2 Alpha Division, which is part of the Delta Group, is considering an investment opportunity to which the followingestimated information relates:(1) An initial investment of $45m in equipment at the beginning of year 1 will be depreciated on a straight-li

题目

2 Alpha Division, which is part of the Delta Group, is considering an investment opportunity to which the following

estimated information relates:

(1) An initial investment of $45m in equipment at the beginning of year 1 will be depreciated on a straight-line basis

over a three-year period with a nil residual value at the end of year 3.

(2) Net operating cash inflows in each of years 1 to 3 will be $12·5m, $18·5m and $27m respectively.

(3) The management accountant of Alpha Division has estimated that the NPV of the investment would be

$1·937m using a cost of capital of 10%.

(4) A bonus scheme which is based on short-term performance evaluation is in operation in all divisions within the

Delta Group.

Required:

(a) (i) Calculate the residual income of the proposed investment and comment briefly (using ONLY the above

information) on the values obtained in reconciling the short-term and long-term decision views likely to

be adopted by divisional management regarding the viability of the proposed investment. (6 marks)

相似考题

更多“2 Alpha Division, which is part of the Delta Group, is considering an investment opportunity to which the followingestimated information relates:(1) An initial investment of $45m in equipment at the beginning of year 1 will be depreciated on a straight-li”相关问题

-

第1题:

2 The Information Technology division (IT) of the RJ Business Consulting Group provides consulting services to its

clients as well as to other divisions within the group. Consultants always work in teams of two on every consulting

day. Each consulting day is charged to external clients at £750 which represents cost plus 150% profit mark up. The

total cost per consulting day has been estimated as being 80% variable and 20% fixed.

The director of the Human Resources (HR) division of RJ Business Consulting Group has requested the services of

two teams of consultants from the IT division on five days per week for a period of 48 weeks, and has suggested that

she meets with the director of the IT division in order to negotiate a transfer price. The director of the IT division has

responded by stating that he is aware of the limitations of using negotiated transfer prices and intends to charge the

HR division £750 per consulting day.

The IT division always uses ‘state of the art’ video-conferencing equipment on all internal consultations which would

reduce the variable costs by £50 per consulting day. Note: this equipment can only be used when providing internal

consultations.

Required:

(a) Calculate and discuss the transfer prices per consulting day at which the IT division should provide

consulting services to the HR division in order to ensure that the profit of the RJ Business Consulting Group

is maximised in each of the following situations:

(i) Every pair of consultants in the IT division is 100% utilised during the required 48-week period in

providing consulting services to external clients, i.e. there is no spare capacity.

(ii) There is one team of consultants who, being free from other commitments, would be available to

undertake the provision of services to the HR division during the required 48-week period. All other

teams of consultants would be 100% utilised in providing consulting services to external clients.

(iii) A major client has offered to pay the IT division £264,000 for the services of two teams of consultants

during the required 48-week period.

(12 marks)

正确答案:

(a) (i) The transfer price of £750 proposed by the IT division is based on cost plus 150% from which it can be deduced that

the total cost of a consulting day is (100/250) x £750 = £300. This comprises £240 (80%) variable cost and £60

(20%) fixed cost. In this instance the transfer price should be set at marginal costs plus opportunity cost. It is assumed

in this situation that transferring internally would result in the IT division having a lost contribution of £750 – £240 =

£510 per consulting day. The marginal cost of the transfer of services to the HR division is £190 (£240 external variable

costs less £50 saving due to use of internal video-conferencing equipment). Adding the opportunity cost of £510 gives

a transfer price of £700 per consulting day. This is equivalent to using market price as a basis for transfer pricing where

the transfer price is set at the external market price (£750) less any costs avoided (£50) by transferring internally.

(ii) There is in effect no external market available for one of the required pairs of consultants within the IT division and

therefore opportunity cost will not apply and transfers should be made at the variable cost per consulting day of £190.

The other pair of consultants, who would otherwise be 100% utilised in providing consulting services to external clients,

should be charged at a rate of £700 per day which represents marginal cost plus opportunity cost.

