(c) During the year Albreda paid $0·1 million (2004 – $0·3 million) in fines and penalties relating to breaches ofhealth and safety regulations. These amounts have not been separately disclosed but included in cost of sales.(5 marks)Required:For each of t

题目

(c) During the year Albreda paid $0·1 million (2004 – $0·3 million) in fines and penalties relating to breaches of

health and safety regulations. These amounts have not been separately disclosed but included in cost of sales.

(5 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

相似考题

参考答案和解析

(c) Fines and penalties

(i) Matters

■ $0·1 million represents 5·6% of profit before tax and is therefore material. However, profit has fallen, and

compared with prior year profit it is less than 5%. So ‘borderline’ material in quantitative terms.

■ Prior year amount was three times as much and represented 13·6% of profit before tax.

■ Even though the payments may be regarded as material ‘by nature’ separate disclosure may not be necessary if,

for example, there are no external shareholders.

■ Treatment (inclusion in cost of sales) should be consistent with prior year (‘The Framework’/IAS 1 ‘Presentation of

Financial Statements’).

■ The reason for the fall in expense. For example, whether due to an improvement in meeting health and safety

regulations and/or incomplete recording of liabilities (understatement).

■ The reason(s) for the breaches. For example, Albreda may have had difficulty implementing new guidelines in

response to stricter regulations.

■ Whether expenditure has been adjusted for in the income tax computation (as disallowed for tax purposes).

■ Management’s attitude to health and safety issues (e.g. if it regards breaches as an acceptable operational practice

or cheaper than compliance).

■ Any references to health and safety issues in other information in documents containing audited financial

statements that might conflict with Albreda incurring these costs.

■ Any cost savings resulting from breaches of health and safety regulations would result in Albreda possessing

proceeds of its own crime which may be a money laundering offence.

(ii) Audit evidence

■ A schedule of amounts paid totalling $0·1 million with larger amounts being agreed to the cash book/bank

statements.

■ Review/comparison of current year schedule against prior year for any apparent omissions.

■ Review of after-date cash book payments and correspondence with relevant health and safety regulators (e.g. local

authorities) for liabilities incurred before 30 September 2005.

■ Notes in the prior year financial statements confirming consistency, or otherwise, of the lack of separate disclosure.

■ A ‘signed off’ review of ‘other information’ (i.e. directors’ report, chairman’s statement, etc).

■ Written management representation that there are no fines/penalties other than those which have been reflected in

the financial statements.

更多“(c) During the year Albreda paid $0·1 million (2004 – $0·3 million) in fines and penalties relating to breaches ofhealth and safety regulations. These amounts have not been separately disclosed but included in cost of sales.(5 marks)Required:For each of t”相关问题

-

第1题:

(b) One of the hotels owned by Norman is a hotel complex which includes a theme park, a casino and a golf course,

as well as a hotel. The theme park, casino, and hotel were sold in the year ended 31 May 2008 to Conquest, a

public limited company, for $200 million but the sale agreement stated that Norman would continue to operate

and manage the three businesses for their remaining useful life of 15 years. The residual interest in the business

reverts back to Norman after the 15 year period. Norman would receive 75% of the net profit of the businesses

as operator fees and Conquest would receive the remaining 25%. Norman has guaranteed to Conquest that the

net minimum profit paid to Conquest would not be less than $15 million. (4 marks)

Norman has recently started issuing vouchers to customers when they stay in its hotels. The vouchers entitle the

customers to a $30 discount on a subsequent room booking within three months of their stay. Historical

experience has shown that only one in five vouchers are redeemed by the customer. At the company’s year end

of 31 May 2008, it is estimated that there are vouchers worth $20 million which are eligible for discount. The

income from room sales for the year is $300 million and Norman is unsure how to report the income from room

sales in the financial statements. (4 marks)

Norman has obtained a significant amount of grant income for the development of hotels in Europe. The grants

have been received from government bodies and relate to the size of the hotel which has been built by the grant

assistance. The intention of the grant income was to create jobs in areas where there was significant

unemployment. The grants received of $70 million will have to be repaid if the cost of building the hotels is less

than $500 million. (4 marks)

Appropriateness and quality of discussion (2 marks)

Required:

Discuss how the above income would be treated in the financial statements of Norman for the year ended

31 May 2008.

正确答案:

(b) Property is sometimes sold with a degree of continuing involvement by the seller so that the risks and rewards of ownership

have not been transferred. The nature and extent of the buyer’s involvement will determine how the transaction is accounted

for. The substance of the transaction is determined by looking at the transaction as a whole and IAS18 ‘Revenue’ requires

this by stating that where two or more transactions are linked, they should be treated as a single transaction in order to

understand the commercial effect (IAS18 paragraph 13). In the case of the sale of the hotel, theme park and casino, Norman

should not recognise a sale as the company continues to enjoy substantially all of the risks and rewards of the businesses,

and still operates and manages them. Additionally the residual interest in the business reverts back to Norman. Also Norman

has guaranteed the income level for the purchaser as the minimum payment to Conquest will be $15 million a year. The

transaction is in substance a financing arrangement and the proceeds should be treated as a loan and the payment of profits

as interest.

The principles of IAS18 and IFRIC13 ‘Customer Loyalty Programmes’ require that revenue in respect of each separate

component of a transaction is measured at its fair value. Where vouchers are issued as part of a sales transaction and are

redeemable against future purchases, revenue should be reported at the amount of the consideration received/receivable less

the voucher’s fair value. In substance, the customer is purchasing both goods or services and a voucher. The fair value of the

voucher is determined by reference to the value to the holder and not the cost to the issuer. Factors to be taken into account

when estimating the fair value, would be the discount the customer obtains, the percentage of vouchers that would be

redeemed, and the time value of money. As only one in five vouchers are redeemed, then effectively the hotel has sold goods

worth ($300 + $4) million, i.e. $304 million for a consideration of $300 million. Thus allocating the discount between the

two elements would mean that (300 ÷ 304 x $300m) i.e. $296·1 million will be allocated to the room sales and the balance

of $3·9 million to the vouchers. The deferred portion of the proceeds is only recognised when the obligations are fulfilled.

The recognition of government grants is covered by IAS20 ‘Accounting for government grants and disclosure of government

assistance’. The accruals concept is used by the standard to match the grant received with the related costs. The relationship

between the grant and the related expenditure is the key to establishing the accounting treatment. Grants should not be

recognised until there is reasonable assurance that the company can comply with the conditions relating to their receipt and

the grant will be received. Provision should be made if it appears that the grant may have to be repaid.

