(b) (i) Advise Alasdair of the tax implications and relative financial risks attached to the following propertyinvestments:(1) buy to let residential property;(2) commercial property; and(3) shares in a property investment company/unit trust. (9 marks)

题目

(b) (i) Advise Alasdair of the tax implications and relative financial risks attached to the following property

investments:

(1) buy to let residential property;

(2) commercial property; and

(3) shares in a property investment company/unit trust. (9 marks)

相似考题

更多“(b) (i) Advise Alasdair of the tax implications and relative financial risks attached to the following propertyinvestments:(1) buy to let residential property;(2) commercial property; and(3) shares in a property investment company/unit trust. (9 marks)”相关问题

-

第1题:

6 Alasdair, aged 42, is single. He is considering investing in property, as he has heard that this represents a good

investment. In order to raise the funds to buy the property, he wants to extract cash from his personal company, Beezer

Limited, whose year end is 31 December.

Beezer Limited was formed on 1 May 1998 with £1,000 of capital issued as 1,000 £1 ordinary shares, and traded

until 1 January 2005 when Alasdair sold the trade and related assets. The company’s only asset is cash of

£120,000. Alasdair wants to extract this cash from the company with the minimum amount of tax payable. He is

considering either, paying himself a dividend of £120,000, on 31 March 2006, after which the company would have

no assets and be wound up or, leaving the cash in the company and then liquidating the company. Costs of liquidation

of £5,000 would then be incurred.

Since Beezer Limited ceased trading, Alasdair has been taken on as a partner at a marketing firm, Gallus & Co. He

estimates his profit share for the year of assessment 2005/06 will be £30,000. He has not made any capital disposals

in the current tax year.

Alasdair wishes to reinvest the cash extracted from Beezer Limited in property but is not sure whether he should invest

directly in residential or commercial property, or do so via some form. of collective investment. He is aware that Gallus

& Co are looking to rent a new warehouse which could be bought for £200,000. Alasdair thinks that he may be able

to buy the warehouse himself and lease it to his firm, but only if he can borrow the additional money to buy the

property.

Alasdair has a 25% shareholding in another company, Glaikit Limited, whose year end is 31 March. The remaining

shares in this company are held by his friend, Gill. Alasdair is considering borrowing £15,000 from Glaikit Limited

on 1 January 2006. He does not intend to pay any interest on the loan, which is likely to be written off some time

in 2007. Alasdair does not have any connection with Glaikit Limited other than his shareholding.

Required:

(a) Advise Alasdair whether or not a dividend payment will result in a higher after-tax cash sum than the

liquidation of Beezer Limited. Assume that either the dividend would be paid on 31 March 2006 or the

liquidation would take place on 31 March 2006. (9 marks)

Assume that Beezer Limited has always paid corporation tax at or above the small companies rate of 19%

and that the tax rates and allowances for 2004/05 apply throughout this part.

正确答案:

-

第2题:

(ii) Explain the income tax (IT), national insurance (NIC) and capital gains tax (CGT) implications arising on

the grant to and exercise by an employee of an option to buy shares in an unapproved share option

scheme and on the subsequent sale of these shares. State clearly how these would apply in Henry’s

case. (8 marks)

正确答案:

(ii) Exercising of share options

The share option is not part of an approved scheme, and will not therefore enjoy the benefits of such a scheme. There

are three events with tax consequences – grant, exercise and sale.

Grant. If shares or options over shares are sold or granted at less than market value, an income tax charge can arise on

the difference between the price paid and the market value. [Weight v Salmon]. In addition, if options can be exercised

more than 10 years after the date of the grant, an employment income charge can arise. This is based on the market

value at the date of grant less the grant and exercise priced.

In Henry’s case, the options were issued with an exercise price equal to the then market value, and cannot be exercised

more than 10 years from the grant. No income tax charge therefore arises on grant.

Exercise. On exercise, the individual pays the agreed amount in return for a number of shares in the company. The price

paid is compared with the open market value at that time, and if less, the difference is charged to income tax. National

insurance also applies, and the company has to pay Class 1 NIC. If the company and shareholder agree, the national

insurance can be passed onto the individual, and the liability becomes a deductible expense in calculating the income

tax charge.

In Henry’s case on exercise, the difference between market value (£14) and the price paid (£1) per share will be taxed

as income. Therefore, £130,000 (10,000 x (£14 – £1)) will be taxed as income. In addition, national insurance will

be chargeable on the company at 12·8% (£16,640) and on Henry at the rate of 1% (£1,300).

