(c) Comment on the matters to be considered in seeking to determine the extent of Indigo Co’s financial lossresulting from the alleged fraud. (6 marks)

题目

(c) Comment on the matters to be considered in seeking to determine the extent of Indigo Co’s financial loss

resulting from the alleged fraud. (6 marks)

相似考题

更多“(c) Comment on the matters to be considered in seeking to determine the extent of Indigo Co’s financial lossresulting from the alleged fraud. (6 marks)”相关问题

-

第1题:

2 Your firm was appointed as auditor to Indigo Co, an iron and steel corporation, in September 2005. You are the

manager in charge of the audit of the financial statements of Indigo, for the year ending 31 December 2005.

Indigo owns office buildings, a workshop and a substantial stockyard on land that was leased in 1995 for 25 years.

Day-to-day operations are managed by the chief accountant, purchasing manager and workshop supervisor who

report to the managing director.

All iron, steel and other metals are purchased for cash at ‘scrap’ prices determined by the purchasing manager. Scrap

metal is mostly high volume. A weighbridge at the entrance to the stockyard weighs trucks and vans before and after

the scrap metals that they carry are unloaded into the stockyard.

Two furnaces in the workshop melt down the salvageable scrap metal into blocks the size of small bricks that are then

stored in the workshop. These are sold on both credit and cash terms. The furnaces are now 10 years old and have

an estimated useful life of a further 15 years. However, the furnace linings are replaced every four years. An annual

provision is made for 25% of the estimated cost of the next relining. A by-product of the operation of the furnaces is

the production of ‘clinker’. Most of this is sold, for cash, for road surfacing but some is illegally dumped.

Indigo’s operations are subsidised by the local authority as their existence encourages recycling and means that there

is less dumping of metal items. Indigo receives a subsidy calculated at 15% of the market value of metals purchased,

as declared in a quarterly return. The return for the quarter to 31 December 2005 is due to be submitted on

21 January 2006.

Indigo maintains manual inventory records by metal and estimated quality. Indigo counted inventory at 30 November

2005 with the intention of ‘rolling-forward’ the purchasing manager’s valuation as at that date to the year-end

quantities per the manual records. However, you were not aware of this until you visited Indigo yesterday to plan

your year-end procedures.

During yesterday’s tour of Indigo’s premises you saw that:

(i) sheets of aluminium were strewn across fields adjacent to the stockyard after a storm blew them away;

(ii) much of the vast quantity of iron piled up in the stockyard is rusty;

(iii) piles of copper and brass, that can be distinguished with a simple acid test, have been mixed up.

The count sheets show that metal quantities have increased, on average, by a third since last year; the quantity of

aluminium, however, is shown to be three times more. There is no suitably qualified metallurgical expert to value

inventory in the region in which Indigo operates.

The chief accountant disappeared on 1 December, taking the cash book and cash from three days’ sales with him.

The cash book was last posted to the general ledger as at 31 October 2005. The managing director has made an

allegation of fraud against the chief accountant to the police.

The auditor’s report on the financial statements for the year ended 31 December 2004 was unmodified.

Required:

(a) Describe the principal audit procedures to be carried out on the opening balances of the financial statements

of Indigo Co for the year ending 31 December 2005. (6 marks)

正确答案:

2 INDIGO CO

(a) Opening balances – principal audit procedures

Tutorial note: ‘Opening balances’ means those account balances which exist at the beginning of the period. The question

clearly states that the prior year auditor’s report was unmodified therefore any digression into the prior period opinion being

other than unmodified or the prior period not having been audited will not earn marks.

■ Review of the application of appropriate accounting policies in the financial statements for the year ended 31 December

2004 to ensure consistent with those applied in 2005.

■ Where permitted (e.g. if there is a reciprocal arrangement with the predecessor auditor to share audit working papers

on a change of appointment), a review of the prior period audit working papers.

Tutorial note: There is no legal, ethical or other professional duty that requires a predecessor auditor to make available

its working papers.

■ Current period audit procedures that provide evidence concerning the existence, measurement and completeness of

rights and obligations. For example:

? after-date receipts (in January 2005 and later) confirming the recoverable amount of trade receivables at

31 December 2004;

? similarly, after-date payments confirming the completeness of trade and other payables (for services);

? after-date sales of inventory held at 31 December 2004;

? review of January 2005 bank reconciliation (confirming clearance of reconciling items at 31 December 2004).

■ Analytical procedures on ratios calculated month-on-month from 31 December 2004 to date and further investigation

of any distortions identified at the beginning of the current reporting period. For example:

? inventory turnover (by category of metal);

? average collection payment;

? average payment period;

? gross profit percentage (by metal).

■ Examination of historic accounting records for non-current assets and liabilities (if necessary). For example:

? agreeing balances on asset registers to the client’s trial balance as at 31 December 2004;

? agreeing statements of balances on loan accounts to the financial statements as at 31 December 2004.

■ If the above procedures do not provide sufficient evidence, additional substantive procedures should be performed. For

example, if additional evidence is required concerning inventory at 31 December 2004, cut-off tests may be

reperformed. -

第2题:

(c) During the year Albreda paid $0·1 million (2004 – $0·3 million) in fines and penalties relating to breaches of

health and safety regulations. These amounts have not been separately disclosed but included in cost of sales.

(5 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(c) Fines and penalties

(i) Matters

■ $0·1 million represents 5·6% of profit before tax and is therefore material. However, profit has fallen, and

compared with prior year profit it is less than 5%. So ‘borderline’ material in quantitative terms.

■ Prior year amount was three times as much and represented 13·6% of profit before tax.

■ Even though the payments may be regarded as material ‘by nature’ separate disclosure may not be necessary if,

for example, there are no external shareholders.

■ Treatment (inclusion in cost of sales) should be consistent with prior year (‘The Framework’/IAS 1 ‘Presentation of

Financial Statements’).

■ The reason for the fall in expense. For example, whether due to an improvement in meeting health and safety

regulations and/or incomplete recording of liabilities (understatement).

■ The reason(s) for the breaches. For example, Albreda may have had difficulty implementing new guidelines in

response to stricter regulations.

■ Whether expenditure has been adjusted for in the income tax computation (as disallowed for tax purposes).

■ Management’s attitude to health and safety issues (e.g. if it regards breaches as an acceptable operational practice

or cheaper than compliance).

■ Any references to health and safety issues in other information in documents containing audited financial

statements that might conflict with Albreda incurring these costs.

■ Any cost savings resulting from breaches of health and safety regulations would result in Albreda possessing

proceeds of its own crime which may be a money laundering offence.

(ii) Audit evidence

■ A schedule of amounts paid totalling $0·1 million with larger amounts being agreed to the cash book/bank

statements.

■ Review/comparison of current year schedule against prior year for any apparent omissions.

■ Review of after-date cash book payments and correspondence with relevant health and safety regulators (e.g. local

authorities) for liabilities incurred before 30 September 2005.

