The following information is relevant for questions 9 and 10A company’s draft financial statements for 2005 showed a profit of $630,000. However, the trial balance did not agree,and a suspense account appeared in the company’s draft balance sheet.Subseque

题目

The following information is relevant for questions 9 and 10

A company’s draft financial statements for 2005 showed a profit of $630,000. However, the trial balance did not agree,

and a suspense account appeared in the company’s draft balance sheet.

Subsequent checking revealed the following errors:

(1) The cost of an item of plant $48,000 had been entered in the cash book and in the plant account as $4,800.

Depreciation at the rate of 10% per year ($480) had been charged.

(2) Bank charges of $440 appeared in the bank statement in December 2005 but had not been entered in the

company’s records.

(3) One of the directors of the company paid $800 due to a supplier in the company’s payables ledger by a personal

cheque. The bookkeeper recorded a debit in the supplier’s ledger account but did not complete the double entry

for the transaction. (The company does not maintain a payables ledger control account).

(4) The payments side of the cash book had been understated by $10,000.

9 Which of the above items would require an entry to the suspense account in correcting them?

A All four items

B 3 and 4 only

C 2 and 3 only

D 1, 2 and 4 only

相似考题

更多“The following information is relevant for questions 9 and 10A company’s draft financial statements for 2005 showed a profit of $630,000. However, the trial balance did not agree,and a suspense account appeared in the company’s draft balance sheet.Subseque”相关问题

-

第1题:

14 Alpha buys goods from Beta. At 30 June 2005 Beta’s account in Alpha’s records showed $5,700 owing to Beta.

Beta submitted a statement to Alpha as at the same date showing a balance due of $5,200.

Which of the following could account fully for the difference?

A Alpha has sent a cheque to Beta for $500 which has not yet been received by Beta.

B The credit side of Beta’s account in Alpha’s records has been undercast by $500.

C An invoice for $250 from Beta has been treated in Alpha’s records as if it had been a credit note.

D Beta has issued a credit note for $500 to Alpha which Alpha has not yet received.

正确答案:D

-

第2题:

23 The capital structure of a company at 30 June 2005 is as follows:

$m

Ordinary share capital 100

Share premium account 40

Retained earnings 60

10% Loan notes 40

The company’s income statement for the year ended 30 June 2005 showed:

$m

Operating profit 44

Loan note interest (4)

___

Profit for year 40

____

What is the company’s return on capital employed?

A 40/240 = 162/3 per cent

B 40/100 = 40 per cent

C 44/240 = 181/3 per cent

D 44/200 = 22 per cent

正确答案:C

-

第3题:

9 Which of the following items must be disclosed in a company’s published financial statements (including notes)

if material, according to IAS1 Presentation of financial statements?

1 Finance costs.

2 Staff costs.

3 Depreciation and amortisation expense.

4 Movements on share capital.

A 1 and 3 only

B 1, 2 and 4 only

C 2, 3 and 4 only

D All four items

正确答案:D

-

第4题:

2 The draft financial statements of Choctaw, a limited liability company, for the year ended 31 December 2004 showed

a profit of $86,400. The trial balance did not balance, and a suspense account with a credit balance of $3,310 was

included in the balance sheet.

In subsequent checking the following errors were found:

(a) Depreciation of motor vehicles at 25 per cent was calculated for the year ended 31 December 2004 on the

reducing balance basis, and should have been calculated on the straight-line basis at 25 per cent.

Relevant figures:

Cost of motor vehicles $120,000, net book value at 1 January 2004, $88,000

(b) Rent received from subletting part of the office accommodation $1,200 had been put into the petty cash box.

No receivable balance had been recognised when the rent fell due and no entries had been made in the petty

cash book or elsewhere for it. The petty cash float in the trial balance is the amount according to the records,

which is $1,200 less than the actual balance in the box.

(c) Bad debts totalling $8,400 are to be written off.

(d) The opening accrual on the motor repairs account of $3,400, representing repair bills due but not paid at

31 December 2003, had not been brought down at 1 January 2004.

(e) The cash discount totals for December 2004 had not been posted to the discount accounts in the nominal ledger.

The figures were:

$

Discount allowed 380

Discount received 290

After the necessary entries, the suspense account balanced.

Required:

Prepare journal entries, with narratives, to correct the errors found, and prepare a statement showing the

necessary adjustments to the profit.

(10 marks)

正确答案:

-

第5题:

2 The draft financial statements of Rampion, a limited liability company, for the year ended 31 December 2005

included the following figures:

$

Profit 684,000

Closing inventory 116,800

Trade receivables 248,000

Allowance for receivables 10,000

No adjustments have yet been made for the following matters:

(1) The company’s inventory count was carried out on 3 January 2006 leading to the figure shown above. Sales

between the close of business on 31 December 2005 and the inventory count totalled $36,000. There were no

deliveries from suppliers in that period. The company fixes selling prices to produce a 40% gross profit on sales.

The $36,000 sales were included in the sales records in January 2006.

(2) $10,000 of goods supplied on sale or return terms in December 2005 have been included as sales and

receivables. They had cost $6,000. On 10 January 2006 the customer returned the goods in good condition.

(3) Goods included in inventory at cost $18,000 were sold in January 2006 for $13,500. Selling expenses were

$500.

(4) $8,000 of trade receivables are to be written off.

(5) The allowance for receivables is to be adjusted to the equivalent of 5% of the trade receivables after allowing for

the above matters, based on past experience.

Required:

(a) Prepare a statement showing the effect of the adjustments on the company’s net profit for the year ended

31 December 2005. (5 marks)

正确答案:

-

第6题:

(b) You are the audit manager of Johnston Co, a private company. The draft consolidated financial statements for

the year ended 31 March 2006 show profit before taxation of $10·5 million (2005 – $9·4 million) and total

assets of $55·2 million (2005 – $50·7 million).