Sale. The base cost of the shares is taken to be the market value at the time of exercise. On the sale of the shares, any

gain or loss arising falls under the capital gains tax rules, and CGT will be payable on any gain. Business asset taper

relief will be available as the company is an unquoted trading company, but the relief will only run from the time that

the share options are exercised – i.e. from the time when the shares were acquired.

In Henry’s case, the sale of the shares will immediately follow the exercise of the option (6 days later). The sale proceeds

and the market value at the time of exercise are likely to be similar; thus little to no gain is likely to arise. -

第3题:

(ii) Compute the annual income tax saving from your recommendation in (i) above as compared with the

situation where Cindy retains both the property and the shares. Identify any other tax implications

arising from your recommendation. Your answer should consider all relevant taxes. (3 marks)

正确答案:

-

第4题:

6 Andrew is aged 38 and is single. He is employed as a consultant by Bestadvice & Co and pays income tax at the

higher rate.

Andrew is considering investing in a new business, and to provide funds for this investment he has recently disposed

of the following assets:

(1) A short leasehold interest in a residential property. Andrew originally paid £50,000 for a 47 year lease of the

property in May 1995, and assigned the lease in May 2006 for £90,000.

(2) His holding of £10,000 7% Government Stock, on which interest is payable half-yearly on 20 April and

20 October. Andrew originally purchased this holding on 1 June 1999 for £9,980 and he sold it for £11,250

on 14 March 2005.

Andrew intends to subscribe for ordinary shares in a new company, Scalar Limited, which will be a UK based

manufacturing company. Three investors (including Andrew) have been identified, but a fourth investor may also be

invited to subscribe for shares. The investors are all unconnected, and would subscribe for shares in equal measure.

The intention is to raise £450,000 in this manner. The company will also raise a further £50,000 from the investors

in the form. of loans. Andrew has been told that he can take advantage of some tax reliefs on his investment in Scalar

Limited, but does not know anything about the details of these reliefs

Andrew’s employer, Bestadvice & Co, is proposing to change the staff pension scheme from a defined benefit scheme

to which the firm and the employees each contribute 6% of their annual salary, to a defined contribution scheme, to

which the employees will continue to contribute 6%, but the firm will contribute 8% of their annual salary. The

majority of Andrew’s colleagues are opposed to this move, but, given the increase in the firm’s contribution rate

Andrew himself is less sure that the proposal is without merit.

Required:

(a) (i) Calculate the chargeable gain arising on the assignment of the residential property lease in May 2006.

(2 marks)

正确答案:

-

第5题:

2 Clifford and Amanda, currently aged 54 and 45 respectively, were married on 1 February 1998. Clifford is a higher

rate taxpayer who has realised taxable capital gains in 2007/08 in excess of his capital gains tax annual exemption.

Clifford moved into Amanda’s house in London on the day they were married. Clifford’s own house in Oxford, where

he had lived since acquiring it for £129,400 on 1 August 1996, has been empty since that date although he and

Amanda have used it when visiting friends. Clifford has been offered £284,950 for the Oxford house and has decided

that it is time to sell it. The house has a large garden such that Clifford is also considering an offer for the house and

a part only of the garden. He would then sell the remainder of the garden at a later date as a building plot. His total

sales proceeds will be higher if he sells the property in this way.

Amanda received the following income from quoted investments in 2006/07:

£

Dividends in respect of quoted trading company shares 1,395

Dividends paid by a Real Estate Investment Trust out of tax exempt property income 485

On 1 May 2006, Amanda was granted a 22 year lease of a commercial investment property. She paid the landlord

a premium of £6,900 and also pays rent of £2,100 per month. On 1 June 2006 Amanda granted a nine year

sub-lease of the property. She received a premium of £14,700 and receives rent of £2,100 per month.

On 1 September 2006 Amanda gave quoted shares with a value of £2,200 to a registered charity. She paid broker’s

fees of £115 in respect of the gift.

