(b) Describe the audit work to be performed in respect of the carrying amount of the following items in thebalance sheet of GVF as at 30 September 2005:(i) goat herd; (4 marks)

题目

(b) Describe the audit work to be performed in respect of the carrying amount of the following items in the

balance sheet of GVF as at 30 September 2005:

(i) goat herd; (4 marks)

相似考题

参考答案和解析

(b) Audit work on carrying amounts

Tutorial note: This part concerns audit work to be undertaken in respect of non-current tangible assets (the production

animals in the goat herd and certain equipment) and inventories (the for-sale animals and cheese). One of the ‘tests’ for

assessing whether or not a point is worthy of a mark will be whether or not the asset to which it relates is apparent. Points

which are so vague that they could apply to ANY non-current asset for ANY entity, rather than those of GVF are unlikely to

attract many marks, if any, at this level.

(i) Goat herd

■ Physical inspection of the number and condition of animals in the herd and confirming, on a test basis, that they

are tagged (or otherwise ‘branded’ as being owned by GVF).

■ Tests of controls on management’s system of identifying and distinguishing held-for-sale animals (inventory) from

the production herd (depreciable non-current assets).

■ Comparison of GVF’s depreciation policies (including useful lives, depreciation methods and residual values) with

those used by other farming entities.

■ ‘Proof in total’, or other reasonableness check, of the depreciation charge for the herd for the year.

■ Observing test counts or total counts of animals held for sale.

■ Comparing carrying amounts of the kids, according to their weight and age, as at 30 September 2005 with their

market values. (These may approximate to actual invoiced selling prices obtained by GVF.)

Tutorial note: Market value of the production herd could also be compared with its carrying amount to assess possible

impairment. However, if value in use appears to be less than market value the herd should be sold rather than used

for production.

更多“(b) Describe the audit work to be performed in respect of the carrying amount of the following items in thebalance sheet of GVF as at 30 September 2005:(i) goat herd; (4 marks)”相关问题

-

第1题:

(b) Historically, all owned premises have been measured at cost depreciated over 10 to 50 years. The management

board has decided to revalue these premises for the year ended 30 September 2005. At the balance sheet date

two properties had been revalued by a total of $1·7 million. Another 15 properties have since been revalued by

$5·4 million and there remain a further three properties which are expected to be revalued during 2006. A

revaluation surplus of $7·1 million has been credited to equity. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Revaluation of owned premises

(i) Matters

■ The revaluations are clearly material as $1·7 million, $5·4 million and $7·1 million represent 5·5% , 17·6% and

23·1% of total assets, respectively.

■ The change in accounting policy, from a cost model to a revaluation model, should be accounted for in accordance

with IAS 16 ‘Property, Plant and Equipment’ (i.e. as a revaluation).

Tutorial note: IAS 8 ‘Accounting Policies, Changes in Accounting Estimates and Errors’ does not apply to the initial

application of a policy to revalue assets in accordance with IAS 16.

■ The basis on which the valuations have been carried out, for example, market-based fair value (IAS 16).

■ Independence, qualifications and expertise of valuer(s).

■ IAS 16 does not permit the selective revaluation of assets thus the whole class of premises should have been

revalued.

■ The valuations of properties after the year end are adjusting events (i.e. providing additional evidence of conditions

existing at the year end) per IAS 10 ‘Events After the Balance Sheet Date’.

Tutorial note: It is ‘now’ still less than three months after the year end so these valuations can reasonably be

expected to reflect year-end values.

■ If $5·4 million is a net amount of surpluses and deficits it should be grossed up so that the credit to equity reflects

the sum of the surpluses with any deficits being expensed through profit and loss (IAS 36 ‘Impairment of Assets’).

■ The revaluation exercise is incomplete. If the revaluations on the remaining three properties are expected to be

material and cannot be reasonably estimated for inclusion in the financial statements for the year ended

30 September 2005 perhaps the change in policy should be deferred for a year.

■ Depreciation for the year should have been calculated on cost as usual to establish carrying amount before

revaluation.

■ Any premises held under finance leases should be similarly revalued.

(ii) Audit evidence

■ A schedule of depreciated cost of owned premises extracted from the non-current asset register.

■ Calculation of difference between valuation and depreciated cost by property. Separate summation of surpluses

and deficits.

■ Copy of valuation certificate for each property.

■ Physical inspection of properties with largest surpluses (including the two valued before the year end) to confirm

condition.

■ Extracts from local property guides/magazines indicating a range of values of similarly styled/sized properties.

■ Separate presentation of the revaluation surpluses (gross) in:

– the statement of changes in equity; and

– reconciliation of carrying amount at the beginning and end of the period.

■ IAS 16 disclosures in the notes to the financial statements including:

– the effective date of revaluation;

– whether an independent valuer was involved;

– the methods and significant assumptions applied in estimating fair values; and

– the carrying amount that would have been recognised under the cost model. -

第2题:

4 (a) Explain the auditor’s responsibilities in respect of subsequent events. (5 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

正确答案:

4 JINACK CO

(a) Auditor’s responsibilities for subsequent events

■ Auditors must consider the effect of subsequent events on:

– the financial statements;

– the auditor’s report.

■ Subsequent events are all events occurring after a period end (i.e. reporting date) i.e.:

– events after the balance sheet date (as defined in IAS 10); and

– events after the financial statements have been authorised for issue.

Events occurring up to date of auditor’s report

■ The auditor is responsible for carrying out procedures designed to obtain sufficient appropriate audit evidence that all

events up to the date of the auditor’s report that may require adjustment of, or disclosure in, the financial statements

have been identified.

■ These procedures are in addition to those applied to specific transactions occurring after the period end that provide

audit evidence of period-end account balances (e.g. inventory cut-off and receipts from trade receivables). Such

procedures should ordinarily include:

– reviewing minutes of board/audit committee meetings;

– scrutinising latest interim financial statements/budgets/cash flows, etc;

– making/extending inquiries to legal advisors on litigation matters;

– inquiring of management whether any subsequent events have occurred that might affect the financial statements

(e.g. commitments entered into).

■ When the auditor becomes aware of events that materially affect the financial statements, the auditor must consider

whether they have been properly accounted for and adequately disclosed in the financial statements.

Facts discovered after the date of the auditor’s report but before financial statements are issued

Tutorial note: After the date of the auditor’s report it is management’s responsibility to inform. the auditor of facts which

may affect the financial statements.

■ If the auditor becomes aware of such facts which may materially affect the financial statements, the auditor:

– considers whether the financial statements need amendment;

– discusses the matter with management; and

– takes appropriate action (e.g. audit any amendments to the financial statements and issue a new auditor’s report).

■ If management does not amend the financial statements (where the auditor believes they need to be amended) and the

auditor’s report has not been released to the entity, the auditor should express a qualified opinion or an adverse opinion

(as appropriate).

■ If the auditor’s report has been released to the entity, the auditor must notify those charged with governance not to issue

the financial statements (and the auditor’s report thereon) to third parties.

Tutorial note: The auditor would seek legal advice if the financial statements and auditor’s report were subsequently issued.

Facts discovered after the financial statements have been issued

■ The auditor has no obligation to make any inquiry regarding financial statements that have been issued.