There may be difficulties of matching costs and revenues when the terms of the grant do not specify precisely the expense

towards which the grant contributes. In this case the grant appears to relate to both the building of hotels and the creation of

employment. However, if the grant was related to revenue expenditure, then the terms would have been related to payroll or

a fixed amount per job created. Hence it would appear that the grant is capital based and should be matched against the

depreciation of the hotels by using a deferred income approach or deducting the grant from the carrying value of the asset

(IAS20). Additionally the grant is only to be repaid if the cost of the hotel is less than $500 million which itself would seem

to indicate that the grant is capital based. If the company feels that the cost will not reach $500 million, a provision should

be made for the estimated liability if the grant has been recognised. -

第2题:

(ii) The percentage change in revenue, total costs and net assets during the year ended 31 May 2008 that

would have been required in order to have achieved a target ROI of 20% by the Beetown centre. Your

answer should consider each of these three variables in isolation. State any assumptions that you make.

(6 marks)

正确答案:

(ii) The ROI of Beetown is currently 13·96%. In order to obtain an ROI of 20%, operating profit would need to increase to

(20% x $3,160,000) = $632,000, based on the current level of net assets. Three alternative ways in which a target

ROI of 20% could be achieved for the Beetown centre are as follows:

(1) Attempts could be made to increase revenue by attracting more clients while keeping invested capital and operating

profit per $ of revenue constant. Revenue would have to increase to $2,361,644, assuming that the current level

of profitability is maintained and fixed costs remain unchanged. The current rate of contribution to revenue is

$2,100,000 – $567,000 = $1,533,000/$2,100,000 = 73%. Operating profit needs to increase by $191,000

in order to achieve an ROI of 20%. Therefore, revenue needs to increase by $191,000/0·73 = $261,644 =

12·46%.

(2) Attempts could be made to decrease the level of operating costs by, for example, increasing the efficiency of

maintenance operations. This would have the effect of increasing operating profit per $ of revenue. This would

require that revenue and invested capital were kept constant. Total operating costs would need to fall by $191,000

in order to obtain an ROI of 20%. This represents a percentage decrease of 191,000/1,659,000 = 11·5%. If fixed

costs were truly fixed, then variable costs would need to fall to a level of $376,000, which represents a decrease

of 33·7%.

(3) Attempts could be made to decrease the net asset base of HFG by, for example, reducing debtor balances and/or

increasing creditor balances, while keeping turnover and operating profit per $ of revenue constant. Net assets

would need to fall to a level of ($441,000/0·2) = $2,205,000, which represents a percentage decrease

amounting to $3,160,000 – $2,205,000 = 955,000/3,160,000 = 30·2%. -

第3题:

3 You are the manager responsible for the audit of Albreda Co, a limited liability company, and its subsidiaries. The

group mainly operates a chain of national restaurants and provides vending and other catering services to corporate

clients. All restaurants offer ‘eat-in’, ‘take-away’ and ‘home delivery’ services. The draft consolidated financial

statements for the year ended 30 September 2005 show revenue of $42·2 million (2004 – $41·8 million), profit

before taxation of $1·8 million (2004 – $2·2 million) and total assets of $30·7 million (2004 – $23·4 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In September 2005 the management board announced plans to cease offering ‘home delivery’ services from the

end of the month. These sales amounted to $0·6 million for the year to 30 September 2005 (2004 – $0·8

million). A provision of $0·2 million has been made as at 30 September 2005 for the compensation of redundant

employees (mainly drivers). Delivery vehicles have been classified as non-current assets held for sale as at 30

September 2005 and measured at fair value less costs to sell, $0·8 million (carrying amount,

$0·5 million). (8 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:3 ALBREDA CO

(a) Cessation of ‘home delivery’ service

(i) Matters

■ $0·6 million represents 1·4% of reported revenue (prior year 1·9%) and is therefore material.

Tutorial note: However, it is clearly not of such significance that it should raise any doubts whatsoever regarding

the going concern assumption. (On the contrary, as revenue from this service has declined since last year.)

■ The home delivery service is not a component of Albreda and its cessation does not classify as a discontinued

operation (IFRS 5 ‘Non-current Assets Held for Sale and Discontinued Operations’).

? It is not a cash-generating unit because home delivery revenues are not independent of other revenues

generated by the restaurant kitchens.

? 1·4% of revenue is not a ‘major line of business’.

? Home delivery does not cover a separate geographical area (but many areas around the numerous

restaurants).

■ The redundancy provision of $0·2 million represents 11·1% of profit before tax (10% before allowing for the

provision) and is therefore material. However, it represents only 0·6% of total assets and is therefore immaterial

to the balance sheet.

■ As the provision is a liability it should have been tested primarily for understatement (completeness).

■ The delivery vehicles should be classified as held for sale if their carrying amount will be recovered principally

through a sale transaction rather than through continuing use. For this to be the case the following IFRS 5 criteria

must be met:

? the vehicles must be available for immediate sale in their present condition; and

? their sale must be highly probable.

Tutorial note: Highly probable = management commitment to a plan + initiation of plan to locate buyer(s) +

active marketing + completion expected in a year.

■ However, even if the classification as held for sale is appropriate the measurement basis is incorrect.

■ Non-current assets classified as held for sale should be carried at the lower of carrying amount and fair value less

costs to sell.

■ It is incorrect that the vehicles are being measured at fair value less costs to sell which is $0·3 million in excess

of the carrying amount. This amounts to a revaluation. Wherever the credit entry is (equity or income statement)

it should be reversed. $0·3 million represents just less than 1% of assets (16·7% of profit if the credit is to the

income statement).

■ Comparison of fair value less costs to sell against carrying amount should have been made on an item by item

basis (and not on their totals).

(ii) Audit evidence

■ Copy of board minute documenting management’s decision to cease home deliveries (and any press

releases/internal memoranda to staff).

■ An analysis of revenue (e.g. extracted from management accounts) showing the amount attributed to home delivery

sales.

■ Redundancy terms for drivers as set out in their contracts of employment.

■ A ‘proof in total’ for the reasonableness/completeness of the redundancy provision (e.g. number of drivers × sum

of years employed × payment per year of service).

■ A schedule of depreciated cost of delivery vehicles extracted from the non-current asset register.

■ Checking of fair values on a sample basis to second hand market prices (as published/advertised in used vehicle

guides).

■ After-date net sale proceeds from sale of vehicles and comparison of proceeds against estimated fair values.

■ Physical inspection of condition of unsold vehicles.

■ Separate disclosure of the held for sale assets on the face of the balance sheet or in the notes.

■ Assets classified as held for sale (and other disposals) shown in the reconciliation of carrying amount at the

beginning and end of the period.

■ Additional descriptions in the notes of:

? the non-current assets; and

? the facts and circumstances leading to the sale/disposal (i.e. cessation of home delivery service). -

第4题:

3 You are the manager responsible for the audit of Volcan, a long-established limited liability company. Volcan operates

a national supermarket chain of 23 stores, five of which are in the capital city, Urvina. All the stores are managed in

the same way with purchases being made through Volcan’s central buying department and product pricing, marketing,

advertising and human resources policies being decided centrally. The draft financial statements for the year ended

31 March 2005 show revenue of $303 million (2004 – $282 million), profit before taxation of $9·5 million (2004

– $7·3 million) and total assets of $178 million (2004 – $173 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) On 1 May 2005, Volcan announced its intention to downsize one of the stores in Urvina from a supermarket to

a ‘City Metro’ in response to a significant decline in the demand for supermarket-style. shopping in the capital.