Your firm was appointed auditor of Tiltman Co when Johnston Co acquired all the shares of Tiltman Co in March

2006. Tiltman’s draft financial statements for the year ended 31 March 2006 show profit before taxation of

$0·7 million (2005 – $1·7 million) and total assets of $16·1 million (2005 – $16·6 million). The auditor’s

report on the financial statements for the year ended 31 March 2005 was unmodified.

You are currently reviewing two matters that have been left for your attention on the audit working paper files for

the year ended 31 March 2006:

(i) In December 2004 Tiltman installed a new computer system that properly quantified an overvaluation of

inventory amounting to $2·7 million. This is being written off over three years.

(ii) In May 2006, Tiltman’s head office was relocated to Johnston’s premises as part of a restructuring.

Provisions for the resulting redundancies and non-cancellable lease payments amounting to $2·3 million

have been made in the financial statements of Tiltman for the year ended 31 March 2006.

Required:

Identify and comment on the implications of these two matters for your auditor’s reports on the financial

statements of Johnston Co and Tiltman Co for the year ended 31 March 2006. (10 marks)

正确答案:

(b) Tiltman Co

Tiltman’s total assets at 31 March 2006 represent 29% (16·1/55·2 × 100) of Johnston’s total assets. The subsidiary is

therefore material to Johnston’s consolidated financial statements.

Tutorial note: Tiltman’s profit for the year is not relevant as the acquisition took place just before the year end and will

therefore have no impact on the consolidated income statement. Calculations of the effect on consolidated profit before

taxation are therefore inappropriate and will not be awarded marks.

(i) Inventory overvaluation

This should have been written off to the income statement in the year to 31 March 2005 and not spread over three

years (contrary to IAS 2 ‘Inventories’).

At 31 March 2006 inventory is overvalued by $0·9m. This represents all Tiltmans’s profit for the year and 5·6% of

total assets and is material. At 31 March 2005 inventory was materially overvalued by $1·8m ($1·7m reported profit

should have been a $0·1m loss).

Tutorial note: 1/3 of the overvaluation was written off in the prior period (i.e. year to 31 March 2005) instead of $2·7m.

That the prior period’s auditor’s report was unmodified means that the previous auditor concurred with an incorrect

accounting treatment (or otherwise gave an inappropriate audit opinion).

As the matter is material a prior period adjustment is required (IAS 8 ‘Accounting Policies, Changes in Accounting

Estimates and Errors’). $1·8m should be written off against opening reserves (i.e. restated as at 1 April 2005).

(ii) Restructuring provision

$2·3m expense has been charged to Tiltman’s profit and loss in arriving at a draft profit of $0·7m. This is very material.

(The provision represents 14·3% of Tiltman’s total assets and is material to the balance sheet date also.)

The provision for redundancies and onerous contracts should not have been made for the year ended 31 March 2006

unless there was a constructive obligation at the balance sheet date (IAS 37 ‘Provisions, Contingent Liabilities and

Contingent Assets’). So, unless the main features of the restructuring plan had been announced to those affected (i.e.

redundancy notifications issued to employees), the provision should be reversed. However, it should then be disclosed

as a non-adjusting post balance sheet event (IAS 10 ‘Events After the Balance Sheet Date’).

Given the short time (less than one month) between acquisition and the balance sheet it is very possible that a

constructive obligation does not arise at the balance sheet date. The relocation in May was only part of a restructuring

(and could be the first evidence that Johnston’s management has started to implement a restructuring plan).

There is a risk that goodwill on consolidation of Tiltman may be overstated in Johnston’s consolidated financial

statements. To avoid the $2·3 expense having a significant effect on post-acquisition profit (which may be negligible

due to the short time between acquisition and year end), Johnston may have recognised it as a liability in the

determination of goodwill on acquisition.

However, the execution of Tiltman’s restructuring plan, though made for the year ended 31 March 2006, was conditional

upon its acquisition by Johnston. It does not therefore represent, immediately before the business combination, a

present obligation of Johnston. Nor is it a contingent liability of Johnston immediately before the combination. Therefore

Johnston cannot recognise a liability for Tiltman’s restructuring plans as part of allocating the cost of the combination

(IFRS 3 ‘Business Combinations’).

Tiltman’s auditor’s report

The following adjustments are required to the financial statements:

■ restructuring provision, $2·3m, eliminated;

■ adequate disclosure of relocation as a non-adjusting post balance sheet event;

■ current period inventory written down by $0·9m;

■ prior period inventory (and reserves) written down by $1·8m.

Profit for the year to 31 March 2006 should be $3·9m ($0·7 + $0·9 + $2·3).

If all these adjustments are made the auditor’s report should be unmodified. Otherwise, the auditor’s report should be

qualified ‘except for’ on grounds of disagreement. If none of the adjustments are made, the qualification should still be

‘except for’ as the matters are not pervasive.

Johnston’s auditor’s report

If Tiltman’s auditor’s report is unmodified (because the required adjustments are made) the auditor’s report of Johnston

should be similarly unmodified. As Tiltman is wholly-owned by Johnston there should be no problem getting the

adjustments made.

If no adjustments were made in Tiltman’s financial statements, adjustments could be made on consolidation, if

necessary, to avoid modification of the auditor’s report on Johnston’s financial statements.

The effect of these adjustments on Tiltman’s net assets is an increase of $1·4m. Goodwill arising on consolidation (if

any) would be reduced by $1·4m. The reduction in consolidated total assets required ($0·9m + $1·4m) is therefore

the same as the reduction in consolidated total liabilities (i.e. $2·3m). $2·3m is material (4·2% consolidated total

assets). If Tiltman’s financial statements are not adjusted and no adjustments are made on consolidation, the

consolidated financial position (balance sheet) should be qualified ‘except for’. The results of operations (i.e. profit for

the period) should be unqualified (if permitted in the jurisdiction in which Johnston reports).