■ However, if the auditor becomes aware of a fact which existed at the date of the auditor’s report and which, if known

at that date, may have caused the auditor’s report to be modified, the auditor should:

– consider whether the financial statements need revision;

– discuss the matter with management; and

– take appropriate action (e.g. issuing a new report on revised financial statements). -

第3题:

(ii) Audit work on after-date bank transactions identified a transfer of cash from Batik Co. The audit senior has

documented that the finance director explained that Batik commenced trading on 7 October 2005, after

being set up as a wholly-owned foreign subsidiary of Jinack. No other evidence has been obtained.

(4 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

正确答案:

(ii) Wholly-owned foreign subsidiary

■ The cash transfer is a non-adjusting post balance sheet event. It indicates that Batik was trading after the balance

sheet date. However, that does not preclude Batik having commenced trading before the year end.

■ The finance director’s oral representation is wholly insufficient evidence with regard to the existence (or otherwise)

of Batik at 30 September 2005. If it existed at the balance sheet date its financial statements should have been

consolidated (unless immaterial).

■ The lack of evidence that might reasonably be expected to be available (e.g. legal papers, registration payments,

etc) suggests a limitation on the scope of the audit.

■ If such evidence has been sought but not obtained then the limitation is imposed by the entity (rather than by

circumstances).

■ Whilst the transaction itself may not be material, the information concerning the existence of Batik may be material

to users and should therefore be disclosed (as a non-adjusting event). The absence of such disclosure, if the

auditor considered necessary, would result in a qualified ‘except for’, opinion.

Tutorial note: Any matter that is considered sufficiently material to be worthy of disclosure as a non-adjusting

event must result in such a qualified opinion if the disclosure is not made.

■ If Batik existed at the balance sheet date and had material assets and liabilities then its non-consolidation would

have a pervasive effect. This would warrant an adverse opinion.

■ Also, the nature of the limitation (being imposed by the entity) could have a pervasive effect if the auditor is

suspicious that other audit evidence has been withheld. In this case the auditor should disclaim an opinion. -

第4题:

(d) Briefly describe the principal audit work to be performed in respect of the carrying amount of the following

items in the balance sheet:

(i) trade receivables; and (3 marks)

正确答案:

(d) Principal audit work

(i) Trade receivables

■ Review of agreements to determine the volume rebates terms. For example,

– the % discounts;

– the volumes to which they apply;

– the period over which they accumulate;

– settlement method (e.g. by credit note or other off-set or repayment).

■ Direct positive confirmation of a value-weighted sample of balances (i.e. larger amounts) to identify potential

overstatement (e.g. due to discounts earned not being awarded).

■ Monitoring of after-date cash receipts and matching against amounts due as shortfalls may indicate disputed

amounts.

■ Review of after-date credit notes to ensure adequate allowance (accrual) is made for discounts earned in the year

to 30 June 2006.

■ Credit risk analysis of individually significant balances and assessment of impairment losses (where carrying value

is less than the present value of the estimated cash flows discounted at the effective interest rate). -

第5题:

3 You are the manager responsible for the audit of Seymour Co. The company offers information, proprietary foods and

medical innovations designed to improve the quality of life. (Proprietary foods are marketed under and protected by

registered names.) The draft consolidated financial statements for the year ended 30 September 2006 show revenue

of $74·4 million (2005 – $69·2 million), profit before taxation of $13·2 million (2005 – $15·8 million) and total

assets of $53·3 million (2005 – $40·5 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In 2001, Seymour had been awarded a 20-year patent on a new drug, Tournose, that was also approved for

food use. The drug had been developed at a cost of $4 million which is being amortised over the life of the

patent. The patent cost $11,600. In September 2006 a competitor announced the successful completion of

preliminary trials on an alternative drug with the same beneficial properties as Tournose. The alternative drug is

expected to be readily available in two years time. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

■ A change in the estimated useful life should be accounted for as a change in accounting estimate in accordance

with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. For example, if the development

costs have little, if any, useful life after the introduction of the alternative drug (‘worst case’ scenario), the carrying

value ($3 million) should be written off over the current and remaining years, i.e. $1 million p.a. The increase in

amortisation/decrease in carrying value ($800,000) is material to PBT (6%) and total assets (1·5%).

■ Similarly a change in the expected pattern of consumption of the future economic benefits should be accounted for

as a change in accounting estimate (IAS 8). For example, it may be that the useful life is still to 2020 but that

the economic benefits may reduce significantly in two years time.

■ After adjusting the carrying amount to take account of the change in accounting estimate(s) management should

have tested it for impairment and any impairment loss recognised in profit or loss.

(ii) Audit evidence

■ $3 million carrying amount of development costs brought forward agreed to prior year working papers and financial

statements.

■ A copy of the press release announcing the competitor’s alternative drug.

■ Management’s projections of future cashflows from Tournose-related sales as evidence of the useful life of the

development costs and pattern of consumption.

■ Reperformance of management’s impairment test on the development costs: Recalculation of management’s

calculation of the carrying amount after revising estimates of useful life and/or consumption of benefits compared

with management’s calculation of value in use.

■ Sensitivity analysis on management’s key assumptions (e.g. estimates of useful life, discount rate).

■ Written management representation on the key assumptions concerning the future that have a significant risk of

causing material adjustment to the carrying amount of the development costs. (These assumptions should be

disclosed in accordance with IAS 1 Presentation of Financial Statements.) -

第6题:

(c) In November 2006 Seymour announced the recall and discontinuation of a range of petcare products. The

product recall was prompted by the high level of customer returns due to claims of poor quality. For the year to

30 September 2006, the product range represented $8·9 million of consolidated revenue (2005 – $9·6 million)

and $1·3 million loss before tax (2005 – $0·4 million profit before tax). The results of the ‘petcare’ operations

are disclosed separately on the face of the income statement. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

■ The discontinuation of the product line after the balance sheet date provides additional evidence that, as at the

balance sheet date, it was of poor quality. Therefore, as at the balance sheet date:

– an allowance (‘provision’) may be required for credit notes for returns of products after the year end that were

sold before the year end;

– goods returned to inventory should be written down to net realisable value (may be nil);

– any plant and equipment used exclusively in the production of the petcare range of products should be tested

for impairment;

– any material contingent liabilities arising from legal claims should be disclosed.

(ii) Audit evidence

■ A copy of Seymour’s announcement (external ‘press release’ and any internal memorandum).

■ Credit notes raised/refunds paid after the year end for faulty products returned.

■ Condition of products returned as inspected during physical attendance of inventory count.

■ Correspondence from customers claiming reimbursement/compensation for poor quality.

