(ii) Following on from your answer to (i), evaluate the two purchase proposals, and advise Bill and Benwhich course of action will result in the highest amount of after tax cash being received by theshareholders if the disposal takes place on 31 March 200

题目

(ii) Following on from your answer to (i), evaluate the two purchase proposals, and advise Bill and Ben

which course of action will result in the highest amount of after tax cash being received by the

shareholders if the disposal takes place on 31 March 2006. (4 marks)

相似考题

参考答案和解析

更多“(ii) Following on from your answer to (i), evaluate the two purchase proposals, and advise Bill and Benwhich course of action will result in the highest amount of after tax cash being received by theshareholders if the disposal takes place on 31 March 200”相关问题

-

第1题:

(ii) Assuming that Donald operates through a company, advise Donald on the corporation tax (CT) that

would be payable for the year ended 31 March 2007 if he pays himself a gross salary of £31,000, plus

a net dividend of £10,000, instead of a gross salary of £42,648. (4 marks)

正确答案:

-

第2题:

(c) Advise Alan on the proposed disposal of the shares in Mobile Ltd. Your answer should include calculations

of the potential capital gain, and explain any options available to Alan to reduce this tax liability. (7 marks)

正确答案:

However, an exemption from corporation tax exists for any gain arising when a trading company (or member of a trading

group) sells the whole or any part of a substantial shareholding in another trading company.

A substantial shareholding is one where the investing company holds 10% of the ordinary share capital and is beneficially

entitled to at least 10% of the

(i) profits available for distribution to equity holders and

(ii) assets of the company available for distribution to equity holders on a winding up.

In meeting the 10% test, shares owned by a chargeable gains group may be amalgamated. The 10% test must have been

met for a continuous 12 month period during the 2 years preceding the disposal.

The companies making the disposals must have been trading companies (or members of a trading group) throughout the

12 month period, as well as at the date of disposal. In addition, they must also be trading companies (or members of a trading

group) immediately after the disposal.

The exemption is given automatically, and acts to deny losses as well as eliminate gains.

While Alantech Ltd has owned its holding in Mobile Ltd for 33 months, its ownership of the Boron holding has only lasted

for 10 months (at 1 June 2005) since Boron was acquired on 1 July 2004. Selling the shares in June 2005 will fail the

12 month test, and the gain will become chargeable.

It would be better for the companies to wait for a further month until July 2005 before selling the amalgamated shareholding.

By doing so, they will both be able to take advantage of the substantial shareholdings relief, thereby saving tax of £29,625

assuming a corporation tax rate of 19%. -

第3题:

(ii) Advise Benny of the amount of tax he could save by delaying the sale of the shares by 30 days. For the

purposes of this part, you may assume that the benefit in respect of the furnished flat is £11,800 per

year. (3 marks)

正确答案:

-

第4题:

(ii) Compute the annual income tax saving from your recommendation in (i) above as compared with the

situation where Cindy retains both the property and the shares. Identify any other tax implications

arising from your recommendation. Your answer should consider all relevant taxes. (3 marks)

正确答案:

-

第5题:

4 (a) For this part, assume today’s date is 1 March 2006.

Bill and Ben each own 50% of the ordinary share capital in Flower Limited, an unquoted UK trading company

that makes electronic toys. Flower Limited was incorporated on 1 August 2005 with 1,000 £1 ordinary shares,

and commenced trading on the same day. The business has been successful, and the company has accumulated

a large cash balance of £180,000, which is to be used to purchase a new factory. However, Bill and Ben have

received an offer from a rival company, which they are considering. The offer provides Bill and Ben with two

alternative methods of payment for the purchase of their shares:

(i) £480,000 for the company, inclusive of the £180,000 cash balance.

(ii) £300,000 for the company assuming the cash available for the factory purchase is extracted prior to sale.

Bill and Ben each currently receive a gross salary of £3,750 per month from Flower Limited. Part of the offer

terms is that Bill and Ben would be retained as employees of the company on the same salary.

Neither Bill nor Ben has used any of their capital gains tax annual exemption for the tax year 2005/06.

Required:

(i) Calculate which of the following means of extracting the £180,000 from Flower Limited on 31 March

2006 will result in the highest after tax cash amount for Bill and Ben:

(1) payment of a dividend, or

(2) payment of a salary bonus.

You are not required to consider the corporation tax (CT) implications for Flower Limited in your

answer. (5 marks)

正确答案:

As a result, Bill and Ben would each be better off by £15,005 (69,142 – 54,137). If the cash were extracted by way

of dividend.