Adjustment in respect of the inventory valuation may not be required as Johnston should have consolidated inventory

at fair value on acquisition. In this case, consolidated total liabilities should be reduced by $2·3m and goodwill arising

on consolidation (if any) reduced by $2·3m.

Tutorial note: The effect of any possible goodwill impairment has been ignored as the subsidiary has only just been

acquired and the balance sheet date is very close to the date of acquisition. -

第7题:

You are an audit manager responsible for providing hot reviews on selected audit clients within your firm of Chartered

Certified Accountants. You are currently reviewing the audit working papers for Pulp Co, a long standing audit client,

for the year ended 31 January 2008. The draft statement of financial position (balance sheet) of Pulp Co shows total

assets of $12 million (2007 – $11·5 million).The audit senior has made the following comment in a summary of

issues for your review:

‘Pulp Co’s statement of financial position (balance sheet) shows a receivable classified as a current asset with a value

of $25,000. The only audit evidence we have requested and obtained is a management representation stating the

following:

(1) that the amount is owed to Pulp Co from Jarvis Co,

(2) that Jarvis Co is controlled by Pulp Co’s chairman, Peter Sheffield, and

(3) that the balance is likely to be received six months after Pulp Co’s year end.

The receivable was also outstanding at the last year end when an identical management representation was provided,

and our working papers noted that because the balance was immaterial no further work was considered necessary.

No disclosure has been made in the financial statements regarding the balance. Jarvis Co is not audited by our firm

and we have verified that Pulp Co does not own any shares in Jarvis Co.’

Required:

(b) In relation to the receivable recognised on the statement of financial position (balance sheet) of Pulp Co as

at 31 January 2008:

(i) Comment on the matters you should consider. (5 marks)

正确答案:

(b) (i) Matters to consider

Materiality

The receivable represents only 0·2% (25,000/12 million x 100) of total assets so is immaterial in monetary terms.

However, the details of the transaction could make it material by nature.

The amount is outstanding from a company under the control of Pulp Co’s chairman. Readers of the financial statements

would be interested to know the details of this transaction, which currently is not disclosed. Elements of the transaction

could be subject to bias, specifically the repayment terms, which appear to be beyond normal commercial credit terms.

Paul Sheffield may have used his influence over the two companies to ‘engineer’ the transaction. Disclosure is necessary

due to the nature of the transaction, the monetary value is irrelevant.

A further matter to consider is whether this is a one-off transaction, or indicative of further transactions between the two

companies.

Relevant accounting standard

The definitions in IAS 24 must be carefully considered to establish whether this actually constitutes a related party

transaction. The standard specifically states that two entities are not necessarily related parties just because they have

a director or other member of key management in common. The audit senior states that Jarvis Co is controlled by Peter

Sheffield, who is also the chairman of Pulp Co. It seems that Peter Sheffield is in a position of control/significant influence

over the two companies (though this would have to be clarified through further audit procedures), and thus the two

companies are likely to be perceived as related.

IAS 24 requires full disclosure of the following in respect of related party transactions:

– the nature of the related party relationship,

– the amount of the transaction,

– the amount of any balances outstanding including terms and conditions, details of security offered, and the nature

of consideration to be provided in settlement,

– any allowances for receivables and associated expense.

There is currently a breach of IAS 24 as no disclosure has been made in the notes to the financial statements. If not

amended, the audit opinion on the financial statements should be qualified with an ‘except for’ disagreement. In

addition, if practicable, the auditor’s report should include the information that would have been included in the financial

statements had the requirements of IAS 24 been adhered to.

Valuation and classification of the receivable

A receivable should only be recognised if it will give rise to future economic benefit, i.e. a future cash inflow. It appears

that the receivable is long outstanding – if the amount is unlikely to be recovered then it should be written off as a bad

debt and the associated expense recognised. It is possible that assets and profits are overstated.

Although a representation has been received indicating that the amount will be paid to Pulp Co, the auditor should be

sceptical of this claim given that the same representation was given last year, and the amount was not subsequently

recovered. The $25,000 could be recoverable in the long term, in which case the receivable should be reclassified as

a non-current asset. The amount advanced to Jarvis Co could effectively be an investment rather than a short term

receivable. Correct classification on the statement of financial position (balance sheet) is crucial for the financial

statements to properly show the liquidity position of the company at the year end.

Tutorial note: Digressions into management imposing a limitation in scope by withholding evidence are irrelevant in this

case, as the scenario states that the only evidence that the auditors have asked for is a management representation.

There is no indication in the scenario that the auditors have asked for, and been refused any evidence. -

第8题:

听力原文:M: Can you tell me something about a balance sheet?

W: Yes. It is divided into three sections: assets, liabilities, and owner's equity and it is used to summarize a company's financial position on a given date.

Q: Which of the following is not a section of a balance sheet?

(15)

A.Profit and Joss

B.Owner's equity.

C.Liabilities

D.Assets.

正确答案:A

解析:根据女士回答资产负债表分为三部分,即"assets", "liabilities" 和"owner's equity",A项未提及。 -

第9题:

This company ( ) that it had made a profit of $107 billion by the end of this year, however, most of the share holders did not believe it.A.states

B.claims

C.asserts

D.announces

正确答案:B

-

第10题:

You are an audit manager at Rockwell & Co, a firm of Chartered Certified Accountants. You are responsible for the audit of the Hopper Group, a listed audit client which supplies ingredients to the food and beverage industry worldwide.