■ Direct confirmation from legal adviser (solicitor) regarding any claims for customers including estimates of possible

payouts. -

第7题:

(b) Explain the principal audit procedures to be performed during the final audit in respect of the estimated

warranty provision in the balance sheet of Island Co as at 30 November 2007. (5 marks)

正确答案:

(b) ISA 540 Audit of Accounting Estimates requires that auditors should obtain sufficient audit evidence as to whether an

accounting estimate, such as a warranty provision, is reasonable given the entity’s circumstances, and that disclosure is

appropriate. One, or a combination of the following approaches should be used:

Review and test the process used by management to develop the estimate

– Review contracts or orders for the terms of the warranty to gain an understanding of the obligation of Island Co

– Review correspondence with customers during the year to gain an understanding of claims already in progress at the

year end

– Perform. analytical procedures to compare the level of warranty provision year on year, and compare actual to budgeted

provisions. If possible disaggregate the data, for example, compare provision for specific types of machinery or customer

by customer

– Re-calculate the warranty provision

– Agree the percentage applied in the calculation to the stated accounting policy of Island Co

– Review board minutes for discussion of on-going warranty claims, and for approval of the amount provided

– Use management accounts to ascertain normal level of warranty rectification costs during the year

– Discuss with Kate Shannon the assumptions she used to determine the percentage used in her calculations

– Consider whether assumptions used are consistent with the auditors’ understanding of the business

– Compare prior year provision with actual expenditure on warranty claims in the accounting period

– Compare the current year provision with prior year and discuss any fluctuation with Kate Shannon.

Review subsequent events which confirm the estimate made

– Review any work carried out post year end on specific faults that have been provided for. Agree that all costs are included

in the year end provision.

– Agree cash expended on rectification work in the post balance sheet period to the cash book

– Agree cash expended on rectification work post year end to suppliers’ invoices, or to internal cost ledgers if work carried

out by employees of Island Co

– Read customer correspondence received post year end for any claims received since the year end. -

第8题:

(b) Describe the principal audit procedures to be carried out in respect of the following:

(i) The measurement of the share-based payment expense; (6 marks)

正确答案:

(b) (i) Principal audit procedures – measurement of share-based payment expense

– Obtain management calculation of the expense and agree the following from the calculation to the contractual

terms of the scheme:

– Number of employees and executives granted options

– Number of options granted per employee

– The official grant date of the share options

– Vesting period for the scheme

– Required performance conditions attached to the options.

– Recalculate the expense and check that the fair value has been correctly spread over the stated vesting period.

– Agree fair value of share options to specialist’s report and calculation, and evaluate whether the specialist report is

a reliable source of evidence.

– Agree that the fair value calculated is at the grant date.

Tutorial note: A specialist such as a chartered financial analyst would commonly be used to calculate the fair value

of non-traded share options at the grant date, using models such as the Black-Scholes Model.

– Obtain and review a forecast of staffing levels or employee turnover rates for the duration of the vesting period, and

scrutinise the assumptions used to predict level of staff turnover.

– Discuss previous levels of staff turnover with a representative of the human resources department and query why

0% staff turnover has been predicted for the next three years.

– Check the sensitivity of the calculations to a change in the assumptions used in the valuation, focusing on the

assumption of 0% staff turnover.

– Obtain written representation from management confirming that the assumptions used in measuring the expense

are reasonable.

Tutorial note: A high degree of scepticism must be used by the auditor when conducting the final three procedures

due to the management assumption of 0% staff turnover during the vesting period. -

第9题:

(c) Identify and discuss the implications for the audit report if:

(i) the directors refuse to disclose the note; (4 marks)

正确答案:

(c) (i) Audit report implications

Audit procedures have shown that there is a significant level of doubt over Dexter Co’s going concern status. IAS 1

requires that disclosure is made in the financial statements regarding material uncertainties which may cast significant

doubt on the ability of the entity to continue as a going concern. If the directors refuse to disclose the note to the financial

statements, there is a clear breach of financial reporting standards.

In this case the significant uncertainty is caused by not knowing the extent of the future availability of finance needed

to fund operating activities. If the note describing this uncertainty is not provided, the financial statements are not fairly

presented.

The audit report should contain a qualified or an adverse opinion due to the disagreement. The auditors need to make

a decision as to the significance of the non-disclosure. If it is decided that without the note the financial statements are

not fairly presented, and could be considered misleading, an adverse opinion should be expressed. Alternatively, it could

be decided that the lack of the note is material, but not pervasive to the financial statements; then a qualified ‘except

for’ opinion should be expressed.

ISA 570 Going Concern and ISA 701 Modifications to the Independent Auditor’s Report provide guidance on the

presentation of the audit report in the case of a modification. The audit report should include a paragraph which contains

specific reference to the fact that there is a material uncertainty that may cast significant doubt about the entity’s ability

to continue as a going concern. The paragraph should include a clear description of the uncertainties and would

normally be presented immediately before the opinion paragraph. -

第10题:

5 You are the manager responsible for the audit of Blod Co, a listed company, for the year ended 31 March 2008. Your

firm was appointed as auditors of Blod Co in September 2007. The audit work has been completed, and you are

reviewing the working papers in order to draft a report to those charged with governance. The statement of financial

position (balance sheet) shows total assets of $78 million (2007 – $66 million). The main business activity of Blod

Co is the manufacture of farm machinery.

During the audit of property, plant and equipment it was discovered that controls over capital expenditure transactions

had deteriorated during the year. Authorisation had not been gained for the purchase of office equipment with a cost

of $225,000. No material errors in the financial statements were revealed by audit procedures performed on property,

plant and equipment.

An internally generated brand name has been included in the statement of financial position (balance sheet) at a fair

value of $10 million. Audit working papers show that the matter was discussed with the financial controller, who

stated that the $10 million represents the present value of future cash flows estimated to be generated by the brand

name. The member of the audit team who completed the work programme on intangible assets has noted that this

treatment appears to be in breach of IAS 38 Intangible Assets, and that the management refuses to derecognise the

asset.

Problems were experienced in the audit of inventories. Due to an oversight by the internal auditors of Blod Co, the

external audit team did not receive a copy of inventory counting procedures prior to attending the count. This caused

a delay at the beginning of the inventory count, when the audit team had to quickly familiarise themselves with the

procedures. In addition, on the final audit, when the audit senior requested documentation to support the final

inventory valuation, it took two weeks for the information to be received because the accountant who had prepared

the schedules had mislaid them.

Required:

(a) (i) Identify the main purpose of including ‘findings from the audit’ (management letter points) in a report

to those charged with governance. (2 marks)

正确答案:

5 Blod Co

(a) (i) A report to those charged with governance is produced to communicate matters relating to the external audit to those

who are ultimately responsible for the financial statements. ISA 260 Communication of Audit Matters With Those

Charged With Governance requires the auditor to communicate many matters, including independence and other ethical

issues, the audit approach and scope, the details of management representations, and the findings of the audit. The

findings of the audit are commonly referred to as management letter points. By communicating these matters, the auditor

is confident that there is written documentation outlining all significant matters raised during the audit process, and that

such matters have been formally notified to the highest level of management of the client. For the management, the

report should ensure that they fully understand the scope and results of the audit service which has been provided, and

is likely to provide constructive comments to help them to fulfil their duties in relation to the financial statements and

accounting systems and controls more effectively. The report should also include, where relevant, any actions that

management has indicated they will take in relation to recommendations made by the auditors. -

第11题:

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

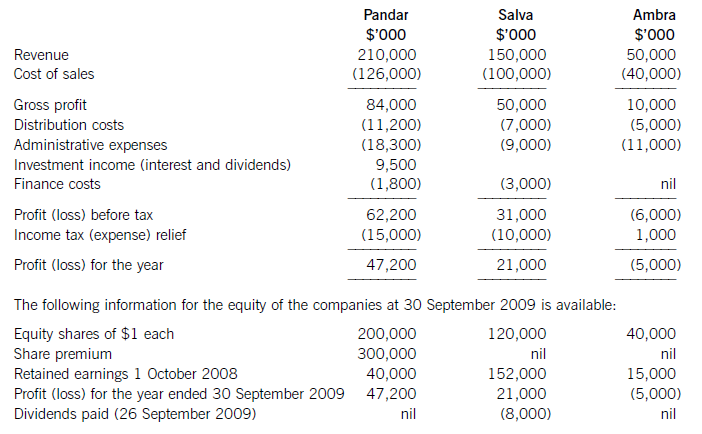

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

正确答案:

-

第12题:

(a) An assistant of yours has been criticised over a piece of assessed work that he produced for his study course for giving the definition of a non-current asset as ‘a physical asset of substantial cost, owned by the company, which will last longer than one year’.