Tutorial note: In this answer the employers’ national insurance liability on the salary has been ignored. Credit would be

given to a candidate who recognised this issue. -

第6题:

(ii) Advise Andrew of the tax implications arising from the disposal of the 7% Government Stock, clearly

identifying the tax year in which any liability will arise and how it will be paid. (3 marks)

正确答案:

(ii) Government stock is an exempt asset for the purposes of capital gains tax, however, as Andrew’s holding has a nominal

value in excess of £5,000, a charge to income tax will arise under the accrued income scheme. This charge to income

tax will arise in 2005/06, being the tax year in which the next interest payment following disposal falls due (20 April

2005) and it will relate to the income accrued for the period 21 October 2004 to 14 March 2005 of £279 (145/182

x £350). As interest on Government Stock is paid gross (unless the holder applies to receive it net), the tax due of £112

(£279 x 40%) will be collected via the self-assessment system and as the interest was an ongoing source of income

will be included within Andrew’s half yearly payments on account payable on 31 January and 31 July 2006. -

第7题:

(ii) Advise Clifford of the capital gains tax implications of the alternative of selling the Oxford house and

garden by means of two separate disposals as proposed. Calculations are not required for this part of

the question. (3 marks)

正确答案:

(ii) The implications of selling the Oxford house and garden in two separate disposals

The additional sales proceeds would result in an increase in Clifford’s capital gains and consequently his tax liability.

When computing the gain on the sale of the house together with a small part of the garden, the allowable cost would

be a proportion of the original cost. That proportion would be A/A + B where A is the value of the house and garden

that has been sold and B is the value of the part of the garden that has been retained. Principal private residence relief

and taper relief would be available in the same way as that set out in (i) above.

When computing the gain on the sale of the remainder of the garden, the cost would be the original cost of the property

less the amount used in computing the gain on the earlier disposal. Principal private residence relief would not be

available as the land sold is not a dwelling house or part of one. -

第8题:

4 Coral is the owner and managing director of Reef Ltd. She is considering the manner in which she will make her first

pension contributions. In November 2007 she inherited her mother’s house in the country of Kalania.

The following information has been extracted from client files and from telephone conversations with Coral.

Coral:

– 1972 – Born in the country of Kalania. Her father, who died in 2002, was domiciled in Kalania.

– 1999 – Moved to the UK and has lived and worked here since then.

– 2001 – Subscribed for 100% of the ordinary share capital of Reef Ltd.

– Intends to sell Reef Ltd and return to live in the country of Kalania in 2012.

– No income apart from that received from Reef Ltd.

Reef Ltd:

– A UK resident company with annual profits chargeable to corporation tax of approximately £70,000.

– Four employees including Coral.

– Provides scuba diving lessons to members of the public.

Payments from Reef Ltd to Coral in 2007/08:

– Director’s fees of £460 per month.

– Dividends paid of £14,250 in June 2007 and £14,250 in September 2007.

Pension contributions:

– Coral has not so far made any pension contributions in the tax year 2007/08 but wishes to make gross pension

contributions of £9,000.

– The contributions are to be made by Reef Ltd or Coral or a combination of the two in such a way as to minimise

the total after tax cost.

– Any contributions made by Coral will be funded by an additional dividend from Reef Ltd.

House in the country of Kalania:

– Beachfront property with potential rental income of £550 per month after deduction of allowable expenditure.

– Coral will use it for holidays for two months each year.

The tax system in the country of Kalania:

– No capital gains tax or inheritance tax.

– Income tax at 8% on income arising in the country of Kalania.

– No double tax treaty with the UK.

Required:

(a) With the objective of minimising the total after tax cost, advise Coral as to whether the gross pension

contributions of £9,000 should be made:

– wholly by Reef Ltd; or

– by Coral to the extent that they are tax allowable with the balance made by Reef Ltd.

Your answer should include supporting calculations where necessary. (9 marks)

正确答案:

-

第9题:

Which of the following operations need NOT to be entered on the Oil Record Book Part I? I、Disposal of oil residues. II、 Internal transfer of fuel oil

A.I only

B.II only

C.both I and II

D.neither I nor II

正确答案:A

-

第10题:

February18th

Ruth Walter

2921 Cypress Lane

Smith field,UT 00375

Dear Ms.Walter,

It has come to our attention that you have failed to remit payment for service provided during the two billing periods of 7/15—8/14 and 9/15—10/14 last year.