The audit work for the year ended 30 June 2015 is nearly complete, and you are reviewing the draft audit report which has been prepared by the audit senior. During the year the Hopper Group purchased a new subsidiary company, Seurat Sweeteners Co, which has expertise in the research and design of sugar alternatives. The draft financial statements of the Hopper Group for the year ended 30 June 2015 recognise profit before tax of $495 million (2014 – $462 million) and total assets of $4,617 million (2014: $4,751 million). An extract from the draft audit report is shown below:

Basis of modified opinion (extract)

In their calculation of goodwill on the acquisition of the new subsidiary, the directors have failed to recognise consideration which is contingent upon meeting certain development targets. The directors believe that it is unlikely that these targets will be met by the subsidiary company and, therefore, have not recorded the contingent consideration in the cost of the acquisition. They have disclosed this contingent liability fully in the notes to the financial statements. We do not feel that the directors’ treatment of the contingent consideration is correct and, therefore, do not believe that the criteria of the relevant standard have been met. If this is the case, it would be appropriate to adjust the goodwill balance in the statement of financial position.

We believe that any required adjustment may materially affect the goodwill balance in the statement of financial position. Therefore, in our opinion, the financial statements do not give a true and fair view of the financial position of the Hopper Group and of the Hopper Group’s financial performance and cash flows for the year then ended in accordance with International Financial Reporting Standards.

Emphasis of Matter Paragraph

We draw attention to the note to the financial statements which describes the uncertainty relating to the contingent consideration described above. The note provides further information necessary to understand the potential implications of the contingency.

Required:

(a) Critically appraise the draft audit report of the Hopper Group for the year ended 30 June 2015, prepared by the audit senior.

Note: You are NOT required to re-draft the extracts from the audit report. (10 marks)

(b) The audit of the new subsidiary, Seurat Sweeteners Co, was performed by a different firm of auditors, Fish Associates. During your review of the communication from Fish Associates, you note that they were unable to obtain sufficient appropriate evidence with regard to the breakdown of research expenses. The total of research costs expensed by Seurat Sweeteners Co during the year was $1·2 million. Fish Associates has issued a qualified audit opinion on the financial statements of Seurat Sweeteners Co due to this inability to obtain sufficient appropriate evidence.

Required:

Comment on the actions which Rockwell & Co should take as the auditor of the Hopper Group, and the implications for the auditor’s report on the Hopper Group financial statements. (6 marks)

(c) Discuss the quality control procedures which should be carried out by Rockwell & Co prior to the audit report on the Hopper Group being issued. (4 marks)

正确答案:(a) Critical appraisal of the draft audit report

Type of opinion

When an auditor issues an opinion expressing that the financial statements ‘do not give a true and fair view’, this represents an adverse opinion. The paragraph explaining the modification should, therefore, be titled ‘Basis of Adverse Opinion’ rather than simply ‘Basis of Modified Opinion’.

An adverse opinion means that the auditor considers the misstatement to be material and pervasive to the financial statements of the Hopper Group. According to ISA 705 Modifications to Opinions in the Independent Auditor’s Report, pervasive matters are those which affect a substantial proportion of the financial statements or fundamentally affect the users’ understanding of the financial statements. It is unlikely that the failure to recognise contingent consideration is pervasive; the main effect would be to understate goodwill and liabilities. This would not be considered a substantial proportion of the financial statements, neither would it be fundamental to understanding the Hopper Group’s performance and position.

However, there is also some uncertainty as to whether the matter is even material. If the matter is determined to be material but not pervasive, then a qualified opinion would be appropriate on the basis of a material misstatement. If the matter is not material, then no modification would be necessary to the audit opinion.

Wording of opinion/report

The auditor’s reference to ‘the acquisition of the new subsidiary’ is too vague; the Hopper Group may have purchased a number of subsidiaries which this phrase could relate to. It is important that the auditor provides adequate description of the event and in these circumstances it would be appropriate to name the subsidiary referred to.

The auditor has not quantified the amount of the contingent element of the consideration. For the users to understand the potential implications of any necessary adjustments, they need to know how much the contingent consideration will be if it becomes payable. It is a requirement of ISA 705 that the auditor quantifies the financial effects of any misstatements, unless it is impracticable to do so.

In addition to the above point, the auditor should provide more description of the financial effects of the misstatement, including full quantification of the effect of the required adjustment to the assets, liabilities, incomes, revenues and equity of the Hopper Group.

The auditor should identify the note to the financial statements relevant to the contingent liability disclosure rather than just stating ‘in the note’. This will improve the understandability and usefulness of the contents of the audit report.

The use of the term ‘we do not feel that the treatment is correct’ is too vague and not professional. While there may be some interpretation necessary when trying to apply financial reporting standards to unique circumstances, the expression used is ambiguous and may be interpreted as some form. of disclaimer by the auditor with regard to the correct accounting treatment. The auditor should clearly explain how the treatment applied in the financial statements has departed from the requirements of the relevant standard.

Tutorial note: As an illustration to the above point, an appropriate wording would be: ‘Management has not recognised the acquisition-date fair value of contingent consideration as part of the consideration transferred in exchange for the acquiree, which constitutes a departure from International Financial Reporting Standards.’

The ambiguity is compounded by the use of the phrase ‘if this is the case, it would be appropriate to adjust the goodwill’. This once again suggests that the correct treatment is uncertain and perhaps open to interpretation.

If the auditor wishes to refer to a specific accounting standard they should refer to its full title. Therefore instead of referring to ‘the relevant standard’ they should refer to International Financial Reporting Standard 3 Business Combinations.

The opinion paragraph requires an appropriate heading. In this case the auditors have issued an adverse opinion and the paragraph should be headed ‘Adverse Opinion’.

As with the basis paragraph, the opinion paragraph lacks authority; suggesting that the required adjustments ‘may’ materially affect the financial statements implies that there is a degree of uncertainty. This is not the case; the amount of the contingent consideration will be disclosed in the relevant purchase agreement, so the auditor should be able to determine whether the required adjustments are material or not. Regardless, the sentence discussing whether the balance is material or not is not required in the audit report as to warrant inclusion in the report the matter must be considered material. The disclosure of the nature and financial effect of the misstatement in the basis paragraph is sufficient.