Required:

Provide an explanation to your assistant of the weaknesses in his definition of non-current assets when

compared to the International Accounting Standards Board’s (IASB) view of assets. (4 marks)

(b) The same assistant has encountered the following matters during the preparation of the draft financial statements of Darby for the year ending 30 September 2009. He has given an explanation of his treatment of them.

(i) Darby spent $200,000 sending its staff on training courses during the year. This has already led to an

improvement in the company’s efficiency and resulted in cost savings. The organiser of the course has stated that the benefits from the training should last for a minimum of four years. The assistant has therefore treated the cost of the training as an intangible asset and charged six months’ amortisation based on the average date during the year on which the training courses were completed. (3 marks)

(ii) During the year the company started research work with a view to the eventual development of a new

processor chip. By 30 September 2009 it had spent $1·6 million on this project. Darby has a past history

of being particularly successful in bringing similar projects to a profitable conclusion. As a consequence the

assistant has treated the expenditure to date on this project as an asset in the statement of financial position.

Darby was also commissioned by a customer to research and, if feasible, produce a computer system to

install in motor vehicles that can automatically stop the vehicle if it is about to be involved in a collision. At

30 September 2009, Darby had spent $2·4 million on this project, but at this date it was uncertain as to

whether the project would be successful. As a consequence the assistant has treated the $2·4 million as an

expense in the income statement. (4 marks)

(iii) Darby signed a contract (for an initial three years) in August 2009 with a company called Media Today to

install a satellite dish and cabling system to a newly built group of residential apartments. Media Today will

provide telephone and television services to the residents of the apartments via the satellite system and pay

Darby $50,000 per annum commencing in December 2009. Work on the installation commenced on

1 September 2009 and the expenditure to 30 September 2009 was $58,000. The installation is expected

to be completed by 31 October 2009. Previous experience with similar contracts indicates that Darby will

make a total profit of $40,000 over the three years on this initial contract. The assistant correctly recorded

the costs to 30 September 2009 of $58,000 as a non-current asset, but then wrote this amount down to

$40,000 (the expected total profit) because he believed the asset to be impaired.

The contract is not a finance lease. Ignore discounting. (4 marks)

Required:

For each of the above items (i) to (iii) comment on the assistant’s treatment of them in the financial

statements for the year ended 30 September 2009 and advise him how they should be treated under

International Financial Reporting Standards.

Note: the mark allocation is shown against each of the three items above.

正确答案:

(a)Therearefourelementstotheassistant’sdefinitionofanon-currentassetandheissubstantiallyincorrectinrespectofallofthem.Thetermnon-currentassetswillnormallyincludeintangibleassetsandcertaininvestments;theuseoftheterm‘physicalasset’wouldbespecifictotangibleassetsonly.Whilstitisusuallythecasethatnon-currentassetsareofrelativelyhighvaluethisisnotadefiningaspect.Awastepaperbinmayexhibitthecharacteristicsofanon-currentasset,butonthegroundsofmaterialityitisunlikelytobetreatedassuch.Furthermorethepastcostofanassetmaybeirrelevant;nomatterhowmuchanassethascost,itistheexpectationoffutureeconomicbenefitsflowingfromaresource(normallyintheform.offuturecashinflows)thatdefinesanassetaccordingtotheIASB’sFrameworkforthepreparationandpresentationoffinancialstatements.Theconceptofownershipisnolongeracriticalaspectofthedefinitionofanasset.Itisprobablythecasethatmostnoncurrentassetsinanentity’sstatementoffinancialpositionareownedbytheentity;however,itistheabilityto‘control’assets(includingpreventingothersfromhavingaccesstothem)thatisnowadefiningfeature.Forexample:thisisanimportantcharacteristicintreatingafinanceleaseasanassetofthelesseeratherthanthelessor.Itisalsotruethatmostnon-currentassetswillbeusedbyanentityformorethanoneyearandapartofthedefinitionofproperty,plantandequipmentinIAS16Property,plantandequipmentreferstoanexpectationofuseinmorethanoneperiod,butthisisnotnecessarilyalwaysthecase.Itmaybethatanon-currentassetisacquiredwhichprovesunsuitablefortheentity’sintendeduseorisdamagedinanaccident.Inthesecircumstancesassetsmaynothavebeenusedforlongerthanayear,butneverthelesstheywerereportedasnon-currentsduringthetimetheywereinuse.Anon-currentassetmaybewithinayearoftheendofitsusefullifebut(unlessasaleagreementhasbeenreachedunderIFRS5Non-currentassetsheldforsaleanddiscontinuedoperations)wouldstillbereportedasanon-currentassetifitwasstillgivingeconomicbenefits.Anotherdefiningaspectofnon-currentassetsistheirintendedusei.e.heldforcontinuinguseintheproduction,supplyofgoodsorservices,forrentaltoothersorforadministrativepurposes.(b)(i)TheexpenditureonthetrainingcoursesmayexhibitthecharacteristicsofanassetinthattheyhaveandwillcontinuetobringfutureeconomicbenefitsbywayofincreasedefficiencyandcostsavingstoDarby.However,theexpenditurecannotberecognisedasanassetonthestatementoffinancialpositionandmustbechargedasanexpenseasthecostisincurred.Themainreasonforthislieswiththeissueof’control’;itisDarby’semployeesthathavethe‘skills’providedbythecourses,buttheemployeescanleavethecompanyandtaketheirskillswiththemor,throughaccidentorinjury,maybedeprivedofthoseskills.AlsothecapitalisationofstafftrainingcostsisspecificallyprohibitedunderInternationalFinancialReportingStandards(specificallyIAS38Intangibleassets).(ii)Thequestionspecificallystatesthatthecostsincurredtodateonthedevelopmentofthenewprocessorchipareresearchcosts.IAS38statesthatresearchcostsmustbeexpensed.Thisismainlybecauseresearchistherelativelyearlystageofanewprojectandanyfuturebenefitsaresofarinthefuturethattheycannotbeconsideredtomeetthedefinitionofanasset(probablefutureeconomicbenefits),despitethegoodrecordofsuccessinthepastwithsimilarprojects.Althoughtheworkontheautomaticvehiclebrakingsystemisstillattheresearchstage,thisisdifferentinnaturefromthepreviousexampleastheworkhasbeencommissionedbyacustomer,Assuch,fromtheperspectiveofDarby,itisworkinprogress(acurrentasset)andshouldnotbewrittenoffasanexpense.Anoteofcautionshouldbeaddedhereinthatthequestionsaysthatthesuccessoftheprojectisuncertainwhichpresumablymeansitmaynotbecompleted.ThisdoesnotmeanthatDarbywillnotreceivepaymentfortheworkithascarriedout,butitshouldbecheckedtothecontracttoensurethattheamountithasspenttodate($2·4million)willberecoverable.Intheeventthatsay,forexample,thecontractstatedthatonly$2millionwouldbeallowedforresearchcosts,thiswouldplacealimitonhowmuchDarbycouldtreatasworkinprogress.Ifthiswerethecasethen,forthisexample,Darbywouldhavetoexpense$400,000andtreatonly$2millionasworkinprogress.(iii)Thequestionsuggeststhecorrecttreatmentforthiskindofcontractistotreatthecostsoftheinstallationasanon-currentassetand(presumably)depreciateitoveritsexpectedlifeof(atleast)threeyearsfromwhenitbecomesavailableforuse.Inthiscasetheassetwillnotcomeintouseuntilthenextfinancialyear/reportingperiodandnodepreciationneedstobeprovidedat30September2009.Thecapitalisedcoststodateof$58,000shouldonlybewrittendownifthereisevidencethattheassethasbecomeimpaired.Impairmentoccurswheretherecoverableamountofanassetislessthanitscarryingamount.Theassistantappearstobelievethattherecoverableamountisthefutureprofit,whereas(inthiscase)itisthefuture(net)cashinflows.Thusanyimpairmenttestat30September2009shouldcomparethecarryingamountof$58,000withtheexpectednetcashflowfromthesystemof$98,000($50,000perannumforthreeyearslessfuturecashoutflowstocompletiontheinstallationof$52,000(seenotebelow)).Asthefuturenetcashflowsareinexcessofthecarryingamount,theassetisnotimpairedanditshouldnotbewrittendownbutshownasanon-currentasset(underconstruction)atcostof$58,000.Note:asthecontractisexpectedtomakeaprofitof$40,000onincomeof$150,000,thetotalcostsmustbe$110,000,withcoststodateat$58,000thisleavescompletioncostsof$52,000. -