(iii) The lost contribution from the major client amounts to £264,000/(2 x 240) = £550 less variable costs of £240 =

£310 per consulting day. Thus, in this instance the transfer price should be the contribution foregone of £310 plus

internal variable costs of £190 making a total of £500 per consulting day.

-

第2题:

(ii) Briefly discuss TWO factors which could reduce the rate of return earned by the investment as per the

results in part (a). (4 marks)

正确答案:

(ii) Two factors which might reduce the return earned by the investment are as follows:

(i) Poor product quality

The very nature of the product requires that it is of the highest quality i.e. the cakes are made for human

consumption. Bad publicity via a ‘product recall’ could potentially have a catastrophic effect on the total sales to

Superstores plc over the eighteen month period.

(ii) The popularity of the Mighty Ben character

There is always the risk that the popularity of the character upon which the product is based will diminish with a

resultant impact on sales volumes achieved. In this regard it would be advisable to attempt to negotiate with

Superstores plc in order to minimise potential future losses. -

第3题:

4 The Better Agriculture Group (BAG), which has a divisional structure, produces a range of products for the farming

industry. Divisions B and C are two of its divisions. Division B sells a fertiliser product (BF) to customers external to

BAG. Division C produces a chemical (CC) which it could transfer to Division B for use in the manufacture of its

product BF. However, Division C could also sell some of its output of chemical CC to external customers of BAG.

An independent external supplier to The Better Agriculture Group has offered to supply Division B with a chemical

which is equivalent to component CC. The independent supplier has a maximum spare capacity of 60,000 kilograms

of the chemical which it is willing to make available (in total or in part) to Division B at a special price of $55 per

kilogram.

Forecast information for the forthcoming period is as follows:

Division B:

Production and sales of 360,000 litres of BF at a selling price of $120 per litre.

Variable conversion costs of BF will amount to $15 per litre.

Fixed costs are estimated at $18,000,000.

Chemical (CC) is used at the rate of 1 kilogram of CC per 4 litres of product BF.

Division C:

Total production capacity of 100,000 kilograms of chemical CC.

Variable costs will be $50 per kilogram of CC.

Fixed costs are estimated at $2,000,000.

Market research suggests that external customers of BAG are willing to take up sales of 40,000 kilograms of CC at a

price of $105 per kilogram. The remaining 60,000 kilograms of CC could be transferred to Division B for use in

product BF. Currently no other market external to BAG is available for the 60,000 kilograms of CC.

Required:

(a) (i) State the price/prices per kilogram at which Division C should offer to transfer chemical CC to Division

B in order that the maximisation of BAG profit would occur if Division B management implement rational

sourcing decisions based on purely financial grounds.

Note: you should explain the basis on which Division B would make its decision using the information

available, incorporating details of all relevant calculations. (6 marks)

正确答案:

(a) (i) In order to facilitate BAG profit maximising decisions the following strategy should apply:

Division C should offer to transfer chemical CC to Division B at marginal cost plus opportunity cost. This would apply

as follows:

– 40,000 kilograms of CC at $105 per kilogram since this is the price that could be achieved from sales to external

customers of BAG.

– 60,000 kilograms of CC at marginal cost of $50 per kilogram since no alternative opportunity exists.

Division B has a sales forecast of 360,000 litres of product BF. This will require 360,000/4 = 90,000 kilograms of

chemical CC input.

Based on the pricing by Division C indicated above, Division B would choose to purchase 60,000 kilograms of CC from

Division C at $50 per kilogram, since this is less than the $55 per kilogram quoted by the independent supplier.

Division B would purchase its remaining requirement for 30,000 kilograms of CC from the independent supplier at $55

per kilogram since this is less than the $105 per kilogram at which Division C would offer to transfer its remaining output

– given that it can sell the residual output to external customers of BAG. -

第4题:

听力原文:The primary objective of financial reporting is to provide information useful for making investment and lending decisions.

