithasfurtherbeensuggestedthatcompanieschoosethesourceoffinancewhich,foronereasonoranother,iseasiestforthemtoaccess(peckingordertheory).Thisresultsinaninitialpreferenceforretainedearnings,followedbyapreferencefordebtbeforeturningtoequity.TheviewsuggeststhatcompaniesmaynotinpracticeseektominimisetheirWACC(andconsequentlymaximisecompanyvalueandshareholderwealth).TurningtothesuggestionthatdebtcouldbeusedtofinanceacashbidforNGN,thecurrentandpostacquisitioncapitalstructuresandtheirrelativegearinglevelsshouldbeconsidered,aswellastheamountofdebtfinancethatwouldbeneeded.Earliercalculationssuggestthatatleast$58mwouldbeneeded,ignoringanypremiumpaidtopersuadetargetcompanyshareholderstoselltheirshares.Thecurrentdebt/equityratioofKFPCois60%(15m/25m).Thedebtofthecompanywouldincreaseby$58minordertofinancethebidandbyafurther$20maftertheacquisition,duetotakingontheexistingdebtofNGN,givingatotalof$93m.Ignoringotherfactors,thegearingwouldincreaseto372%(93m/25m).KFPCowouldneedtoconsiderhowitcouldservicethisdangerouslyhighlevelofgearinganddealwiththesignificantriskofbankruptcythatitmightcreate.ItwouldalsoneedtoconsiderwhetherthebenefitsarisingfromtheacquisitionofNGNwouldcompensateforthesignificantincreaseinfinancialriskandbankruptcyriskresultingfromusingdebtfinance. -

第18题:

Your company network has 500 client computers that run Windows 7. Your team consists of 20 desktop support technicians. Two technicians troubleshoot a hardware-related performance issue on a computer. The technicians obtain different results by using their own User Defined Data Collector Sets. You need to create a standardized Data Collector Set on a network share that is accessible to your team. What should you create?()

A.Event Trace Data Collector Set

B.Performance Counter Data Collector Set

C.Performance Counter Alert Data Collector Set

D.System Configuration Information Data Collector Set

参考答案:B

-

第19题:

资料: The following passage is the introduction about one of the Monsell international financial products.According to the passage,there will be 5 questions.You should read carefully,then select the right answer.

Passage:

As a teenager between the age of 13 and 18,maybe you would like to manage your own money and have your own bank account.The good news is that Bank of Monsell has just launched several great solutions for you.

The first one is the Teen Discounted Bank Plans(TDBPS).TDBPS feature a discount of $9.95 per month on your monthly bank fee—that’s a savings of up to $120 per year.It’s the primary and most common account chosen by nearly 45% of our teen customers.If it is not to your liking,maybe the following alternatives which offer more discount and benefits on your bank accounts are able to meet your demands.

In a Plus Plan,you can have up to 30 transactions per month free of charge on as many as accounts as you need on the condition that your Primary Chequing Account must be your lead account,the one you designate to pay any fees required by your Bank Plan(i.e.monthly plan fees,transaction fees).It includes Primary Chequing and up to 19 more eligible accounts.You can make 30 transactions either in branch,by phone,online,by mobile or at an ATM of Bank of Monsell.From the 31st transaction,a fee of $0.7 per transaction will be charged.A Plus Plan is able to help save you up to $288.60 a year on fees.Besides,it enables you to send money globally to over 200 countries and territories via Interact e–Transfer through its Online Banking. A Plus Plan offers preferred exchange rate only when buying U.S. cash (up to $5,000 U.S. per transaction).

In a Performance Plan,the number of transactions is unlimited on as many as accounts as you need,meaning that you can make as many everyday banking transactions as you want free of chargein branch,on line or at an ATM of Bank of Monsell.It does not include phone banking services.However,a fee of $4.00 a month is charged for this service.It also includes Primary Chequing and up to 16 more eligible accounts.It helps you save up to $456.60 a year on fees.It also enables you to send money globally to over 200 countries and territories via Interac e–Transfer through its Online Banking.What’s more,one non-bank of Monsell ATM withdrawal on the Interac network per month is offered.A Performance Plan offers preferred exchange rate when buying or selling U.S.cash(up to $5,000 U.S.per transaction).

In a Premium Plan you can also make unlimited transactions on as many accounts as you need at a monthly fee of $15.05.It includes Primary Chequing and up to 15 more eligible accounts.The everyday banking transactions of this plan should be controlled fewer than 40,or you have to pay a fee of $0.8 for every transaction beyond 40.It helps save up to $791.95 per year on fees.What’s more,5 non-bank of Monsell ATM debit transactions on the Interac network and 5 international debit transactions using non-bank of Monsell ATMs per month is included.However,it does not have the ability to send money globally to any country or territory via Interac e–Transfer through its Online Banking.A Premium Plan offers preferred exchange rate only when selling U.S.cash(up to $5,000 U.S.per transaction).

You can apply for any of these accounts by phone,online or in person.Please feel free to call us at 1-870-226-5266 or write emails to Bank of Monsell Mike@yahoo.com or get on our website for any further details of these services and products.

Which of the following is TRUE about the Performance Plan?A.Not including Primary Chequing,you can own 17 accounts.

B.You can make unlimited everyday banking transactions in branch,online,at an ATM of Bank of Monsell,or phone banking services.

C.It offers preferred exchange rate when buying U.S.cash(up to $5,000 U.S.per transaction).