第13题:

(c) During the year Albreda paid $0·1 million (2004 – $0·3 million) in fines and penalties relating to breaches of

health and safety regulations. These amounts have not been separately disclosed but included in cost of sales.

(5 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(c) Fines and penalties

(i) Matters

■ $0·1 million represents 5·6% of profit before tax and is therefore material. However, profit has fallen, and

compared with prior year profit it is less than 5%. So ‘borderline’ material in quantitative terms.

■ Prior year amount was three times as much and represented 13·6% of profit before tax.

■ Even though the payments may be regarded as material ‘by nature’ separate disclosure may not be necessary if,

for example, there are no external shareholders.

■ Treatment (inclusion in cost of sales) should be consistent with prior year (‘The Framework’/IAS 1 ‘Presentation of

Financial Statements’).

■ The reason for the fall in expense. For example, whether due to an improvement in meeting health and safety

regulations and/or incomplete recording of liabilities (understatement).

■ The reason(s) for the breaches. For example, Albreda may have had difficulty implementing new guidelines in

response to stricter regulations.

■ Whether expenditure has been adjusted for in the income tax computation (as disallowed for tax purposes).

■ Management’s attitude to health and safety issues (e.g. if it regards breaches as an acceptable operational practice

or cheaper than compliance).

■ Any references to health and safety issues in other information in documents containing audited financial

statements that might conflict with Albreda incurring these costs.

■ Any cost savings resulting from breaches of health and safety regulations would result in Albreda possessing

proceeds of its own crime which may be a money laundering offence.

(ii) Audit evidence

■ A schedule of amounts paid totalling $0·1 million with larger amounts being agreed to the cash book/bank

statements.

■ Review/comparison of current year schedule against prior year for any apparent omissions.

■ Review of after-date cash book payments and correspondence with relevant health and safety regulators (e.g. local

authorities) for liabilities incurred before 30 September 2005.

■ Notes in the prior year financial statements confirming consistency, or otherwise, of the lack of separate disclosure.

■ A ‘signed off’ review of ‘other information’ (i.e. directors’ report, chairman’s statement, etc).

■ Written management representation that there are no fines/penalties other than those which have been reflected in

the financial statements. -

第14题:

(b) You are the audit manager of Jinack Co, a private limited liability company. You are currently reviewing two

matters that have been left for your attention on the audit working paper file for the year ended 30 September

2005:

(i) Jinack holds an extensive range of inventory and keeps perpetual inventory records. There was no full

physical inventory count at 30 September 2005 as a system of continuous stock checking is operated by

warehouse personnel under the supervision of an internal audit department.

A major systems failure in October 2005 caused the perpetual inventory records to be corrupted before the

year-end inventory position was determined. As data recovery procedures were found to be inadequate,

Jinack is reconstructing the year-end quantities through a physical count and ‘rollback’. The reconstruction

exercise is expected to be completed in January 2006. (6 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

正确答案:

(b) Implications for the auditor’s report

(i) Corruption of perpetual inventory records

■ The loss of data (of physical inventory quantities at the balance sheet date) gives rise to a limitation on scope.

Tutorial note: It is the records of the asset that have been destroyed – not the physical asset.

■ The systems failure in October 2005 is clearly a non-adjusting post balance sheet event (IAS 10). If it is material

(such that non-disclosure could influence the economic decisions of users) Jinack should disclose:

– the nature of the event (i.e. systems failure); and

– an estimate of its financial effect (i.e. the cost of disruption and reconstruction of data to the extent that it is

not covered by insurance).

Tutorial note: The event has no financial effect on the realisability of inventory, only on its measurement for the

purpose of reporting it in the financial statements.

■ If material this disclosure could be made in the context of explaining how inventory has been estimated at

30 September 2005 (see later). If such disclosure, that the auditor considers to be necessary, is not made, the

audit opinion should be qualified ‘except for’ disagreement (over lack of disclosure).

Tutorial note: Such qualifications are extremely rare since management should be persuaded to make necessary

disclosure in the notes to the financial statements rather than have users’ attention drawn to the matter through

a qualification of the audit opinion.

■ The limitation on scope of the auditor’s work has been imposed by circumstances. Jinack’s accounting records

(for inventory) are inadequate (non-existent) for the auditor to perform. tests on them.

■ An alternative procedure to obtain sufficient appropriate audit evidence of inventory quantities at a year end is

subsequent count and ‘rollback’. However, the extent of ‘roll back’ testing is limited as records are still under

reconstruction.

■ The auditor may be able to obtain sufficient evidence that there is no material misstatement through a combination

of procedures:

– testing management’s controls over counting inventory after the balance sheet date and recording inventory

movements (e.g. sales and goods received);

– reperforming the reconstruction for significant items on a sample basis;

– analytical procedures such as a review of profit margins by inventory category.