Amanda began working for Shearer plc, a quoted company, on 1 June 2006 having had a two year break from her

career. She earns an annual salary of £38,600 and was paid a bonus of £5,750 in August 2006 for agreeing to

come and work for the company. On 1 August 2006 Amanda was provided with a fully expensed company car,

including the provision of private petrol, which had a list price when new of £23,400 and a CO2 emissions rate of

187 grams per kilometre. Amanda is required to pay Shearer plc £22 per month in respect of the private use of the

car. In June and July 2006 Amanda used her own car whilst on company business. She drove 720 business miles

during this two month period and was paid 34 pence per mile. Amanda had PAYE of £6,785 deducted from her gross

salary in the tax year 2006/07.

After working for Shearer plc for a full year, Amanda becomes entitled to the following additional benefits:

– The opportunity to purchase a large number of shares in Shearer plc on 1 July 2007 for £3·30 per share. It is

anticipated that the share price on that day will be at least £7·50 per share. The company will make an interestfree

loan to Amanda equal to the cost of the shares to be repaid in two years.

– Exclusive free use of the company sailing boat for one week in August 2007. The sailing boat was purchased by

Shearer plc in January 2005 for use by its senior employees and costs the company £1,400 a week in respect

of its crew and other running expenses.

Required:

(a) (i) Calculate Clifford’s capital gains tax liability for the tax year 2007/08 on the assumption that the Oxford

house together with its entire garden is sold on 31 July 2007 for £284,950. Comment on the relevance

to your calculations of the size of the garden; (5 marks)

正确答案:

-

第6题:

(b) Explain the corporation tax and value added tax (VAT) implications of the following aspects of the proposed

restructuring of the Rapier Ltd group.

(i) The immediate tax implications of the restructuring. (6 marks)

正确答案:

(b) The tax implications of the proposed restructuring of the Rapier Ltd group

(i) Immediate implications

Corporation tax

Rapier Ltd and its subsidiaries are in a capital gains group as Rapier Ltd owns at least 75% of the ordinary share capital

of each of the subsidiary companies. Any non-exempt items of plant and machinery owned by the subsidiaries will

therefore be transferred to Rapier Ltd at no gain, no loss.

No taxable credit or allowable debit will arise on the transfer of the subsidiaries’ goodwill to Rapier Ltd because the

companies are in a capital gains group.

The trading losses brought forward in Dirk Ltd will be transferred with the trade to Rapier Ltd as the effective ownership

of the three trades will not change (Rapier Ltd owns the subsidiaries which own the trades and, following the

restructuring, will own the three trades directly). The losses will be restricted to being offset against the future trading

profits of the Dirk trade only.

There will be no balancing adjustments in respect of the plant and machinery transferred to Rapier Ltd. Writing down

allowances will be claimed by the subsidiaries in respect of the year ending 30 June 2007 and by Rapier Ltd in respect

of future periods.

Value added tax (VAT)

No VAT should be charged on the sales of the businesses to Rapier Ltd as they are outside the scope of VAT. This is

because the trades are to be transferred as going concerns to a VAT registered person with no significant break in trading.

Switch Ltd must notify HM Revenue and Customs by 30 July 2007 that it has ceased to make taxable supplies. -

第7题:

(b) (i) Explain, by reference to Coral’s residence, ordinary residence and domicile position, how the rental

income arising in respect of the property in the country of Kalania will be taxed in the UK in the tax year

2007/08. State the strategy that Coral should adopt in order to minimise the total income tax suffered

on the rental income. (7 marks)

正确答案:

(b) (i) UK tax on the rental income

Coral is UK resident in 2007/08 because she is present in the UK for more than 182 days. Accordingly, she will be

subject to UK income tax on her Kalanian rental income.

Coral is ordinarily resident in the UK in 2007/08 as she is habitually resident in the UK.

Coral will have acquired a domicile of origin in Kalania from her father. She has not acquired a domicile of choice in the

UK as she has not severed her ties with Kalania and does not intend to make her permanent home in the UK.

Accordingly, the rental income will be taxed in the UK on the remittance basis.

Any rental income remitted to the UK will fall into the basic rate band and will be subject to income tax at 22% on the

gross amount (before deduction of Kalanian tax). Unilateral double tax relief will be available in respect of the 8% tax

suffered in Kalania such that the effective rate of tax suffered by Coral in the UK on the grossed up amount of income

remitted will be 14%.

In order to minimise the total income tax suffered on the rental income Coral should ensure that it is not brought into or

used in the UK such that it will not be subject to income tax in the UK.