The store will be closed throughout June, re-opening on 1 July 2005. Goodwill of $5·5 million was recognised

three years ago when this store, together with two others, was bought from a national competitor. It is Volcan’s

policy to write off goodwill over five years. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Volcan for the year ended

31 March 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

3 VOLCAN

(a) Store impairment

(i) Matters

■ Materiality

? The cost of goodwill represents 3·1% of total assets and is therefore material.

? However, after three years the carrying amount of goodwill ($2·2m) represents only 1·2% of total assets –

and is therefore immaterial in the context of the balance sheet.

? The annual amortisation charge ($1·1m) represents 11·6% profit before tax (PBT) and is therefore also

material (to the income statement).

? The impact of writing off the whole of the carrying amount would be material to PBT (23%).

Tutorial note: The temporary closure of the supermarket does not constitute a discontinued operation under IFRS 5

‘Non-Current Assets Held for Sale and Discontinued Operations’.

■ Under IFRS 3 ‘Business Combinations’ Volcan should no longer be writing goodwill off over five years but

subjecting it to an annual impairment test.

■ The announcement is after the balance sheet date and is therefore a non-adjusting event (IAS 10 ‘Events After the

Balance Sheet Date’) insofar as no provision for restructuring (for example) can be made.

■ However, the event provides evidence of a possible impairment of the cash-generating unit which is this store and,

in particular, the value of goodwill assigned to it.

■ If the carrying amount of goodwill ($2·2m) can be allocated on a reasonable and consistent basis to this and the

other two stores (purchased at the same time) Volcan’s management should have applied an impairment test to

the goodwill of the downsized store (this is likely to show impairment).

■ If more than 22% of goodwill is attributable to the City Metro store – then its write-off would be material to PBT

(22% × $2·2m ÷ $9·5m = 5%).

■ If the carrying amount of goodwill cannot be so allocated; the impairment test should be applied to the

cash-generating unit that is the three stores (this may not necessarily show impairment).

■ Management should have considered whether the other four stores in Urvina (and elsewhere) are similarly

impaired.

■ Going concern is unlikely to be an issue unless all the supermarkets are located in cities facing a downward trend

in demand.

Tutorial note: Marks will be awarded for stating the rules for recognition of an impairment loss for a cash-generating

unit. However, as it is expected that the majority of candidates will not deal with this matter, the rules of IAS 36 are

not reproduced here.

(ii) Audit evidence

■ Board minutes approving the store’s ‘facelift’ and documenting the need to address the fall in demand for it as a

supermarket.

■ Recomputation of the carrying amount of goodwill (2/5 × $5·5m = $2·2m).

■ A schedule identifying all the assets that relate to the store under review and the carrying amounts thereof agreed

to the underlying accounting records (e.g. non-current asset register).

■ Recalculation of value in use and/or fair value less costs to sell of the cash-generating unit (i.e. the store that is to

become the City Metro, or the three stores bought together) as at 31 March 2005.

Tutorial note: If just one of these amounts exceeds carrying amount there will be no impairment loss. Also, as

there is a plan NOT to sell the store it is most likely that value in use should be used.

■ Agreement of cash flow projections (e.g. to approved budgets/forecast revenues and costs for a maximum of five

years, unless a longer period can be justified).

■ Written management representation relating to the assumptions used in the preparation of financial budgets.

■ Agreement that the pre-tax discount rate used reflects current market assessments of the time value of money (and

the risks specific to the store) and is reasonable. For example, by comparison with Volcan’s weighted average cost

of capital.

■ Inspection of the store (if this month it should be closed for refurbishment).

■ Revenue budgets and cash flow projections for:

– the two stores purchased at the same time;

– the other stores in Urvina; and

– the stores elsewhere.

Also actual after-date sales by store compared with budget. -

第5题:

(b) A sale of industrial equipment to Deakin Co in May 2005 resulted in a loss on disposal of $0·3 million that has

been separately disclosed on the face of the income statement. The equipment cost $1·2 million when it was

purchased in April 1996 and was being depreciated on a straight-line basis over 20 years. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Sale of industrial equipment

(i) Matters

■ The industrial equipment was in use for nine years (from April 1996) and would have had a carrying value of

$660,000 at 31 March 2005 (11/20 × $1·2m – assuming nil residual value and a full year’s depreciation charge

in the year of acquisition and none in the year of disposal). Disposal proceeds were therefore only $360,000.

■ The $0·3m loss represents 15% of PBT (for the year to 31 March 2006) and is therefore material. The equipment

was material to the balance sheet at 31 March 2005 representing 2·6% of total assets ($0·66/$25·7 × 100).

■ Separate disclosure, of a material loss on disposal, on the face of the income statement is in accordance with

IAS 16 ‘Property, Plant and Equipment’. However, in accordance with IAS 1 ‘Presentation of Financial Statements’,

it should not be captioned in any way that might suggest that it is not part of normal operating activities (i.e. not

‘extraordinary’, ‘exceptional’, etc).

Tutorial note: However, note that if there is a prior period error to be accounted for (see later), there would be

no impact on the current period income statement requiring consideration of any disclosure.

■ The reason for the sale. For example, whether the equipment was:

– surplus to operating requirements (i.e. not being replaced); or

– being replaced with newer equipment (thereby contributing to the $8·1m increase (33·8 – 25·7) in total

assets).

■ The reason for the loss on sale. For example, whether:

– the sale was at an under-value (e.g. to a related party);

– the equipment had a bad maintenance history (or was otherwise impaired);

– the useful life of the equipment is less than 20 years;

– there is any deferred consideration not yet recorded;

– any non-cash disposal proceeds have been overlooked (e.g. if another asset was acquired in a part-exchange).

■ If the useful life was less than 20 years, tangible non-current assets may be materially overstated in respect of other

items of equipment that are still in use and being depreciated on the same basis.

■ If the sale was to a related party then additional disclosure should be required in a note to the financial statements

for the year to 31 March 2006 (IAS 24 ‘Related Party Disclosures’).

Tutorial note: Since there are no specific pointers to a related party transaction (RPT), this point is not expanded

on.

■ Whether the sale was identified in the prior year audit’s post balance sheet event review. If so:

– the disclosure made in the prior year’s financial statements (IAS 10 ‘Events After the Balance Sheet Date’);

– whether an impairment loss was recognised at 31 March 2005.

■ If not, and the equipment was impaired at 31 March 2005, a prior period error should be accounted for (IAS 8

‘Accounting Policies, Changes in Accounting Estimates and Errors’). An impairment loss of $0·3m would have

been material to prior year profit (12·5%).

Tutorial note: Unless this was a RPT or the impairment arose after 31 March 2005 a prior period adjustment

should be made.

