(c) Calculate the theoretical ex rights price per share and the net funds to be raised by the rights issue, anddetermine and discuss the likely effect of the proposed expansion on:(i) the current share price of Merton plc;(ii) the gearing of the company.A

题目

(c) Calculate the theoretical ex rights price per share and the net funds to be raised by the rights issue, and

determine and discuss the likely effect of the proposed expansion on:

(i) the current share price of Merton plc;

(ii) the gearing of the company.

Assume that the price–earnings ratio of Merton plc remains unchanged at 12 times. (11 marks)

相似考题

更多“(c) Calculate the theoretical ex rights price per share and the net funds to be raised by the rights issue, anddetermine and discuss the likely effect of the proposed expansion on:(i) the current share price of Merton plc;(ii) the gearing of the company.A”相关问题

-

第1题:

4 Ryder, a public limited company, is reviewing certain events which have occurred since its year end of 31 October

2005. The financial statements were authorised on 12 December 2005. The following events are relevant to the

financial statements for the year ended 31 October 2005:

(i) Ryder has a good record of ordinary dividend payments and has adopted a recent strategy of increasing its

dividend per share annually. For the last three years the dividend per share has increased by 5% per annum.

On 20 November 2005, the board of directors proposed a dividend of 10c per share for the year ended

31 October 2005. The shareholders are expected to approve it at a meeting on 10 January 2006, and a

dividend amount of $20 million will be paid on 20 February 2006 having been provided for in the financial

statements at 31 October 2005. The directors feel that a provision should be made because a ‘valid expectation’

has been created through the company’s dividend record. (3 marks)

(ii) Ryder disposed of a wholly owned subsidiary, Krup, a public limited company, on 10 December 2005 and made

a loss of $9 million on the transaction in the group financial statements. As at 31 October 2005, Ryder had no

intention of selling the subsidiary which was material to the group. The directors of Ryder have stated that there

were no significant events which have occurred since 31 October 2005 which could have resulted in a reduction

in the value of Krup. The carrying value of the net assets and purchased goodwill of Krup at 31 October 2005

were $20 million and $12 million respectively. Krup had made a loss of $2 million in the period 1 November

2005 to 10 December 2005. (5 marks)

(iii) Ryder acquired a wholly owned subsidiary, Metalic, a public limited company, on 21 January 2004. The

consideration payable in respect of the acquisition of Metalic was 2 million ordinary shares of $1 of Ryder plus

a further 300,000 ordinary shares if the profit of Metalic exceeded $6 million for the year ended 31 October

2005. The profit for the year of Metalic was $7 million and the ordinary shares were issued on 12 November

2005. The annual profits of Metalic had averaged $7 million over the last few years and, therefore, Ryder had

included an estimate of the contingent consideration in the cost of the acquisition at 21 January 2004. The fair

value used for the ordinary shares of Ryder at this date including the contingent consideration was $10 per share.

The fair value of the ordinary shares on 12 November 2005 was $11 per share. Ryder also made a one for four

bonus issue on 13 November 2005 which was applicable to the contingent shares issued. The directors are

unsure of the impact of the above on earnings per share and the accounting for the acquisition. (7 marks)

(iv) The company acquired a property on 1 November 2004 which it intended to sell. The property was obtained

as a result of a default on a loan agreement by a third party and was valued at $20 million on that date for

accounting purposes which exactly offset the defaulted loan. The property is in a state of disrepair and Ryder

intends to complete the repairs before it sells the property. The repairs were completed on 30 November 2005.

The property was sold after costs for $27 million on 9 December 2005. The property was classified as ‘held for

sale’ at the year end under IFRS5 ‘Non-current Assets Held for Sale and Discontinued Operations’ but shown at

the net sale proceeds of $27 million. Property is depreciated at 5% per annum on the straight-line basis and no

depreciation has been charged in the year. (5 marks)

(v) The company granted share appreciation rights (SARs) to its employees on 1 November 2003 based on ten

million shares. The SARs provide employees at the date the rights are exercised with the right to receive cash

equal to the appreciation in the company’s share price since the grant date. The rights vested on 31 October

2005 and payment was made on schedule on 1 December 2005. The fair value of the SARs per share at

31 October 2004 was $6, at 31 October 2005 was $8 and at 1 December 2005 was $9. The company has

recognised a liability for the SARs as at 31 October 2004 based upon IFRS2 ‘Share-based Payment’ but the

liability was stated at the same amount at 31 October 2005. (5 marks)

Required:

Discuss the accounting treatment of the above events in the financial statements of the Ryder Group for the year

ended 31 October 2005, taking into account the implications of events occurring after the balance sheet date.

(The mark allocations are set out after each paragraph above.)

(25 marks)

正确答案:

4 (i) Proposed dividend

The dividend was proposed after the balance sheet date and the company, therefore, did not have a liability at the balance

sheet date. No provision for the dividend should be recognised. The approval by the directors and the shareholders are

enough to create a valid expectation that the payment will be made and give rise to an obligation. However, this occurred

after the current year end and, therefore, will be charged against the profits for the year ending 31 October 2006.

The existence of a good record of dividend payments and an established dividend policy does not create a valid expectation

or an obligation. However, the proposed dividend will be disclosed in the notes to the financial statements as the directors

approved it prior to the authorisation of the financial statements.