Our records indicate that multiple bills for these periods have been sent to your address with out reply.At this point.we are regrettably required to take stronger measures.If by April 15 we have not received payment in full,including all late fees charged,we will be forced to terminate service to your residence.

For further information about this action,or to verify the amount of your outstanding balance,please call our Customer Service Center at l—888—555—3802。or write to the following address:

Accounts Payable Division

Northern Utah Gas&Power

55755 State Highway 1 6

Logan,UT 00378

February 27th

Accounts Payable Division

Northern Utah Gas&Power

55755 State Highway l 6

Logan,UT 00378

Service representative,

I recently received a notification of outstanding charges on my account.I am very confused and distressed by the situation outlined in your letter.

First of all,I am certain that I paid for all services during the two billing period in question.The payments were on time and for the correct amount.I used your company’S automated telephone billing system and paid with my credit card.I am including transaction receipts from my credit card company that list these payments and the dates on which they were processed by your company.

After I had paid then,I did receive multiple bills for the periods 7/15—8/14 and 9/15—10/14 as stated in your letter.I tried repeatedly to report this error to your company via the customer service email system,but I never received a response.I am also attaching copies of these emails for your review.

These documents clearly show that I have made all payments in a timely fashion,and I hope they will help you resolve this situation.If you have any more questions for me,please contact me by phone(555-7690)or email(rwalt79@mzmail.com).

Ruth Walter

What does the first letter require Ms.Walter to do?A.Call the Customer Service Center

B.Sent payment to the utilities firm

C.Review two bills from last year

D.Verify her account balance答案:B解析:第二段第三句说,截至4月15日不缴纳费用的话就会中断服务。 -

第11题:

We have received with thanks your fax of March 30 and () to reply as follows.

- A、pleased

- B、be pleased

- C、are pleased

- D、being pleased

正确答案:C -

第12题:

问答题Practice 3 ● Your manager is considering whether to purchase or to rent a new company premise. He has asked you to write a report concerning this. ● Write a report for your manager, including the following information: ● what you know about the premise, ● why it is good for you to take the relevant action, ● how your company would benefit from it. ● Write 200-250 words.正确答案: 【参考范文】

To: Manager

From: Will Smith

Date: Oct.23, 2012

Subject: New Premise

Introduction

The Health, Safety, and Environmental team and the Admin Team jointly inspected our targeted premise-16th floor of the Fortune Building. It is an upscale office building with very good facilities such as parking lot, and A/C. The top floor of the building is what we are looking at. It is quoted 100 per square meters per month.

Recommendation

We, the working team, suggest that we would like to take this premise. We made this decision after inspecting a dozen of office buildings in the three month’s. The judgment is made in terms of the cost, fame and accessibility. The schedule of its availability can also satisfy our schedule of moving.

Conclusion

In the downtown area, this is the ONLY new office building. Locating in the downtown area means that we get much closer to all our suppliers and customers. This will make us more appealing and bring us convenience, and also save our people time, cost and energy to travel from what we are now to the downtown area. The building has really very good fame that matches us as a Multi-National Company better than before. With respect to cost, our planned budget is enough to cover the cost, and according to the agency the offer is negotiable.解析: 暂无解析 -

第13题:

6 Alasdair, aged 42, is single. He is considering investing in property, as he has heard that this represents a good

investment. In order to raise the funds to buy the property, he wants to extract cash from his personal company, Beezer

Limited, whose year end is 31 December.

Beezer Limited was formed on 1 May 1998 with £1,000 of capital issued as 1,000 £1 ordinary shares, and traded

until 1 January 2005 when Alasdair sold the trade and related assets. The company’s only asset is cash of

£120,000. Alasdair wants to extract this cash from the company with the minimum amount of tax payable. He is

considering either, paying himself a dividend of £120,000, on 31 March 2006, after which the company would have

no assets and be wound up or, leaving the cash in the company and then liquidating the company. Costs of liquidation

of £5,000 would then be incurred.

Since Beezer Limited ceased trading, Alasdair has been taken on as a partner at a marketing firm, Gallus & Co. He

estimates his profit share for the year of assessment 2005/06 will be £30,000. He has not made any capital disposals

in the current tax year.

Alasdair wishes to reinvest the cash extracted from Beezer Limited in property but is not sure whether he should invest

directly in residential or commercial property, or do so via some form. of collective investment. He is aware that Gallus

& Co are looking to rent a new warehouse which could be bought for £200,000. Alasdair thinks that he may be able

to buy the warehouse himself and lease it to his firm, but only if he can borrow the additional money to buy the

property.