■ Failure to account for a prior period error (if any) would result in modification of the audit opinion ‘except for’ noncompliance

with IAS 8 (in the current year) and IAS 36 (in the prior period).

(ii) Audit evidence

■ Carrying amount ($0·66m as above) agreed to the non-current asset register balances at 31 March 2005 and

recalculation of the loss on disposal.

■ Cost and accumulated depreciation removed from the asset register in the year to 31 March 2006.

■ Receipt of proceeds per cash book agreed to bank statement.

■ Sales invoice transferring title to Deakin.

■ A review of maintenance expenses and records (e.g. to confirm reason for loss on sale).

■ Post balance sheet event review on prior year audit working papers file.

■ Management representation confirming that Deakin is not a related party (provided that there is no evidence to

suggest otherwise). -

第6题:

(b) You are the audit manager of Johnston Co, a private company. The draft consolidated financial statements for

the year ended 31 March 2006 show profit before taxation of $10·5 million (2005 – $9·4 million) and total

assets of $55·2 million (2005 – $50·7 million).

Your firm was appointed auditor of Tiltman Co when Johnston Co acquired all the shares of Tiltman Co in March

2006. Tiltman’s draft financial statements for the year ended 31 March 2006 show profit before taxation of

$0·7 million (2005 – $1·7 million) and total assets of $16·1 million (2005 – $16·6 million). The auditor’s

report on the financial statements for the year ended 31 March 2005 was unmodified.

You are currently reviewing two matters that have been left for your attention on the audit working paper files for

the year ended 31 March 2006:

(i) In December 2004 Tiltman installed a new computer system that properly quantified an overvaluation of

inventory amounting to $2·7 million. This is being written off over three years.

(ii) In May 2006, Tiltman’s head office was relocated to Johnston’s premises as part of a restructuring.

Provisions for the resulting redundancies and non-cancellable lease payments amounting to $2·3 million

have been made in the financial statements of Tiltman for the year ended 31 March 2006.

Required:

Identify and comment on the implications of these two matters for your auditor’s reports on the financial

statements of Johnston Co and Tiltman Co for the year ended 31 March 2006. (10 marks)

正确答案:

(b) Tiltman Co

Tiltman’s total assets at 31 March 2006 represent 29% (16·1/55·2 × 100) of Johnston’s total assets. The subsidiary is

therefore material to Johnston’s consolidated financial statements.

Tutorial note: Tiltman’s profit for the year is not relevant as the acquisition took place just before the year end and will

therefore have no impact on the consolidated income statement. Calculations of the effect on consolidated profit before

taxation are therefore inappropriate and will not be awarded marks.

(i) Inventory overvaluation

This should have been written off to the income statement in the year to 31 March 2005 and not spread over three

years (contrary to IAS 2 ‘Inventories’).

At 31 March 2006 inventory is overvalued by $0·9m. This represents all Tiltmans’s profit for the year and 5·6% of

total assets and is material. At 31 March 2005 inventory was materially overvalued by $1·8m ($1·7m reported profit

should have been a $0·1m loss).

Tutorial note: 1/3 of the overvaluation was written off in the prior period (i.e. year to 31 March 2005) instead of $2·7m.

That the prior period’s auditor’s report was unmodified means that the previous auditor concurred with an incorrect

accounting treatment (or otherwise gave an inappropriate audit opinion).

As the matter is material a prior period adjustment is required (IAS 8 ‘Accounting Policies, Changes in Accounting

Estimates and Errors’). $1·8m should be written off against opening reserves (i.e. restated as at 1 April 2005).

(ii) Restructuring provision

$2·3m expense has been charged to Tiltman’s profit and loss in arriving at a draft profit of $0·7m. This is very material.

(The provision represents 14·3% of Tiltman’s total assets and is material to the balance sheet date also.)

The provision for redundancies and onerous contracts should not have been made for the year ended 31 March 2006

unless there was a constructive obligation at the balance sheet date (IAS 37 ‘Provisions, Contingent Liabilities and

Contingent Assets’). So, unless the main features of the restructuring plan had been announced to those affected (i.e.

redundancy notifications issued to employees), the provision should be reversed. However, it should then be disclosed

as a non-adjusting post balance sheet event (IAS 10 ‘Events After the Balance Sheet Date’).

Given the short time (less than one month) between acquisition and the balance sheet it is very possible that a

constructive obligation does not arise at the balance sheet date. The relocation in May was only part of a restructuring

(and could be the first evidence that Johnston’s management has started to implement a restructuring plan).

There is a risk that goodwill on consolidation of Tiltman may be overstated in Johnston’s consolidated financial

statements. To avoid the $2·3 expense having a significant effect on post-acquisition profit (which may be negligible

due to the short time between acquisition and year end), Johnston may have recognised it as a liability in the

determination of goodwill on acquisition.

However, the execution of Tiltman’s restructuring plan, though made for the year ended 31 March 2006, was conditional

upon its acquisition by Johnston. It does not therefore represent, immediately before the business combination, a

present obligation of Johnston. Nor is it a contingent liability of Johnston immediately before the combination. Therefore

Johnston cannot recognise a liability for Tiltman’s restructuring plans as part of allocating the cost of the combination

(IFRS 3 ‘Business Combinations’).

Tiltman’s auditor’s report

The following adjustments are required to the financial statements:

■ restructuring provision, $2·3m, eliminated;

■ adequate disclosure of relocation as a non-adjusting post balance sheet event;

■ current period inventory written down by $0·9m;

■ prior period inventory (and reserves) written down by $1·8m.

Profit for the year to 31 March 2006 should be $3·9m ($0·7 + $0·9 + $2·3).

If all these adjustments are made the auditor’s report should be unmodified. Otherwise, the auditor’s report should be

qualified ‘except for’ on grounds of disagreement. If none of the adjustments are made, the qualification should still be

‘except for’ as the matters are not pervasive.

Johnston’s auditor’s report

If Tiltman’s auditor’s report is unmodified (because the required adjustments are made) the auditor’s report of Johnston

should be similarly unmodified. As Tiltman is wholly-owned by Johnston there should be no problem getting the

adjustments made.

If no adjustments were made in Tiltman’s financial statements, adjustments could be made on consolidation, if

necessary, to avoid modification of the auditor’s report on Johnston’s financial statements.

The effect of these adjustments on Tiltman’s net assets is an increase of $1·4m. Goodwill arising on consolidation (if

any) would be reduced by $1·4m. The reduction in consolidated total assets required ($0·9m + $1·4m) is therefore

the same as the reduction in consolidated total liabilities (i.e. $2·3m). $2·3m is material (4·2% consolidated total

assets). If Tiltman’s financial statements are not adjusted and no adjustments are made on consolidation, the

consolidated financial position (balance sheet) should be qualified ‘except for’. The results of operations (i.e. profit for

the period) should be unqualified (if permitted in the jurisdiction in which Johnston reports).