(ii) Disposal of subsidiary

It would appear that the loss on the sale of the subsidiary provides evidence that the value of the consolidated net assets of

the subsidiary was impaired at the year end as there has been no significant event since 31 October 2005 which would have

caused the reduction in the value of the subsidiary. The disposal loss provides evidence of the impairment and, therefore,

the value of the net assets and goodwill should be reduced by the loss of $9 million plus the loss ($2 million) to the date of

the disposal, i.e. $11 million. The sale provides evidence of a condition that must have existed at the balance sheet date

(IAS10). This amount will be charged to the income statement and written off goodwill of $12 million, leaving a balance of

$1 million on that account. The subsidiary’s assets are impaired because the carrying values are not recoverable. The net

assets and goodwill of Krup would form. a separate income generating unit as the subsidiary is being disposed of before the

financial statements are authorised. The recoverable amount will be the sale proceeds at the date of sale and represents the

value-in-use to the group. The impairment loss is effectively taking account of the ultimate loss on sale at an earlier point in

time. IFRS5, ‘Non-current assets held for sale and discontinued operations’, will not apply as the company had no intention

of selling the subsidiary at the year end. IAS10 would require disclosure of the disposal of the subsidiary as a non-adjusting

event after the balance sheet date.

(iii) Issue of ordinary shares

IAS33 ‘Earnings per share’ states that if there is a bonus issue after the year end but before the date of the approval of the

financial statements, then the earnings per share figure should be based on the new number of shares issued. Additionally

a company should disclose details of all material ordinary share transactions or potential transactions entered into after the

balance sheet date other than the bonus issue or similar events (IAS10/IAS33). The principle is that if there has been a

change in the number of shares in issue without a change in the resources of the company, then the earnings per share

calculation should be based on the new number of shares even though the number of shares used in the earnings per share

calculation will be inconsistent with the number shown in the balance sheet. The conditions relating to the share issue

(contingent) have been met by the end of the period. Although the shares were issued after the balance sheet date, the issue

of the shares was no longer contingent at 31 October 2005, and therefore the relevant shares will be included in the

computation of both basic and diluted EPS. Thus, in this case both the bonus issue and the contingent consideration issue

should be taken into account in the earnings per share calculation and disclosure made to that effect. Any subsequent change

in the estimate of the contingent consideration will be adjusted in the period when the revision is made in accordance with

IAS8.

Additionally IFRS3 ‘Business Combinations’ requires the fair value of all types of consideration to be reflected in the cost of

the acquisition. The contingent consideration should be included in the cost of the business combination at the acquisition

date if the adjustment is probable and can be measured reliably. In the case of Metalic, the contingent consideration has

been paid in the post-balance sheet period and the value of such consideration can be determined ($11 per share). Thus

an accurate calculation of the goodwill arising on the acquisition of Metalic can be made in the period to 31 October 2005.

Prior to the issue of the shares on 12 November 2005, a value of $10 per share would have been used to value the

contingent consideration. The payment of the contingent consideration was probable because the average profits of Metalic

averaged over $7 million for several years. At 31 October 2005 the value of the contingent shares would be included in a

separate category of equity until they were issued on 12 November 2005 when they would be transferred to the share capital

and share premium account. Goodwill will increase by 300,000 x ($11 – $10) i.e. $300,000.

(iv) Property

IFRS5 (paragraph 7) states that for a non-current asset to be classified as held for sale, the asset must be available for

immediate sale in its present condition subject to the usual selling terms, and its sale must be highly probable. The delay in

this case in the selling of the property would indicate that at 31 October 2005 the property was not available for sale. The

property was not to be made available for sale until the repairs were completed and thus could not have been available for

sale at the year end. If the criteria are met after the year end (in this case on 30 November 2005), then the non-current

asset should not be classified as held for sale in the previous financial statements. However, disclosure of the event should

be made if it meets the criteria before the financial statements are authorised (IFRS5 paragraph 12). Thus in this case,

disclosure should be made.

The property on the application of IFRS5 should have been carried at the lower of its carrying amount and fair value less

costs to sell. However, the company has simply used fair value less costs to sell as the basis of valuation and shown the

property at $27 million in the financial statements.

The carrying amount of the property would have been $20 million less depreciation $1 million, i.e. $19 million. Because

the property is not held for sale under IFRS5, then its classification in the balance sheet will change and the property will be

valued at $19 million. Thus the gain of $7 million on the wrong application of IFRS5 will be deducted from reserves, and

the property included in property, plant and equipment. Total equity will therefore be reduced by $8 million.

(v) Share appreciation rights

IFRS2 ‘Share-based payment’ (paragraph 30) requires a company to re-measure the fair value of a liability to pay cash-settled

share based payment transactions at each reporting date and the settlement date, until the liability is settled. An example of

such a transaction is share appreciation rights. Thus the company should recognise a liability of ($8 x 10 million shares),

i.e. $80 million at 31 October 2005, the vesting date. The liability recognised at 31 October 2005 was in fact based on the

share price at the previous year end and would have been shown at ($6 x 1/2) x 10 million shares, i.e. $30 million. This

liability at 31 October 2005 had not been changed since the previous year end by the company. The SARs vest over a twoyear

period and thus at 31 October 2004 there would be a weighting of the eventual cost by 1 year/2 years. Therefore, an

additional liability and expense of $50 million should be accounted for in the financial statements at 31 October 2005. The

SARs would be settled on 1 December 2005 at $9 x 10 million shares, i.e. $90 million. The increase in the value of the

SARs since the year end would not be accrued in the financial statements but charged to profit or loss in the year ended31 October 2006. -

第2题:

(b) On 31 May 2007, Leigh purchased property, plant and equipment for $4 million. The supplier has agreed to

accept payment for the property, plant and equipment either in cash or in shares. The supplier can either choose

1·5 million shares of the company to be issued in six months time or to receive a cash payment in three months

time equivalent to the market value of 1·3 million shares. It is estimated that the share price will be $3·50 in

three months time and $4 in six months time.