Alasdair has a 25% shareholding in another company, Glaikit Limited, whose year end is 31 March. The remaining

shares in this company are held by his friend, Gill. Alasdair is considering borrowing £15,000 from Glaikit Limited

on 1 January 2006. He does not intend to pay any interest on the loan, which is likely to be written off some time

in 2007. Alasdair does not have any connection with Glaikit Limited other than his shareholding.

Required:

(a) Advise Alasdair whether or not a dividend payment will result in a higher after-tax cash sum than the

liquidation of Beezer Limited. Assume that either the dividend would be paid on 31 March 2006 or the

liquidation would take place on 31 March 2006. (9 marks)

Assume that Beezer Limited has always paid corporation tax at or above the small companies rate of 19%

and that the tax rates and allowances for 2004/05 apply throughout this part.

正确答案:

-

第14题:

(b) Mabel has two objectives when making the gifts to Bruce and Padma:

(1) To pay no tax on any gift in her lifetime; and

(2) To reduce the eventual liability to inheritance tax on her death.

Advise Mabel which item to gift to Bruce and to Padma in order to satisfy her objectives. Give reasons for

your advice.

Your advice should include a computation of the inheritance tax saved as a result of the two gifts, on the

assumption that Mabel dies on 30 June 2011. (10 marks)

正确答案:

-

第15题:

3 On 1 January 2007 Dovedale Ltd, a company with no subsidiaries, intends to purchase 65% of the ordinary share

capital of Hira Ltd from Belgrove Ltd. Belgrove Ltd currently owns 100% of the share capital of Hira Ltd and has no

other subsidiaries. All three companies have their head offices in the UK and are UK resident.

Hira Ltd had trading losses brought forward, as at 1 April 2006, of £18,600 and no income or gains against which

to offset losses in the year ended 31 March 2006. In the year ending 31 March 2007 the company expects to make

further tax adjusted trading losses of £55,000 before deduction of capital allowances, and to have no other income

or gains. The tax written down value of Hira Ltd’s plant and machinery as at 31 March 2006 was £96,000 and

there will be no fixed asset additions or disposals in the year ending 31 March 2007. In the year ending 31 March

2008 a small tax adjusted trading loss is anticipated. Hira Ltd will surrender the maximum possible trading losses

to Belgrove Ltd and Dovedale Ltd.

The tax adjusted trading profit of Dovedale Ltd for the year ending 31 March 2007 is expected to be £875,000 and

to continue at this level in the future. The profits chargeable to corporation tax of Belgrove Ltd are expected to be

£38,000 for the year ending 31 March 2007 and to increase in the future.

On 1 February 2007 Dovedale Ltd will sell a small office building to Hira Ltd for its market value of £234,000.

Dovedale Ltd purchased the building in March 2005 for £210,000. In October 2004 Dovedale Ltd sold a factory

for £277,450 making a capital gain of £84,217. A claim was made to roll over the gain on the sale of the factory

against the acquisition cost of the office building.

On 1 April 2007 Dovedale Ltd intends to acquire the whole of the ordinary share capital of Atapo Inc, an unquoted

company resident in the country of Morovia. Atapo Inc sells components to Dovedale Ltd as well as to other

companies in Morovia and around the world.

It is estimated that Atapo Inc will make a profit before tax of £160,000 in the year ending 31 March 2008 and will

pay a dividend to Dovedale Ltd of £105,000. It can be assumed that Atapo Inc’s taxable profits are equal to its profit

before tax. The rate of corporation tax in Morovia is 9%. There is a withholding tax of 3% on dividends paid to

non-Morovian resident shareholders. There is no double tax agreement between the UK and Morovia.

Required:

(a) Advise Belgrove Ltd of any capital gains that may arise as a result of the sale of the shares in Hira Ltd. You

are not required to calculate any capital gains in this part of the question. (4 marks)

正确答案:

(a) Capital gains that may arise on the sale by Belgrove Ltd of shares in Hira Ltd

Belgrove Ltd will realise a capital gain on the sale of the shares unless the substantial shareholding exemption applies. The

exemption will be given automatically provided all of the following conditions are satisfied.

– Belgrove Ltd has owned at least 10% of Hira Ltd for a minimum of 12 months during the two years prior to the sale.

– Belgrove Ltd is a trading company or a member of a trading group during that 12-month period and immediately after

the sale.

– Hira Ltd is a trading company or the holding company of a trading group during that 12-month period and immediately

after the sale.