(6)

A.The financial reporting is to provide information for the investors and lenders only.

B.The main aim of financial reporting is to offer information useful for decision-making.

C.Investment and lending decisions can be made from the financial reporting.

D.Investment and lending decisions can not be made from the financial reporting.

正确答案:B

解析:录音单句意思为“财务报告的主要目标是为投资者和贷款者做决定提供有用信息”。 -

第5题:

Investment is freely transferable, which means one owner can sell his ownership interests to an ________ without a change in the nature of the business.A.investor

B.person

C.owner

D.outsider

正确答案:D

-

第6题:

A manufacturing company, Man Co, has two divisions: Division L and Division M. Both divisions make a single standardised product. Division L makes component L, which is supplied to both Division M and external customers.

Division M makes product M using one unit of component L and other materials. It then sells the completed

product M to external customers. To date, Division M has always bought component L from Division L.

The following information is available:

Division L charges the same price for component L to both Division M and external customers. However, it does not incur the selling and distribution costs when transferring internally.

Division M has just been approached by a new supplier who has offered to supply it with component L for $37 per unit. Prior to this offer, the cheapest price which Division M could have bought component L for from outside the group was $42 per unit.

It is head office policy to let the divisions operate autonomously without interference at all.

Required:

(a) Calculate the incremental profit/(loss) per component for the group if Division M accepts the new supplier’s

offer and recommend how many components Division L should sell to Division M if group profits are to be

maximised. (3 marks)

(b) Using the quantities calculated in (a) and the current transfer price, calculate the total annual profits of each division and the group as a whole. (6 marks)

(c) Discuss the problems which will arise if the transfer price remains unchanged and advise the divisions on a suitable alternative transfer price for component L. (6 marks)

正确答案:

(a)MaximisinggroupprofitDivisionLhasenoughcapacitytosupplybothDivisionManditsexternalcustomerswithcomponentL.Therefore,incrementalcostofDivisionMbuyingexternallyisasfollows:CostperunitofcomponentLwhenboughtfromexternalsupplier:$37CostperunitforDivisionLofmakingcomponentL:$20.ThereforeincrementalcosttogroupofeachunitofcomponentLbeingboughtinbyDivisionMratherthantransferredinternally:$17($37–20).Fromthegroup’spointofview,themostprofitablecourseofactionisthereforethatall120,000unitsofcomponentLshouldbetransferredinternally.(b)CalculatingtotalgroupprofitTotalgroupprofitswillbeasfollows:DivisionL:Contributionearnedpertransferredcomponent=$40–$20=$20Profitearnedpercomponentsoldexternally=$40–$24=$16(c)ProblemswithcurrenttransferpriceandsuggestedalternativeTheproblemisthatthecurrenttransferpriceof$40perunitisnowtoohigh.Whilstthishasnotbeenaproblembeforesinceexternalsupplierswerecharging$42perunit,itisaproblemnowthatDivisionMhasbeenofferedcomponentLfor$37perunit.IfDivisionMnowactsinitsowninterestsratherthantheinterestsofthegroupasawhole,itwillbuycomponentLfromtheexternalsupplierratherthanfromDivisionL.ThiswillmeanthattheprofitsofthegroupwillfallsubstantiallyandDivisionLwillhavesignificantunusedcapacity.Consequently,DivisionLneedstoreduceitsprice.Thecurrentpricedoesnotreflectthefactthattherearenosellinganddistributioncostsassociatedwithtransferringinternally,i.e.thecostofsellinginternallyis$4lessforDivisionLthansellingexternally.So,itcouldreducethepriceto$36andstillmakethesameprofitonthesesalesasonitsexternalsales.ThiswouldthereforebethesuggestedtransferpricesothatDivisionMisstillsaving$1perunitcomparedtotheexternalprice.Atransferpriceof$37wouldalsopresumablybeacceptabletoDivisionMsincethisisthesameastheexternalsupplierisoffering. -

第7题:

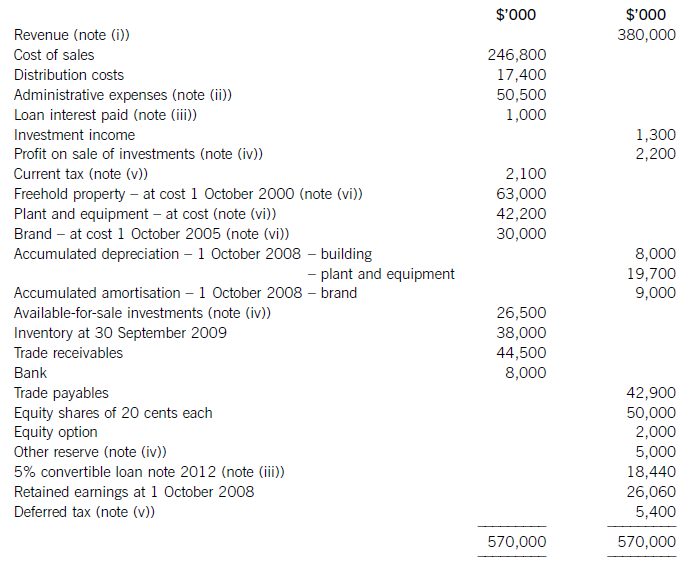

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

正确答案:

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities. -

第8题:

The world's energy watchdog has sounded the alarm over a"worrying"pause in the shift to clean energy after global investment in renewables fell 7%to$318bn(~240bn)last year.The International Energy Agency said the decline is set to continue int0 2018,threatening energy security,climate change and air pollution goals.Fossil fuels increased their share of energy supply investment for the first time since 2014,to$790bn,and will play a significant role for years on current trends,the IEA said.Investment in coal power dropped sharply but was offset by an uptick in oil and gas spending,the World Energy Investment repoit found..Dr Fatih Birol,the executive director of the IEA,said of the renewables fall:"We are seeing a decrease,which is disappointing.And more disappointing is we see the signs this decline may continue this year-this is a worrying trend."Fossil fuels'share of energy investment needs to drop t0 40%by 2030 to meet climate targets but instead rose fractionally t0 59%in 2017.World leaders'warm words on renewables and energy efficiency needed to be matched with action,Birol said,urging govemments to create less investment uncertainty for green energy.Globally,energy investment fell 2%to$1.8tn in 2017,with electricity taking a bigger share than oil and gas for the second year in a row.The decline in renewable power generation spending was mostly down to falls in wind power and hydro but solar hit record levels despite becoming cheaper to install.While coal investment fell to its lowest level in 10 years,spending on gas-fired power stations rose 40%.Nuclear power fell sharply to the lowest level of investment in five years.In the oil and gas industry,rising prices have helped investment in production rise 4%last year and is expected to grow 5%this year.The US's shale boom will drive much of the groivth,and frackers are on track to achieve positive free cashflow this year,for the first time.The US is not expected to pump enough extra crude to bring down oil prices,though.Birol said"Us shale growth is very welcome growth for badly needed additions but this growth alone will not be enough to balance out the markets.Outside the US,investment in conventional oil and gas projects remains subdued and Birol said the world faced"major difficulties"if investment was not stepped u Motorists spent S 43bn on fully electric cars and plug-in hybrids last year,accounting for half of global growth in car sales.However,the battery-powered cars are not seriously denting oil demand yet the IEA said Governments are increasing investment in energy markets,either directly through state-owned firms or indirectly via investments policies and regulation,which Birol said was a surprising development

Which of the following statement can be inferred from Paragraph 2?A.Decline of the investment in green energy will hinder global climate goals

B.The investment in clean energy has dropped dramatically since 2014

C.Fossil fuels continue to account for the majority of increased energy

D.The investment in oil and gas will remain on a decreasing trend by 2030答案:A解析:推理题。根据题干信息可定位到第二段。 -

第9题:

Which statement most accurately describes the account planning service component in the prepare phase for Cisco Unified Communications()

- A、It performs a detailed financial analysis, including current phone network costs, training, and return of investment.