Finally, the emphasis of matter paragraph should not be included in the audit report. An emphasis of matter paragraph is only used to draw attention to an uncertainty/matter of fundamental importance which is correctly accounted for and disclosed in the financial statements. An emphasis of matter is not required in this case for the following reasons:

– Emphasis of matter is only required to highlight matters which the auditor believes are fundamental to the users’ understanding of the business. An example may be where a contingent liability exists which is so significant it could lead to the closure of the reporting entity. That is not the case with the Hopper Group; the contingent liability does not appear to be fundamental.

– Emphasis of matter is only used for matters where the auditor has obtained sufficient appropriate evidence that the matter is not materially misstated in the financial statements. If the financial statements are materially misstated, in this regard the matter would be fully disclosed by the auditor in the basis of qualified/adverse opinion paragraph and no emphasis of matter is necessary.

(b) Communication from the component auditor

The qualified opinion due to insufficient evidence may be a significant matter for the Hopper Group audit. While the possible adjustments relating to the current year may not be material to the Hopper Group, the inability to obtain sufficient appropriate evidence with regard to a material matter in Seurat Sweeteners Co’s financial statements may indicate a control deficiency which the auditor was not aware of at the planning stage and it could indicate potential problems with regard to the integrity of management, which could also indicate a potential fraud. It could also indicate an unwillingness of management to provide information, which could create problems for future audits, particularly if research and development costs increase in future years. If the group auditor suspects that any of these possibilities are true, they may need to reconsider their risk assessment and whether the audit procedures performed are still appropriate.

If the detail provided in the communication from the component auditor is insufficient, the group auditor should first discuss the matter with the component auditor to see whether any further information can be provided. The group auditor can request further working papers from the component auditor if this is necessary. However, if Seurat Sweeteners has not been able to provide sufficient appropriate evidence, it is unlikely that this will be effective.

If the discussions with the component auditor do not provide satisfactory responses to evaluate the potential impact on the Hopper Group, the group auditor may need to communicate with either the management of Seurat Sweeteners or the Hopper Group to obtain necessary clarification with regard to the matter.

Following these procedures, the group auditor needs to determine whether they have sufficient appropriate evidence to draw reasonable conclusions on the Hopper Group’s financial statements. If they believe the lack of information presents a risk of material misstatement in the group financial statements, they can request that further audit procedures be performed, either by the component auditor or by themselves.

Ultimately the group engagement partner has to evaluate the effect of the inability to obtain sufficient appropriate evidence on the audit opinion of the Hopper Group. The matter relates to research expenses totalling $1·2 million, which represents 0·2% of the profit for the year and 0·03% of the total assets of the Hopper Group. It is therefore not material to the Hopper Group’s financial statements. For this reason no modification to the audit report of the Hopper Group would be required as this does not represent a lack of sufficient appropriate evidence with regard to a matter which is material to the Group financial statements.

Although this may not have an impact on the Hopper Group audit opinion, this may be something the group auditor wishes to bring to the attention of those charged with governance. This would be particularly likely if the group auditor believed that this could indicate some form. of fraud in Seurat Sweeteners Co, a serious deficiency in financial reporting controls or if this could create problems for accepting future audits due to management’s unwillingness to provide access to accounting records.

(c) Quality control procedures prior to issuing the audit report

ISA 220 Quality Control for an Audit of Financial Statements and ISQC 1 Quality Control for Firms that Perform. Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Agreements require that an engagement quality control reviewer shall be appointed for audits of financial statements of listed entities. The audit engagement partner then discusses significant matters arising during the audit engagement with the engagement quality control reviewer.

The engagement quality control reviewer and the engagement partner should discuss the failure to recognise the contingent consideration and its impact on the auditor’s report. The engagement quality control reviewer must review the financial statements and the proposed auditor’s report, in particular focusing on the conclusions reached in formulating the auditor’s report and consideration of whether the proposed auditor’s opinion is appropriate. The audit documentation relating to the acquisition of Seurat Sweeteners Co will be carefully reviewed, and the reviewer is likely to consider whether procedures performed in relation to these balances were appropriate.

Given the listed status of the Hopper Group, any modification to the auditor’s report will be scrutinised, and the firm must be sure of any decision to modify the report, and the type of modification made. Once the engagement quality control reviewer has considered the necessity of a modification, they should consider whether a qualified or an adverse opinion is appropriate in the circumstances. This is an important issue, given that it requires judgement as to whether the matters would be material or pervasive to the financial statements.

The engagement quality control reviewer should ensure that there is adequate documentation regarding the judgements used in forming the final audit opinion, and that all necessary matters have been brought to the attention of those charged with governance.

The auditor’s report must not be signed and dated until the completion of the engagement quality control review.

Tutorial note: In the case of the Hopper Group’s audit, the lack of evidence in respect of research costs is unlikely to be discussed unless the audit engagement partner believes that the matter could be significant, for example, if they suspected the lack of evidence is being used to cover up a financial statements fraud.

-

第11题:

Financial documents include the following except ().

- A、promissory notes

- B、bills of lading

- C、checks

- D、draft

正确答案:B -

第12题:

单选题从水线到船底是“吃水”。()A“From the centerline to the ship’s bottom” is “draft”.

B“From the keel to the ship’s bottom” is “draft”.

CThe maximum distance from the waterline to the ship’s bottom is “draft”.

D“From the centerline to the ship’s main deck” is “draft”.

正确答案: C解析: 暂无解析 -

第13题:

22 Which of the following items may appear in a company’s statement of changes in equity, according to IAS 1 Presentation of financial statements?