Coral should retain evidence, for example bank statements, to show that the rental income has not been removed from

Kalania. Coral can use the money whilst she is on holiday in Kalania with no UK tax implications. -

第8题:

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

正确答案:

(b) (i) Enquiries in respect of the external valuer

Enquiries would need to be made for two main reasons, firstly to determine the competence, and secondly the objectivity

of the valuer. ISA 620 Using the Work of an Expert contains guidance in this area.

Competence

Enquiries could include:

– Is the valuer a member of a recognised professional body, for example a nationally or internationally recognised

institute of registered surveyors?

– Does the valuer possess any necessary licence to carry out valuations for companies?

– How long has the valuer been a member of the recognised body, or how long has the valuer been licensed under

that body?

– How much experience does the valuer have in providing valuations of the particular type of investment properties

held by Poppy Co?

– Does the valuer have specific experience of evaluating properties for the purpose of including their fair value within

the financial statements?

– Is there any evidence of the reputation of the valuer, e.g. professional references, recommendations from other

companies for which a valuation service has been provided?

– How much experience, if any, does the valuer have with Poppy Co?

Using the above enquiries, the auditor is trying to form. an opinion as to the relevance and reliability of the valuation

provided. ISA 500 Audit Evidence requires that the auditor gathers evidence that is both sufficient and appropriate. The

auditor needs to ensure that the fair values provided by the valuer for inclusion in the financial statements have been

arrived at using appropriate knowledge and skill which should be evidenced by the valuer being a member of a

professional body, and, if necessary, holding a licence under that body.

It is important that the fair values have been arrived at using methods allowed under IAS 40 Investment Property. If any

other valuation method has been used then the value recognised in the statement of financial position may not be in

accordance with financial reporting standards. Thus it is important to understand whether the valuer has experience

specifically in providing valuations that comply with IAS 40, and how many times the valuer has appraised properties

similar to those owned by Poppy Co.

In gauging the reliability of the fair value, the auditor may wish to consider how Poppy Co decided to appoint this

particular valuer, e.g. on the basis of a recommendation or after receiving references from companies for which

valuations had previously been provided.

It will also be important to consider how familiar the valuer is with Poppy Co’s business and environment, as a way to

assess the reliability and appropriateness of any assumptions used in the valuation technique.

Objectivity

Enquiries could include:

– Does the valuer have any financial interest in Poppy Co, e.g. shares held directly or indirectly in the company?

– Does the valuer have any personal relationship with any director or employee of Poppy Co?

– Is the fee paid for the valuation service reasonable and a fair, market based price?

With these enquiries, the auditor is gaining assurance that the valuer will perform. the valuation from an independent

point of view. If the valuer had a financial interest in Poppy Co, there would be incentive to manipulate the valuation in

a way best suited to the financial statements of the company. Equally if the valuer had a personal relationship with a

senior member of staff at Poppy Co, the valuer may feel pressured to give a favourable opinion on the valuation of the

properties.

The level of fee paid is important. It should be commensurate with the market rate paid for this type of valuation. If the

valuer was paid in excess of what might be considered a normal fee, it could indicate that the valuer was encouraged,

or even bribed, to provide a favourable valuation. -

第9题:

Which of the following statements concerning intellectual property is wrong?()

- A、Intellectual property is an intangible creation

- B、Intellectual property in ludes patents,trademarks,copyrights,etc.

- C、Intellectual property is a visible creation

- D、There are some agreement sconcerning intellectual property under the WTO

正确答案:C -

第10题:

You have a custom button, with should have a Property "IsActive", one must be able to bind this Property on a class Property.()

- A、 Dependency Property

- B、 INotifyPropertyChanged

- C、 net Property

正确答案:B -

第11题:

单选题Which of the following statements concerning intellectual property is wrong?()AIntellectual property is an intangible creation

BIntellectual property in ludes patents,trademarks,copyrights,etc.

CIntellectual property is a visible creation

DThere are some agreement sconcerning intellectual property under the WTO

正确答案: C解析: 暂无解析 -

第12题:

单选题You are creating a Windows Communication Foundation (WCF) service that accepts messages from clients when they are started. The message is defined as follows:[MessageContract] public class Agent { public string CodeName { get; set; } public string SecretHandshake { get; set; }}You have the following requirements: The CodeName property must be sent in clear text. The service must be able to verify that the property value was not changed after being sent by the client. The SecretHandshake property must not be sent in clear text and must be readable by the service.What should you do?()AAdd a MessageBodyMember attribute to the CodeName property and set the ProtectionLevel to Sign. Add a MessageBodyMember attribute to the SecretHandshake property and set the ProtectionLevel to EncryptAndSign.