- B、It researches unique challenges and conducts competitive analysis to determine a vertical approach and strategy.

- C、It identifies the key players, high-level solution requirements, timelines, and scope of the opportunity.

- D、It provides the partner with information regarding customer acceptance of the new solution.

正确答案:B -

第10题:

单选题Which statement most accurately describes the account planning service component in the prepare phase for Cisco Unified Communications()AIt performs a detailed financial analysis, including current phone network costs, training, and return of investment.

BIt researches unique challenges and conducts competitive analysis to determine a vertical approach and strategy.

CIt identifies the key players, high-level solution requirements, timelines, and scope of the opportunity.

DIt provides the partner with information regarding customer acceptance of the new solution.

正确答案: B解析: 暂无解析 -

第11题:

单选题Given: Which code, inserted at line 16, will cause a java.lang.ClassCastException?()AAlpha a = x;

BFoo f = (Delta)x;

CFoo f = (Alpha)x;

DBeta b = (Beta)(Alpha)x;

正确答案: B解析: 暂无解析 -

第12题:

单选题Which code, inserted at line 16, will cause a java.lang.ClassCastException?()AAlpha a=x;

BFoo f=(Delta)x;

CFoo f=(Alpha)x;

DBeta b=(Beta)(Alpha)x;

正确答案: B解析: 暂无解析 -

第13题:

(b) (i) Advise the directors of GWCC on specific actions which may be considered in order to improve the

estimated return on their investment of £1,900,000. (8 marks)

正确答案:

(b) (i) The directors of GWCC might consider any of the following specific actions in order to improve the return on the

investment:

– Attempt to raise the selling price of the Mighty Ben cake to Superstores plc. Much will depend on the nature of the

relationship in terms of mutuality of trust and co-operation between the parties. If Superstores plc are insistent on

a launch price of £20·25 and a mark-up of 35% on its purchase price from GWCC then this is likely to be

unsuccessful.

– Attempt to reduce the material losses in the first 600 batches of production via improved process control.

– Attempt to negotiate a retrospective rebate based on volumes of packaging purchased.

– Improve the rate of learning of the hand-skilled cake decorators via a more intensive training programme and/or

altering the flow of production.

– Undertake a thorough review of all variable overheads which have been absorbed on the basis of direct labour

hours. It might well be the case that labour is not the only ‘cost driver’ in which case variable overheads might be

overstated.

– Undertake a thorough review of all fixed overheads to ensure that they are specific to the production of the Mighty

Ben cake.

– Adopt a ‘value engineering’ approach in order to identify ‘non value added’ features/aspects of the product or

processes used to produce it. This would have to be done in conjunction with Superstores plc, but might end in a

‘win-win’ scenario.

– Ensure that all overhead expenditure will be incurred in the most ‘economic’ manner. -

第14题:

2 Ice-Time Ltd (ITL) manufactures a range of sports equipment used in a variety of winter-sports in Snowland.

Development engineers within ITL have recently developed a prototype of a small engine-propelled bobsleigh named

the ‘Snowballer’, which has been designed for use by young children. The directors of ITL recently spent £200,000

on market research, the findings of which led them to believe that a market exists for the Snowballer.

The marketing director has suggested that ITL should use the ‘Olympic’ brand in order to market the Snowballer.

The finance director of ITL has gathered relevant information and prepared the following evaluation relating to the

proposed manufacture and sale of the Snowballer.

(1) Sales are expected to be 3,200 units per annum at a selling price of £2,500 per unit.

(2) Variable material, labour, and overhead costs are estimated at £1,490 per unit.

(3) In addition, a royalty of £150 per unit would be payable to Olympic plc, for the use of their brand name.

(4) Fixed overheads are estimated at £900,000 per annum. These overheads cannot be avoided until the end of the

year in which the Snowballer is withdrawn from the market.