D.It is able to help save you up to $288.60 a year on fees.答案:C解析:本题考查的是细节理解。

【关键词】TRUE;Performance Plan

【主题句】第4自然段

1.It also includes Primary Chequing and up to 16 more eligible accounts.它还包括初始支票账户和另外多达16个符合条件的账户。

2.In a Performance Plan,the number of transactions is unlimited on as many as accounts as you need,meaning that you can make as many everyday banking transactions as you want free of chargein branch,on line or at an ATM of Bank of Monsell.It does not include phone banking services.在高效方案中,免手续费交易的数量和账户不受限制,意思是在每天通过分行柜台,网上银行,或者Bank of Monsell的ATM机的交易数量不受限制。但不包括手机银行服务。

3.A Performance Plan offers preferred exchange rate when buying or selling U.S.cash(up to $5,000 U.S.per transaction).高效方案提供以优先汇率购入或售出美元(每笔交易上限是5000美元)。

4.It helps you save up to $456.60 a year on fees.每年帮助节约费用456.6美元。

【解析】本题的问题是“根据高效方案,下列哪项正确?”A选项“不包括初始支票账户,你可以拥有17个账户。”,根据主题句1,包括初始支票账户,一共17个,错误。B选项“你每天可以通过分行柜台,网上银行,Bank of Monsell的ATM机和手机银行服务进行无限量交易。”,根据主题句2,手机银行服务不包括在内,错误。C选项“它提供以优先汇率购入美元(每笔交易上限是5000美元)。”根据主题句3,正确。D选项“它每年能帮助节约费用288.6美元。”。根据主题句4,节约456.6美元,错误。 -

第20题:

pany uses GLBP to provide for router redundancy in the network. Which describes the default load balancing scheme used by the Gateway Load Balancing Protocol (GLBP)?()

- A、 Per host basis using a strict priority scheme

- B、 Per session using a round-robin scheme

- C、 Per session using a strict priority scheme

- D、 Per GLBP group using a strict priority scheme

- E、 Per host basis using a round-robin scheme

- F、 Per GLBP group using a round-robin scheme

正确答案:E -

第21题:

Which of the following logs contains information on overall performance and events not related to user authentication?()

- A、Security

- B、Audit

- C、Application

- D、System

正确答案:D -

第22题:

Your company network has 500 client computers that run Windows 7. Your team consists of 20 desktop support technicians. Two technicians troubleshoot a hardware-related performance issue on a computer. The technicians obtain different results by using their own User Defined Data Collector Sets. You need to create a standardized Data Collector Set on a network share that is accessible to your team. What should you create?()

- A、Event Trace Data Collector Set

- B、Performance Counter Data Collector Set

- C、Performance Counter Alert Data Collector Set

- D、System Configuration Information Data Collector Set

正确答案:B -

第23题:

问答题Discuss, and decide together: ● What the likely reactions from staff might be to the introduction of the scheme? ● How feedback should be given to staff on their performance?正确答案:

【参考范例】

Candidate A=A Candidate B=B

A: ABC Company is about to introduce an appraisal scheme to assess the performance of staff. It will benefit both individual and company. Individual appraisals are not always very effective, and people tend to think that there are too many categories. They are not sure how the system works, so they are not happy with the legal aspects. What might be the likely reactions of the staff to the introduction of the scheme?

B: I think some employees would accept the appraisal scheme, in the hope that introduction of the scheme will be beneficial to both individual and company. Some would regard it as a chance to improve their salary. Some others may dislike it for they don’t like the way they are assessed. Many more have doubt about the meaning of the staff appraisal. Everybody works in teams these days and team members share responsibility for results. And team leaders could sense resentment between members. Teams much prefer to be awarded a group rating. We often receive complaints about the system of performance appraisals. What is your opinion of the feedback on appraisal? I think the feedback on performance appraisal is very likely not as positive as the leaders have expected.

A: I agree with you. The staff appraisal may be one of the biggest causes of dissatisfaction at work. In America, the unhappy workers even sue their employers over appraisal interviews. Problems will rise from the scheme itself and from the implementation and understanding of that scheme. Senior staff find it difficult to do appraisals. They have no choice but to listen to staff’s complaint about the company during the appraisal.

B: Therefore, I recommend that before reversing the appraisal’s negative associations, an organization needs to find out the underlying reasons contributing to them. The guidelines should be given to the employees by the management These guidelines suggest that a successful scheme have a clear appeal process, that all the negative feedback should be accompanied by evidence like dates, times and outcomes and that, most importantly, ratings should be able to reflect specific measurable elements of the job requirements.

A: I suggest we should make some changes to the current schemes. But how should feedback be given to staff on their performance?

B: That’s the question that needs discussion. Yes, you’re right. Some changes to current schemes are actually simply a matter of logic.

A: For example, if employees are constantly encouraged to work in teams and to shoulder joint responsibility for their successes and failures, it practically makes little sense for the appraisals to focus on individuals, as this may result in resentments and cause divisions within the group. Therefore, it is possible, and more suitable in some cases to arrange appraisals where performance is rated for the group.

B: And in addition, staff members should also be educated about the best way to approach appraisals. They feel uncomfortable about being asked to play a more supportive role than they are accustomed to without any training. I think it is sensible to give written feedback to most staff members. For some employees, we’d better give them oral feedback on their performance plus the written one.

A: Your idea is acceptable. However, those who are appraised may regard it as a chance to air their grievances and highlight the company’s failings instead of considering their own role. Therefore, the feedback to be given to staff should not be too negative. Rather, the appraisal needs to be positive.解析: 暂无解析