BAdd a DataProtectionPermission attribute to the each property and set the ProtectData property to true.

CAdd an xmlText attribute to the CodeName property and set the DataType property to Signed. Add a PasswordPropertyText attribute to the SecretHandshake property and set its value to true.

DAdd an ImmutableObject attribute to the CodeName property and set its value property to true. Add a Browsable attribute to the SecretHandshake property and set its value to false.

正确答案: D解析: 暂无解析 -

第13题:

(c) State the tax consequences for both Glaikit Limited and Alasdair if he borrows money from the company, as

proposed, on 1 January 2006. (3 marks)

正确答案:

(c) Alasdair is not employed, nor is he a director, of Glaikit Limited. As he holds 25% of the shares in Glaikit Limited, he is a

participator in a close company and therefore the special close company provisions will apply. Thus Alsadair will be taxed

under the ‘loans to participator’ rules.

When the loan is written off, the amount waived will be treated as a gross distribution of £16,667 (£15,000 x 10/9). This

will be assessed in the tax year in which the loan is written off (expected to be 2006/07 or 2007/08). To the extent that this

additional income makes Alasdair a higher rate taxpayer in that year, he will have to pay additional income tax of 32·5% of

the gross amount, less the available 10% tax credit.

From the company’s perspective, Glaikit Limited will have to pay 25% of the net value of any loan made to Alasdair which

has not been repaid to the company (or written off) within nine months of the year end. As the loan will remain outstanding

as at 31 March 2006, Glaikit Limited will have to pay £3,750 (25% x £15,000) to the Revenue by 1 January 2007. This

amount will not be repaid until the loan is repaid or written off. This usually takes place nine months after the year end in

which the loan is written off, so Glaikit Limited should ensure that any write-off occurs prior to 31 March 2007, or else the

repayment may be delayed for up to one year.

As the loan is tax free, the Revenue may also seek to tax Alasdair under the beneficial loan rules. If the Revenue were to seek

an assessment in this manner, the value of the benefit would be calculated and taxed as a deemed distribution. However, as

Alasdair has no connection with the company other than as an investor, it is unlikely that the beneficial loan benefit will lead

to such a deemed distribution. -

第14题:

(b) (i) Advise Benny of the income tax implications of the grant and exercise of the share options in Summer

Glow plc on the assumption that the share price on 1 September 2007 and on the day he exercises the

options is £3·35 per share. Explain why the share option scheme is not free from risk by reference to

the rules of the scheme and the circumstances surrounding the company. (4 marks)

正确答案:

(b) (i) The share options

There are no income tax implications on the grant of the share options.

In the tax year in which Benny exercises the options and acquires the shares, the excess of the market value of the

shares over the price paid, i.e. £11,500 ((£3·35 – £2·20) x 10,000) will be subject to income tax.

Benny’s financial exposure is caused by the rule within the share option scheme obliging him to hold the shares for a

year before he can sell them. If the company’s expansion into Eastern Europe fails, such that its share price

subsequently falls to less than £2·20 before Benny has the chance to sell the shares, Benny’s financial position may be

summarised as follows:

– Benny will have paid £22,000 (£2·20 x 10,000) for shares which are now worth less than that.

– He will also have paid income tax of £4,600 (£11,500 x 40%). -

第15题:

(b) For this part, assume today’s date is 1 May 2010.

Bill and Ben decided not to sell their company, and instead expanded the business themselves. Ben, however,

is now pursuing other interests, and is no longer involved with the day to day activities of Flower Limited. Bill

believes that the company would be better off without Ben as a voting shareholder, and wishes to buy Ben’s

shares. However, Bill does not have sufficient funds to buy the shares himself, and so is wondering if the

company could acquire the shares instead.

The proposed price for Ben’s shares would be £500,000. Both Bill and Ben pay income tax at the higher rate.

Required:

Write a letter to Ben:

(1) stating the income tax (IT) and/or capital gains tax (CGT) implications for Ben if Flower Limited were to

repurchase his 50% holding of ordinary shares, immediately in May 2010; and

(2) advising him of any available planning options that might improve this tax position. Clearly explain any

conditions which must be satisfied and quantify the tax savings which may result.

(13 marks)

Assume that the corporation tax rates for the financial year 2005 and the income tax rates and allowances

for the tax year 2005/06 apply throughout this question.