(5) An initial investment of £5 million would be required. A government grant equal to 50% of the initial investment

would be received on the date the investment is made. However, because the Snowballer would be classified as

a luxury good, no tax allowances would be available on this initial investment. The estimated life cycle of the

Snowballer is six years.

(6) Corporation tax at the rate of 30% per annum is payable in the year in which profit occurs.

(7) All cash flows are stated in current prices and, with the exception of the initial investment and the government

grant, will occur at the end of each year.

(8) The nominal cost of capital is 15·44%. Annual inflation during the period is expected to amount to 4%.

Required:

(a) Calculate the net present value (NPV) of the Snowballer proposal and recommend whether it should be

undertaken by the directors of ITL. (4 marks)

正确答案:

-

第15题:

(c) Outline the ways in which Arthur and Cindy can reduce their income tax liability by investing in unquoted

shares and recommend, with reasons, which form. of investment best suits their circumstances. You are not

required to discuss the qualifying conditions applicable to the investment vehicle recommended. (5 marks)

You should assume that the income tax rates and allowances for the tax year 2005/06 apply throughout this

question

正确答案:

(c) Reduction of income tax liability by investing in unquoted shares

The two forms of investment

Income tax relief is available for investments in venture capital trusts (VCTs) and enterprise investment scheme (EIS) shares.

A VCT is a quoted company that invests in shares in a number of unquoted trading companies. EIS shares are shares in

qualifying unquoted trading companies.

Recommendation

The most suitable investment for Arthur and Cindy is a VCT for the following reasons.

– An investment in a VCT is likely to be less risky than investing directly in EIS companies as the risk will be spread over

a greater number of companies.

– The tax deduction is 40% of the amount invested as opposed to 20% for EIS shares.

– Dividends from a VCT are not taxable whereas dividends on EIS shares are taxed in the normal way. -

第16题:

听力原文:The financial reporting is used to provide information useful for making investment and lending decision.

(2)

A.The objective of financial reporting is to provide information useful for making investment and lending decisions.

B.The financial reporting is useless.

C.The financial reporting can't help people to decide whether they invest on something or not.

D.The financial reporting has no objectives.

正确答案:A

解析:单句的意思为“财务报告被用来为投资及借贷决策提供有用信息。” -

第17题:

Given:Which code, inserted at line 16, will cause a java.lang.ClassCastException?()

A.Alpha a = x;

B.Foo f = (Delta)x;

C.Foo f = (Alpha)x;

D.Beta b = (Beta)(Alpha)x;

参考答案:B

-

第18题:

PV Co is evaluating an investment proposal to manufacture Product W33, which has performed well in test marketing trials conducted recently by the company’s research and development division. The following information relating to this investment proposal has now been prepared.

Initial investment $2 million

Selling price (current price terms) $20 per unit

Expected selling price inflation 3% per year

Variable operating costs (current price terms) $8 per unit

Fixed operating costs (current price terms) $170,000 per year

Expected operating cost inflation 4% per year

The research and development division has prepared the following demand forecast as a result of its test marketing trials. The forecast reflects expected technological change and its effect on the anticipated life-cycle of Product W33.

It is expected that all units of Product W33 produced will be sold, in line with the company’s policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product W33 is planned to end. For investment appraisal purposes, PV Co uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 30% per year. Ignore taxation.

Required:

(a) Identify and explain the key stages in the capital investment decision-making process, and the role of

investment appraisal in this process. (7 marks)

(b) Calculate the following values for the investment proposal:

(i) net present value;

(ii) internal rate of return;

(iii) return on capital employed (accounting rate of return) based on average investment; and

(iv) discounted payback period. (13 marks)

(c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. (5 marks)

正确答案:

(a)Thekeystagesinthecapitalinvestmentdecision-makingprocessareidentifyinginvestmentopportunities,screeninginvestmentproposals,analysingandevaluatinginvestmentproposals,approvinginvestmentproposals,andimplementing,monitoringandreviewinginvestments.IdentifyinginvestmentopportunitiesInvestmentopportunitiesorproposalscouldarisefromanalysisofstrategicchoices,analysisofthebusinessenvironment,researchanddevelopment,orlegalrequirements.Thekeyrequirementisthatinvestmentproposalsshouldsupporttheachievementoforganisationalobjectives.ScreeninginvestmentproposalsIntherealworld,capitalmarketsareimperfect,soitisusualforcompaniestoberestrictedintheamountoffinanceavailableforcapitalinvestment.Companiesthereforeneedtochoosebetweencompetinginvestmentproposalsandselectthosewiththebeststrategicfitandthemostappropriateuseofeconomicresources.AnalysingandevaluatinginvestmentproposalsCandidateinvestmentproposalsneedtobeanalysedindepthandevaluatedtodeterminewhichofferthemostattractiveopportunitiestoachieveorganisationalobjectives,forexampletoincreaseshareholderwealth.Thisisthestagewhereinvestmentappraisalplaysakeyrole,indicatingforexamplewhichinvestmentproposalshavethehighestnetpresentvalue.ApprovinginvestmentproposalsThemostsuitableinvestmentproposalsarepassedtotherelevantlevelofauthorityforconsiderationandapproval.Verylargeproposalsmayrequireapprovalbytheboardofdirectors,whilesmallerproposalsmaybeapprovedatdivisionallevel,andsoon.Onceapprovalhasbeengiven,implementationcanbegin.Implementing,monitoringandreviewinginvestmentsThetimerequiredtoimplementtheinvestmentproposalorprojectwilldependonitssizeandcomplexity,andislikelytobeseveralmonths.Followingimplementation,theinvestmentprojectmustbemonitoredtoensurethattheexpectedresultsarebeingachievedandtheperformanceisasexpected.Thewholeoftheinvestmentdecision-makingprocessshouldalsobereviewedinordertofacilitateorganisationallearningandtoimprovefutureinvestmentdecisions. -

第19题:

The world's energy watchdog has sounded the alarm over a"worrying"pause in the shift to clean energy after global investment in renewables fell 7%to$318bn(~240bn)last year.The International Energy Agency said the decline is set to continue int0 2018,threatening energy security,climate change and air pollution goals.Fossil fuels increased their share of energy supply investment for the first time since 2014,to$790bn,and will play a significant role for years on current trends,the IEA said.Investment in coal power dropped sharply but was offset by an uptick in oil and gas spending,the World Energy Investment repoit found..Dr Fatih Birol,the executive director of the IEA,said of the renewables fall:"We are seeing a decrease,which is disappointing.And more disappointing is we see the signs this decline may continue this year-this is a worrying trend."Fossil fuels'share of energy investment needs to drop t0 40%by 2030 to meet climate targets but instead rose fractionally t0 59%in 2017.World leaders'warm words on renewables and energy efficiency needed to be matched with action,Birol said,urging govemments to create less investment uncertainty for green energy.Globally,energy investment fell 2%to$1.8tn in 2017,with electricity taking a bigger share than oil and gas for the second year in a row.The decline in renewable power generation spending was mostly down to falls in wind power and hydro but solar hit record levels despite becoming cheaper to install.While coal investment fell to its lowest level in 10 years,spending on gas-fired power stations rose 40%.Nuclear power fell sharply to the lowest level of investment in five years.In the oil and gas industry,rising prices have helped investment in production rise 4%last year and is expected to grow 5%this year.The US's shale boom will drive much of the groivth,and frackers are on track to achieve positive free cashflow this year,for the first time.The US is not expected to pump enough extra crude to bring down oil prices,though.Birol said"Us shale growth is very welcome growth for badly needed additions but this growth alone will not be enough to balance out the markets.Outside the US,investment in conventional oil and gas projects remains subdued and Birol said the world faced"major difficulties"if investment was not stepped u Motorists spent S 43bn on fully electric cars and plug-in hybrids last year,accounting for half of global growth in car sales.However,the battery-powered cars are not seriously denting oil demand yet the IEA said Governments are increasing investment in energy markets,either directly through state-owned firms or indirectly via investments policies and regulation,which Birol said was a surprising development

