Under the terms of 2/10 net 30, the buyer may:A . deduct 10% of the invoice amount for payment within 30 daysB . deduct 2% of the invoice for payment within 10 daysC . incurs a penalty on 10% for payments more than 30 days lateD . settle the invoice with

题目

Under the terms of 2/10 net 30, the buyer may:

A . deduct 10% of the invoice amount for payment within 30 days

B . deduct 2% of the invoice for payment within 10 days

C . incurs a penalty on 10% for payments more than 30 days late

D . settle the invoice with 2 equal payments; one within 10 days and the other within 30 days

E . None of the above

相似考题

参考答案和解析

更多“Under the terms of 2/10 net 30, the buyer may:A.deduct 10% of the invoice amount for payme ”相关问题

-

第1题:

(b) Router has a number of film studios and office buildings. The office buildings are in prestigious areas whereas

the film studios are located in ‘out of town’ locations. The management of Router wish to apply the ‘revaluation

model’ to the office buildings and the ‘cost model’ to the film studios in the year ended 31 May 2007. At present

both types of buildings are valued using the ‘revaluation model’. One of the film studios has been converted to a

theme park. In this case only, the land and buildings on the park are leased on a single lease from a third party.

The lease term was 30 years in 1990. The lease of the land and buildings was classified as a finance lease even

though the financial statements purport to comply with IAS 17 ‘Leases’.

The terms of the lease were changed on 31 May 2007. Router is now going to terminate the lease early in 2015

in exchange for a payment of $10 million on 31 May 2007 and a reduction in the monthly lease payments.

Router intends to move from the site in 2015. The revised lease terms have not resulted in a change of

classification of the lease in the financial statements of Router. (10 marks)

Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.

正确答案:

(b) IAS16 ‘Property, Plant and Equipment’ permits assets to be revalued on a class by class basis. The different characteristics

of the buildings allow them to be classified separately. Different measurement models can, therefore, be used for the office

buildings and the film studios. However, IAS8 ‘Accounting policies, changes in accounting estimates and errors’ says that

once an entity has decided on its accounting policies, it should apply them consistently from period to period and across all

relevant transactions. An entity can change its accounting policies but only in specific circumstances. These circumstances

are:

(a) where there is a new accounting standard or interpretation or changes to an accounting standard

(b) where the change results in the financial statements providing reliable and more relevant information about the effects

of transactions, other events or conditions on the entity’s financial position, financial performance, or cash flows

Voluntary changes in accounting policies are quite uncommon but may occur when an accounting policy is no longer

appropriate. Router will have to ensure that the change in accounting policy meets the criteria in IAS8. Additionally,

depreciated historical cost will have to be calculated for the film studios at the commencement of the period and the opening

balance on the revaluation reserve and any other affected component of equity adjusted. The comparative amounts for each

prior period should be presented as if the new accounting policy had always been applied. There are limits on retrospective

application on the grounds of impracticability.

It is surprising that the lease of the land is considered to be a finance lease under IAS17 ‘Leases’. Land is considered to have

an indefinite life and should, therefore normally be classified as an operating lease unless ownership passes to the lessee

during the lease term. The lease of the land should be separated out from the lease and treated individually. The value of the

land so determined would be taken off the balance sheet in terms of the liability and asset and the lease payments treated

as rentals in the income statement. A prior period adjustment should also be made. The buildings would continue to be

treated as property, plant and equipment (PPE) and the carrying amount not adjusted. However, the remaining useful life of

the building should be revised to reflect the shorter lease term. This will result in the carrying amount being depreciated over

the shorter period. This change to the depreciation policy is applied prospectively not retrospectively.

The lease liability must be assessed for derecognition under IAS39 ‘Financial Instruments: Recognition and Measurement’,

because of the revision of the lease terms, in order to determine whether the new terms are substantially different from the

old. The purpose of this is to determine whether the change in terms is a modification or an extinguishment. The change

seems to constitute a ‘modification’ because there is little change to the terms. The lease liability is, therefore, amended by

deducting the one off payment ($10 million) from the carrying amount (after adjustment for the lease of land) together with

any transaction costs. The lease liability is then remeasured to the present value of the revised future cash flows, discounted

using the original effective interest rate. Any adjustment made in remeasuring the lease liability will be taken to the income

statement.