正确答案:(b) [Ben’s address] [Firm’s address]

Dear Ben [Date]

A company purchase of own shares can be subject to capital gains treatment if certain conditions are satisfied. However, one

of these conditions is that the shares in question must have been held for a minimum period of five years. As at 1 May 2010,

your shares in Flower Limited have only been held for four years and ten months. As a result, the capital gains treatment will

not apply.

In the absence of capital gains treatment, the position on a company repurchase of its own shares is that the payment will

be treated as an income distribution (i.e. a dividend) in the hands of the recipient. The distribution element is calculated as

the proceeds received for the shares less the price paid for them. On the basis that the purchase price is £500,000, then the

element of distribution will be £499,500 (500,000 – 500). This would be taxed as follows:

-

第16题:

(ii) Advise Andrew of the tax implications arising from the disposal of the 7% Government Stock, clearly

identifying the tax year in which any liability will arise and how it will be paid. (3 marks)

正确答案:

(ii) Government stock is an exempt asset for the purposes of capital gains tax, however, as Andrew’s holding has a nominal

value in excess of £5,000, a charge to income tax will arise under the accrued income scheme. This charge to income

tax will arise in 2005/06, being the tax year in which the next interest payment following disposal falls due (20 April

2005) and it will relate to the income accrued for the period 21 October 2004 to 14 March 2005 of £279 (145/182

x £350). As interest on Government Stock is paid gross (unless the holder applies to receive it net), the tax due of £112

(£279 x 40%) will be collected via the self-assessment system and as the interest was an ongoing source of income

will be included within Andrew’s half yearly payments on account payable on 31 January and 31 July 2006. -

第17题:

(ii) Advise Mr Fencer of the income tax implications of the proposed financing arrangements. (2 marks)

正确答案:

(ii) The income tax implications of the proposed financing arrangements

Mr Fencer has borrowed money from a UK bank in order to make a loan to Rapier Ltd, a close company. The interest

paid by Mr Fencer to the bank will be an allowable charge on income as long as he continues to hold more than 5% of

Rapier Ltd. Charges on income are deductible in arriving at an individual’s statutory total income.

Mr Fencer will receive interest from Rapier Ltd net of 20% income tax. The gross amount of interest will be subject to

income tax at either 10%, 20% or 40% depending on whether the income falls into Mr Fencer’s starting rate, basic rate

or higher rate tax band. Mr Fencer will obtain a tax credit for the 20% income tax suffered at source. -

第18题:

(b) Advise Sergio on the appropriateness of investing in a domestic rental property in view of his personal

circumstances and recommend suitable alternative investments giving reasons for your advice. (4 marks)

正确答案:

(b) Sergio’s investments

Sergio aims to leave a substantial asset to his family on his death. Accordingly, in view of his age, he is right to be considering

investing in an asset whose value is unlikely to fall suddenly, such as a domestic rental property. However, it must be

recognised that although the value of land and buildings can usually be relied on to increase over a long period of time, its

value may fall over a shorter period. The only investments that cannot fall in value are cash deposits, although they do, of

course, fall in real terms due to the effects of inflation.

Sergio should consider whether or not he wishes to increase his annual income. The return on capital invested in a domestic

rental property is unlikely to be very high due to the recent increases in property values in the UK. Also, there are likely to be

periods when the house is unoccupied during which no income will be generated. If it is important to Sergio to generate

additional income he should consider other low-risk investments with a more reliable and higher rate of return, for example,

gilt edged stocks, unit trusts and cash deposits.

Sergio must also decide whether it is important to him to be able to access capital quickly, as it is usually not possible to

realise the capital invested in land and buildings at short notice. If this is important, Sergio should consider holding some of

his capital in cash deposits or other liquid investments, eg unit trusts.

Sergio could invest up to £7,000 each year in an individual savings account (ISA). A maximum of £3,000 can be held as a

cash deposit with the balance invested in quoted shares. The income and gains arising on the funds invested would be

exempt from both income tax and capital gains tax. This would be a relatively low-risk investment and would also be

accessible quickly if required. -

第19题:

(b) You are an audit manager with specific responsibility for reviewing other information in documents containing

audited financial statements before your firm’s auditor’s report is signed. The financial statements of Hegas, a

privately-owned civil engineering company, show total assets of $120 million, revenue of $261 million, and profit

before tax of $9·2 million for the year ended 31 March 2005. Your review of the Annual Report has revealed

the following:

(i) The statement of changes in equity includes $4·5 million under a separate heading of ‘miscellaneous item’

which is described as ‘other difference not recognized in income’. There is no further reference to this

amount or ‘other difference’ elsewhere in the financial statements. However, the Management Report, which

is required by statute, is not audited. It discloses that ‘changes in shareholders’ equity not recognized in

income includes $4·5 million arising on the revaluation of investment properties’.