Birol suggested that the leaders shouldA.ensure the supply of green energy

B.call for the public to use the new ener

C.match the energy efficiency with the new ener

D.spur sustained investment in renewable energy答案:D解析:推理题。根据题干关键词Birol可定位到第三段。 -

第20题:

The world's energy watchdog has sounded the alarm over a"worrying"pause in the shift to clean energy after global investment in renewables fell 7%to$318bn(~240bn)last year.The International Energy Agency said the decline is set to continue int0 2018,threatening energy security,climate change and air pollution goals.Fossil fuels increased their share of energy supply investment for the first time since 2014,to$790bn,and will play a significant role for years on current trends,the IEA said.Investment in coal power dropped sharply but was offset by an uptick in oil and gas spending,the World Energy Investment repoit found..Dr Fatih Birol,the executive director of the IEA,said of the renewables fall:"We are seeing a decrease,which is disappointing.And more disappointing is we see the signs this decline may continue this year-this is a worrying trend."Fossil fuels'share of energy investment needs to drop t0 40%by 2030 to meet climate targets but instead rose fractionally t0 59%in 2017.World leaders'warm words on renewables and energy efficiency needed to be matched with action,Birol said,urging govemments to create less investment uncertainty for green energy.Globally,energy investment fell 2%to$1.8tn in 2017,with electricity taking a bigger share than oil and gas for the second year in a row.The decline in renewable power generation spending was mostly down to falls in wind power and hydro but solar hit record levels despite becoming cheaper to install.While coal investment fell to its lowest level in 10 years,spending on gas-fired power stations rose 40%.Nuclear power fell sharply to the lowest level of investment in five years.In the oil and gas industry,rising prices have helped investment in production rise 4%last year and is expected to grow 5%this year.The US's shale boom will drive much of the groivth,and frackers are on track to achieve positive free cashflow this year,for the first time.The US is not expected to pump enough extra crude to bring down oil prices,though.Birol said"Us shale growth is very welcome growth for badly needed additions but this growth alone will not be enough to balance out the markets.Outside the US,investment in conventional oil and gas projects remains subdued and Birol said the world faced"major difficulties"if investment was not stepped u Motorists spent S 43bn on fully electric cars and plug-in hybrids last year,accounting for half of global growth in car sales.However,the battery-powered cars are not seriously denting oil demand yet the IEA said Governments are increasing investment in energy markets,either directly through state-owned firms or indirectly via investments policies and regulation,which Birol said was a surprising development

What is the main reason for the falling investment in the renewable power generation?A.The complicated investment procedures

B.The drop in the demand of the green en

C.The decline in wind power and hydro

D.The lack of financial support and channels答案:C解析:细节题。根据题干信息renewable power generation等可定位到第四段。 -

第21题:

Which three steps are considered part of the initial configuration?()

- A、SNMP

- B、hostname

- C、root password

- D、user password

- E、management access interface

正确答案:B,C,E -

第22题:

多选题Which three steps are considered part of the initial configuration?()ASNMP

Bhostname

Croot password

Duser password

Emanagement access interface

正确答案: D,C解析: 暂无解析 -

第23题:

问答题Practice 2 ● You work in a company which deals with industrial waste. You have read about a new kind of pump which could save your company thousands of dollars in service and maintenance costs. ● Write a memo to your Head of Department saying: ● where you read about the new pump ● why you think it could be a good investment ● how you might get more information about it. ● Write 40—50 words on a separate sheet.正确答案: 【参考范文】

To: Head of Department

From: Char Shui

Date: 3 April, 2012

Subject: Disk flow pump

I (have) read about the Disk flow pump in the Pump Times.

It needs very little maintenance. And therefore, it could help the company save a lot of money.

If you are interested, I could make a call to Disk flow Company for more information.解析: 暂无解析