Adjustment in respect of the inventory valuation may not be required as Johnston should have consolidated inventory

at fair value on acquisition. In this case, consolidated total liabilities should be reduced by $2·3m and goodwill arising

on consolidation (if any) reduced by $2·3m.

Tutorial note: The effect of any possible goodwill impairment has been ignored as the subsidiary has only just been

acquired and the balance sheet date is very close to the date of acquisition. -

第7题:

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Goodwill

(i) Matters

■ Cost of goodwill, $1·8 million, represents 3·4% consolidated total assets and is therefore material.

Tutorial note: Any assessments of materiality of goodwill against amounts in Aragon’s financial statements are

meaningless since goodwill only exists in the consolidated financial statements of Seymour.

■ It is correct that the goodwill is not being amortised (IFRS 3 Business Combinations). However, it should be tested

at least annually for impairment, by management.

■ Aragon has incurred losses amounting to $1·1 million since it was acquired (two years ago). The write-off of this

amount against goodwill in the consolidated financial statements would be material (being 61% cost of goodwill,

8·3% PBT and 2·1% total assets).

■ The cost of the investment ($4·5 million) in Seymour’s separate financial statements will also be material and

should be tested for impairment.

■ The fair value of net assets acquired was only $2·7 million ($4·5 million less $1·8 million). Therefore the fair

value less costs to sell of Aragon on other than a going concern basis will be less than the carrying amount of the

investment (i.e. the investment is impaired by at least the amount of goodwill recognised on acquisition).

■ In assessing recoverable amount, value in use (rather than fair value less costs to sell) is only relevant if the going

concern assumption is appropriate for Aragon.

■ Supporting Aragon financially may result in Seymour being exposed to actual and/or contingent liabilities that

should be provided for/disclosed in Seymour’s financial statements in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets.

(ii) Audit evidence

■ Carrying values of cost of investment and goodwill arising on acquisition to prior year audit working papers and

financial statements.

■ A copy of Aragon’s draft financial statements for the year ended 30 September 2006 showing loss for year.

■ Management’s impairment test of Seymour’s investment in Aragon and of the goodwill arising on consolidation at

30 September 2006. That is a comparison of the present value of the future cash flows expected to be generated

by Aragon (a cash-generating unit) compared with the cost of the investment (in Seymour’s separate financial

statements).

■ Results of any impairment tests on Aragon’s assets extracted from Aragon’s working paper files.

■ Analytical procedures on future cash flows to confirm their reasonableness (e.g. by comparison with cash flows for

the last two years).

■ Bank report for audit purposes for any guarantees supporting Aragon’s loan facilities.

■ A copy of Seymour’s ‘comfort letter’ confirming continuing financial support of Aragon for the foreseeable future. -

第8题:

3 You are the manager responsible for the audit of Lamont Co. The company’s principal activity is wholesaling frozen

fish. The draft consolidated financial statements for the year ended 31 March 2007 show revenue of $67·0 million

(2006 – $62·3 million), profit before taxation of $11·9 million (2006 – $14·2 million) and total assets of

$48·0 million (2006 – $36·4 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In early 2007 a chemical leakage from refrigeration units owned by Lamont caused contamination of some of its

property. Lamont has incurred $0·3 million in clean up costs, $0·6 million in modernisation of the units to

prevent future leakage and a $30,000 fine to a regulatory agency. Apart from the fine, which has been expensed,

these costs have been capitalised as improvements. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Lamont Co for the year ended

31 March 2007.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

3 LAMONT CO

(a) Chemical leakage

(i) Matters

■ $30,000 fine is very immaterial (just 1/4% profit before tax). This is revenue expenditure and it is correct that it

has been expensed to the income statement.

■ $0·3 million represents 0·6% total assets and 2·5% profit before tax and is not material on its own. $0·6 million

represents 1·2% total assets and 5% profit before tax and is therefore material to the financial statements.

■ The $0·3 million clean-up costs should not have been capitalised as the condition of the property is not improved

as compared with its condition before the leakage occurred. Although not material in isolation this amount should

be adjusted for and expensed, thereby reducing the aggregate of uncorrected misstatements.

■ It may be correct that $0·6 million incurred in modernising the refrigeration units should be capitalised as a major

overhaul (IAS 16 Property, Plant and Equipment). However, any parts scrapped as a result of the modernisation

should be treated as disposals (i.e. written off to the income statement).

■ The carrying amount of the refrigeration units at 31 March 2007, including the $0·6 million for modernisation,

should not exceed recoverable amount (i.e. the higher of value in use and fair value less costs to sell). If it does,

an allowance for the impairment loss arising must be recognised in accordance with IAS 36 Impairment of Assets.

(ii) Audit evidence

■ A breakdown/analysis of costs incurred on the clean-up and modernisation amounting to $0·3 million and

$0·6 million respectively.

■ Agreement of largest amounts to invoices from suppliers/consultants/sub-contractors, etc and settlement thereof

traced from the cash book to the bank statement.

■ Physical inspection of the refrigeration units to confirm their modernisation and that they are in working order. (Do

they contain frozen fish?)

■ Sample of components selected from the non-current asset register traced to the refrigeration units and inspected

to ensure continuing existence.

■ $30,000 penalty notice from the regulatory agency and corresponding cash book payment/payment per the bank

statement.

■ Written management representation that there are no further penalties that should be provided for or disclosed other

than the $30,000 that has been accounted for. -

第9题:

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

正确答案:

(b) (i) Enquiries in respect of the external valuer

Enquiries would need to be made for two main reasons, firstly to determine the competence, and secondly the objectivity

of the valuer. ISA 620 Using the Work of an Expert contains guidance in this area.

Competence

Enquiries could include:

– Is the valuer a member of a recognised professional body, for example a nationally or internationally recognised

institute of registered surveyors?

– Does the valuer possess any necessary licence to carry out valuations for companies?

– How long has the valuer been a member of the recognised body, or how long has the valuer been licensed under

that body?

– How much experience does the valuer have in providing valuations of the particular type of investment properties

held by Poppy Co?

– Does the valuer have specific experience of evaluating properties for the purpose of including their fair value within

the financial statements?

– Is there any evidence of the reputation of the valuer, e.g. professional references, recommendations from other

companies for which a valuation service has been provided?

– How much experience, if any, does the valuer have with Poppy Co?

Using the above enquiries, the auditor is trying to form. an opinion as to the relevance and reliability of the valuation

provided. ISA 500 Audit Evidence requires that the auditor gathers evidence that is both sufficient and appropriate. The

auditor needs to ensure that the fair values provided by the valuer for inclusion in the financial statements have been

arrived at using appropriate knowledge and skill which should be evidenced by the valuer being a member of a

professional body, and, if necessary, holding a licence under that body.

It is important that the fair values have been arrived at using methods allowed under IAS 40 Investment Property. If any

other valuation method has been used then the value recognised in the statement of financial position may not be in

accordance with financial reporting standards. Thus it is important to understand whether the valuer has experience

specifically in providing valuations that comply with IAS 40, and how many times the valuer has appraised properties

similar to those owned by Poppy Co.