■ Notes in the prior year financial statements confirming consistency, or otherwise, of the lack of separate disclosure.

■ A ‘signed off’ review of ‘other information’ (i.e. directors’ report, chairman’s statement, etc).

■ Written management representation that there are no fines/penalties other than those which have been reflected in

the financial statements. -

第3题:

(ii) Audit work on after-date bank transactions identified a transfer of cash from Batik Co. The audit senior has

documented that the finance director explained that Batik commenced trading on 7 October 2005, after

being set up as a wholly-owned foreign subsidiary of Jinack. No other evidence has been obtained.

(4 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

正确答案:

(ii) Wholly-owned foreign subsidiary

■ The cash transfer is a non-adjusting post balance sheet event. It indicates that Batik was trading after the balance

sheet date. However, that does not preclude Batik having commenced trading before the year end.

■ The finance director’s oral representation is wholly insufficient evidence with regard to the existence (or otherwise)

of Batik at 30 September 2005. If it existed at the balance sheet date its financial statements should have been

consolidated (unless immaterial).

■ The lack of evidence that might reasonably be expected to be available (e.g. legal papers, registration payments,

etc) suggests a limitation on the scope of the audit.

■ If such evidence has been sought but not obtained then the limitation is imposed by the entity (rather than by

circumstances).

■ Whilst the transaction itself may not be material, the information concerning the existence of Batik may be material

to users and should therefore be disclosed (as a non-adjusting event). The absence of such disclosure, if the

auditor considered necessary, would result in a qualified ‘except for’, opinion.

Tutorial note: Any matter that is considered sufficiently material to be worthy of disclosure as a non-adjusting

event must result in such a qualified opinion if the disclosure is not made.

■ If Batik existed at the balance sheet date and had material assets and liabilities then its non-consolidation would

have a pervasive effect. This would warrant an adverse opinion.

■ Also, the nature of the limitation (being imposed by the entity) could have a pervasive effect if the auditor is

suspicious that other audit evidence has been withheld. In this case the auditor should disclaim an opinion. -

第4题:

(c) Your firm has provided financial advice to the Pholey family for many years and this has sometimes involved your

firm in carrying out transactions on their behalf. The eldest son, Esau, is to take up a position as a senior

government official to a foreign country next month. (4 marks)

Required:

Identify and comment on the ethical and other professional issues raised by each of these matters and state what

action, if any, Dedza should now take.

NOTE: The mark allocation is shown against each of the three situations

正确答案:

(c) Financial advisor

■ Customer due diligence (CDD) and record-keeping measures apply to designated non-financial businesses and

professions (such as Dedza) who prepare for or carry out certain transactions on behalf of their clients.

■ Esau is a ‘politically exposed person’ (‘PEP’) (i.e. an individual who is to be entrusted with prominent public functions

in a foreign country).

■ Dedza’s business relationships with Pholey therefore involve reputational risks similar to those with Esau. In addition

to performing normal due diligence measures Dedza should:

? have risk management systems to have determined that Esau is a PEP;

? obtain senior partner approval for maintaining business relationships with such customers;

? take reasonable measures to establish the source of wealth and source of funds;

? conduct enhanced ongoing monitoring of the business relationship.

■ Dedza can choose to decline to act for Pholey and/or Esau (if asked).

■ If the business relationship is to be continued senior partner approval should be obtained for any transactions carried

out on Pholey’s behalf in future.

Tutorial note: The Pholey family is not described as an audit client therefore no familiarity threat arises in relation to an

audit (the family may not have any involvement in entities requiring an audit). -

第5题:

(c) In April 2006, Keffler was banned by the local government from emptying waste water into a river because the

water did not meet minimum standards of cleanliness. Keffler has made a provision of $0·9 million for the

technological upgrading of its water purifying process and included $45,000 for the penalties imposed in ‘other

provisions’. (5 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(c) Ban on emptying waste water

(i) Matter

■ $0·9m provision for upgrading the process represents 45% PBT and is very material. This provision is also

material to the balance sheet (2·7% of total assets).

■ The provision for penalties is immaterial (2·2% PBT and 0·1% total assets).

■ The ban is an adjusting post balance sheet event in respect of the penalties (IAS 10). It provides evidence that at

the balance sheet date Keffler was in contravention of local government standards. Therefore it is correct (in

accordance with IAS 37) that a provision has been made for the penalties. As the matter is not material inclusion

in ‘other provisions’ is appropriate.

■ However, even if Keffler has a legal obligation to meet minimum standards, there is no obligation for upgrading the

purifying process at 31 March 2006 and the $0·9m provision should be written back.

■ If the provision for upgrading is not written back the audit opinion should be qualified ‘except for’ (disagreement).

■ Keffler does not even have a contingent liability for upgrading the process because there is no present obligation to

do so. The obligation is to stop emptying unclean water into the river. Nor is there a possible obligation whose

existence will be confirmed by an uncertain future event not wholly within Keffler’s control.

Tutorial note: Consider that Keffler has alternatives wholly within its control. For example, it could ignore the ban

and incur fines, or relocate/close this particular plant/operation or perhaps dispose of the water by alternative

means.

■ The need for a technological upgrade may be an indicator of impairment. Management should have carried out

an impairment test on the carrying value of the water purifying process and recognised any impairment loss in the

profit for the year to 31 March 2006.

■ Management’s intention to upgrade the process is more appropriate to an environmental responsibility report (if

any).

■ Whether there is any other information in documents containing financial statements.

(ii) Audit evidence

■ Penalty notices of fines received to confirm amounts and period/dates covered.

■ After-date payment of fines agreed to the cash book.

■ A copy of the ban and any supporting report on the local government’s findings.

■ Minutes of board meetings at which the ban was discussed confirming management’s intentions (e.g. to upgrade

the process).

Tutorial note: This may be disclosed in the directors’ report and/or as a non-adjusting post balance sheet event.

■ Any tenders received/costings for upgrading.

Tutorial note: This will be relevant if, for example, capital commitment authorised (by the board) but not

contracted for at the year end are disclosed in the notes to the financial statements.

■ Physical inspection of the emptying point at the river to confirm that Keffler is not still emptying waste water into

it (unless the upgrading has taken place).

Tutorial note: Thereby incurring further penalties. -

第6题:

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Goodwill

(i) Matters

■ Cost of goodwill, $1·8 million, represents 3·4% consolidated total assets and is therefore material.

Tutorial note: Any assessments of materiality of goodwill against amounts in Aragon’s financial statements are

meaningless since goodwill only exists in the consolidated financial statements of Seymour.

■ It is correct that the goodwill is not being amortised (IFRS 3 Business Combinations). However, it should be tested

at least annually for impairment, by management.

■ Aragon has incurred losses amounting to $1·1 million since it was acquired (two years ago). The write-off of this

amount against goodwill in the consolidated financial statements would be material (being 61% cost of goodwill,

8·3% PBT and 2·1% total assets).

■ The cost of the investment ($4·5 million) in Seymour’s separate financial statements will also be material and

should be tested for impairment.