Additionally, at 31 May 2007, one of the directors recently appointed to the board has been granted the right to

choose either 50,000 shares of Leigh or receive a cash payment equal to the current value of 40,000 shares at

the settlement date. This right has been granted because of the performance of the director during the year and

is unconditional at 31 May 2007. The settlement date is 1 July 2008 and the company estimates the fair value

of the share alternative is $2·50 per share at 31 May 2007. The share price of Leigh at 31 May 2007 is $3 per

share, and if the director chooses the share alternative, they must be kept for a period of four years. (9 marks)

Required:

Discuss with suitable computations how the above share based transactions should be accounted for in the

financial statements of Leigh for the year ended 31 May 2007.

正确答案:(b) Transactions that allow choice of settlement are accounted for as cash-settled to the extent that the entity has incurred a

liability (IFRS2 para 34). The share based transaction is treated as the issuance of a compound financial instrument. IFRS2

applies similar measurement principles to determine the value of the constituent parts of a compound instrument as that

required by IAS32 ‘Financial Instruments: Disclosure and Presentation’. The purchase of the property, plant and equipment

(PPE) and the grant to the director, both fall under this section of IFRS2 as the supplier and the director have a choice of

settlement. The fair value of the goods can be measured directly as regards the purchase of the PPE and therefore this fact

determines that the transaction is treated in a certain way. In the case of the director, the fair value of the service rendered

will be determined by the fair value of the equity instruments given and IFRS2 says that this type of share based transaction

should be dealt with in a certain way. Under IFRS2, if the fair value of the goods or services received can be measured directly

and easily then the equity element is determined by taking the fair value of the goods or services less the fair value of the

debt element of this instrument. The debt element is essentially the cash payment that will occur. If the fair value of the goods

or services is measured by reference to the fair value of the equity instruments given then the whole of the compound

instrument should be fair valued. The equity element becomes the difference between the fair value of the equity instruments

granted less the fair value of the debt component. It should take into account the fact that the counterparty must forfeit its

right to receive cash in order to receive the equity instrument.

When Leigh received the property, plant and equipment it should have recorded a liability of $4 million and an increase in

equity of $0·55 million being the difference between the value of the property, plant and equipment and the fair value of theliability. The fair value of the liability is the cash payment of $3·50 x 1·3 million shares, i.e. $4·55 million.

The accounting entry would be:

-

第3题:

JOL Co was the market leader with a share of 30% three years ago. The managing director of JOL Co stated at a

recent meeting of the board of directors that: ‘our loss of market share during the last three years might lead to the

end of JOL Co as an organisation and therefore we must address this issue immediately’.

Required:

(b) Discuss the statement of the managing director of JOL Co and discuss six performance indicators, other than

decreasing market share, which might indicate that JOL Co might fail as a corporate entity. (10 marks)

正确答案:

(b) It would appear that JOL’s market share has declined from 30% to (80 – 26)/3 = 18% during the last three years. A 12%

fall in market share is probably very significant with a knock-on effect on profits and resultant cash flows. Obviously such a

declining trend needs to be arrested immediately and this will require a detailed investigation to be undertaken by the directors

of JOL. Consequently loss of market share can be seen to be an indicator of potential corporate failure. Other indicators of

corporate failure are as follows:

Six performance indicators that an organisation might fail are as follows:

Poor cash flow

Poor cash flow might render an organisation unable to pay its debts as and when they fall due for payment. This might mean,

for example, that providers of finance might be able to invoke the terms of a loan covenant and commence legal action against

an organisation which might eventually lead to its winding-up.

Lack of new production/service introduction

Innovation can often be seen to be the difference between ‘life and death’ as new products and services provide continuity

of income streams in an ever-changing business environment. A lack of new product/service introduction may arise from a

shortage of funds available for re-investment. This can lead to organisations attempting to compete with their competitors with

an out of date range of products and services, the consequences of which will invariably turn out to be disastrous.

General economic conditions

Falling demand and increasing interest rates can precipitate the demise of organisations. Highly geared organisations will

suffer as demand falls and the weight of the interest burden increases. Organisations can find themselves in a vicious circle

as increasing amounts of interest payable are paid from diminishing gross margins leading to falling profits/increasing losses

and negative cash flows. This leads to the need for further loan finance and even higher interest burden, further diminution

in margins and so on.

Lack of financial controls

The absence of sound financial controls has proven costly to many organisations. In extreme circumstances it can lead to

outright fraud (e.g. Enron and WorldCom).

Internal rivalry

The extent of internal rivalry that exists within an organisation can prove to be of critical significance to an organisation as

managerial effort is effectively channeled into increasing the amount of internal conflict that exists to the detriment of the

organisation as a whole. Unfortunately the adverse consequences of internal rivalry remain latent until it is too late to redress

them.

Loss of key personnel

In certain types of organisation the loss of key personnel can ‘spell the beginning of the end’ for an organisation. This is

particularly the case when individuals possess knowledge which can be exploited by direct competitors, e.g. sales contacts,

product specifications, product recipes, etc.

-

第4题:

2 Graeme, aged 57, is married to Catherine, aged 58. They work as medical consultants, and both are higher rate

taxpayers. Barry, their son, is aged 32. Graeme, Catherine and Barry are all UK resident, ordinarily resident and

domiciled. Graeme has come to you for some tax advice.

Graeme has invested in shares for some time, in particular shares in Thistle Dubh Limited. He informs you of the

following transactions in Thistle Dubh Limited shares:

(i) In December 1986, on the death of his grandmother, he inherited 10,000 £1 ordinary shares in Thistle Dubh

Limited, an unquoted UK trading company providing food supplies for sporting events. The probate value of the

shares was 360p per share.

(ii) In March 1992, he took up a rights issue, buying one share for every two held. The price paid for the rights

shares was £10 per share.

(iii) In October 1999, the company underwent a reorganisation, and the ordinary shares were split into two new

classes of ordinary share – ‘T’ shares and ‘D’ shares, each with differing rights. Graeme received two ‘T’ and three

‘D’ shares for each original Thistle Dubh Limited share held. The market values for the ‘T’ shares and the ‘D’

shares on the date of reorganisation were 135p and 405p per share respectively.