Hira Ltd will no longer be in a capital gains group with Belgrove Ltd after the sale. Accordingly, a capital gain, known as a

degrouping charge, may arise in Hira Ltd. A degrouping charge will arise if, at the time it leaves the Belgrove Ltd group, Hira

Ltd owns any capital assets which were transferred to it at no gain, no loss within the previous six years by a member of the

Belgrove Ltd capital gains group. -

第16题:

(ii) Assuming the relief in (i) is available, advise Sharon on the maximum amount of cash she could receive

on incorporation, without triggering a capital gains tax (CGT) liability. (3 marks)

正确答案:

(ii) As Sharon is entitled to the full rate of business asset taper relief, any gain will be reduced by 75%. The position is

maximised where the chargeable gain equals Sharon’s unused capital gains tax annual exemption of £8,500. Thus,

before taper relief, the gain she requires is £34,000 (1/0·25 x £8,500).

The amount to be held over is therefore £46,000 (80,000 – 34,000). Where part of the consideration is in the form

of cash, the gain eligible for incorporation relief is calculated using the formula:

Gain deferred = Gain x value of shares issued/total consideration

The formula is manipulated on the following basis:

£46,000 = £80,000 x (shares/120,000)

Shares/120,000 = £46,000/80,000

Shares = £46,000 x 120,000/80,000

i.e. £69,000.

As the total consideration is £120,000, this means that Sharon can take £51,000 (£120,000 – £69,000) in cash

without any CGT consequences. -

第17题:

(ii) Calculate the corporation tax (CT) payable by Tay Limited for the year ended 31 March 2006, taking

advantage of all available reliefs. (3 marks)

正确答案:

-

第18题:

(b) (i) Advise Andrew of the income tax (IT) and capital gains tax (CGT) reliefs available on his investment in

the ordinary share capital of Scalar Limited, together with any conditions which need to be satisfied.

Your answer should clearly identify any steps that should be taken by Andrew and the other investors

to obtain the maximum relief. (13 marks)

正确答案:

(b) (i) Andrew may be able to take advantage of tax reliefs under the enterprise investment scheme (EIS) provided the

necessary conditions are met. The conditions that have to be satisfied before full relief is available fall into three areas,

and broadly require that a ‘qualifying individual’ subscribes for ‘eligible shares’ in a ‘qualifying company’.

‘Qualifying Individual’

To be a qualifying individual, Andrew must not be connected with the EIS company. This means that he should not be

an employee (or, at the time the shares are issued, a director) or have an interest in (i.e. control) 30% or more of the

capital of the company. These conditions need to be satisfied throughout the period beginning two years before the share

issue and three years after the ‘relevant date’. Where the relevant date is defined as the later of the date the shares were

issued and the date on which the company commenced trading.

Andrew does not intend to become an employee (or director) of Scalar Limited, but he needs to exercise caution as to

how many shares he subscribes for. If only three investors subscribe for 100% of the shares, each will hold 33% of the

share capital. This exceeds the 30% limit and will mean that EIS relief (other than deferral relief) will not be available.

Therefore, Andrew and the other two investors should ensure not only that the potential fourth investor is recruited, but

that s/he subscribes for sufficient shares, such that none of them will hold 30% or more of the issued share capital, as

only then will they all attain qualifying individual status.

‘Eligible shares’

Qualifying shares need to be new ordinary shares which are subscribed for in cash and fully paid up at the time of issue.

The shares must not be redeemable for at least three years from the relevant date, and not carry any preferential rights

to dividends. On the basis of the information provided, the shares of Scalar Limited would qualify as eligible shares.

‘Qualifying Company’

The company must be unquoted, not controlled by another company, and engaged in qualifying business activities. The

latter requires that the company engage in a trading activity, which is carried on wholly or mainly in the UK, throughout

the three years following the relevant date. While certain trading activities, such as dealing in shares or trading in land,

are excluded, the manufacturing trade Scalar Limited proposes to carry on will qualify.

However, it is also necessary for at least 80% of the money raised to be used for the qualifying business activity within

12 months of the relevant date and the remaining 20% to be so used within the following 12 months. Andrew and the

other investors will thus have to ensure that Scalar Limited has not raised more funds than it is able to employ in the

business within the appropriate time periods.

Reliefs available:

Andrew can claim income tax relief at 20% income tax relief on the amount invested up to a maximum of £200,000

in any one tax year. The relief is given in the form. of a tax reducing allowance, which can reduce the investor’s income

tax liability to nil, but cannot be used to generate a tax refund. If the investment is made prior to 6 October in the tax

year, then 50% of the amount invested (up to a maximum of £25,000) can be treated as having been made in the

previous tax year.