■ The fair value of net assets acquired was only $2·7 million ($4·5 million less $1·8 million). Therefore the fair

value less costs to sell of Aragon on other than a going concern basis will be less than the carrying amount of the

investment (i.e. the investment is impaired by at least the amount of goodwill recognised on acquisition).

■ In assessing recoverable amount, value in use (rather than fair value less costs to sell) is only relevant if the going

concern assumption is appropriate for Aragon.

■ Supporting Aragon financially may result in Seymour being exposed to actual and/or contingent liabilities that

should be provided for/disclosed in Seymour’s financial statements in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets.

(ii) Audit evidence

■ Carrying values of cost of investment and goodwill arising on acquisition to prior year audit working papers and

financial statements.

■ A copy of Aragon’s draft financial statements for the year ended 30 September 2006 showing loss for year.

■ Management’s impairment test of Seymour’s investment in Aragon and of the goodwill arising on consolidation at

30 September 2006. That is a comparison of the present value of the future cash flows expected to be generated

by Aragon (a cash-generating unit) compared with the cost of the investment (in Seymour’s separate financial

statements).

■ Results of any impairment tests on Aragon’s assets extracted from Aragon’s working paper files.

■ Analytical procedures on future cash flows to confirm their reasonableness (e.g. by comparison with cash flows for

the last two years).

■ Bank report for audit purposes for any guarantees supporting Aragon’s loan facilities.

■ A copy of Seymour’s ‘comfort letter’ confirming continuing financial support of Aragon for the foreseeable future. -

第7题:

(c) Describe the examination procedures you should use to verify Cusiter Co’s prospective financial information.

(9 marks)

正确答案:

(c) Examination procedures

■ The arithmetic accuracy of the PFI should be confirmed, i.e. subtotals and totals should be recast and agreed.

■ The actual information for the year to 31 December 2006 that is shown as comparative information should be agreed

to the audited financial statements for that year to ensure consistency.

■ Balances and transaction totals for the quarter to 31 March 2007 should be agreed to general ledger account balances

at that date. The net book value of property, plant and equipment should be agreed to the non-current asset register;

accounts receivable/payable to control accounts and cash at bank to a bank reconciliation statement.

■ Tenders for the new equipment should be inspected to confirm the additional cost included in property, plant and

equipment included in the forecast for the year to 31 December 2008 and that it can be purchased with the funds being

lent by the bank.

■ The reasonableness of all new assumptions should be considered. For example, the expected useful life of the new

equipment, the capacity at which it will be operating, the volume of new product that can be sold, and at what price.

■ The forecast income statement should be reviewed for completeness of costs associated with the expansion. For

example, operating expenses should include salaries of additional equipment operatives or supervisors.

■ The consistency of accounting practices reflected in the forecast with International Financial Reporting Standards (IFRS)

should be considered. For example, the intangible asset might be expected to be less than $10,000 at 31 December

2008 as it should be carried at amortised cost.

■ The cost of property, plant and equipment at 31 December 2008 is $280,000 more than as at 31 December 2007.

Consideration should be given to the adequacy of borrowing $250,000 if the actual investment is $30,000 more.

■ The terms of existing borrowings (both non-current and short-term) should be reviewed to ensure that the forecast takes

full account of existing repayment schedules. For example, to confirm that only $23,000 of term borrowings will become

current by the end of 2007.

Trends should be reviewed and fluctuations explained, for example:

■ Revenue for the first quarter of 2007 is only 22% of revenue for 2006 and so may appear to be understated. However,

revenue may not be understated if sales are seasonal and the first quarter is traditionally ‘quieter’.

■ Forecast revenue for 2007 is 18% up on 2006. However, forecast revenue for 2008 is only 19% up on 2007. As the

growth in 2007 is before the investment in new plant and equipment it does not look as though the new investment

will be contributing significantly to increased growth in the first year.

■ The gross profit % is maintained at around 29% for the three years. However, the earnings before interest and tax (EBIT)

% is forecast to fall by 2% for 2008. Earnings after interest might be worrying to the potential lender as this is forecast

to rise from 12·2% in 2006 to 13·7% in 2007 but then fall to 7·6% in 2008.

The reasonableness of relationships between income statement and balance sheet items should be considered. For example:

■ The average collection period at each of the balance sheet dates presented is 66, 69, 66 and 66 days respectively (e.g.

71/394 × 365 = 66 days). Although it may be realistic to assume that the current average collection period may be

maintained in future it is possible that it could deteriorate if, for example, new customers taken on to launch the new

product are not as credit worthy as the existing customer base.

■ The number of days sales in inventory at each balance sheet date is 66, 88, 66 and 65 days respectively (e.g. 50/278

× 365 = 66 days). The reason for the increase to 88 at the end of the first quarter must be established and

management’s assertion that 66 days will be re-established as the ‘norm’ corroborated.

■ As the $42,000 movement on retained earnings from 2007 to 2008 is the earnings before income tax for 2008 it may

be that there is no tax in 2008 or that tax effects have not been forecast. (However, some deferred tax effect might be

expected if the investment in new plant and equipment is likely to attract accelerated capital allowances.) -

第8题:

(b) While the refrigeration units were undergoing modernisation Lamont outsourced all its cold storage requirements

to Hogg Warehousing Services. At 31 March 2007 it was not possible to physically inspect Lamont’s inventory

held by Hogg due to health and safety requirements preventing unauthorised access to cold storage areas.

Lamont’s management has provided written representation that inventory held at 31 March 2007 was

$10·1 million (2006 – $6·7 million). This amount has been agreed to a costing of Hogg’s monthly return of

quantities held at 31 March 2007. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Lamont Co for the year ended

31 March 2007.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Outsourced cold storage

(i) Matters

■ Inventory at 31 March 2007 represents 21% of total assets (10·1/48·0) and is therefore a very material item in the

balance sheet.

■ The value of inventory has increased by 50% though revenue has increased by only 7·5%. Inventory may be

overvalued if no allowance has been made for slow-moving/perished items in accordance with IAS 2 Inventories.

■ Inventory turnover has fallen to 6·6 times per annum (2006 – 9·3 times). This may indicate a build up of

unsaleable items.

Tutorial note: In the absence of cost of sales information, this is calculated on revenue. It may also be expressed

as the number of days sales in inventory, having increased from 39 to 55 days.

■ Inability to inspect inventory may amount to a limitation in scope if the auditor cannot obtain sufficient audit

evidence regarding quantity and its condition. This would result in an ‘except for’ opinion.

■ Although Hogg’s monthly return provides third party documentary evidence concerning the quantity of inventory it

does not provide sufficient evidence with regard to its valuation. Inventory will need to be written down if, for

example, it was contaminated by the leakage (before being moved to Hogg’s cold storage) or defrosted during

transfer.

■ Lamont’s written representation does not provide sufficient evidence regarding the valuation of inventory as

presumably Lamont’s management did not have access to physically inspect it either. If this is the case this may

call into question the value of any other representations made by management.