-

第2题:

有如下程序:includeusing namespace std;class Amount{int amount;public:Amount(int 有如下程序: #include<iostream> using namespace std; class Amount{ int amount; public: Amount(int n=0):amount(n){ } int getAmount( )const{return amount;} Amount&operator+=(Amount A) { amount+=a.amount; return; } }; int main( ){ Amount x(3),y(7); x+=y: cout<<x.getAmount( )<<endl; return 0; } 已知程序的运行结果是10,则下画线处缺失的表达式是

A.*this

B.this

C.&amount

D.amount

正确答案:A

-

第3题:

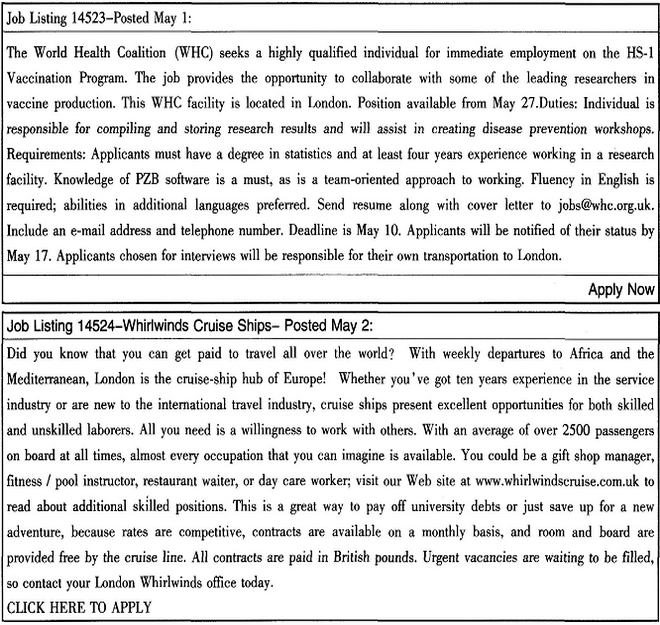

根据以下内容,回答235-239题。

What is the last day to apply for the WHC position? ( )A.May 1

B.May 10

C.May 17

D.May 27答案:B解析: -

第4题:

(d) Sirus raised a loan with a bank of $2 million on 1 May 2007. The market interest rate of 8% per annum is to

be paid annually in arrears and the principal is to be repaid in 10 years time. The terms of the loan allow Sirus

to redeem the loan after seven years by paying the full amount of the interest to be charged over the ten year

period, plus a penalty of $200,000 and the principal of $2 million. The effective interest rate of the repayment

option is 9·1%. The directors of Sirus are currently restructuring the funding of the company and are in initial

discussions with the bank about the possibility of repaying the loan within the next financial year. Sirus is

uncertain about the accounting treatment for the current loan agreement and whether the loan can be shown as

a current liability because of the discussions with the bank. (6 marks)

Appropriateness of the format and presentation of the report and quality of discussion (2 marks)

Required:

Draft a report to the directors of Sirus which discusses the principles and nature of the accounting treatment of

the above elements under International Financial Reporting Standards in the financial statements for the year

ended 30 April 2008.

正确答案:

(d) Repayment of the loan

If at the beginning of the loan agreement, it was expected that the repayment option would not be exercised, then the effective

interest rate would be 8% and at 30 April 2008, the loan would be stated at $2 million in the statement of financial position

with interest of $160,000 having been paid and accounted for. If, however, at 1 May 2007, the option was expected to be

exercised, then the effective interest rate would be 9·1% and at 30 April 2008, the cash interest paid would have been

$160,000 and the interest charged to the income statement would have been (9·1% x $2 million) $182,000, giving a

statement of financial position figure of $2,022,000 for the amount of the financial liability. However, IAS39 requires the

carrying amount of the financial instrument to be adjusted to reflect actual and revised estimated cash flows. Thus, even if

the option was not expected to be exercised at the outset but at a later date exercise became likely, then the carrying amount

would be revised so that it represented the expected future cash flows using the effective interest rate. As regards the

discussions with the bank over repayment in the next financial year, if the loan was shown as current, then the requirements

of IAS1 ‘Presentation of Financial Statements’ would not be met. Sirus has an unconditional right to defer settlement for longer

than twelve months and the liability is not due to be legally settled in 12 months. Sirus’s discussions should not be considered

when determining the loan’s classification.

It is hoped that the above report clarifies matters. -

第5题:

在2/10 net 30条款中买方会( )

A.扣除发票额的10%在30天内支付

B.扣除发票额的2%在10天内支付

C.超过30天付款则需支付10%的罚金

D.将发票额分成对等的两部分一部分在10天内支付另一部分在30天内支付

正确答案:B