Any capital gains arising on the sale of EIS shares will be fully exempt from capital gains tax provided that income tax

relief was given on the investment when made and has not been withdrawn. If the EIS shares are disposed of at a loss,

capital losses are still allowable, but reduced by the amount of any EIS relief attributable to the shares disposed of.

In addition, gains from the disposal of other assets can be deferred against the base cost of EIS shares acquired within

one year before and three years after their disposal. Such gains will, thus, not normally become chargeable until the EIS

shares themselves are disposed of. Further, for deferral relief to be available, it is not necessary for the investment to

qualify for EIS income tax relief, i.e. deferral is available even where the investor is not a qualifying individual. Thus,

Andrew could still defer the gain arising on the disposal of the residential property lease made in order to raise part of

the funds for his EIS investment, even if no fourth investor were to be found and his shareholding were to exceed 30%

of the issued share capital of Scalar Limited. Does not require the existence of income tax relief in order to be claimed.

Withdrawal of relief:

Any EIS relief claimed by Andrew will be withdrawn (partially or fully) if, within three year of the relevant date:

(1) he disposes of the shares;

(2) he receives value from the company;

(3) he ceases to be a qualifying individual; or

(4) Scalar Limited ceases to be a qualifying company.

With regard to receiving value from the company, the definition excludes dividends which do not exceed a normal rate

of return, but does include the repayment of any loans made to the company before the shares were issued, the provision

of benefits and the purchase of assets from the company at an undervalue. In this regard, Andrew and the other

subscribers should ensure that the £50,000 they are to invest in Scalar Limited as loan capital is appropriately timed

and structured relative to the issue of the EIS shares. -

第19题:

3 Palm plc recently acquired 100% of the ordinary share capital of Nikau Ltd from Facet Ltd. Palm plc intends to use

Nikau Ltd to develop a new product range, under the name ‘Project Sabal’. Nikau Ltd owns shares in a non-UK

resident company, Date Inc.

The following information has been extracted from client files and from a meeting with the Finance Director of Palm

plc.

Palm plc:

– Has more than 40 wholly owned subsidiaries such that all group companies pay corporation tax at 30%.

– All group companies prepare accounts to 31 March.

– Acquired Nikau Ltd on 1 November 2007 from Facet Ltd, an unrelated company.

Nikau Ltd:

– UK resident company that manufactures domestic electronic appliances for sale in the European Union (EU).

– Large enterprise for the purposes of the enhanced relief available for research and development expenditure.

– Trading losses brought forward as at 1 April 2007 of £195,700.

– Budgeted taxable trading profit of £360,000 for the year ending 31 March 2008 before taking account of ‘Project

Sabal’.

– Dividend income of £38,200 will be received in the year ending 31 March 2008 in respect of the shares in Date

Inc.

‘Project Sabal’:

– Development of a range of electronic appliances, for sale in North America.

– Project Sabal will represent a significant advance in the technology of domestic appliances.

– Nikau Ltd will spend £70,000 on staffing costs and consumables researching and developing the necessary

technology between now and 31 March 2008. Further costs will be incurred in the following year.

– Sales to North America will commence in 2009 and are expected to generate significant profits from that year.

Shares in Date Inc:

– Nikau Ltd owns 35% of the ordinary share capital of Date Inc.

– The shares were purchased from Facet Ltd on 1 June 2003 for their market value of £338,000.

– The sale was a no gain, no loss transfer for the purposes of corporation tax.

– Facet Ltd purchased the shares in Date Inc on 1 March 1994 for £137,000.

Date Inc:

– A controlled foreign company resident in the country of Palladia.

– Annual chargeable profits arising out of property investment activities are approximately £120,000, of which

approximately £115,000 is distributed to its shareholders each year.

The tax system in Palladia:

– No taxes on income or capital profits.

– 4% withholding tax on dividends paid to shareholders resident outside Palladia.

Required:

(a) Prepare detailed explanatory notes, including relevant supporting calculations, on the effect of the following

issues on the amount of corporation tax payable by Nikau Ltd for the year ending 31 March 2008.

(i) The costs of developing ‘Project Sabal’ and the significant commercial changes to the company’s

activities arising out of its implementation. (8 marks)

正确答案:

(a) Nikau Ltd – Effect on corporation tax payable for the year ending 31 March 2008

(i) Project Sabal

Research and development expenditure

The expenditure incurred in respect of research and development will give rise to an enhanced deduction for the

purposes of computing the taxable trading profits of Nikau Ltd. The enhanced deduction is 125% of the qualifying

expenditure as Nikau Ltd is a large enterprise for this purpose.