■ Whether, since the balance sheet date, inventory has been moved back from Hogg’s cold storage to Lamont’s

refrigeration units. If so, a physical inspection and roll-back of the most significant fish lines should have been

undertaken.

Tutorial note: Credit will be awarded for other relevant accounting issues. For example a candidate may question

whether, for example, cold storage costs have been capitalised into the cost of inventory. Or whether inventory moves

on a FIFO basis in deep storage (rather than LIFO).

(ii) Audit evidence

■ A copy of the health and safety regulation preventing the auditor from gaining access to Hogg’s cold storage to

inspect Lamont’s inventory.

■ Analysis of Hogg’s monthly returns and agreement of significant movements to purchase/sales invoices.

■ Analytical procedures such as month-on-month comparison of gross profit percentage and inventory turnover to

identify any trend that may account for the increase in inventory valuation (e.g. if Lamont has purchased

replacement inventory but spoiled items have not been written off).

■ Physical inspection of any inventory in Lamont’s refrigeration units after the balance sheet date to confirm its

condition.

■ An aged-inventory analysis and recalculation of any allowance for slow-moving items.

■ A review of after-date sales invoices for large quantities of fish to confirm that fair value (less costs to sell) exceed

carrying amount.

■ A review of after-date credit notes for any returns of contaminated/perished or otherwise substandard fish. -

第9题:

(ii) On 1 July 2006 Petrie introduced a 10-year warranty on all sales of its entire range of stainless steel

cookware. Sales of stainless steel cookware for the year ended 31 March 2007 totalled $18·2 million. The

notes to the financial statements disclose the following:

‘Since 1 July 2006, the company’s stainless steel cookware is guaranteed to be free from defects in

materials and workmanship under normal household use within a 10-year guarantee period. No provision

has been recognised as the amount of the obligation cannot be measured with sufficient reliability.’

(4 marks)

Your auditor’s report on the financial statements for the year ended 31 March 2006 was unmodified.

Required:

Identify and comment on the implications of these two matters for your auditor’s report on the financial

statements of Petrie Co for the year ended 31 March 2007.

NOTE: The mark allocation is shown against each of the matters above.

正确答案:

(ii) 10-year guarantee

$18·2 million stainless steel cookware sales amount to 43·1% of revenue and are therefore material. However, the

guarantee was only introduced three months into the year, say in respect of $13·6 million (3/4 × 18·2 million) i.e.

approximately 32% of revenue.

The draft note disclosure could indicate that Petrie’s management believes that Petrie has a legal obligation in respect

of the guarantee, that is not remote and likely to be material (otherwise no disclosure would have been required).

A best estimate of the obligation amounting to 5% profit before tax (or more) is likely to be considered material, i.e.

$90,000 (or more). Therefore, if it is probable that 0·66% of sales made under guarantee will be returned for refund,

this would require a warranty provision that would be material.

Tutorial note: The return of 2/3% of sales over a 10-year period may well be probable.

Clearly there is a present obligation as a result of a past obligating event for sales made during the nine months to

31 March 2007. Although the likelihood of outflow under the guarantee is likely to be insignificant (even remote) it is

probable that some outflow will be needed to settle the class of such obligations.

The note in the financial statements is disclosing this matter as a contingent liability. This term encompasses liabilities

that do not meet the recognition criteria (e.g. of reliable measurement in accordance with IAS 37 Provisions, Contingent

Liabilities and Contingent Assets).

However, it is extremely rare that no reliable estimate can be made (IAS 37) – the use of estimates being essential to

the preparation of financial statements. Petrie’s management must make a best estimate of the cost of refunds/repairs

under guarantee taking into account, for example:

■ the proportion of sales during the nine months to 31 March 2007 that have been returned under guarantee at the

balance sheet date (and in the post balance sheet event period);

■ the average age of cookware showing a defect;

■ the expected cost of a replacement item (as a refund of replacement is more likely than a repair, say).

If management do not make a provision for the best estimate of the obligation the audit opinion should be qualified

‘except for’ non-compliance with IAS 37 (no provision made). The disclosure made in the note to the financial

statements, however detailed, is not a substitute for making the provision.

Tutorial note: No marks will be awarded for suggesting that an emphasis of matter of paragraph would be appropriate

(drawing attention to the matter more fully explained in the note).

Management’s claim that the obligation cannot be measured with sufficient reliability does not give rise to a limitation

on scope on the audit. The auditor has sufficient evidence of the non-compliance with IAS 37 and disagrees with it. -

第10题:

(c) Identify and discuss the ethical and professional matters raised at the inventory count of LA Shots Co.

(6 marks)

正确答案:

(c) There are several ethical and professional issues raised in relation to the inventory count of LA Shots Co.

Firstly, it was inappropriate of Brenda Mangle to offer the incentive to the audit juniors. As she is a new manager, it may be

that she didn’t realise how the incentive would be perceived. Brenda should be informed that her actions could have serious

implications.

The offer could be viewed as a bribe of the audit juniors, and could be perceived as a self-interest independence threat as

there is a financial benefit offered to members of the audit team.

The value of the ten bottles of ‘Super Juice’ should be considered, as it is only appropriate for a member of the audit team to

accept any goods or hospitality from the audit client if the value is ‘clearly insignificant’. Ultimately it would be the decision

of the audit partner as to whether the value is clearly insignificant. It is likely that this does not constitute a significant threat

to independence, however the offer should still be referred to the audit partner.

Also, if the juniors took ten bottles of ‘Super Juice’, this could interfere with the physical count of goods and/or with cut off

details obtained at the count. The juniors should therefore have declined the offer and informed a senior member of the audit

team of the situation.

There may be a need to adequately train new members of staff on ethical matters if the juniors were unsure of how to react

to the offer.

The work performed by the juniors at the inventory count must be reviewed. The audit procedures were performed very

quickly compared to last year and therefore sufficient evidence may not have been gathered. In an extreme situation the whole

inventory count may have to be reperformed if it is found that the procedures performed cannot be relied upon.

In addition, the juniors should not have attended the audit client’s office party without the permission of the audit manager.

The party appears to have taken place during work time, when the juniors should have been completing the inventory count

procedures. The two juniors have not acted with due professional consideration, and could be considered to lack integrity.

The actions of the juniors should be discussed with them, possibly with a view to disciplinary action.

There may also be questions over whether the direction and supervision of the juniors was adequate. As the two juniors are

both recent recruits, this is likely to be the first inventory count that they have attended. It appears that they may not have

been adequately briefed as to the importance of the inventory count as a source of audit evidence, or that they have

disregarded any such briefing that was provided to them. In either case possibly a more senior auditor should have

accompanied them to the inventory count and supervised their actions. -

第11题:

(b) (i) Explain the matters you should consider, and the evidence you would expect to find in respect of the

carrying value of the cost of investment of Dylan Co in the financial statements of Rosie Co; and

(7 marks)

正确答案:

(b) (i) Cost of investment on acquisition of Dylan Co

Matters to consider

According to the schedule provided by the client, the cost of investment comprises three elements. One matter to

consider is whether the cost of investment is complete.