The notes to the financial statements state that the company has implemented IAS 40 ‘Investment Property’

for the first time in the year to 31 March 2005 and also that ‘the adoption of this standard did not have a

significant impact on Hegas’s financial position or its results of operations during 2005’.

(ii) The chairman’s statement asserts ‘Hegas has now achieved a position as one of the world’s largest

generators of hydro-electricity, with a dedicated commitment to accountable ethical professionalism’. Audit

working papers show that 14% of revenue was derived from hydro-electricity (2004: 12%). Publicly

available information shows that there are seven international suppliers of hydro-electricity in Africa alone,

which are all at least three times the size of Hegas in terms of both annual turnover and population supplied.

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Hegas for the year ended 31 March 2005. (10 marks)

正确答案:

(b) Implications for the auditor’s report

(i) Management Report

■ $4·5 million represents 3·75% of total assets, 1·7% of revenue and 48·9% profit before tax. As this is material

by any criteria (exceeding all of 2% of total assets, 1/2% revenue and 5% PBT), the specific disclosure requirements

of IASs need to be met (IAS 1 ‘Presentation of Financial Statements’).

■ The Management Report discloses the amount and the reason for a material change in equity whereas the financial

statements do not show the reason for the change and suggest that it is immaterial. As the increase in equity

attributable to this adjustment is nearly half as much as that attributable to PBT there is a material inconsistency

between the Management Report and the audited financial statements.

■ Amendment to the Management Report is not required.

Tutorial note: Marks will be awarded for arguing, alternatively, that the Management Report disclosure needs to

be amended to clarify that the revaluation arises from the first time implementation.

■ Amendment to the financial statements is required because the disclosure is:

– incorrect – as, on first adoption of IAS 40, the fair value adjustment should be against the opening balance

of retained earnings; and

– inadequate – because it is being ‘supplemented’ by additional disclosure in a document which is not within

the scope of the audit of financial statements.

■ Whilst it is true that the adoption of IAS 40 did not have a significant impact on results of operations, Hegas’s

financial position has increased by nearly 4% in respect of the revaluation (to fair value) of just one asset category

(investment properties). As this is significant, the statement in the notes should be redrafted.

■ If the financial statements are not amended, the auditor’s report should be qualified ‘except for’ on grounds of

disagreement (non-compliance with IAS 40) as the matter is material but not pervasive. Additional disclosure

should also be given (e.g. that the ‘other difference’ is a fair value adjustment).

■ However, it is likely that when faced with the prospect of a qualified auditor’s report Hegas’s management will

rectify the financial statements so that an unmodified auditor’s report can be issued.

Tutorial note: Marks will be awarded for other relevant points e.g. citing IAS 8 ‘Accounting Policies, Changes in

Accounting Estimates and Errors’.

(ii) Chairman’s statement

Tutorial note: Hegas is privately-owned therefore IAS 14 ‘Segment Reporting’ does not apply and the proportion of

revenue attributable to hydro-electricity will not be required to be disclosed in the financial statements. However, credit

will be awarded for discussing the implications for the auditor’s report if it is regarded as a material inconsistency on

the assumption that segment revenue (or similar) is reported in the financial statements.

■ The assertion in the chairman’s statement, which does not fall within the scope of the audit of the financial

statements, claims two things, namely that the company:

(1) is ‘one of the world’s largest generators of hydro-electricity’; and

(2) has ‘a dedicated commitment to accountable ethical professionalism’.

■ To the extent that this information does not relate to matters disclosed in the financial statements it may give rise

to a material misstatement of fact. In particular, the first statement presents a misleading impression of the

company’s size. In misleading a user of the financial statements with this statement, the second statement is not

true (as it is not ethical or professional to mislead the reader and potentially undermine the credibility of the

financial statements).