In gauging the reliability of the fair value, the auditor may wish to consider how Poppy Co decided to appoint this

particular valuer, e.g. on the basis of a recommendation or after receiving references from companies for which

valuations had previously been provided.

It will also be important to consider how familiar the valuer is with Poppy Co’s business and environment, as a way to

assess the reliability and appropriateness of any assumptions used in the valuation technique.

Objectivity

Enquiries could include:

– Does the valuer have any financial interest in Poppy Co, e.g. shares held directly or indirectly in the company?

– Does the valuer have any personal relationship with any director or employee of Poppy Co?

– Is the fee paid for the valuation service reasonable and a fair, market based price?

With these enquiries, the auditor is gaining assurance that the valuer will perform. the valuation from an independent

point of view. If the valuer had a financial interest in Poppy Co, there would be incentive to manipulate the valuation in

a way best suited to the financial statements of the company. Equally if the valuer had a personal relationship with a

senior member of staff at Poppy Co, the valuer may feel pressured to give a favourable opinion on the valuation of the

properties.

The level of fee paid is important. It should be commensurate with the market rate paid for this type of valuation. If the

valuer was paid in excess of what might be considered a normal fee, it could indicate that the valuer was encouraged,

or even bribed, to provide a favourable valuation. -

第10题:

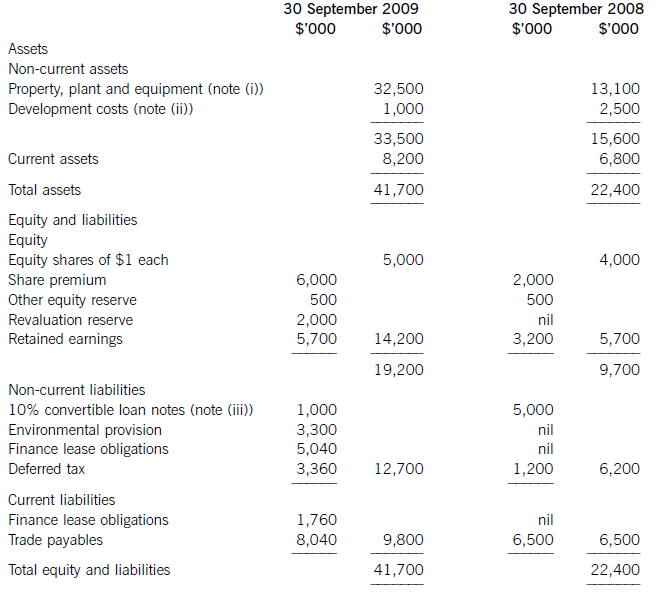

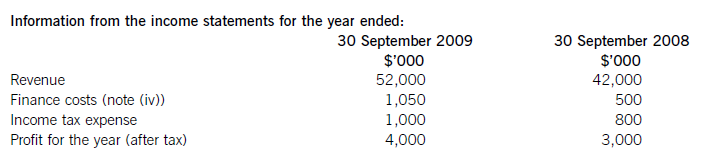

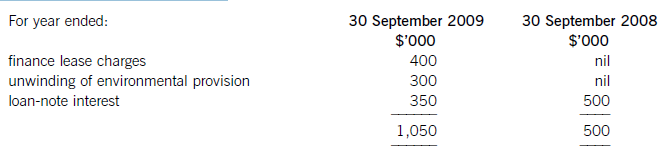

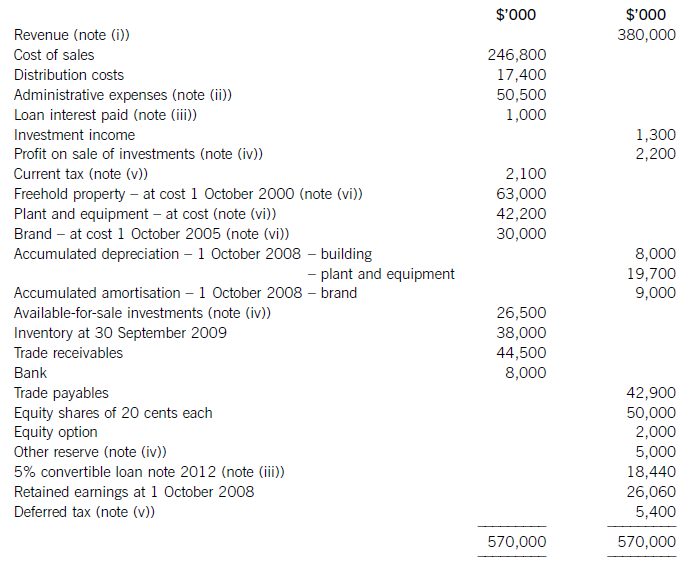

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

正确答案:

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced. -

第11题:

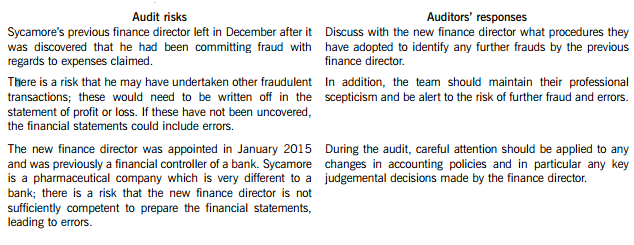

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

正确答案:(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

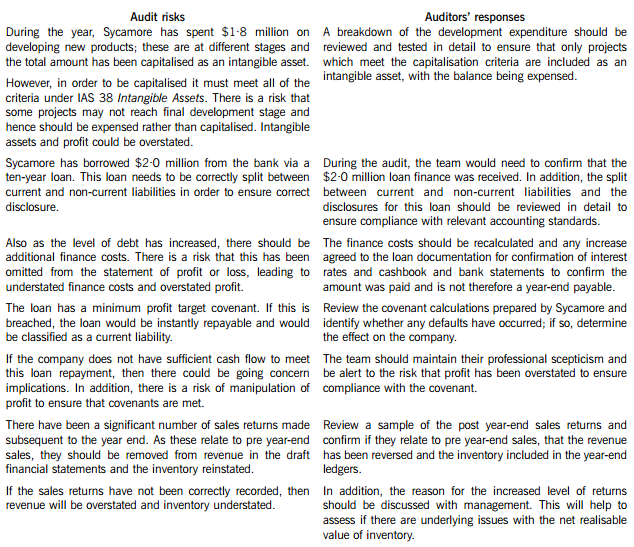

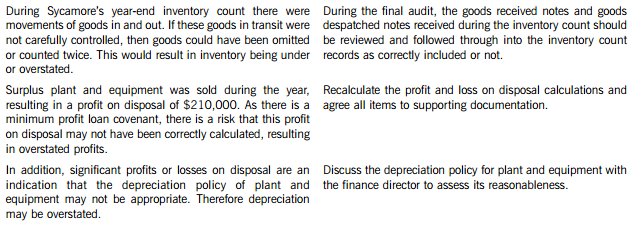

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

-

第12题:

You are the audit manager of Chestnut & Co and are reviewing the key issues identified in the files of two audit clients.