It appears that no legal or professional fees have been included in the cost of investment (unless included within the

heading ‘cash consideration’). Directly attributable costs should be included per IFRS 3 Business Combinations, and

there is a risk that these costs may be expensed in error, leading to understatement of the investment.

The cash consideration of $2·5 million is the least problematical component. The only matter to consider is whether the

cash has actually been paid. Given that Dylan Co was acquired in the last month of the financial year it is possible that

the amount had not been paid before the year end, in which case the amount should be recognised as a current liability

on the statement of financial position (balance sheet). However, this seems unlikely given that normally control of an

acquired company only passes to the acquirer on cash payment.

IFRS 3 states that the cost of investment should be recognised at fair value, which means that deferred consideration

should be discounted to present value at the date of acquisition. If the consideration payable on 31 January 2009 has

not been discounted, the cost of investment, and the corresponding liability, will be overstated. It is possible that the

impact of discounting the $1·5 million payable one year after acquisition would be immaterial to the financial

statements, in which case it would be acceptable to leave the consideration at face value within the cost of investment.

Contingent consideration should be accrued if it is probable to be paid. Here the amount is payable if revenue growth

targets are achieved over the next four years. The auditor must therefore assess the probability of the targets being

achieved, using forecasts and projections of Maxwell Co’s revenue. Such information is inherently subjective, and could

have been manipulated, if prepared by the vendor of Maxwell Co, in order to secure the deal and maximise

consideration. Here it will be crucial to be sceptical when reviewing the forecasts, and the assumptions underlying the

data. The management of Rosie Co should have reached their own opinion on the probability of paying the contingent

consideration, but they may have relied heavily on information provided at the time of the acquisition.

Audit evidence

– Agreement of the monetary value and payment dates of the consideration per the client schedule to legal

documentation signed by vendor and acquirer.

– Agreement of $2·5 million paid to Rosie Co’s bank statement and cash book prior to year end. If payment occurs

after year end confirm that a current liability is recognised on the individual company and consolidated statement

of financial position (balance sheet).

– Board minutes approving the payment.

– Recomputation of discounting calculations applied to deferred and contingent consideration.

– Agreement that the discount rate used is pre-tax, and reflects current market assessment of the time value of money

(e.g. by comparison to Rosie Co’s weighted average cost of capital).

– Revenue and profit projections for the period until January 2012, checked for arithmetic accuracy.

– A review of assumptions used in the projections, and agreement that the assumptions are comparable with the

auditor’s understanding of Dylan Co’s business.

Tutorial note: As the scenario states that Chien & Co has audited Dylan Co for several years, it is reasonable to rely on

their cumulative knowledge and understanding of the business in auditing the revenue projections. -

第12题:

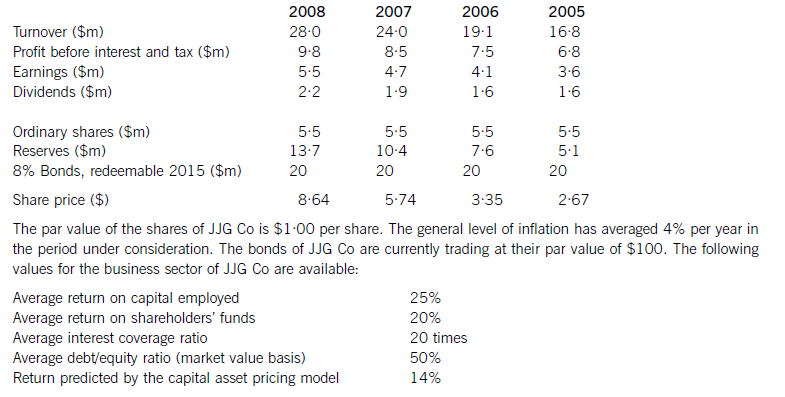

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第13题:

(b) Using the information provided, state the financial statement risks arising and justify an appropriate audit

approach for Indigo Co for the year ending 31 December 2005. (14 marks)

正确答案:

(b) Financial statement risks

Assets

■ There is a very high risk that inventory could be materially overstated in the balance sheet (thereby overstating profit)

because:

? there is a high volume of metals (hence material);

? valuable metals are made more portable;

? subsidy gives an incentive to overstate purchases (and hence inventory);

? inventory may not exist due to lack of physical controls (e.g. aluminium can blow away);

? scrap metal in the stockyard may have zero net realisable value (e.g. iron is rusty and slow-moving);

? quantities per counts not attended by an auditor have increased by a third.

■ Inventory could be otherwise misstated (over or under) due to:

? the weighbridge being inaccurate;

? metal qualities being estimated;

? different metals being mixed up; and

? the lack of an independent expert to identify/measure/value metals.

■ Tangible non-current assets are understated as the parts of the furnaces that require replacement (the linings) are not

capitalised (and depreciated) as separate items but treated as repairs/maintenance/renewals and expensed.

■ Cash may be understated due to incomplete recording of sales.

■ Recorded cash will be overstated if it does not exist (e.g. if it has been stolen).

■ Trade receivables may be understated if cash receipts from credit customers have been misappropriated.

Liabilities

■ The provision for the replacement of the furnace linings is overstated by the amount provided in the current and previous

year (i.e. in its entirety).

Tutorial note: Last replacement was two years ago.

Income statement

■ Revenue will be understated in respect of unrecorded cash sales of salvaged metals and ‘clinker’.

■ Scrap metal purchases (for cash) are at risk of overstatement:

? to inflate the 15% subsidy;

? to conceal misappropriated cash.

■ The income subsidy will be overstated if quantities purchased are overstated and/or overvalued (on the quarterly returns)

to obtain the amount of the subsidy.

■ Cash receipts/payments that were recorded only in the cash book in November are at risk of being unrecorded (in the

absence of cash book postings for November), especially if they are of a ‘one-off’ nature.

Tutorial note: Cash purchases of scrap and sales of salvaged metal should be recorded elsewhere (i.e. in the manual

inventory records). However, a one-off expense (of a capital or revenue nature) could be omitted in the absence of

another record.

■ Expenditure is overstated in respect of the 25% provision for replacing the furnace linings. However, as depreciation

will be similarly understated (as the furnace linings have not been capitalised) there is no risk of material misstatement

to the income statement overall.

Disclosure risk

■ A going concern (‘failure’) risk may arise through the loss of:

? sales revenue (e.g. through misappropriation of salvaged metals and/or cash);

? the subsidy (e.g. if returns are prepared fraudulently);

? cash (e.g. if material amounts stolen).

Any significant doubts about going concern must be suitably disclosed in the notes to the financial statements.

Disclosure risk arises if the requirements of IAS 1 ‘Presentation of Financial Statements’ are not met.