The expenditure will reduce the profits chargeable to corporation tax of Nikau Ltd by £87,500 (£70,000 x 1·25) and

its corporation tax liability by £26,250 (£87,500 x 30%).

The budgeted expenditure will qualify for the enhanced deduction because it appears to satisfy the following conditions.

– It is likely to qualify as research and development expenditure within generally accepted accounting principles as

it will result in new technical knowledge and the production of a substantially improved device for use in the

industry.

– It exceeds £10,000 in Nikau Ltd’s accounting period.

– It relates to staff costs, consumable items or other qualifying expenditure as opposed to capital items.

– It will result in further trading activities for Nikau Ltd.

Use of brought forward trading losses

The development of products for the North American market is likely to represent a major change in the nature and

conduct of the trade of Nikau Ltd. This is because the company is developing new products and intends to sell them in

a new market. It is a major change as sales to North America are expected to generate significant additional profits.

Because this change will occur within three years of the change in the ownership of Nikau Ltd on 1 November 2007,

any trading losses arising prior to that date cannot be carried forward beyond that date.

Accordingly, the trading losses brought forward may only be offset against £158,958 ((£360,000 – £87,500) x 7/12)

of the company’s trading profits for the year. The remainder of the trading losses £36,742 (£195,700 – £158,958) will

be lost resulting in lost tax relief of £11,023 (£36,742 x 30%).

Tutorial note

The profits for the year ending 31 March 2008 will be apportioned to the periods pre and post 1 November 2007 on

either a time basis or some other basis that is just and reasonable. -

第20题:

(ii) On 1 July 2006 Petrie introduced a 10-year warranty on all sales of its entire range of stainless steel

cookware. Sales of stainless steel cookware for the year ended 31 March 2007 totalled $18·2 million. The

notes to the financial statements disclose the following:

‘Since 1 July 2006, the company’s stainless steel cookware is guaranteed to be free from defects in

materials and workmanship under normal household use within a 10-year guarantee period. No provision

has been recognised as the amount of the obligation cannot be measured with sufficient reliability.’

(4 marks)

Your auditor’s report on the financial statements for the year ended 31 March 2006 was unmodified.

Required:

Identify and comment on the implications of these two matters for your auditor’s report on the financial

statements of Petrie Co for the year ended 31 March 2007.

NOTE: The mark allocation is shown against each of the matters above.

正确答案:

(ii) 10-year guarantee

$18·2 million stainless steel cookware sales amount to 43·1% of revenue and are therefore material. However, the

guarantee was only introduced three months into the year, say in respect of $13·6 million (3/4 × 18·2 million) i.e.

approximately 32% of revenue.

The draft note disclosure could indicate that Petrie’s management believes that Petrie has a legal obligation in respect

of the guarantee, that is not remote and likely to be material (otherwise no disclosure would have been required).

A best estimate of the obligation amounting to 5% profit before tax (or more) is likely to be considered material, i.e.

$90,000 (or more). Therefore, if it is probable that 0·66% of sales made under guarantee will be returned for refund,

this would require a warranty provision that would be material.

Tutorial note: The return of 2/3% of sales over a 10-year period may well be probable.

Clearly there is a present obligation as a result of a past obligating event for sales made during the nine months to

31 March 2007. Although the likelihood of outflow under the guarantee is likely to be insignificant (even remote) it is

probable that some outflow will be needed to settle the class of such obligations.

The note in the financial statements is disclosing this matter as a contingent liability. This term encompasses liabilities

that do not meet the recognition criteria (e.g. of reliable measurement in accordance with IAS 37 Provisions, Contingent

Liabilities and Contingent Assets).

However, it is extremely rare that no reliable estimate can be made (IAS 37) – the use of estimates being essential to

the preparation of financial statements. Petrie’s management must make a best estimate of the cost of refunds/repairs

under guarantee taking into account, for example:

■ the proportion of sales during the nine months to 31 March 2007 that have been returned under guarantee at the

balance sheet date (and in the post balance sheet event period);

■ the average age of cookware showing a defect;

■ the expected cost of a replacement item (as a refund of replacement is more likely than a repair, say).

If management do not make a provision for the best estimate of the obligation the audit opinion should be qualified

‘except for’ non-compliance with IAS 37 (no provision made). The disclosure made in the note to the financial

statements, however detailed, is not a substitute for making the provision.

Tutorial note: No marks will be awarded for suggesting that an emphasis of matter of paragraph would be appropriate

(drawing attention to the matter more fully explained in the note).