1 Unrealised revaluation gains.

2 Dividends paid.

3 Proceeds of equity share issue.

4 Profit for the period.

A 2, 3 and 4 only

B 1, 3 and 4 only

C All four items

D 1, 2 and 4 only

正确答案:C

-

第14题:

24 Sigma’s bank statement shows an overdrawn balance of $38,600 at 30 June 2005. A check against the company’s cash book revealed the following differences:

1 Bank charges of $200 have not been entered in the cash book.

2 Lodgements recorded on 30 June 2005 but credited by the bank on 2 July $14,700.

3 Cheque payments entered in cash book but not presented for payment at 30 June 2005 $27,800.

4 A cheque payment to a supplier of $4,200 charged to the account in June 2005 recorded in the cash book as a receipt.

Based on this information, what was the cash book balance BEFORE any adjustments?

A $43,100 overdrawn

B $16,900 overdrawn

C $60,300 overdrawn

D $34,100 overdrawn

正确答案:A

-

第15题:

22 Which of the following statements about limited liability companies’ accounting is/are correct?

1 A revaluation reserve arises when a non-current asset is sold at a profit.

2 The authorised share capital of a company is the maximum nominal value of shares and loan notes the company

may issue.

3 The notes to the financial statements must contain details of all adjusting events as defined in IAS10 Events after

the balance sheet date.

A All three statements

B 1 and 2 only

C 2 and 3 only

D None of the statements

正确答案:D

-

第16题:

5 The directors of Quapaw, a limited liability company, are reviewing the company’s draft financial statements for the

year ended 31 December 2004.

The following material matters are under discussion:

(a) During the year the company has begun selling a product with a one-year warranty under which manufacturing

defects are remedied without charge. Some claims have already arisen under the warranty. (2 marks)

Required:

Advise the directors on the correct treatment of these matters, stating the relevant accounting standard which

justifies your answer in each case.

NOTE: The mark allocation is shown against each of the three matters

正确答案:

(a) The correct treatment is to provide for the best estimate of the costs likely to be incurred under the warranty, as required by

IAS37 Provisions, contingent liabilities and contingent assets. -

第17题:

(b) You are an audit manager with specific responsibility for reviewing other information in documents containing

audited financial statements before your firm’s auditor’s report is signed. The financial statements of Hegas, a

privately-owned civil engineering company, show total assets of $120 million, revenue of $261 million, and profit

before tax of $9·2 million for the year ended 31 March 2005. Your review of the Annual Report has revealed

the following:

(i) The statement of changes in equity includes $4·5 million under a separate heading of ‘miscellaneous item’

which is described as ‘other difference not recognized in income’. There is no further reference to this

amount or ‘other difference’ elsewhere in the financial statements. However, the Management Report, which

is required by statute, is not audited. It discloses that ‘changes in shareholders’ equity not recognized in

income includes $4·5 million arising on the revaluation of investment properties’.

The notes to the financial statements state that the company has implemented IAS 40 ‘Investment Property’

for the first time in the year to 31 March 2005 and also that ‘the adoption of this standard did not have a

significant impact on Hegas’s financial position or its results of operations during 2005’.

(ii) The chairman’s statement asserts ‘Hegas has now achieved a position as one of the world’s largest

generators of hydro-electricity, with a dedicated commitment to accountable ethical professionalism’. Audit

working papers show that 14% of revenue was derived from hydro-electricity (2004: 12%). Publicly

available information shows that there are seven international suppliers of hydro-electricity in Africa alone,

which are all at least three times the size of Hegas in terms of both annual turnover and population supplied.

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Hegas for the year ended 31 March 2005. (10 marks)

正确答案:

(b) Implications for the auditor’s report

(i) Management Report

■ $4·5 million represents 3·75% of total assets, 1·7% of revenue and 48·9% profit before tax. As this is material

by any criteria (exceeding all of 2% of total assets, 1/2% revenue and 5% PBT), the specific disclosure requirements

of IASs need to be met (IAS 1 ‘Presentation of Financial Statements’).

■ The Management Report discloses the amount and the reason for a material change in equity whereas the financial

statements do not show the reason for the change and suggest that it is immaterial. As the increase in equity

attributable to this adjustment is nearly half as much as that attributable to PBT there is a material inconsistency

between the Management Report and the audited financial statements.

■ Amendment to the Management Report is not required.

Tutorial note: Marks will be awarded for arguing, alternatively, that the Management Report disclosure needs to

be amended to clarify that the revaluation arises from the first time implementation.

■ Amendment to the financial statements is required because the disclosure is:

– incorrect – as, on first adoption of IAS 40, the fair value adjustment should be against the opening balance

of retained earnings; and

– inadequate – because it is being ‘supplemented’ by additional disclosure in a document which is not within

the scope of the audit of financial statements.

■ Whilst it is true that the adoption of IAS 40 did not have a significant impact on results of operations, Hegas’s

financial position has increased by nearly 4% in respect of the revaluation (to fair value) of just one asset category

(investment properties). As this is significant, the statement in the notes should be redrafted.

■ If the financial statements are not amended, the auditor’s report should be qualified ‘except for’ on grounds of

disagreement (non-compliance with IAS 40) as the matter is material but not pervasive. Additional disclosure

should also be given (e.g. that the ‘other difference’ is a fair value adjustment).

■ However, it is likely that when faced with the prospect of a qualified auditor’s report Hegas’s management will

rectify the financial statements so that an unmodified auditor’s report can be issued.

Tutorial note: Marks will be awarded for other relevant points e.g. citing IAS 8 ‘Accounting Policies, Changes in

Accounting Estimates and Errors’.

(ii) Chairman’s statement

Tutorial note: Hegas is privately-owned therefore IAS 14 ‘Segment Reporting’ does not apply and the proportion of

revenue attributable to hydro-electricity will not be required to be disclosed in the financial statements. However, credit

will be awarded for discussing the implications for the auditor’s report if it is regarded as a material inconsistency on

the assumption that segment revenue (or similar) is reported in the financial statements.

■ The assertion in the chairman’s statement, which does not fall within the scope of the audit of the financial

statements, claims two things, namely that the company:

(1) is ‘one of the world’s largest generators of hydro-electricity’; and

(2) has ‘a dedicated commitment to accountable ethical professionalism’.