■ Disclosure risk arises if contingent liabilities in connection with the dumping of ‘clinker’ (e.g. for fines and penalties) are

not adequately disclosed in accordance with IAS 37 ‘Provisions, Contingent Liabilities and Contingent Assets’.

Appropriate audit approach

Tutorial note: In explaining why AN audit approach is appropriate for Indigo it can be relevant to comment on the

unsuitability of other approaches.

■ A risk-based approach is suitable because:

? inherent risk is high at the entity and financial assertion levels;

? material errors are likely to arise in inventory where a high degree of subjectivity will be involved (regarding quality

of metals, quantities, net realisable value, etc);

? it directs the audit effort to inventory, purchases, income (sales and subsidy) and other risk areas (e.g. contingent

liabilities).

■ A systems-based/compliance approach is not suited to the risk areas identified because controls are lacking/ineffective

(e.g. over inventory and cash). Also, as the audit appointment was not more than three months ago and no interim

audit has been conducted (and the balance sheet date is only three weeks away) testing controls is likely to be less

efficient than a substantive approach.

■ A detailed substantive/balance sheet approach would be suitable to direct audit effort to the appropriate valuation of

assets (and liabilities) existing at balance sheet date. Principal audit work would include:

? attendance at a full physical inventory count at 31 December 2005;

? verifying cash at bank (through bank confirmation and reconciliation) and in hand (through physical count);

? confirming the accuracy of the quarterly returns to the local authority.

■ A cyclical approach/directional testing is unlikely to be suitable as cycles are incomplete. For example the purchases

cycle for metals is ‘purchase/cash’ rather than ‘purchase/payable/cash’ and there is no independent third party evidence

to compensate for that which would be available if there were trade payables (i.e. suppliers’ statements). Also the cycles

are inextricably inter-related to cash and inventory – amounts of which are subject to high inherent risk.

■ Analytical procedures may be of limited use for substantive purposes. Factors restricting the use of substantive analytical

procedures include:

? fluctuating margins (e.g. as many factors will influence the price at which scrap is purchased and subsequently

sold, when salvaged, sometime later);

? a lack of reliable/historic information on which to make comparisons. -

第14题:

4 (a) Explain the auditor’s responsibilities in respect of subsequent events. (5 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

正确答案:

4 JINACK CO

(a) Auditor’s responsibilities for subsequent events

■ Auditors must consider the effect of subsequent events on:

– the financial statements;

– the auditor’s report.

■ Subsequent events are all events occurring after a period end (i.e. reporting date) i.e.:

– events after the balance sheet date (as defined in IAS 10); and

– events after the financial statements have been authorised for issue.

Events occurring up to date of auditor’s report

■ The auditor is responsible for carrying out procedures designed to obtain sufficient appropriate audit evidence that all

events up to the date of the auditor’s report that may require adjustment of, or disclosure in, the financial statements

have been identified.

■ These procedures are in addition to those applied to specific transactions occurring after the period end that provide

audit evidence of period-end account balances (e.g. inventory cut-off and receipts from trade receivables). Such

procedures should ordinarily include:

– reviewing minutes of board/audit committee meetings;

– scrutinising latest interim financial statements/budgets/cash flows, etc;

– making/extending inquiries to legal advisors on litigation matters;

– inquiring of management whether any subsequent events have occurred that might affect the financial statements

(e.g. commitments entered into).

■ When the auditor becomes aware of events that materially affect the financial statements, the auditor must consider

whether they have been properly accounted for and adequately disclosed in the financial statements.

Facts discovered after the date of the auditor’s report but before financial statements are issued

Tutorial note: After the date of the auditor’s report it is management’s responsibility to inform. the auditor of facts which

may affect the financial statements.

■ If the auditor becomes aware of such facts which may materially affect the financial statements, the auditor:

– considers whether the financial statements need amendment;

– discusses the matter with management; and

– takes appropriate action (e.g. audit any amendments to the financial statements and issue a new auditor’s report).

■ If management does not amend the financial statements (where the auditor believes they need to be amended) and the

auditor’s report has not been released to the entity, the auditor should express a qualified opinion or an adverse opinion

(as appropriate).

■ If the auditor’s report has been released to the entity, the auditor must notify those charged with governance not to issue

the financial statements (and the auditor’s report thereon) to third parties.

Tutorial note: The auditor would seek legal advice if the financial statements and auditor’s report were subsequently issued.

Facts discovered after the financial statements have been issued

■ The auditor has no obligation to make any inquiry regarding financial statements that have been issued.

■ However, if the auditor becomes aware of a fact which existed at the date of the auditor’s report and which, if known

at that date, may have caused the auditor’s report to be modified, the auditor should:

– consider whether the financial statements need revision;

– discuss the matter with management; and

– take appropriate action (e.g. issuing a new report on revised financial statements). -

第15题:

(b) The chief executive of Xalam Co, an exporter of specialist equipment, has asked for advice on the accounting

treatment and disclosure of payments made for security consultancy services. The payments, which aim to

ensure that consignments are not impounded in the destination country of a major customer, may be material to

the financial statements for the year ending 30 June 2006. Xalam does not treat these payments as tax

deductible. (4 marks)

Required:

Identify and comment on the ethical and other professional issues raised by each of these matters and state what

action, if any, Dedza should now take.

NOTE: The mark allocation is shown against each of the three situations.

正确答案:

(b) Advice on payments

■ As compared with (a) there is no obvious tax issue. Xalam is not overstating expenditure for tax purposes.

■ The payments being made for security consultancy services amount to a bribe. Corruption and bribery (and extortion)

are designated categories of money laundering offence under ‘The Forty Recommendations’ of the Financial Action Task

Force on Money Laundering (FATF).

■ Xalam clearly benefits from the payments as it receives income from the contract with the major customer. This is

criminal property and possession of it is a money laundering offence.

■ Dedza should consider the seriousness of the disclosure made by the chief executive in the context of domestic law.

■ Dedza should consider its knowledge of import duties etc in the destination country before recommending a course of

action to Xalam.

■ Dedza may be guilty of a money laundering offence if the matter is not reported. If a report to the FIU is considered

necessary then Dedza should encourage Xalam to make voluntary disclosure. If Xalam does not, Dedza will not be in

breach of client confidentiality for reporting knowledge of a suspicious transaction.

Tutorial note: Making a report takes precedence over client confidentiality. -

第16题:

(b) A sale of industrial equipment to Deakin Co in May 2005 resulted in a loss on disposal of $0·3 million that has

been separately disclosed on the face of the income statement. The equipment cost $1·2 million when it was

purchased in April 1996 and was being depreciated on a straight-line basis over 20 years. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Sale of industrial equipment

(i) Matters

■ The industrial equipment was in use for nine years (from April 1996) and would have had a carrying value of

$660,000 at 31 March 2005 (11/20 × $1·2m – assuming nil residual value and a full year’s depreciation charge

in the year of acquisition and none in the year of disposal). Disposal proceeds were therefore only $360,000.