■ The first statement is a material misstatement of fact because, for example:

– the company is privately-owned, and publicly-owned international/multi-nationals are larger;

– the company’s main activity is civil engineering not electricity generation (only 14% of revenue is derived from

HEP);

– as the company ranks at best eighth against African companies alone it ranks much lower globally.

■ Hegas should be asked to reconsider the wording of the chairman’s statement (i.e. removing these assertions) and

consult, as necessary, the company’s legal advisor.

■ If the statement is not changed there will be no grounds for qualification of the opinion on the audited financial

statements. The audit firm should therefore take legal advice on how the matter should be reported.

■ However, an emphasis of matter paragraph may be used to report on matters other than those affecting the audited

financial statements. For example, to explain the misstatement of fact if management refuses to make the

amendment.

Tutorial note: Marks will also be awarded for relevant comments about the chairman’s statement being perceived by

many readers to be subject to audit and therefore that the unfounded statement might undermine the credibility of the

financial statements. Shareholders tend to rely on the chairman’s statement, even though it is not regulated or audited,

because modern financial statements are so complex. -

第20题:

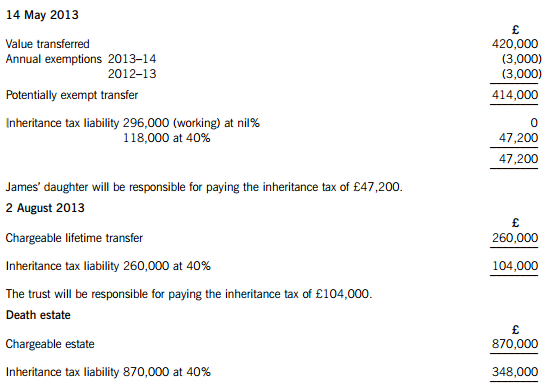

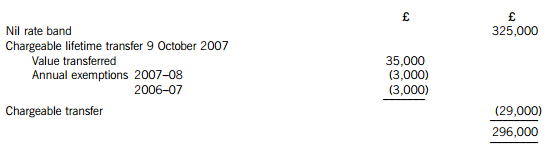

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

正确答案:(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

-

第21题:

transition-property属性语法格式正确的是()。

- A、transition-property:name;

- B、transition-property:none;

- C、transition-property:widthheight;

- D、transition-property:all;

正确答案:B,D -

第22题:

You are creating a Windows Communication Foundation (WCF) service that accepts messages from clients when they are started. The message is defined as follows. [MessageContract] public class Agent { public string CodeName { get; set; }public string SecretHandshake { get; set; } } You have the following requirements: "The CodeName property must be sent in clear text. The service must be able to verify that the property value was not changed after being sent by the client. "The SecretHandshake property must not be sent in clear text and must be readable by the service. What should you do?()

- A、 Add a MessageBodyMember attribute to the CodeName property and set the ProtectionLevel to Sign. Add a MessageBodyMember attribute to the SecretHandshake property and set the protectionLevel to EncryptAndSign.

- B、 Add a DataProtectionPermission attribute to the each property and set the ProtectData property to true.

- C、 Add an XmlText attribute to the CodeName property and set the DataType property to Signed. add a PasswordPropertyText attribute to the SecretHandshake property and set its value to true.

- D、 Add an ImmutableObject attribute to the CodeName property and set its value property to true. Add a Browsable attribute to the SecretHandshake property and set its value to false.

正确答案:A -

第23题:

单选题You are creating a Windows Communication Foundation (WCF) service that accepts messages from clients when they are started. The message is defined as follows. [MessageContract] public class Agent { public string CodeName { get; set; }public string SecretHandshake { get; set; } } You have the following requirements: "The CodeName property must be sent in clear text. The service must be able to verify that the property value was not changed after being sent by the client. "The SecretHandshake property must not be sent in clear text and must be readable by the service. What should you do?()AAdd a MessageBodyMember attribute to the CodeName property and set the ProtectionLevel to Sign. Add a MessageBodyMember attribute to the SecretHandshake property and set the protectionLevel to EncryptAndSign.

BAdd a DataProtectionPermission attribute to the each property and set the ProtectData property to true.

CAdd an XmlText attribute to the CodeName property and set the DataType property to Signed. add a PasswordPropertyText attribute to the SecretHandshake property and set its value to true.

DAdd an ImmutableObject attribute to the CodeName property and set its value property to true. Add a Browsable attribute to the SecretHandshake property and set its value to false.

正确答案: D解析: 暂无解析