■ ‘An extensive range of inventory’ is clearly material. The matter (i.e. systems failure) is not however pervasive, as

only inventory is affected.

■ Unless the reconstruction is substantially completed (i.e. inventory items not accounted for are insignificant) the

auditor cannot determine what adjustment, if any, might be determined to be necessary. The auditor’s report

should then be modified, ‘except for’, limitation on scope.

■ However, if sufficient evidence is obtained the auditor’s report should be unmodified.

■ An ‘emphasis of matter’ paragraph would not be appropriate because this matter is not one of significant

uncertainty.

Tutorial note: An uncertainty in this context is a matter whose outcome depends on future actions or events not

under the direct control of Jinack.

2006

■ If the 2005 auditor’s report is qualified ‘except for’ on grounds of limitation on scope there are two possibilities for

the inventory figure as at 30 September 2005 determined on completion of the reconstruction exercise:

(1) it is not materially different from the inventory figure reported; or

(2) it is materially different.

■ In (1), with the limitation now removed, the need for qualification is removed and the 2006 auditor’s report would

be unmodified (in respect of this matter).

■ In (2) the opening position should be restated and the comparatives adjusted in accordance with IAS 8 ‘Accounting

Policies, Changes in Accounting Estimates and Errors’. The 2006 auditor’s report would again be unmodified.

Tutorial note: If the error was not corrected in accordance with IAS 8 it would be a different matter and the

auditor’s report would be modified (‘except for’ qualification) disagreement on accounting treatment. -

第15题:

1 Geno Vesa Farm (GVF), a limited liability company, is a cheese manufacturer. Its principal activity is the production

of a traditional ‘Farmhouse’ cheese that is retailed around the world to exclusive shops, through mail order and web

sales. Other activities include the sale of locally produced foods through a farm shop and cheese-making

demonstrations and tours.

The farm’s herd of 700 goats is used primarily for the production of milk. Kids (i.e. goat offspring), which are a

secondary product, are selected for herd replacement or otherwise sold. Animals held for sale are not usually retained

beyond the time they reach optimal size or weight because their value usually does not increase thereafter.

There are two main variations of the traditional farmhouse cheese; ‘Rabida Red’ and ‘Bachas Blue’. The red cheese

is coloured using Innittu, which is extracted from berries found only in South American rain forests. The cost of Innittu

has risen sharply over the last year as the collection of berries by local village workers has come under the scrutiny

of an international action group. The group is lobbying the South American government to ban the export of Innittu,

claiming that the workers are being exploited and that sustaining the forest is seriously under threat.

Demand for Bachas Blue, which is made from unpasteurised milk, fell considerably in 2003 following the publication

of a research report that suggested a link between unpasteurised milk products and a skin disorder. The financial

statements for the year ended 30 September 2004 recognised a material impairment loss attributable to the

equipment used exclusively for the manufacture of Bachas Blue. However, as the adverse publicity is gradually being

forgotten, sales of Bachas Blue are now showing a steady increase and are currently expected to return to their former

level by the end of September 2005.

Cheese is matured to three strengths – mild, medium and strong – depending on the period of time it is left to ripen,

which is six, 12 and 18 months respectively. When produced, the cheese is sold to a financial institution, Abingdon

Bank, at cost. Under the terms of sale, GVF has the option to buy the cheese on its maturity at cost plus 7% for

every six months which has elapsed.

All cheese is stored to maturity on wooden boards in GVF’s cool and airy sheds. However, recently enacted health

and safety legislation requires that the wooden boards be replaced with stainless steel shelves with effect from 1 July

2005. The management of GVF has petitioned the government health department that to comply with the legislation

would interfere with the maturing process and the production of medium and strong cheeses would have to cease.

In 2003, GVF applied for and received a substantial regional development grant for the promotion of tourism in the

area. GVF’s management has deferred its plan to convert a disused barn into holiday accommodation from 2004

until at least 2006.

Required:

(a) Identify and explain the principal audit risks to be considered when planning the final audit of GVF for the

year ending 30 September 2005. (14 marks)

正确答案:

(a) Principal audit risks

Industry

‘Farming’ is an inherently risky business activity – being subject to conditions (e.g. disease, weather) outside management’s

control. In some jurisdictions, where the industry is highly regulated, compliance risk may be high.

The risks of mail order retailing ‘exclusive’ products are higher (than for ‘essential’ products, say) as demand fluctuations are

more dramatic (e.g. in times of recession). However, the Internet has provided GVF with a global customer base.

The planned audit approach should be risk-based combined with a systems approach to (say) controls in the revenue cycle.

Goat herd

The goat herd will consist of:

■ mature goats held for use in the production of milk and kids which are held for replacement purposes (i.e. of the nature

of non-current tangible assets); and

■ kids which are to be sold (i.e. of the nature of inventory).

Tutorial note: IAS 41 is not an examinable document at 2.5 and candidates are not expected to be familiar with its

requirements. However, those candidates showing an awareness that biological assets are excluded from the scope of

IAS 16 because they are covered by IAS 41 and answered accordingly were not penalised but awarded equivalent marks.

Therefore, the number of animals in each category must be accurately ascertained to determine:

■ the balance sheet carrying amounts analysed between current and non-current assets; and

■ the charge to the income statement (e.g. for depreciation (IAS 16) and fair value adjustments (IAS 41)).

There is a risk that the carrying amount of the production animals will be misstated if, for example:

■ useful lives/depreciation rates are unreasonable;

■ estimates of residual values are not kept under review;

■ they are impaired.

Tutorial note: Under IAS 41 animals raised during the year should be recognised initially and at each balance sheet date

at fair value less estimated point-of-sale costs. There is therefore a risk of misstatement if fair value cannot be measured

reliabiy (e.g. if market-determined prices are not available). However, this seems unlikely.

Kids will be understated in the balance sheet if they are not recorded on birth (i.e. their existence needs to be recorded in

order that a value be assigned to them).

The net realisable value of animals held for sale may fall below cost if they are not sold soon after reaching optimal size and

weight.

The cost of goats is likely to be subjective. For example, the cost of producing a mature goat from a kid might include direct

costs (e.g. vetinary bills and cost of feed) and attributable overheads (e.g. sheltering). Care must be taken not to carry the

goat herd at more than the higher of value in use and fair value less costs to sell (IAS 36 Revised).

Unrecorded revenue

Raised (bred) animals are not purchased and, in the absence of documentation supporting their origination, could be sold for

cash (and the revenue unrecorded).

Although the controls over retailing around the world are likely to be strong, there are other sources of income – the shop and

other activities at the farm. Although revenue from these sundry sources may not be material, there is a risk that it could go

unrecorded due to lack of effective controls.

‘Rabida Red’

The cost of an ingredient which is essential to the manufacturing process has increased significantly. If the cost is passed on

to the customers, demand may fall (increasing going concern risk).

Supplies of the ingredient, Innittu, may be restricted – further increasing going concern risk.

Any disclosure of GVF’s socio-environmental policies (e.g. in other information presented with the audited financial

statements), if any, should be scrutinised to ensure that it does not mislead the reader and/or undermine the credibility of the

financial statements.