(iv) On 1 May 2005, Graeme sold 12,000 ‘T’ shares. The market values for the ‘T’ shares and the ‘D’ shares on that

day were 300p and 600p per share respectively.

(v) In October 2005, Graeme sold all of his ‘D’ shares for £85,000.

(vi) The current market value of ‘T’ shares is 384p per share. The shares remain unquoted.

Graeme and Catherine have owned a holiday cottage in a remote part of the UK for many years. In recent years, they

have used the property infrequently, as they have taken their holidays abroad and the cottage has been let out as

furnished holiday accommodation.

Graeme and Catherine are now considering selling the UK country cottage and purchasing a holiday villa abroad.

Initially they plan to let this villa out on a furnished basis, but following their anticipated retirement, would expect to

occupy the property for a significant part of the year themselves, possibly moving to live in the villa permanently.

Required:

(a) Calculate the total chargeable gains arising on Graeme’s disposals of ‘T’ and ‘D’ ordinary shares in May and

October 2005 respectively. (7 marks)

正确答案:

-

第5题:

(ii) Calculate Paul’s tax liability if he exercises the share options in Memphis plc and subsequently sells the

shares in Memphis plc immediately, as proposed, and show how he may reduce this tax liability.

(4 marks)

正确答案:

-

第6题:

To solve the euro problem ,Germany proposed that______.

A.EU funds for poor regions be increased

B.stricter regulations be imposed

C.only core members be involved in economic co-ordination

D.voting rights of the EU members be guaranteed

正确答案:B

解析:细节题。题干中的Germany定位在第四段,第一句是该段的概括提出应该强化法规。第二句these指代的第一句中的rules。第三句的主语it指代的Germany。因此第四段都提到了Germany,没有明确定位在某句话上。因此需要选项回原文一一对应。 -

第7题:

KFP Co, a company listed on a major stock market, is looking at its cost of capital as it prepares to make a bid to buy a rival unlisted company, NGN. Both companies are in the same business sector. Financial information on KFP Co and NGN is as follows:

NGN has a cost of equity of 12% per year and has maintained a dividend payout ratio of 45% for several years. The current earnings per share of the company is 80c per share and its earnings have grown at an average rate of 4·5% per year in recent years.

The ex div share price of KFP Co is $4·20 per share and it has an equity beta of 1·2. The 7% bonds of the company are trading on an ex interest basis at $94·74 per $100 bond. The price/earnings ratio of KFP Co is eight times.

The directors of KFP Co believe a cash offer for the shares of NGN would have the best chance of success. It has been suggested that a cash offer could be financed by debt.

Required:

(a) Calculate the weighted average cost of capital of KFP Co on a market value weighted basis. (10 marks)

(b) Calculate the total value of the target company, NGN, using the following valuation methods:

(i) Price/earnings ratio method, using the price/earnings ratio of KFP Co; and

(ii) Dividend growth model. (6 marks)

(c) Discuss the relationship between capital structure and weighted average cost of capital, and comment on

the suggestion that debt could be used to finance a cash offer for NGN. (9 marks)

正确答案:

(b)(i)Price/earningsratiomethodEarningspershareofNGN=80cpersharePrice/earningsratioofKFPCo=8SharepriceofNGN=80x8=640cor$6·40NumberofordinarysharesofNGN=5/0·5=10millionsharesValueofNGN=6·40x10m=$64millionHowever,itcanbearguedthatareductionintheappliedprice/earningsratioisneededasNGNisunlistedandthereforeitssharesaremoredifficulttobuyandsellthanthoseofalistedcompanysuchasKFPCo.Ifwereducetheappliedprice/earningsratioby10%(othersimilarpercentagereductionswouldbeacceptable),itbecomes7·2timesandthevalueofNGNwouldbe(80/100)x7·2x10m=$57·6million(ii)DividendgrowthmodelDividendpershareofNGN=80cx0·45=36cpershareSincethepayoutratiohasbeenmaintainedforseveralyears,recentearningsgrowthisthesameasrecentdividendgrowth,i.e.4·5%.Assumingthatthisdividendgrowthcontinuesinthefuture,thefuturedividendgrowthratewillbe4·5%.Sharepricefromdividendgrowthmodel=(36x1·045)/(0·12–0·045)=502cor$5·02ValueofNGN=5·02x10m=$50·2million(c)Adiscussionofcapitalstructurecouldstartfromrecognisingthatequityismoreexpensivethandebtbecauseoftherelativeriskofthetwosourcesoffinance.Equityisriskierthandebtandsoequityismoreexpensivethandebt.Thisdoesnotdependonthetaxefficiencyofdebt,sincewecanassumethatnotaxesexist.Wecanalsoassumethatasacompanygearsup,itreplacesequitywithdebt.Thismeansthatthecompany’scapitalbaseremainsconstantanditsweightedaveragecostofcapital(WACC)isnotaffectedbyincreasinginvestment.Thetraditionalviewofcapitalstructureassumesanon-linearrelationshipbetweenthecostofequityandfinancialrisk.Asacompanygearsup,thereisinitiallyverylittleincreaseinthecostofequityandtheWACCdecreasesbecausethecostofdebtislessthanthecostofequity.Apointisreached,however,wherethecostofequityrisesataratethatexceedsthereductioneffectofcheaperdebtandtheWACCstartstoincrease.Inthetraditionalview,therefore,aminimumWACCexistsand,asaresult,amaximumvalueofthecompanyarises.ModiglianiandMillerassumedaperfectcapitalmarketandalinearrelationshipbetweenthecostofequityandfinancialrisk.Theyarguedthat,asacompanygearedup,thecostofequityincreasedataratethatexactlycancelledoutthereductioneffectofcheaperdebt.WACCwasthereforeconstantatalllevelsofgearingandnooptimalcapitalstructure,wherethevalueofthecompanywasatamaximum,couldbefound.Itwasarguedthattheno-taxassumptionmadebyModiglianiandMillerwasunrealistic,sinceintherealworldinterestpaymentswereanallowableexpenseincalculatingtaxableprofitandsotheeffectivecostofdebtwasreducedbyitstaxefficiency.Theyrevisedtheirmodeltoincludethistaxeffectandshowedthat,asaresult,theWACCdecreasedinalinearfashionasacompanygearedup.Thevalueofthecompanyincreasedbythevalueofthe‘taxshield’andanoptimalcapitalstructurewouldresultbygearingupasmuchaspossible.Itwaspointedoutthatmarketimperfectionsassociatedwithhighlevelsofgearing,suchasbankruptcyriskandagencycosts,wouldlimittheextenttowhichacompanycouldgearup.Inpractice,therefore,itappearsthatcompaniescanreducetheirWACCbyincreasinggearing,whileavoidingthefinancialdistressthatcanariseathighlevelsofgearing.Ithasfurtherbeensuggestedthatcompanieschoosethesourceoffinancewhich,foronereasonoranother,iseasiestforthemtoaccess(peckingordertheory).Thisresultsinaninitialpreferenceforretainedearnings,followedbyapreferencefordebtbeforeturningtoequity.TheviewsuggeststhatcompaniesmaynotinpracticeseektominimisetheirWACC(andconsequentlymaximisecompanyvalueandshareholderwealth).TurningtothesuggestionthatdebtcouldbeusedtofinanceacashbidforNGN,thecurrentandpostacquisitioncapitalstructuresandtheirrelativegearinglevelsshouldbeconsidered,aswellastheamountofdebtfinancethatwouldbeneeded.Earliercalculationssuggestthatatleast$58mwouldbeneeded,ignoringanypremiumpaidtopersuadetargetcompanyshareholderstoselltheirshares.Thecurrentdebt/equityratioofKFPCois60%(15m/25m).Thedebtofthecompanywouldincreaseby$58minordertofinancethebidandbyafurther$20maftertheacquisition,duetotakingontheexistingdebtofNGN,givingatotalof$93m.Ignoringotherfactors,thegearingwouldincreaseto372%(93m/25m).KFPCowouldneedtoconsiderhowitcouldservicethisdangerouslyhighlevelofgearinganddealwiththesignificantriskofbankruptcythatitmightcreate.ItwouldalsoneedtoconsiderwhetherthebenefitsarisingfromtheacquisitionofNGNwouldcompensateforthesignificantincreaseinfinancialriskandbankruptcyriskresultingfromusingdebtfinance. -

第8题:

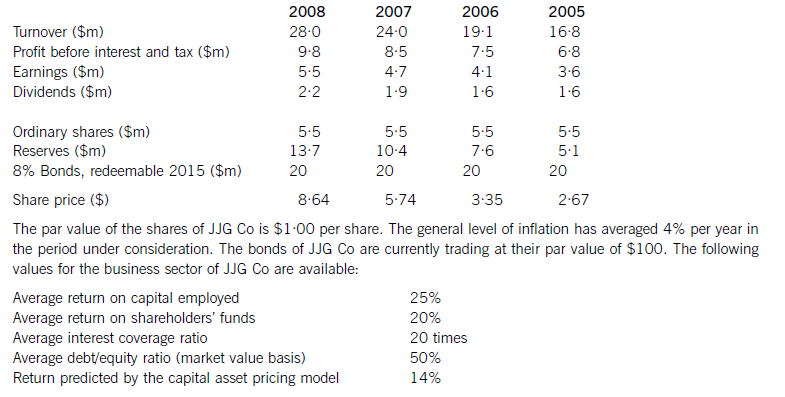

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第9题:

C Co uses material B, which has a current market price of $0·80 per kg. In a linear program, where the objective is to maximise profit, the shadow price of material B is $2 per kg. The following statements have been made:

(i) Contribution will be increased by $2 for each additional kg of material B purchased at the current market price

(ii) The maximum price which should be paid for an additional kg of material B is $2

(iii) Contribution will be increased by $1·20 for each additional kg of material B purchased at the current market price

(iv) The maximum price which should be paid for an additional kg of material B is $2·80

Which of the above statements is/are correct?

A.(ii) only

B.(ii) and (iii)

C.(i) only

D.(i) and (iv)

正确答案:DStatement (ii) is wrong as it reflects the common misconception that the shadow price is the maximum price which should be paid, rather than the maximum extra over the current purchase price.

Statement (iii) is wrong but could be thought to be correct if (ii) was wrongly assumed to be correct.

-

第10题:

删除共享的一般格式是()。

- A、net share 共享名

- B、net share共享名=绝对目录 /del

- C、net use共享名 /del

- D、net share 共享名 /del

正确答案:D -

第11题:

创建amdin$的命令是()。

- A、net user admin$

- B、net share admin$=c:/windows

- C、net share admin$

- D、net use admin$

正确答案:C -

第12题:

单选题What can be said about tighter property rights?AThey make it hard for many developing countries to use such rights.

BThey will reduce the price of technology transfer.

CThey will help distribute social wealth more evenly.

DThey will increase the power of more and more people.

正确答案: B解析:

录音中指出科技的进步也产生了知识产权的问题,更加严格的产权正在增加技术转让的价格(increasing the price of technology transfer),阻止许多发展中国家使用(blocking many developing countries from their use),增加那些大量拥有知识产权的人的权利和财富(increases the power and wealth of those who largely own the property fights),选项中只有A项表述正确。 -

第13题:

3 (a) Leigh, a public limited company, purchased the whole of the share capital of Hash, a limited company, on 1 June

2006. The whole of the share capital of Hash was formerly owned by the five directors of Hash and under the

terms of the purchase agreement, the five directors were to receive a total of three million ordinary shares of $1

of Leigh on 1 June 2006 (market value $6 million) and a further 5,000 shares per director on 31 May 2007,

if they were still employed by Leigh on that date. All of the directors were still employed by Leigh at 31 May

2007.