■ The $0·3m loss represents 15% of PBT (for the year to 31 March 2006) and is therefore material. The equipment

was material to the balance sheet at 31 March 2005 representing 2·6% of total assets ($0·66/$25·7 × 100).

■ Separate disclosure, of a material loss on disposal, on the face of the income statement is in accordance with

IAS 16 ‘Property, Plant and Equipment’. However, in accordance with IAS 1 ‘Presentation of Financial Statements’,

it should not be captioned in any way that might suggest that it is not part of normal operating activities (i.e. not

‘extraordinary’, ‘exceptional’, etc).

Tutorial note: However, note that if there is a prior period error to be accounted for (see later), there would be

no impact on the current period income statement requiring consideration of any disclosure.

■ The reason for the sale. For example, whether the equipment was:

– surplus to operating requirements (i.e. not being replaced); or

– being replaced with newer equipment (thereby contributing to the $8·1m increase (33·8 – 25·7) in total

assets).

■ The reason for the loss on sale. For example, whether:

– the sale was at an under-value (e.g. to a related party);

– the equipment had a bad maintenance history (or was otherwise impaired);

– the useful life of the equipment is less than 20 years;

– there is any deferred consideration not yet recorded;

– any non-cash disposal proceeds have been overlooked (e.g. if another asset was acquired in a part-exchange).

■ If the useful life was less than 20 years, tangible non-current assets may be materially overstated in respect of other

items of equipment that are still in use and being depreciated on the same basis.

■ If the sale was to a related party then additional disclosure should be required in a note to the financial statements

for the year to 31 March 2006 (IAS 24 ‘Related Party Disclosures’).

Tutorial note: Since there are no specific pointers to a related party transaction (RPT), this point is not expanded

on.

■ Whether the sale was identified in the prior year audit’s post balance sheet event review. If so:

– the disclosure made in the prior year’s financial statements (IAS 10 ‘Events After the Balance Sheet Date’);

– whether an impairment loss was recognised at 31 March 2005.

■ If not, and the equipment was impaired at 31 March 2005, a prior period error should be accounted for (IAS 8

‘Accounting Policies, Changes in Accounting Estimates and Errors’). An impairment loss of $0·3m would have

been material to prior year profit (12·5%).

Tutorial note: Unless this was a RPT or the impairment arose after 31 March 2005 a prior period adjustment

should be made.

■ Failure to account for a prior period error (if any) would result in modification of the audit opinion ‘except for’ noncompliance

with IAS 8 (in the current year) and IAS 36 (in the prior period).

(ii) Audit evidence

■ Carrying amount ($0·66m as above) agreed to the non-current asset register balances at 31 March 2005 and

recalculation of the loss on disposal.

■ Cost and accumulated depreciation removed from the asset register in the year to 31 March 2006.

■ Receipt of proceeds per cash book agreed to bank statement.

■ Sales invoice transferring title to Deakin.

■ A review of maintenance expenses and records (e.g. to confirm reason for loss on sale).

■ Post balance sheet event review on prior year audit working papers file.

■ Management representation confirming that Deakin is not a related party (provided that there is no evidence to

suggest otherwise). -

第17题:

(b) You are the audit manager of Johnston Co, a private company. The draft consolidated financial statements for

the year ended 31 March 2006 show profit before taxation of $10·5 million (2005 – $9·4 million) and total

assets of $55·2 million (2005 – $50·7 million).

Your firm was appointed auditor of Tiltman Co when Johnston Co acquired all the shares of Tiltman Co in March

2006. Tiltman’s draft financial statements for the year ended 31 March 2006 show profit before taxation of

$0·7 million (2005 – $1·7 million) and total assets of $16·1 million (2005 – $16·6 million). The auditor’s

report on the financial statements for the year ended 31 March 2005 was unmodified.

You are currently reviewing two matters that have been left for your attention on the audit working paper files for

the year ended 31 March 2006:

(i) In December 2004 Tiltman installed a new computer system that properly quantified an overvaluation of

inventory amounting to $2·7 million. This is being written off over three years.

(ii) In May 2006, Tiltman’s head office was relocated to Johnston’s premises as part of a restructuring.

Provisions for the resulting redundancies and non-cancellable lease payments amounting to $2·3 million

have been made in the financial statements of Tiltman for the year ended 31 March 2006.

Required:

Identify and comment on the implications of these two matters for your auditor’s reports on the financial

statements of Johnston Co and Tiltman Co for the year ended 31 March 2006. (10 marks)

正确答案:

(b) Tiltman Co

Tiltman’s total assets at 31 March 2006 represent 29% (16·1/55·2 × 100) of Johnston’s total assets. The subsidiary is

therefore material to Johnston’s consolidated financial statements.

Tutorial note: Tiltman’s profit for the year is not relevant as the acquisition took place just before the year end and will

therefore have no impact on the consolidated income statement. Calculations of the effect on consolidated profit before

taxation are therefore inappropriate and will not be awarded marks.

(i) Inventory overvaluation

This should have been written off to the income statement in the year to 31 March 2005 and not spread over three

years (contrary to IAS 2 ‘Inventories’).

At 31 March 2006 inventory is overvalued by $0·9m. This represents all Tiltmans’s profit for the year and 5·6% of

total assets and is material. At 31 March 2005 inventory was materially overvalued by $1·8m ($1·7m reported profit

should have been a $0·1m loss).

Tutorial note: 1/3 of the overvaluation was written off in the prior period (i.e. year to 31 March 2005) instead of $2·7m.

That the prior period’s auditor’s report was unmodified means that the previous auditor concurred with an incorrect

accounting treatment (or otherwise gave an inappropriate audit opinion).

As the matter is material a prior period adjustment is required (IAS 8 ‘Accounting Policies, Changes in Accounting

Estimates and Errors’). $1·8m should be written off against opening reserves (i.e. restated as at 1 April 2005).

(ii) Restructuring provision

$2·3m expense has been charged to Tiltman’s profit and loss in arriving at a draft profit of $0·7m. This is very material.

(The provision represents 14·3% of Tiltman’s total assets and is material to the balance sheet date also.)

The provision for redundancies and onerous contracts should not have been made for the year ended 31 March 2006

unless there was a constructive obligation at the balance sheet date (IAS 37 ‘Provisions, Contingent Liabilities and

Contingent Assets’). So, unless the main features of the restructuring plan had been announced to those affected (i.e.

redundancy notifications issued to employees), the provision should be reversed. However, it should then be disclosed

as a non-adjusting post balance sheet event (IAS 10 ‘Events After the Balance Sheet Date’).

Given the short time (less than one month) between acquisition and the balance sheet it is very possible that a

constructive obligation does not arise at the balance sheet date. The relocation in May was only part of a restructuring

(and could be the first evidence that Johnston’s management has started to implement a restructuring plan).