■ To the extent that this information does not relate to matters disclosed in the financial statements it may give rise

to a material misstatement of fact. In particular, the first statement presents a misleading impression of the

company’s size. In misleading a user of the financial statements with this statement, the second statement is not

true (as it is not ethical or professional to mislead the reader and potentially undermine the credibility of the

financial statements).

■ The first statement is a material misstatement of fact because, for example:

– the company is privately-owned, and publicly-owned international/multi-nationals are larger;

– the company’s main activity is civil engineering not electricity generation (only 14% of revenue is derived from

HEP);

– as the company ranks at best eighth against African companies alone it ranks much lower globally.

■ Hegas should be asked to reconsider the wording of the chairman’s statement (i.e. removing these assertions) and

consult, as necessary, the company’s legal advisor.

■ If the statement is not changed there will be no grounds for qualification of the opinion on the audited financial

statements. The audit firm should therefore take legal advice on how the matter should be reported.

■ However, an emphasis of matter paragraph may be used to report on matters other than those affecting the audited

financial statements. For example, to explain the misstatement of fact if management refuses to make the

amendment.

Tutorial note: Marks will also be awarded for relevant comments about the chairman’s statement being perceived by

many readers to be subject to audit and therefore that the unfounded statement might undermine the credibility of the

financial statements. Shareholders tend to rely on the chairman’s statement, even though it is not regulated or audited,

because modern financial statements are so complex. -

第18题:

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Goodwill

(i) Matters

■ Cost of goodwill, $1·8 million, represents 3·4% consolidated total assets and is therefore material.

Tutorial note: Any assessments of materiality of goodwill against amounts in Aragon’s financial statements are

meaningless since goodwill only exists in the consolidated financial statements of Seymour.

■ It is correct that the goodwill is not being amortised (IFRS 3 Business Combinations). However, it should be tested

at least annually for impairment, by management.

■ Aragon has incurred losses amounting to $1·1 million since it was acquired (two years ago). The write-off of this

amount against goodwill in the consolidated financial statements would be material (being 61% cost of goodwill,

8·3% PBT and 2·1% total assets).

■ The cost of the investment ($4·5 million) in Seymour’s separate financial statements will also be material and

should be tested for impairment.

■ The fair value of net assets acquired was only $2·7 million ($4·5 million less $1·8 million). Therefore the fair

value less costs to sell of Aragon on other than a going concern basis will be less than the carrying amount of the

investment (i.e. the investment is impaired by at least the amount of goodwill recognised on acquisition).

■ In assessing recoverable amount, value in use (rather than fair value less costs to sell) is only relevant if the going

concern assumption is appropriate for Aragon.

■ Supporting Aragon financially may result in Seymour being exposed to actual and/or contingent liabilities that

should be provided for/disclosed in Seymour’s financial statements in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets.

(ii) Audit evidence

■ Carrying values of cost of investment and goodwill arising on acquisition to prior year audit working papers and

financial statements.

■ A copy of Aragon’s draft financial statements for the year ended 30 September 2006 showing loss for year.

■ Management’s impairment test of Seymour’s investment in Aragon and of the goodwill arising on consolidation at

30 September 2006. That is a comparison of the present value of the future cash flows expected to be generated

by Aragon (a cash-generating unit) compared with the cost of the investment (in Seymour’s separate financial

statements).

■ Results of any impairment tests on Aragon’s assets extracted from Aragon’s working paper files.

■ Analytical procedures on future cash flows to confirm their reasonableness (e.g. by comparison with cash flows for

the last two years).

■ Bank report for audit purposes for any guarantees supporting Aragon’s loan facilities.

■ A copy of Seymour’s ‘comfort letter’ confirming continuing financial support of Aragon for the foreseeable future. -

第19题:

听力原文: At the end of the total accounting period and after all transactions have been journalized and posted, the equality of the debit and credit entries is checked by preparing a trial balance. A trial balance is a schedule that lists the titles of the accounts in the general ledger and their debit or credit balances. If the trial balance is in balance, the financial statements can be prepared. If a trial balance does not agree, it implies that an error or errors have been made. The account balances, postings and the journal entries must be checked until the error is found. A trial balance does not prove that all transactions have been recorded or that the ledger is correct. The trial balance may still agree when a transaction is not journalized, a journal entry is not posted, an entry is posted twice, incorrect accounts are used in journalizing or posting, or offsetting errors are made in recording the amount of a transaction.

24. How does the accountant check the equality of the debit and credit entries?

25.What is a trial balance?

26.What is implied if a trial balance does not agree?

(24)

A.By posting all the entries.

B.By preparing a trial balance.

C.By comparing the entries on both sides.

D.By recording all the entries once more.

正确答案:B

解析:录音原文提到...the equality of the debit and credit entries is checked by preparing a trial balance,故答案为B项。 -

第20题:

A profit and loss statement indicates the company's ______.

A.assets and liabilities at a particular point in time

B.revenues and expenses for a specific period of time

C.financial resources at a particular point in time

D.performance at a particular point in time

正确答案:B

解析:企业的利润表反映的是企业在一定时间内经营成果(收入和支出)的报表。profit and loss statement损益表。A项是资产负债表内容。 -

第21题:

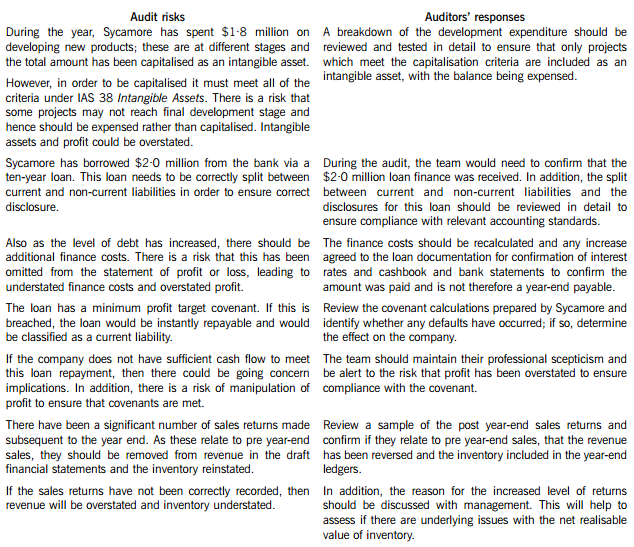

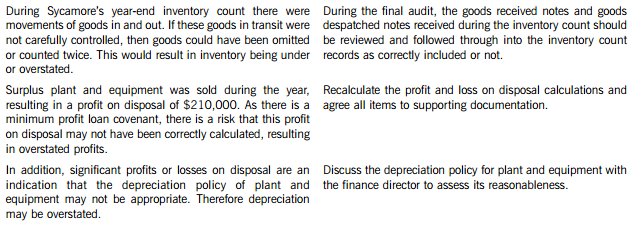

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

正确答案:(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

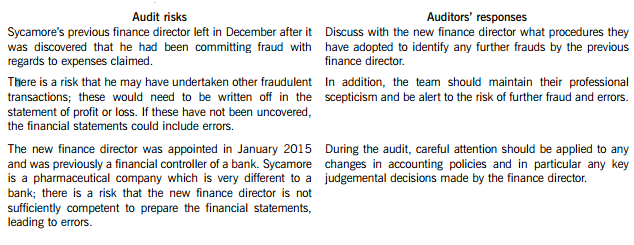

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

-

第22题:

You are the audit manager of Chestnut & Co and are reviewing the key issues identified in the files of two audit clients.

Palm Industries Co (Palm)

Palm’s year end was 31 March 2015 and the draft financial statements show revenue of $28·2 million, receivables of $5·6 million and profit before tax of $4·8 million. The fieldwork stage for this audit has been completed.

A customer of Palm owed an amount of $350,000 at the year end. Testing of receivables in April highlighted that no amounts had been paid to Palm from this customer as they were disputing the quality of certain goods received from Palm. The finance director is confident the issue will be resolved and no allowance for receivables was made with regards to this balance.

Ash Trading Co (Ash)

Ash is a new client of Chestnut & Co, its year end was 31 January 2015 and the firm was only appointed auditors in February 2015, as the previous auditors were suddenly unable to undertake the audit. The fieldwork stage for this audit is currently ongoing.

The inventory count at Ash’s warehouse was undertaken on 31 January 2015 and was overseen by the company’s internal audit department. Neither Chestnut & Co nor the previous auditors attended the count. Detailed inventory records were maintained but it was not possible to undertake another full inventory count subsequent to the year end.

The draft financial statements show a profit before tax of $2·4 million, revenue of $10·1 million and inventory of $510,000.

Required:

For each of the two issues:

(i) Discuss the issue, including an assessment of whether it is material;

(ii) Recommend ONE procedure the audit team should undertake to try to resolve the issue; and

(iii) Describe the impact on the audit report if the issue remains UNRESOLVED.

Notes:

1 The total marks will be split equally between each of the two issues.

2 Audit report extracts are NOT required.

正确答案:Audit reports

Palm Industries Co (Palm)

(i) A customer of Palm’s owing $350,000 at the year end has not made any post year-end payments as they are disputing the quality of goods received. No allowance for receivables has been made against this balance. As the balance is being disputed, there is a risk of incorrect valuation as some or all of the receivable balance is overstated, as it may not be paid.

This $350,000 receivables balance represents 1·2% (0·35/28·2m) of revenue, 6·3% (0·35/5·6m) of receivables and 7·3% (0·35/4·8m) of profit before tax; hence this is a material issue.

(ii) A procedure to adopt includes:

– Review whether any payments have subsequently been made by this customer since the audit fieldwork was completed.

– Discuss with management whether the issue of quality of goods sold to the customer has been resolved, or whether it is still in dispute.

– Review the latest customer correspondence with regards to an assessment of the likelihood of the customer making payment.

(iii) If management refuses to provide against this receivable, the audit report will need to be modified. As receivables are overstated and the error is material but not pervasive a qualified opinion would be necessary.

A basis for qualified opinion paragraph would be needed and would include an explanation of the material misstatement in relation to the valuation of receivables and the effect on the financial statements. The opinion paragraph would be qualified ‘except for’.

Ash Trading Co (Ash)

(i) Chestnut & Co was only appointed as auditors subsequent to Ash’s year end and hence did not attend the year-end inventory count. Therefore, they have not been able to gather sufficient and appropriate audit evidence with regards to the completeness and existence of inventory.

Inventory is a material amount as it represents 21·3% (0·51/2·4m) of profit before tax and 5% (0·51/10·1m) of revenue; hence this is a material issue.

(ii) A procedure to adopt includes:

– Review the internal audit reports of the inventory count to identify the level of adjustments to the records to assess the reasonableness of relying on the inventory records.

– Undertake a sample check of inventory in the warehouse and compare to the inventory records and then from inventory records to the warehouse, to assess the reasonableness of the inventory records maintained by Ash.

(iii) The auditors will need to modify the audit report as they are unable to obtain sufficient appropriate evidence in relation to inventory which is a material but not pervasive balance. Therefore a qualified opinion will be required.

A basis for qualified opinion paragraph will be required to explain the limitation in relation to the lack of evidence over inventory. The opinion paragraph will be qualified ‘except for’.

-

第23题:

从水线到船底是“吃水”。()

- A、“From the centerline to the ship’s bottom” is “draft”.

- B、“From the keel to the ship’s bottom” is “draft”.

- C、The maximum distance from the waterline to the ship’s bottom is “draft”.

- D、“From the centerline to the ship’s main deck” is “draft”.

正确答案:C