Leigh granted and issued fully paid shares to its own employees on 31 May 2007. Normally share options issued

to employees would vest over a three year period, but these shares were given as a bonus because of the

company’s exceptional performance over the period. The shares in Leigh had a market value of $3 million

(one million ordinary shares of $1 at $3 per share) on 31 May 2007 and an average fair value of

$2·5 million (one million ordinary shares of $1 at $2·50 per share) for the year ended 31 May 2007. It is

expected that Leigh’s share price will rise to $6 per share over the next three years. (10 marks)

Required:

Discuss with suitable computations how the above share based transactions should be accounted for in the

financial statements of Leigh for the year ended 31 May 2007.

正确答案:

(a) The shares issued to the management of Hash by Leigh (three million ordinary shares of $1) for the purchase of the company

would not be accounted for under IFRS2 ‘Share-based payment’ but would be dealt with under IFRS3 ‘Business

Combinations’.

The cost of the business combination will be the total of the fair values of the consideration given by the acquirer plus any

attributable cost. In this case the shares of Leigh will be fair valued at $6 million with $3 million being shown as share capital

and $3million as share premium. However, the shares issued as contingent consideration may be accounted for under IFRS2.

The terms of the issuance of shares will need to be examined. Where part of the consideration may be reliant on uncertain

future events, and it is probable that the additional consideration is payable and can be measured reliably, then it is included

in the cost of the business consideration at the acquisition date. However, the question to be answered in the case of the

additional 5,000 shares per director is whether the shares are compensation or part of the purchase price. There is a need

to understand why the acquisition agreement includes a provision for a contingent payment. It is possible that the price paid

initially by Leigh was quite low and, therefore, this then represents a further purchase consideration. However, in this instance

the additional payment is linked to continuing employment and, therefore, it would be argued that because of the link between

the contingent consideration and continuing employment that it represents a compensation arrangement which should be

included within the scope of IFRS2.

Thus as there is a performance condition, (the performance condition will apply as it is not a market condition) the substance

of the agreement is that the shares are compensation, then they will be fair valued at the grant date and not when the shares

vest. Therefore, the share price of $2 per share will be used to give compensation of $50,000 (5 x 5,000 x $2). (Under

IFRS3, fair value is measured at the date the consideration is provided and discounted to presented value. No guidance is

provided on what the appropriate discount rate might be. Thus the fair value used would have been $3 per share at 31 May

2007.) The compensation will be charged to the income statement and included in equity.

The shares issued to the employees of Leigh will be accounted for under IFRS2. The issuance of fully paid shares will be

presumed to relate to past service. The normal vesting period for share options is irrelevant, as is the average fair value of the

shares during the period. The shares would be expensed at a value of $3 million with a corresponding increase in equity.

Goods or services acquired in a share based payment transaction should be recognised when they are received. In the case

of goods then this will be when this occurs. However, it is somewhat more difficult sometimes to determine when services

are received. In a case of goods the vesting date is not really relevant, however, it is highly relevant for employee services. If

shares are issued that vest immediately then there is a presumption that these are a consideration for past employee services. -

第14题:

11 Which of the following statements are correct?

1 A company might make a rights issue if it wished to raise more equity capital.

2 A rights issue might increase the share premium account whereas a bonus issue is likely to reduce it.

3 A bonus issue will reduce the gearing (leverage) ratio of a company.

4 A rights issue will always increase the number of shareholders in a company whereas a bonus issue will not.

A 1 and 2

B 1 and 3

C 2 and 3

D 2 and 4

正确答案:A

-

第15题:

(ii) Division C is considering a decision to lower its selling price to customers external to the group to $95

per kilogram. If implemented, this decision is expected to increase sales to external customers to

70,000 kilograms.

Required:

For BOTH the current selling price of CC of $105 per kilogram and the proposed selling price of $95

per kilogram, prepare a detailed analysis of revenue, costs and net profits of BAG.

Note: in addition, comment on other considerations that should be taken into account before this selling

price change is implemented. (6 marks)

正确答案:

-

第16题:

(b) (i) Advise Benny of the income tax implications of the grant and exercise of the share options in Summer

Glow plc on the assumption that the share price on 1 September 2007 and on the day he exercises the

options is £3·35 per share. Explain why the share option scheme is not free from risk by reference to

the rules of the scheme and the circumstances surrounding the company. (4 marks)

正确答案:

(b) (i) The share options

There are no income tax implications on the grant of the share options.

In the tax year in which Benny exercises the options and acquires the shares, the excess of the market value of the

shares over the price paid, i.e. £11,500 ((£3·35 – £2·20) x 10,000) will be subject to income tax.

Benny’s financial exposure is caused by the rule within the share option scheme obliging him to hold the shares for a

year before he can sell them. If the company’s expansion into Eastern Europe fails, such that its share price

subsequently falls to less than £2·20 before Benny has the chance to sell the shares, Benny’s financial position may be

summarised as follows:

– Benny will have paid £22,000 (£2·20 x 10,000) for shares which are now worth less than that.

– He will also have paid income tax of £4,600 (£11,500 x 40%). -

第17题:

We learn from Paragraph 2 that outside directors are supposed to be______.