Management’s claim that the obligation cannot be measured with sufficient reliability does not give rise to a limitation

on scope on the audit. The auditor has sufficient evidence of the non-compliance with IAS 37 and disagrees with it. -

第21题:

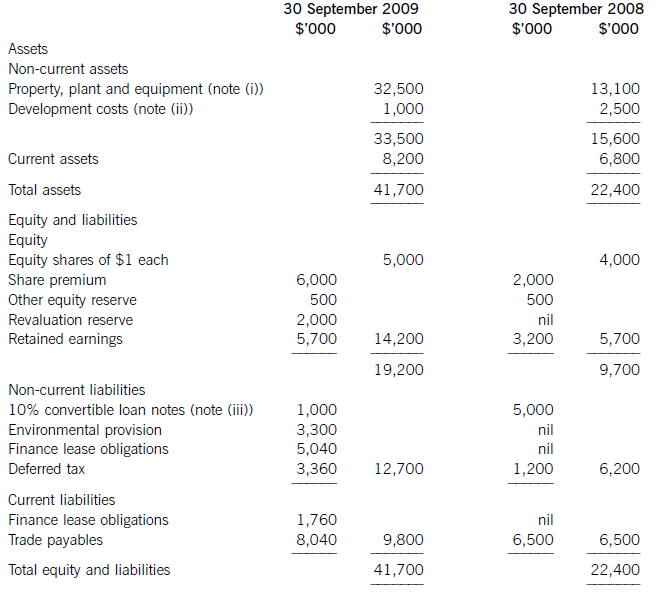

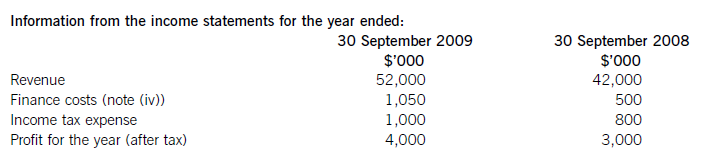

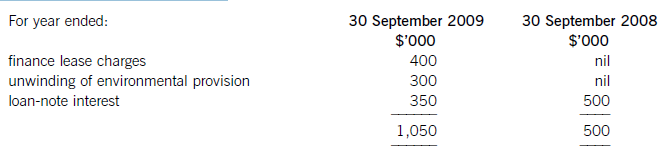

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

正确答案:

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced. -

第22题:

资料:To:Sherry Linton

From:Melanie Jury

Date:15 July

Subject:Purchase orders

Please note that a purchase order (copy attached) must be completed for all purchases over 50 USD.

Complete purchase orders should be passed to Christine Hantke to agree terms of payment with the supplier, and then sent to the Manchester office for final approval.

Purchase orders under 50 USD can be paid for from the petty cash account.

Many thanks for your co-operation.

MJ

Which of the following is NOT a step that should be completed before making a purchase over 50 USD?A.Getting the approval from the Manchester office.

B.Passing the order to Christine Hantke.

C.Using the petty cash account.

D.Completing a purchase order.答案:C解析:本题的问题是“下列哪一项不是采购超过50美元的物品前应该完成的步骤?”选项A意为“获得曼彻斯特办事处的批准”;选项B意为“将订单交给Christine Hantke”;选项C意为“使用小额现金账户”;选项D意为“完成采购订单”。根据主题句可知,A、B、D三个选项均有涉及,选项C“使用零用现金账户”是支付50美元以下的采购物品的,故符合题意。 -

第23题:

问答题Task II (20 marks) Directions:Many nations’ serious school problems nowadays result from the students’ attitude. What causes these problems? What’s your opinion to deal with these problems? State your opinion in no less than about 160 words, and write it on the Answer Sheet.正确答案:

Nowadays in many nations there are serious school problems—absenteeism, disrespect for teachers, drug abuse, and tardiness. Serious school problems are positively associated with high-risk behaviors of teens: smoking, drinking alcohol, smoking marijuana, and so.

There might be many causes for these various school problems in different cases, but one reason is in common—the student’s attitude. Every single person is responsible for his or her own actions, so do the students. And if one’s attitude is upright, there would be no reason for him or her to misbehave. On the contrary, if a student is experiencing serious school problems, parents and teachers better take a close look into his or her attitude. There must be something wrong with it.

Thus, in order to prevent serious school problems, it is necessary to cultivate a positive attitude in the students. Positive attitude will bring out the best in them and will become the key to their success at school.

(Word Count: 158)解析: 暂无解析