Palm Industries Co (Palm)

Palm’s year end was 31 March 2015 and the draft financial statements show revenue of $28·2 million, receivables of $5·6 million and profit before tax of $4·8 million. The fieldwork stage for this audit has been completed.

A customer of Palm owed an amount of $350,000 at the year end. Testing of receivables in April highlighted that no amounts had been paid to Palm from this customer as they were disputing the quality of certain goods received from Palm. The finance director is confident the issue will be resolved and no allowance for receivables was made with regards to this balance.

Ash Trading Co (Ash)

Ash is a new client of Chestnut & Co, its year end was 31 January 2015 and the firm was only appointed auditors in February 2015, as the previous auditors were suddenly unable to undertake the audit. The fieldwork stage for this audit is currently ongoing.

The inventory count at Ash’s warehouse was undertaken on 31 January 2015 and was overseen by the company’s internal audit department. Neither Chestnut & Co nor the previous auditors attended the count. Detailed inventory records were maintained but it was not possible to undertake another full inventory count subsequent to the year end.

The draft financial statements show a profit before tax of $2·4 million, revenue of $10·1 million and inventory of $510,000.

Required:

For each of the two issues:

(i) Discuss the issue, including an assessment of whether it is material;

(ii) Recommend ONE procedure the audit team should undertake to try to resolve the issue; and

(iii) Describe the impact on the audit report if the issue remains UNRESOLVED.

Notes:

1 The total marks will be split equally between each of the two issues.

2 Audit report extracts are NOT required.

正确答案:Audit reports

Palm Industries Co (Palm)

(i) A customer of Palm’s owing $350,000 at the year end has not made any post year-end payments as they are disputing the quality of goods received. No allowance for receivables has been made against this balance. As the balance is being disputed, there is a risk of incorrect valuation as some or all of the receivable balance is overstated, as it may not be paid.

This $350,000 receivables balance represents 1·2% (0·35/28·2m) of revenue, 6·3% (0·35/5·6m) of receivables and 7·3% (0·35/4·8m) of profit before tax; hence this is a material issue.

(ii) A procedure to adopt includes:

– Review whether any payments have subsequently been made by this customer since the audit fieldwork was completed.

– Discuss with management whether the issue of quality of goods sold to the customer has been resolved, or whether it is still in dispute.

– Review the latest customer correspondence with regards to an assessment of the likelihood of the customer making payment.

(iii) If management refuses to provide against this receivable, the audit report will need to be modified. As receivables are overstated and the error is material but not pervasive a qualified opinion would be necessary.

A basis for qualified opinion paragraph would be needed and would include an explanation of the material misstatement in relation to the valuation of receivables and the effect on the financial statements. The opinion paragraph would be qualified ‘except for’.

Ash Trading Co (Ash)

(i) Chestnut & Co was only appointed as auditors subsequent to Ash’s year end and hence did not attend the year-end inventory count. Therefore, they have not been able to gather sufficient and appropriate audit evidence with regards to the completeness and existence of inventory.

Inventory is a material amount as it represents 21·3% (0·51/2·4m) of profit before tax and 5% (0·51/10·1m) of revenue; hence this is a material issue.

(ii) A procedure to adopt includes:

– Review the internal audit reports of the inventory count to identify the level of adjustments to the records to assess the reasonableness of relying on the inventory records.

– Undertake a sample check of inventory in the warehouse and compare to the inventory records and then from inventory records to the warehouse, to assess the reasonableness of the inventory records maintained by Ash.

(iii) The auditors will need to modify the audit report as they are unable to obtain sufficient appropriate evidence in relation to inventory which is a material but not pervasive balance. Therefore a qualified opinion will be required.

A basis for qualified opinion paragraph will be required to explain the limitation in relation to the lack of evidence over inventory. The opinion paragraph will be qualified ‘except for’.

-

第13题:

(c) On 1 May 2007 Sirus acquired another company, Marne plc. The directors of Marne, who were the only

shareholders, were offered an increased profit share in the enlarged business for a period of two years after the

date of acquisition as an incentive to accept the purchase offer. After this period, normal remuneration levels will

be resumed. Sirus estimated that this would cost them $5 million at 30 April 2008, and a further $6 million at

30 April 2009. These amounts will be paid in cash shortly after the respective year ends. (5 marks)

Required:

Draft a report to the directors of Sirus which discusses the principles and nature of the accounting treatment of

the above elements under International Financial Reporting Standards in the financial statements for the year

ended 30 April 2008.

正确答案:

(c) Acquisition of Marne

All business combinations within the scope of IFRS 3 ‘Business Combinations’ must be accounted for using the purchase

method. (IFRS 3.14) The pooling of interests method is prohibited. Under IFRS 3, an acquirer must be identified for all

business combinations. (IFRS 3.17) Sirus will be identified as the acquirer of Marne and must measure the cost of a business

combination at the sum of the fair values, at the date of exchange, of assets given, liabilities incurred or assumed, in exchange

for control of Marne; plus any costs directly attributable to the combination. (IFRS 3.24) If the cost is subject to adjustment

contingent on future events, the acquirer includes the amount of that adjustment in the cost of the combination at the

acquisition date if the adjustment is probable and can be measured reliably. (IFRS 3.32) However, if the contingent payment

either is not probable or cannot be measured reliably, it is not measured as part of the initial cost of the business combination.

If that adjustment subsequently becomes probable and can be measured reliably, the additional consideration is treated as

an adjustment to the cost of the combination. (IAS 3.34) The issue with the increased profit share payable to the directors

of Marne is whether the payment constitutes remuneration or consideration for the business acquired. Because the directors

of Marne fall back to normal remuneration levels after the two year period, it appears that this additional payment will

constitute part of the purchase consideration with the resultant increase in goodwill. It seems as though these payments can

be measured reliably and therefore the cost of the acquisition should be increased by the net present value of $11 million at

1 May 2007 being $5 million discounted for 1 year and $6 million for 2 years. -

第14题:

(b) The marketing director of CTC has suggested the introduction of a new toy ‘Nellie the Elephant’ for which the

following estimated information is available:

1. Sales volumes and selling prices per unit

Year ending, 31 May 2009 2010 2011

Sales units (000) 80 180 100

Selling price per unit ($) 50 50 50

2. Nellie will generate a contribution to sales ratio of 50% throughout the three year period.

3. Product specific fixed overheads during the year ending 31 May 2009 are estimated to be $1·6 million. It

is anticipated that these fixed overheads would decrease by 10% per annum during each of the years ending

31 May 2010 and 31 May 2011.

4. Capital investment amounting to $3·9 million would be required in June 2008. The investment would have

no residual value at 31 May 2011.