There is a risk that goodwill on consolidation of Tiltman may be overstated in Johnston’s consolidated financial

statements. To avoid the $2·3 expense having a significant effect on post-acquisition profit (which may be negligible

due to the short time between acquisition and year end), Johnston may have recognised it as a liability in the

determination of goodwill on acquisition.

However, the execution of Tiltman’s restructuring plan, though made for the year ended 31 March 2006, was conditional

upon its acquisition by Johnston. It does not therefore represent, immediately before the business combination, a

present obligation of Johnston. Nor is it a contingent liability of Johnston immediately before the combination. Therefore

Johnston cannot recognise a liability for Tiltman’s restructuring plans as part of allocating the cost of the combination

(IFRS 3 ‘Business Combinations’).

Tiltman’s auditor’s report

The following adjustments are required to the financial statements:

■ restructuring provision, $2·3m, eliminated;

■ adequate disclosure of relocation as a non-adjusting post balance sheet event;

■ current period inventory written down by $0·9m;

■ prior period inventory (and reserves) written down by $1·8m.

Profit for the year to 31 March 2006 should be $3·9m ($0·7 + $0·9 + $2·3).

If all these adjustments are made the auditor’s report should be unmodified. Otherwise, the auditor’s report should be

qualified ‘except for’ on grounds of disagreement. If none of the adjustments are made, the qualification should still be

‘except for’ as the matters are not pervasive.

Johnston’s auditor’s report

If Tiltman’s auditor’s report is unmodified (because the required adjustments are made) the auditor’s report of Johnston

should be similarly unmodified. As Tiltman is wholly-owned by Johnston there should be no problem getting the

adjustments made.

If no adjustments were made in Tiltman’s financial statements, adjustments could be made on consolidation, if

necessary, to avoid modification of the auditor’s report on Johnston’s financial statements.

The effect of these adjustments on Tiltman’s net assets is an increase of $1·4m. Goodwill arising on consolidation (if

any) would be reduced by $1·4m. The reduction in consolidated total assets required ($0·9m + $1·4m) is therefore

the same as the reduction in consolidated total liabilities (i.e. $2·3m). $2·3m is material (4·2% consolidated total

assets). If Tiltman’s financial statements are not adjusted and no adjustments are made on consolidation, the

consolidated financial position (balance sheet) should be qualified ‘except for’. The results of operations (i.e. profit for

the period) should be unqualified (if permitted in the jurisdiction in which Johnston reports).

Adjustment in respect of the inventory valuation may not be required as Johnston should have consolidated inventory

at fair value on acquisition. In this case, consolidated total liabilities should be reduced by $2·3m and goodwill arising

on consolidation (if any) reduced by $2·3m.

Tutorial note: The effect of any possible goodwill impairment has been ignored as the subsidiary has only just been

acquired and the balance sheet date is very close to the date of acquisition. -

第18题:

(b) Explain the matters that should be considered when planning the nature and scope of the examination of

Cusiter Co’s forecast balance sheet and income statement as prepared for the bank. (7 marks)

正确答案:

(b) Matters to be considered

Tutorial note: Candidates at this level must appreciate that the matters to be considered when planning the nature and

scope of the examination are not the same matters to be considered when deciding whether or not to accept an

engagement. The scenario clearly indicates that the assignment is being undertaken by the current auditor rendering any

‘pre-engagement’/‘professional etiquette’ considerations irrelevant to answering this question.

This PFI has been prepared to show an external user, the bank, the financial consequences of Cusiter’s plans to help the bank

in making an investment decision. If Cusiter is successful in its loan application the PFI provides a management tool against

which the results of investing in the plant and equipment can be measured.

The PFI is unpublished rather than published. That is, it is prepared at the specific request of a third party, the bank. It will

not be published to users of financial information in general.

The auditor’s report on the PFI will provide only negative assurance as to whether the assumptions provide a reasonable basis

for the PFI and an opinion whether the PFI is:

■ properly prepared on the basis of the assumptions; and

■ presented in accordance with the relevant financial reporting framework.

The nature of the engagement is an examination to obtain evidence concerning:

■ the reasonableness and consistency of assumptions made;

■ proper preparation (on the basis of stated assumptions); and

■ consistent presentation (with historical financial statements, using appropriate accounting principles).

Such an examination is likely to take the form. of inquiry, analytical procedures and corroboration.

The period of time covered by the prospective financial information is two years. The assumptions for 2008 are likely to be

more speculative than for 2007, particularly in relation to the impact on earnings, etc of the investment in new plant and

equipment.

The forecast for the year to 31 December 2007 includes an element of historical financial information (because only part of

this period is in the future) hence actual evidence should be available to verify the first three months of the forecast (possibly

more since another three-month period will expire at the end of the month).

Cusiter management’s previous experience in preparing PFI will be relevant. For example, in making accounting estimates

(e.g. for provisions, impairment losses, etc) or preparing cash flow forecasts (e.g. in support of the going concern assertion).

The basis of preparation of the forecast. For example, the extent to which it comprises:

■ proforma financial information (i.e. historical financial information adjusted for the effects of the planned loan and capital

expenditure transaction);

■ new information and assumptions about future performance (e.g. the operating capacity of the new equipment, sales

generated, etc).

The nature and scope of any standards/guidelines under which the PFI has been prepared is likely to assist the auditor in

discharging their responsibilities to report on it. Also, ISAE 3400 The Examination of Prospective Financial Information,

establishes standards and provides guidance on engagements to examine and report on PFI including examination

procedures.

The planned nature and scope of the examination is likely to take into account the time and fee budgets for the assignments

as adjusted for any ‘overlap’ with audit work. For example, the examination of the PFI is likely to draw on the auditor’s

knowledge of the business obtained in auditing the financial statements to 31 December 2006. Analytical procedures carried

out in respect of the PFI may provide evidence relevant to the 31 December 2007 audit. -

第19题:

3 You are the manager responsible for the audit of Lamont Co. The company’s principal activity is wholesaling frozen

fish. The draft consolidated financial statements for the year ended 31 March 2007 show revenue of $67·0 million

(2006 – $62·3 million), profit before taxation of $11·9 million (2006 – $14·2 million) and total assets of

$48·0 million (2006 – $36·4 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In early 2007 a chemical leakage from refrigeration units owned by Lamont caused contamination of some of its

property. Lamont has incurred $0·3 million in clean up costs, $0·6 million in modernisation of the units to

prevent future leakage and a $30,000 fine to a regulatory agency. Apart from the fine, which has been expensed,

these costs have been capitalised as improvements. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Lamont Co for the year ended

31 March 2007.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

3 LAMONT CO

(a) Chemical leakage

(i) Matters

■ $30,000 fine is very immaterial (just 1/4% profit before tax). This is revenue expenditure and it is correct that it

has been expensed to the income statement.

■ $0·3 million represents 0·6% total assets and 2·5% profit before tax and is not material on its own. $0·6 million

represents 1·2% total assets and 5% profit before tax and is therefore material to the financial statements.

■ The $0·3 million clean-up costs should not have been capitalised as the condition of the property is not improved