‘Bachas Blue’

If ‘Bachas Blue’ has been specifically cited as a cause of a skin disorder then GVF could face contingent liabilities for pending

litigation. However, it is more likely that the fall in demand has threatened GVF’s going concern. As the fall in demand has

not been permanent, this threat has been removed for the time being.

The impairment loss previously recognised in respect of the equipment used exclusively in the manufacture of Bachas Blue

should be reversed if there has been a change in the estimates used to determine their recoverable amount (IAS 36

‘Impairment of Assets’).

The recoverable amount would have been based on value in use (since net selling price would not have been applicable).

GVF’s management will have to provide evidence to support their best estimates of future cash flows for the recalculation of

value in use at 30 September 2005.

Maturing cheese

The substance of the sale and repurchase of cheese is that of a loan secured on the inventory. Therefore revenue should not

be recognised on ‘sale’ to Abingdon Bank. The principal terms of the secured borrowings should be disclosed, including the

carrying amount of the inventory to which it applies.

Borrowing costs should all be recognised as an expense in the period unless it is GVF’s policy to capitalise them (the allowed

alternative treatment under IAS 23 ‘Borrowing Costs’). Since the cost of inventories should include all costs incurred in

bringing them to their present location and condition (of maturity), the cost of maturing cheese should include interest at 7%

per six months (as clearly the borrowings are specific). There is a risk that, if the age of maturing cheeses is not accurately

determined, the cost of cheese will be misstated.

Health and safety legislation

At 30 September 2005 the legislation will have been in effect for three months. If GVF’s management has not replaced the

shelves, a provision should be made for the penalties/fines accruing from non-compliance.

If the legislation is complied with:

■ plant and equipment may be overstated e.g:

– if the replaced shelves are not written off;

– if the value of equipment, etc is impaired because the maturing cheese business is to be downsized;

■ inventory may be overstated (e.g. if insufficient allowance is made for the deterioration in maturing cheese resulting from

handling it to replace the shelves);

■ GVF may no longer be a going concern if it does not have the produce to sell to its exclusive customers.

Grant

There is a risk that the grant received has become repayable. For example, if the terms of the grant specified a timeframe. for

the development which is now to be exceeded. In this case the grant should be presented as a payable in the balance sheet.

If the reason for deferring the implementation is related to cash flow problems, this could have implications for the going

concern of GVF. -

第16题:

(c) Briefly describe the principal audit work to be performed in respect of the carrying amount of the following

items in the balance sheet:

(i) development expenditure on the Fox model; (3 marks)

正确答案:

(c) Principal audit work

(i) Development expenditure on the Fox model

■ Agree opening balance, $6·3 million, to prior year working papers.

■ Physically inspect assembly plant/factory where the Fox is being developed and any vehicles so far manufactured

(e.g. for testing).

■ Substantiate costs incurred during the year, for example:

– goods (e.g. components) and services (e.g. consultants) to purchase invoices;

– labour (e.g. design engineers/technicians, mechanics, test drivers) to the payroll analysis;

– overheads (e.g. depreciation of development buildings and equipment, power, consumables) to

management’s calculation of overhead absorption and underlying cost accounts.

■ Review of internal trials/test drive results (e.g. in reports to management and video recordings of events).

■ Reperform. management’s impairment test of development expenditure. In particular recalculate value in use.

Tutorial note: It is highly unlikely that a reasonable estimate of fair value less costs to sell could be made for so

unique an asset.

■ Substantiate the key assumptions made by management in calculating value in use. For example:

– the level of sales expected when the car is launched to advance orders (this may have fallen with the delay

in the launch);

– the discount rate used to Pavia’s cost of capital;

– projected growth in sales to actual sales growth seen last time a new model was launched. -

第17题:

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Goodwill

(i) Matters

■ Cost of goodwill, $1·8 million, represents 3·4% consolidated total assets and is therefore material.

Tutorial note: Any assessments of materiality of goodwill against amounts in Aragon’s financial statements are

meaningless since goodwill only exists in the consolidated financial statements of Seymour.

■ It is correct that the goodwill is not being amortised (IFRS 3 Business Combinations). However, it should be tested

at least annually for impairment, by management.

■ Aragon has incurred losses amounting to $1·1 million since it was acquired (two years ago). The write-off of this

amount against goodwill in the consolidated financial statements would be material (being 61% cost of goodwill,

8·3% PBT and 2·1% total assets).

■ The cost of the investment ($4·5 million) in Seymour’s separate financial statements will also be material and

should be tested for impairment.

■ The fair value of net assets acquired was only $2·7 million ($4·5 million less $1·8 million). Therefore the fair

value less costs to sell of Aragon on other than a going concern basis will be less than the carrying amount of the

investment (i.e. the investment is impaired by at least the amount of goodwill recognised on acquisition).

■ In assessing recoverable amount, value in use (rather than fair value less costs to sell) is only relevant if the going

concern assumption is appropriate for Aragon.

■ Supporting Aragon financially may result in Seymour being exposed to actual and/or contingent liabilities that

should be provided for/disclosed in Seymour’s financial statements in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets.

(ii) Audit evidence

■ Carrying values of cost of investment and goodwill arising on acquisition to prior year audit working papers and

financial statements.

■ A copy of Aragon’s draft financial statements for the year ended 30 September 2006 showing loss for year.

■ Management’s impairment test of Seymour’s investment in Aragon and of the goodwill arising on consolidation at

30 September 2006. That is a comparison of the present value of the future cash flows expected to be generated

by Aragon (a cash-generating unit) compared with the cost of the investment (in Seymour’s separate financial

statements).

■ Results of any impairment tests on Aragon’s assets extracted from Aragon’s working paper files.

■ Analytical procedures on future cash flows to confirm their reasonableness (e.g. by comparison with cash flows for

the last two years).

■ Bank report for audit purposes for any guarantees supporting Aragon’s loan facilities.

■ A copy of Seymour’s ‘comfort letter’ confirming continuing financial support of Aragon for the foreseeable future. -

第18题:

(ii) Briefly explain the implications of Parr & Co’s audit opinion for your audit opinion on the consolidated

financial statements of Cleeves Co for the year ended 30 September 2006. (3 marks)

正确答案:

(ii) Implications for audit opinion on consolidated financial statements of Cleeves

■ If the potential adjustments to non-current asset carrying amounts and loss are not material to the consolidated

financial statements there will be no implication. However, as Howard is material to Cleeves and the modification

appears to be ‘so material’ (giving rise to adverse opinion) this seems unlikely.

Tutorial note: The question clearly states that Howard is material to Cleeves, thus there is no call for speculation

on this.

■ As Howard is wholly-owned the management of Cleeves must be able to request that Howard’s financial statements

are adjusted to reflect the impairment of the assets. The auditor’s report on Cleeves will then be unmodified

(assuming that any impairment of the investment in Howard is properly accounted for in the separate financial

statements of Cleeves).

■ If the impairment losses are not recognised in Howard’s financial statements they can nevertheless be adjusted on

consolidation of Cleeves and its subsidiaries (by writing down assets to recoverable amounts). The audit opinion

on Cleeves should then be unmodified in this respect.