A.generous investors

B.unbiased executives

C.share price forecasters

D.independent advisers

正确答案:D

解析:细节题。题干中的outside directors定位在第二段中3次,第一句和第三句中的outside directors直接出现,第二句中的they也是指代outside directors,因此需要分析每句中outside directors的具体内容。第一句中提到独立董事是在董事会中乐于助人的且较为公正的建议者。第二句中提到他们有足够的独立性来不同意CEO的建议。第三句中提到他们应该根据自己过去度过危机的经历而提出建议(当股票价格下跌时)。 -

第18题:

A manufacturing company, Man Co, has two divisions: Division L and Division M. Both divisions make a single standardised product. Division L makes component L, which is supplied to both Division M and external customers.

Division M makes product M using one unit of component L and other materials. It then sells the completed

product M to external customers. To date, Division M has always bought component L from Division L.

The following information is available:

Division L charges the same price for component L to both Division M and external customers. However, it does not incur the selling and distribution costs when transferring internally.

Division M has just been approached by a new supplier who has offered to supply it with component L for $37 per unit. Prior to this offer, the cheapest price which Division M could have bought component L for from outside the group was $42 per unit.

It is head office policy to let the divisions operate autonomously without interference at all.

Required:

(a) Calculate the incremental profit/(loss) per component for the group if Division M accepts the new supplier’s

offer and recommend how many components Division L should sell to Division M if group profits are to be

maximised. (3 marks)

(b) Using the quantities calculated in (a) and the current transfer price, calculate the total annual profits of each division and the group as a whole. (6 marks)

(c) Discuss the problems which will arise if the transfer price remains unchanged and advise the divisions on a suitable alternative transfer price for component L. (6 marks)

正确答案:

(a)MaximisinggroupprofitDivisionLhasenoughcapacitytosupplybothDivisionManditsexternalcustomerswithcomponentL.Therefore,incrementalcostofDivisionMbuyingexternallyisasfollows:CostperunitofcomponentLwhenboughtfromexternalsupplier:$37CostperunitforDivisionLofmakingcomponentL:$20.ThereforeincrementalcosttogroupofeachunitofcomponentLbeingboughtinbyDivisionMratherthantransferredinternally:$17($37–20).Fromthegroup’spointofview,themostprofitablecourseofactionisthereforethatall120,000unitsofcomponentLshouldbetransferredinternally.(b)CalculatingtotalgroupprofitTotalgroupprofitswillbeasfollows:DivisionL:Contributionearnedpertransferredcomponent=$40–$20=$20Profitearnedpercomponentsoldexternally=$40–$24=$16(c)ProblemswithcurrenttransferpriceandsuggestedalternativeTheproblemisthatthecurrenttransferpriceof$40perunitisnowtoohigh.Whilstthishasnotbeenaproblembeforesinceexternalsupplierswerecharging$42perunit,itisaproblemnowthatDivisionMhasbeenofferedcomponentLfor$37perunit.IfDivisionMnowactsinitsowninterestsratherthantheinterestsofthegroupasawhole,itwillbuycomponentLfromtheexternalsupplierratherthanfromDivisionL.ThiswillmeanthattheprofitsofthegroupwillfallsubstantiallyandDivisionLwillhavesignificantunusedcapacity.Consequently,DivisionLneedstoreduceitsprice.Thecurrentpricedoesnotreflectthefactthattherearenosellinganddistributioncostsassociatedwithtransferringinternally,i.e.thecostofsellinginternallyis$4lessforDivisionLthansellingexternally.So,itcouldreducethepriceto$36andstillmakethesameprofitonthesesalesasonitsexternalsales.ThiswouldthereforebethesuggestedtransferpricesothatDivisionMisstillsaving$1perunitcomparedtotheexternalprice.Atransferpriceof$37wouldalsopresumablybeacceptabletoDivisionMsincethisisthesameastheexternalsupplierisoffering. -

第19题:

PV Co is evaluating an investment proposal to manufacture Product W33, which has performed well in test marketing trials conducted recently by the company’s research and development division. The following information relating to this investment proposal has now been prepared.

Initial investment $2 million

Selling price (current price terms) $20 per unit

Expected selling price inflation 3% per year

Variable operating costs (current price terms) $8 per unit

Fixed operating costs (current price terms) $170,000 per year

Expected operating cost inflation 4% per year

The research and development division has prepared the following demand forecast as a result of its test marketing trials. The forecast reflects expected technological change and its effect on the anticipated life-cycle of Product W33.

It is expected that all units of Product W33 produced will be sold, in line with the company’s policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product W33 is planned to end. For investment appraisal purposes, PV Co uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 30% per year. Ignore taxation.

Required:

(a) Identify and explain the key stages in the capital investment decision-making process, and the role of

investment appraisal in this process. (7 marks)

(b) Calculate the following values for the investment proposal:

(i) net present value;

(ii) internal rate of return;

(iii) return on capital employed (accounting rate of return) based on average investment; and

(iv) discounted payback period. (13 marks)

(c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. (5 marks)

正确答案:

(a)Thekeystagesinthecapitalinvestmentdecision-makingprocessareidentifyinginvestmentopportunities,screeninginvestmentproposals,analysingandevaluatinginvestmentproposals,approvinginvestmentproposals,andimplementing,monitoringandreviewinginvestments.IdentifyinginvestmentopportunitiesInvestmentopportunitiesorproposalscouldarisefromanalysisofstrategicchoices,analysisofthebusinessenvironment,researchanddevelopment,orlegalrequirements.Thekeyrequirementisthatinvestmentproposalsshouldsupporttheachievementoforganisationalobjectives.ScreeninginvestmentproposalsIntherealworld,capitalmarketsareimperfect,soitisusualforcompaniestoberestrictedintheamountoffinanceavailableforcapitalinvestment.Companiesthereforeneedtochoosebetweencompetinginvestmentproposalsandselectthosewiththebeststrategicfitandthemostappropriateuseofeconomicresources.AnalysingandevaluatinginvestmentproposalsCandidateinvestmentproposalsneedtobeanalysedindepthandevaluatedtodeterminewhichofferthemostattractiveopportunitiestoachieveorganisationalobjectives,forexampletoincreaseshareholderwealth.Thisisthestagewhereinvestmentappraisalplaysakeyrole,indicatingforexamplewhichinvestmentproposalshavethehighestnetpresentvalue.ApprovinginvestmentproposalsThemostsuitableinvestmentproposalsarepassedtotherelevantlevelofauthorityforconsiderationandapproval.Verylargeproposalsmayrequireapprovalbytheboardofdirectors,whilesmallerproposalsmaybeapprovedatdivisionallevel,andsoon.Onceapprovalhasbeengiven,implementationcanbegin.Implementing,monitoringandreviewinginvestmentsThetimerequiredtoimplementtheinvestmentproposalorprojectwilldependonitssizeandcomplexity,andislikelytobeseveralmonths.Followingimplementation,theinvestmentprojectmustbemonitoredtoensurethattheexpectedresultsarebeingachievedandtheperformanceisasexpected.Thewholeoftheinvestmentdecision-makingprocessshouldalsobereviewedinordertofacilitateorganisationallearningandtoimprovefutureinvestmentdecisions. -

第20题:

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

正确答案:

(a)Whilstprofitaftertax(anditsgrowth)isausefulmeasure,itmaynotgiveafairrepresentationofthetrueunderlyingearningsperformance.Inthisexample,userscouldinterpretthelargeannualincreaseinprofitaftertaxof80%asbeingindicativeofanunderlyingimprovementinprofitability(ratherthanwhatitreallyis:anincreaseinabsoluteprofit).Itispossible,evenprobable,that(someof)theprofitgrowthhasbeenachievedthroughtheacquisitionofothercompanies(acquisitivegrowth).Wherecompaniesareacquiredfromtheproceedsofanewissueofshares,orwheretheyhavebeenacquiredthroughshareexchanges,thiswillresultinagreaternumberofequitysharesoftheacquiringcompanybeinginissue.ThisiswhatappearstohavehappenedinthecaseofBarsteadastheimprovementindicatedbyitsearningspershare(EPS)isonly5%perannum.ThisexplainswhytheEPS(andthetrendofEPS)isconsideredamorereliableindicatorofperformancebecausetheadditionalprofitswhichcouldbeexpectedfromthegreaterresources(proceedsfromthesharesissued)ismatchedwiththeincreaseinthenumberofshares.Simplylookingatthegrowthinacompany’sprofitaftertaxdoesnottakeintoaccountanyincreasesintheresourcesusedtoearnthem.Anyincreaseingrowthfinancedbyborrowings(debt)wouldnothavethesameimpactonprofit(asbeingfinancedbyequityshares)becausethefinancecostsofthedebtwouldacttoreduceprofit.ThecalculationofadilutedEPStakesintoaccountanypotentialequitysharesinissue.Potentialordinarysharesarisefromfinancialinstruments(e.g.convertibleloannotesandoptions)thatmayentitletheirholderstoequitysharesinthefuture.ThedilutedEPSisusefulasitalertsexistingshareholderstothefactthatfutureEPSmaybereducedasaresultofsharecapitalchanges;inasenseitisawarningsign.InthiscasethelowerincreaseinthedilutedEPSisevidencethatthe(higher)increaseinthebasicEPShas,inpart,beenachievedthroughtheincreaseduseofdilutingfinancialinstruments.Thefinancecostoftheseinstrumentsislessthantheearningstheirproceedshavegeneratedleadingtoanincreaseincurrentprofits(andbasicEPS);however,inthefuturetheywillcausemoresharestobeissued.ThiscausesadilutionwherethefinancecostperpotentialnewshareislessthanthebasicEPS. -

第21题:

For the year just ended, N company had an earnings of$ 2 per share and paid a dividend of $ 1. 2 on its stock. The growth rate in net income and dividend are both expected to be a constant 7 percent per year, indefinitely. N company has a Beta of 0. 8, the risk - free interest rate is 6 percent, and the market risk premium is 8 percent.

P Company is very similar to N company in growth rate, risk and dividend. payout ratio. It had 20 million shares outstanding and an earnings of $ 36 million for the year just ended. The earnings will increase to $ 38. 5 million the next year.

Requirement :

A. Calculate the expected rate of return on N company 's equity.

B. Calculate N Company 's current price-earning ratio and prospective price - earning ratio.

C. Using N company 's current price-earning ratio, value P company 's stock price.

D. Using N company 's prospective price - earning ratio, value P company 's stock price.

答案:解析:A. The expected rate of return on N company's equity =6% +0. 8*8% =12.4%

B. Current price -earning ratio = (1. 2/2) * (1 +7% )/ (12.4% -7% ) =11. 89

Prospective price - earning ratio = (1. 2/2) / (12. 4% - 70% ) =11. 11

C. P company's stock = 11. 89* 36/20 = 21. 4

D. P company's stock = 11. 11* 38. 5/20 = 21. 39

-

第22题:

删除amdin$的命令是()。

- A、net share admin$

- B、net share admin$=c:/windows /del

- C、net share admin$ /del

- D、net use admin$ /del

正确答案:C -

第23题:

单选题The Owners to take over and pay all fuel remaining in the Vessel’s bunkers on re-delivery at current price at the port of redelivery,or at the nearest main bunkering port,if the bunker price at the port of redelivery is not available. This indicates that the Owners are to take over and pay the remaining bunkers().Aat current price at the nearest main bunkering port

Bat current price at the port of redelivery if it is not available to obtain the current price at the nearest main bunkering port

Cat current price at the nearest main bunkering port if it is cheaper than that at the port of redelivery

Dat current price at the port of redelivery if it is obtainable,even the price is higher at the nearest main bunkering port

正确答案: B解析: 暂无解析