5. Additional working capital of $500,000 would be required in June 2008. A further $200,000 would be

required on 31 May 2009. These amounts would be recovered in full at the end of the three year period.

6. The cost of capital is expected to be 12% per annum.

Assume all cash flows (other than where stated) arise at the end of the year.

Required:

(i) Determine whether the new product is viable purely on financial grounds. (4 marks)

正确答案:

-

第15题:

(b) Historically, all owned premises have been measured at cost depreciated over 10 to 50 years. The management

board has decided to revalue these premises for the year ended 30 September 2005. At the balance sheet date

two properties had been revalued by a total of $1·7 million. Another 15 properties have since been revalued by

$5·4 million and there remain a further three properties which are expected to be revalued during 2006. A

revaluation surplus of $7·1 million has been credited to equity. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Revaluation of owned premises

(i) Matters

■ The revaluations are clearly material as $1·7 million, $5·4 million and $7·1 million represent 5·5% , 17·6% and

23·1% of total assets, respectively.

■ The change in accounting policy, from a cost model to a revaluation model, should be accounted for in accordance

with IAS 16 ‘Property, Plant and Equipment’ (i.e. as a revaluation).

Tutorial note: IAS 8 ‘Accounting Policies, Changes in Accounting Estimates and Errors’ does not apply to the initial

application of a policy to revalue assets in accordance with IAS 16.

■ The basis on which the valuations have been carried out, for example, market-based fair value (IAS 16).

■ Independence, qualifications and expertise of valuer(s).

■ IAS 16 does not permit the selective revaluation of assets thus the whole class of premises should have been

revalued.

■ The valuations of properties after the year end are adjusting events (i.e. providing additional evidence of conditions

existing at the year end) per IAS 10 ‘Events After the Balance Sheet Date’.

Tutorial note: It is ‘now’ still less than three months after the year end so these valuations can reasonably be

expected to reflect year-end values.

■ If $5·4 million is a net amount of surpluses and deficits it should be grossed up so that the credit to equity reflects

the sum of the surpluses with any deficits being expensed through profit and loss (IAS 36 ‘Impairment of Assets’).

■ The revaluation exercise is incomplete. If the revaluations on the remaining three properties are expected to be

material and cannot be reasonably estimated for inclusion in the financial statements for the year ended

30 September 2005 perhaps the change in policy should be deferred for a year.

■ Depreciation for the year should have been calculated on cost as usual to establish carrying amount before

revaluation.

■ Any premises held under finance leases should be similarly revalued.

(ii) Audit evidence

■ A schedule of depreciated cost of owned premises extracted from the non-current asset register.

■ Calculation of difference between valuation and depreciated cost by property. Separate summation of surpluses

and deficits.

■ Copy of valuation certificate for each property.

■ Physical inspection of properties with largest surpluses (including the two valued before the year end) to confirm

condition.

■ Extracts from local property guides/magazines indicating a range of values of similarly styled/sized properties.

■ Separate presentation of the revaluation surpluses (gross) in:

– the statement of changes in equity; and

– reconciliation of carrying amount at the beginning and end of the period.

■ IAS 16 disclosures in the notes to the financial statements including:

– the effective date of revaluation;

– whether an independent valuer was involved;

– the methods and significant assumptions applied in estimating fair values; and

– the carrying amount that would have been recognised under the cost model. -

第16题:

3 You are the manager responsible for the audit of Keffler Co, a private limited company engaged in the manufacture of

plastic products. The draft financial statements for the year ended 31 March 2006 show revenue of $47·4 million

(2005 – $43·9 million), profit before taxation of $2 million (2005 – $2·4 million) and total assets of $33·8 million

(2005 – $25·7 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In April 2005, Keffler bought the right to use a landfill site for a period of 15 years for $1·1 million. Keffler

expects that the amount of waste that it will need to dump will increase annually and that the site will be

completely filled after just ten years. Keffler has charged the following amounts to the income statement for the

year to 31 March 2006:

– $20,000 licence amortisation calculated on a sum-of-digits basis to increase the charge over the useful life

of the site; and

– $100,000 annual provision for restoring the land in 15 years’ time. (9 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

3 KEFFLER CO

Tutorial note: None of the issues have any bearing on revenue. Therefore any materiality calculations assessed on revenue are

inappropriate and will not be awarded marks.

(a) Landfill site

(i) Matters

■ $1·1m cost of the right represents 3·3% of total assets and is therefore material.

■ The right should be amortised over its useful life, that is just 10 years, rather than the 15-year period for which

the right has been granted.

Tutorial note: Recalculation on the stated basis (see audit evidence) shows that a 10-year amortisation has been

correctly used.

■ The amortisation charge represents 1% of profit before tax (PBT) and is not material.

■ The amortisation method used should reflect the pattern in which the future economic benefits of the right are

expected to be consumed by Keffler. If that pattern cannot be determined reliably, the straight-line method must

be used (IAS 38 ‘Intangible Assets’).

■ Using an increasing sum-of-digits will ‘end-load’ the amortisation charge (i.e. least charge in the first year, highest

charge in the last year). However, according to IAS 38 there is rarely, if ever, persuasive evidence to support an

amortisation method that results in accumulated amortisation lower than that under the straight-line method.

Tutorial note: Over the first half of the asset’s life, depreciation will be lower than under the straight-line basis

(and higher over the second half of the asset’s life).

■ On a straight line basis the annual amortisation charge would be $0·11m, an increase of $90,000. Although this

difference is just below materiality (4·5% PBT) the cumulative effect (of undercharging amortisation) will become

material.

■ Also, when account is taken of the understatement of cost (see below), the undercharging of amortisation will be

material.

■ The sum-of-digits method might be suitable as an approximation to the unit-of-production method if Keffler has

evidence to show that use of the landfill site will increase annually.

■ However, in the absence of such evidence, the audit opinion should be qualified ‘except for’ disagreement with the

amortisation method (resulting in intangible asset overstatement/amortisation expense understatement).

■ The annual restoration provision represents 5% of PBT and 0·3% of total assets. Although this is only borderline

material (in terms of profit), there will be a cumulative impact.

■ Annual provisioning is contrary to IAS 37 ‘Provisions, Contingent Liabilities and Contingent Assets’.

■ The estimate of the future restoration cost is (presumably) $1·5m (i.e. $0·1 × 15). The present value of this

amount should have been provided in full in the current year and included in the cost of the right.

■ Thus the amortisation being charged on the cost of the right (including the restoration cost) is currently understated

(on any basis).

Tutorial note: A 15-year discount factor at 10% (say) is 0·239. $1·5m × 0·239 is approximately $0·36m. The

resulting present value (of the future cost) would be added to the cost of the right. Amortisation over 10 years

on a straight-line basis would then be increased by $36,000, increasing the difference between amortisation

charged and that which should be charged. The lower the discount rate, the greater the understatement of

amortisation expense.