■ If there is no adjustment of Howard’s asset values (either in Howard’s financial statements or on consolidation) it

is most likely that the audit opinion on Cleeves’s consolidated financial statements would be ‘except for’. (It should

not be adverse as it is doubtful whether even the opinion on Howard’s financial statements should be adverse.)

Tutorial note: There is currently no requirement in ISA 600 to disclose that components have been audited by another

auditor unless the principal auditor is permitted to base their opinion solely upon the report of another auditor. -

第19题:

(b) Describe the potential benefits for Hugh Co in choosing to have a financial statement audit. (4 marks)

正确答案:

(b) There are several benefits for Hugh Co in choosing a voluntary financial statement audit.

An annual audit will ensure that any material mistakes made by the part-qualified accountant in preparing the year end

financial statements will be detected. This is important as the directors will be using the year end accounts to review their

progress in the first year of trading and will need reliable figures to assess performance. An audit will give the directors comfort

that the financial statements are a sound basis for making business decisions.

Accurate first year figures will also enable more effective budgeting and forecasting, which will be crucial if rapid growth is to

be achieved.

The auditors are likely to use the quarterly management accounts as part of normal audit procedures. The auditors will be

able to advise Monty Parkes of any improvements that could be made to the management accounts, for example, increased

level of detail, more frequent reporting. Better quality management accounts will help the day-to-day running of the business

and enable a speedier response to any problems arising during the year.

As a by-product of the audit, a management letter (report to those charged with governance) will be produced, identifying

weaknesses and making recommendations on areas such as systems and controls which will improve the smooth running of

the business.

It is likely that Hugh Co will require more bank funding in order to expand, and it is likely that the bank would like to see

audited figures for review, before deciding on further finance. It will be easier and potentially cheaper to raise finance from

other providers with an audited set of financial statements.

As the business deals in cash sales, and retails small, luxury items there is a high risk of theft of assets. The external audit

can act as both a deterrent and a detective control, thus reducing the risk of fraud and resultant detrimental impact on the

financial statements.

Accurate financial statements will be the best basis for tax assessment and tax planning. An audit opinion will enhance the

credibility of the figures.

If the business grows rapidly, then it is likely that at some point in the future, the audit exemption limit will be exceeded and

thus an audit will become mandatory.

Choosing to have an audit from the first year of incorporation will reduce potential errors carried down to subsequent periods

and thus avoid qualifications of opening balances. -

第20题:

(ii) Identify and explain the principal audit procedures to be performed on the valuation of the investment

properties. (6 marks)

正确答案:

(ii) Additional audit procedures

Audit procedures should focus on the appraisal of the work of the expert valuer. Procedures could include the following:

– Inspection of the written instructions provided by Poppy Co to the valuer, which should include matters such as

the objective and scope of the valuer’s work, the extent of the valuer’s access to relevant records and files, and

clarification of the intended use by the auditor of their work.

– Evaluation, using the valuation report, that any assumptions used by the valuer are in line with the auditor’s

knowledge and understanding of Poppy Co. Any documentation supporting assumptions used by the valuer should

be reviewed for consistency with the auditor’s business understanding, and also for consistency with any other

audit evidence.

– Assessment of the methodology used to arrive at the fair value and confirmation that the method is consistent with

that required by IAS 40.

– The auditor should confirm, using the valuation report, that a consistent method has been used to value each

property.

– It should also be confirmed that the date of the valuation report is reasonably close to the year end of Poppy Co.

– Physical inspection of the investment properties to determine the physical condition of the properties supports the

valuation.

– Inspect the purchase documentation of each investment property to ascertain the cost of each building. As the

properties were acquired during this accounting period, it would be reasonable to expect that the fair value at the

year end is not substantially different to the purchase price. Any significant increase or decrease in value should

alert the auditor to possible misstatement, and lead to further audit procedures.

– Review of forecasts of rental income from the properties – supporting evidence of the valuation.

– Subsequent events should be monitored for any additional evidence provided on the valuation of the properties.

For example, the sale of an investment property shortly after the year end may provide additional evidence relating

to the fair value measurement.

– Obtain a management representation regarding the reasonableness of any significant assumptions, where relevant,

to fair value measurements or disclosures. -

第21题:

(ii) State the principal audit procedures to be performed on the consolidation schedule of the Rosie Group.

(4 marks)

正确答案:

(ii) Audit procedures on the consolidation schedule of the Rosie Group:

– Agree correct extraction of individual company figures by reference to individual company audited financial

statements.

– Cast and cross cast all consolidation schedules.

– Recalculate all consolidation adjustments, including goodwill, elimination of pre acquisition reserves, cancellation

of intercompany balances, fair value adjustments and accounting policy adjustments.

– By reference to prior year audited consolidated accounts, agree accounting policies have been consistently applied.

– Agree brought down figures to prior year audited consolidated accounts and audit working papers (e.g. goodwill

figures for Timber Co and Ben Co, consolidated reserves).

– Agree that any post acquisition profits consolidated for Dylan Co arose since the date of acquisition by reference to

date of control passing per the purchase agreement.

– Reconcile opening and closing group reserves and agree reconciling items to group financial statements. -

第22题:

(a) List and explain FOUR methods of selecting a sample of items to test from a population in accordance with ISA 530 (Redrafted) Audit Sampling and Other Means of Testing. (4 marks)

(b) List and explain FOUR assertions from ISA 500 Audit Evidence that relate to the recording of classes of

transactions. (4 marks)

(c) In terms of audit reports, explain the term ‘modified’. (2 marks)

正确答案:

(a)SamplingmethodsMethodsofsamplinginaccordancewithISA530AuditSamplingandOtherMeansofTesting:Randomselection.Ensureseachiteminapopulationhasanequalchanceofselection,forexamplebyusingrandomnumbertables.Systematicselection.Inwhichanumberofsamplingunitsinthepopulationisdividedbythesamplesizetogiveasamplinginterval.Haphazardselection.Theauditorselectsthesamplewithoutfollowingastructuredtechnique–theauditorwouldavoidanyconsciousbiasorpredictability.Sequenceorblock.Involvesselectingablock(s)ofcontinguousitemsfromwithinapopulation.Tutorialnote:Othermethodsofsamplingareasfollows:MonetaryUnitSampling.Thisselectionmethodensuresthateachindividual$1inthepopulationhasanequalchanceofbeingselected.Judgementalsampling.Selectingitemsbasedontheskillandjudgementoftheauditor.(b)Assertions–classesoftransactionsOccurrence.Thetransactionsandeventsthathavebeenrecordedhaveactuallyoccurredandpertaintotheentity.Completeness.Alltransactionsandeventsthatshouldhavebeenrecordedhavebeenrecorded.Accuracy.Theamountsandotherdatarelatingtorecordedtransactionsandeventshavebeenrecordedappropriately.Cut-off.Transactionsandeventshavebeenrecordedinthecorrectaccountingperiod.Classification.Transactionsandeventshavebeenrecordedintheproperaccounts.(c)AuditreporttermModified.Anauditormodifiesanauditreportinanysituationwhereitisinappropriatetoprovideanunmodifiedreport.Forexample,theauditormayprovideadditionalinformationinanemphasisofmatter(whichdoesnotaffecttheauditor’sopinion)orqualifytheauditreportforlimitationofscopeordisagreement. -

第23题:

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was